SHIPPENSBURG, PA. — Scope Commercial Real Estate Services has brokered the $13.3 million sale of Maverick Apartments, a 480-bed student housing community located near Shippensburg University in southern-central Pennsylvania. The 10-building community recently underwent $1.5 million in capital improvements. The property offers 120 four-bedroom units in standard and loft configurations. Fahd Malik of SCOPE represented the seller, Maverick Apartments LLC, in the transaction. Clark Finney of Matthews Real Estate Investments arranged a $9.5 million acquisition loan on behalf of the undisclosed buyer.

Acquisitions

WALLINGFORD, CONN. — Locally based brokerage firm OR&L Commercial has negotiated the $3.3 million sale of a 45,320-square-foot industrial property in Wallingford, located just north of New Haven. The building, which sits on 3.6 acres and features four loading docks, was roughly 45 percent leased at the time of sale to a single tenant. Frank Hird of OR&L represented the seller, Founders Associates LLC, in the transaction and procured the buyer, NEC Advisors. Hird is also representing the new ownership in leasing the available space.

Chevron Acquires 77 Acres in Metro Houston, Plans Include Potential Research-and-Development Campus

by John Nelson

CYPRESS, TEXAS — Oil-and-gas giant Chevron Corp. (NYSE: CVX) has acquired 77 acres in the northwest Houston suburb of Cypress. The parcel is situated within Bridgeland Central, a multi-phase campus spanning 925 acres within the larger Bridgeland master-planned community. The land seller was The Howard Hughes Corp. (NYSE: HHH), the master developer of the 11,500-acre Bridgeland development. The sales price for the Chevron land deal was not disclosed. “Chevron’s acquisition marks a pivotal moment for Bridgeland as the community enters its next phase of development as a leading job center for the region,” says Jim Carman, president of the Houston region for Howard Hughes Corp. “One of the top-selling communities in the country, Bridgeland is poised to benefit from the influx of businesses and their employees seeking to live and work in a centralized location that offers commercial opportunities, as well as single-family and multifamily housing options to meet growing demand.” Daniel Abate, head of corporate real estate for Chevron, says the company could potentially establish a research-and-development campus on the newly acquired land. “Chevron is attracted to the opportunities Bridgeland has to offer and views this acquisition as a strong addition to our asset portfolio,” says Abate. Details about the …

BETHESDA, MD. — Berkadia Institutional Solutions has arranged the sale of The Elm, a 456-unit multifamily community located at 4710 Elm St. in Bethesda. Completed in 2021, the property features apartments in one-, two- and three-bedroom floor plans across two 28-story towers that are connected via a glass sky bridge. Amenities at the community include a swimming pool, fitness center, pet spa and a dog park. Brian Crivella, Walter Coker and Bill Gribbin of Berkadia’s DC Metro office brokered the sale on behalf of the seller, Washington, D.C.-based Carr Properties. The buyer and sales price were not disclosed.

TAMPA, FLA. — Eagle Property Capital (EPC) and Belay Investment Group have sold Captiva Club Apartments, a 361-unit multifamily community located at 4401 Club Captiva Drive in Tampa. Built in 1973, the property comprises apartments in one-, two- and three-bedroom floor plans. Amenities at the community include a clubhouse, two swimming pools, two dog parks, a business center and onsite laundry. The partners acquired the property in 2016 and implemented $4.3 million in capital improvements, including the addition of 17 new units. The buyer and sales price were not disclosed.

Newmark Negotiates $103.5M Sale of 14-Building Industrial Portfolio in Fremont, California

by Amy Works

FREMONT, CALIF. — Newmark has arranged the sale of Bayside Industrial Portfolio, a 14-property industrial portfolio in Fremont. CIP Real Estate acquired the asset from an undisclosed seller for $103.5 million. At the time of sale, the 352,280-square-foot portfolio was 91 percent occupied by 80 tenants. The properties feature flexible industrial spaces ranging from 2,500 square feet to 25,000 square feet, 16-foot clear heights, ample power distribution throughout the campus, truck courts with depths up to 140 feet and a mix of at-grade and dock-high doors. Steven Golubchik, Edmund Najera, Jonathan Schaefler and Darren Hollak of Newmark represented the seller in the deal. Ramsey Daya and Chris Moritz of Newmark’s Debt and Structured Finance group arranged $63 million in acquisition financing, in the form of debt, for the buyer.

Berkadia Arranges Sale of 348-Unit Broadstone Cavora Apartment Community in Laguna Niguel, California

by Amy Works

LAGUNA NIGUEL, CALIF. — Berkadia Institutional Solutions has brokered the sale of Broadstone Cavora, a multifamily property in Laguna Niguel. A California-based investor acquired the property for an undisclosed price. Located at 26033 Cape Drive, Broadstone Cavora features 348 apartments averaging 890 square feet with walk-in closets, private patios and in-unit washers/dryers. Community amenities include a resident clubhouse, resort-style pool, multi-level fitness center, rooftop sun terrace, game room and leisure lawn. Derrek Ostrzyzek, Rachel Parsons and Tom Moran of Berkadia Irvine, Calif., represented the undisclosed seller in the deal.

Jewell Capital Sells SanTan Gateway North Shopping Center in Chandler, Arizona for $26.6M

by Amy Works

CHANDLER, ARIZ. — Jewell Capital has completed the disposition of SanTan Gateway North, a multi-tenant retail center in Chandler. Coast Meridian Properties acquired the asset for $26.6 million, $215 per square foot. Situated on 17.1 acres at 1005-1205 S. Arizona Ave., SanTan Gateway North features 123,558 square feet of retail space. Current tenants include Walmart Supercenter, O’Reilly Auto Parts, Dollar Tree, Sky Zone and Shane Co. Additionally, Wendy’s, Del Taco and JPM Chase occupy the three outparcels. Darren Tappen, Nathan Thinnes and Peter Beauchamp of Kidder Mathews represented the seller in the transaction.

CASTLE ROCK, COLO. — Newmark has arranged the land sale of The Meadows at Castle Rock in Castle Rock. Limelight Mob II LCC acquired the residential land asset from Castle Rock Development Co. for $1.4 million. The investment sale includes 98,881 square feet of land. Kittie Hook and Cathy Mcdermott of Newmark represented the seller, while Connolly Capital represented the buyer in the deal.

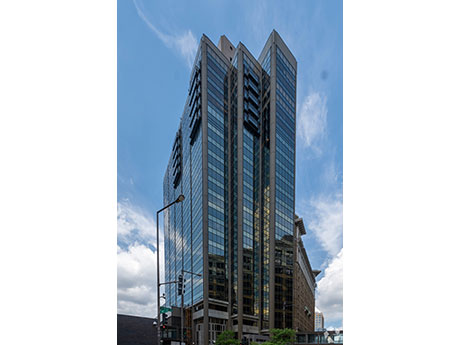

ST. PAUL, MINN. — Transwestern Real Estate Services has brokered the sale of Landmark Towers, a 200,000-square-foot office building in St. Paul. The buyer, Sherman Associates, intends to convert the property into apartment units. Mike Salmen and Erik Coglianese of Transwestern represented the undisclosed seller. The property is located at 345 Saint Peter St.