AUSTIN, TEXAS — A partnership between locally based investment firm Ivy Cos. and Texas-based 35 South Capital has acquired Casis Village, a 48,500-square-foot shopping center located in Austin’s Tarrytown neighborhood. Built in 1952 and anchored by grocer Randalls, the center is also home to tenants such as Benchmark Bank, Starbucks, Tarrytown Pharmacy and Estilo Boutique. Dan Frey of Endeavor Real Estate Group represented the undisclosed seller in the transaction. The partnership was self-represented.

Acquisitions

Northmarq Arranges Sale of 387,303 SF Distribution Facility in Lumberton, North Carolina

by John Nelson

LUMBERTON, N.C. — Northmarq has arranged the sale of a 387,303-square-foot distribution facility located at the intersection of Interstates 95 and 74 in Lumberton. Situated on 49.7 acres, the single-tenant facility was fully leased at the time of sale to Elkay Plumbing Products Co., an affiliate company of Zurn Elkay Water Solutions. The newly built property is a build-to-suit project for Elkay Plumbing, which has a long-term double-net lease at the facility. Brad Pepin and Jonathan Thompson of Northmarq’s Tulsa office represented the seller, an Atlanta-based developer, in the transaction. The buyer, an individual investor based in California, purchased the facility for an undisclosed price.

NEWTON AND ALLSTON, MASS. — Marcus & Millichap has arranged the $23.5 million sale of a portfolio of two multifamily buildings totaling 59 units in the Boston area. The buildings are located in Newton and Allston, both of which are situated west of the downtown area. The Newton property offers eight two-bedroom units and 23 one-bedroom units with private balconies and storage units. Constructed in 1985 on 0.59 acres, the Allston property features 28 units and 41 off-street parking spaces. Evan Griffith and Tony Pepdjonovic of Marcus & Millichap brokered the deal in collaboration with Matthew Petty of Frame Residential. The buyer and seller were not disclosed.

THONOTOSASSA, FLA. — Berkadia has negotiated the sale of The Livano Uptown, a 292-unit, garden-style apartment community located at 11810 Walker Road in the Tampa suburb of Thonotosassa. The buyer, Praedium Group, has rebranded the property as Tessa Springs. Alabama-based LIV Development sold the community to Praedium for an undisclosed price. Matt Mitchell and Bailey Smith of Berkadia’s Tampa office represented the seller in the transaction. Built in 2022, Tessa Springs features one-, two- and three-bedroom apartments, as well as a clubhouse, resort-style pool with lounge seating, private workspaces with conference rooms, “party barn,” 24-hour fitness center with a yoga/spin room, a pet center and a 24-hour onsite community market.

PANAMA CITY, FLA. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has brokered the $18.1 million sale of Bay City Point, a 121,413-square-foot shopping center located at 500 E. 23rd St. in Panama City. The center’s tenant roster includes Hobby Lobby, Burlington, Five Below, Skechers and Ulta Beauty. Zach Taylor of IPA represented the seller, Rome, Ga.-based Ledbetter Properties, in the transaction. The buyer was not disclosed. “Demand remains strong for well-located retail projects with strong credit,” said Taylor. “Interest rates remain a headwind, but property-level fundamentals are as strong as ever.”

SAVOY, ILL. — Evans Senior Investments (ESI) has arranged the sale of Champaign Urbana Nursing & Rehab in Savoy, located about midway between Chicago and St. Louis. A regional owner-operator sold the asset to Mozart Healthcare, which plans to install Accolade Healthcare as the operator. The sales price was undisclosed. Initially built in 1975, the facility is licensed for 213 skilled nursing beds, and at the time of marketing was 49 percent occupied. The current operator restored the occupancy rate to 67 percent by the time of closing.

FOND DU LAC, WIS. — Marcus & Millichap has brokered the $1.2 million sale of a 2,070-square-foot gas station occupied by Exxon in Fond du Lac, a city in eastern Wisconsin along Lake Winnebago. The net-leased property is located at 362 N. Peters Ave. Austin Weisenbeck, Sean Sharko, Nicholas Kanich and Timothy Nichols of Marcus & Millichap represented the seller, a limited liability company. Weisenbeck, Sharko and Nichols secured and represented the buyer, a private investor.

GREENWICH AND DARIEN CONN. — CBRE has brokered the $13.6 million sale of a portfolio of two office buildings totaling 42,794 square feet in Connecticut. The 17,081-square-foot building at 39 Lewis St. in Greenwich was 91 percent leased at the time of sale, and the 25,713-square-foot building at 23 Old Kings Highway in Darien was 86 percent leased at the time of sale. Jeffrey Dunne, Steven Bardsley, Travis Langer and Daniel Blumenkrantz of CBRE represented the seller in the transaction. CBRE also procured separate buyers for each building. All parties requested anonymity.

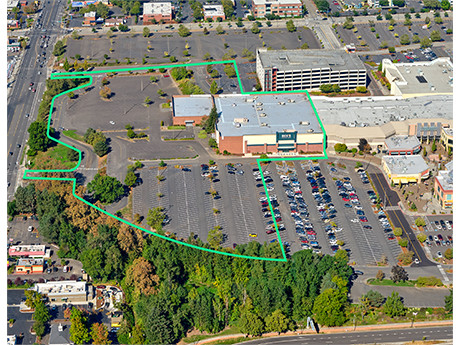

ProEquity Asset Management Sells Power Plaza Retail Center in Vacaville, California for $29.2M

by Amy Works

VACAVILLE, CALIF. — ProEquity Asset Management has completed the disposition of Power Plaza, a grocery-anchored neighborhood retail center at 1001-1071 Helen Drive in Vacaville, approximately midway between Sacramento and San Francisco Bay. DPI Retail acquired the asset for $29.2 million. Built in 1993 and 1994, the 112,250-square-foot retail center was 96 percent occupied at the time of sale. Current tenants include Sprouts Farmers Market, Restoration Hardware Outlet, Williams Sonoma Home Outlet, Pacific Dental Services, The Good Feet Store and Banfield Pet Hospital. Eric Kathrein, Tim Kuruzar, Warren McClean and Andy Spangenberg of JLL Retail Capital Markets represented the seller in the deal.

HAPPY VALLEY, ORE. — CBRE has arranged the sale of a 146,888-square-foot property located in Happy Valley, a suburb of Portland. Sears formerly occupied the building, which is physically attached to the adjacent Clackamas Town Center mall, which totals 1.4 million square feet. Dick’s Sporting Goods partially backfilled the property in 2019 and opened in 2020 following the departure of Sears in 2018. The remainder of the building, including two 15,000-square-foot, ground-level spaces and a 64,000-square-foot upper-level space, remains vacant. Dino Christophilis and Daniel TIbeau of CBRE represented the undisclosed seller in the transaction. A Texas-based private investment group acquired the property for an undisclosed price.