LINDEN, N.J. — SRS Real Estate Partners has brokered the sale of a ground lease for a 185,682-square-foot retail building in the Northern New Jersey community of Linden that is occupied by Walmart. The building was constructed on 14 acres in 2019, and there are 17 years remaining on the corporate-guaranteed lease. Matthew Mousavi, Patrick Luther, Britt Raymond and Kyle Fant of SRS represented the sellers, Dallas-based developer Cypress Equities and San Francisco-based investment firm Stockbridge Capital Group, in the deal. David Chasin of Pegasus Investments Real Estate Advisory represented the buyer.

Acquisitions

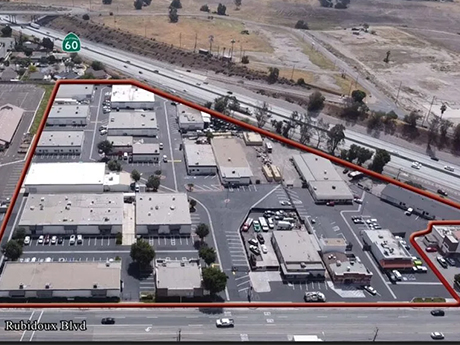

Lee & Associates-Ontario Negotiates $19.5M Sale of Riverside Business Park in Jurupa Valley, California

by Jeff Shaw

JURUPA VALLEY, CALIF. — Lee & Associates-Ontario has facilitated the sale of Riverside Business Park, a fully occupied, multi-tenant business park in Jurupa Valley. Intersection Equities LLC acquired the asset, consisting of 37 units across 22 buildings, for $19.5 million. The park features ground-level and dock-high door loading, private yards, and clear heights of up to 16 feet. The sellers were Bravo Whiskey Properties LLC and Transition Properties LLC. The selling agent, Barret Woods of Lee & Associates-Ontario, represented himself as a principal in the transaction. Brad Yates and Stefan Pastor of Stream Realty represented the buyer.

PHOENIX — Jamie Godwin, president of Stevens-Leinweber Construction (SLC), has purchased a two-story office building in Phoenix’s Camelback Corridor area for $3.8 million. The building will undergo a multi-million-dollar renovation to serve as the company’s new, expanded headquarters. The renovation plans include modernizing the building’s interior, creating employee-centric amenities and improving common areas. Other planned improvements include renovations to the building’s shared courtyard and common areas, new HVAC systems and the addition of a fire sprinkler system. Chris Krewson of Newmark represented SLC in the purchase of the 5045 building. Wally Hale and Drew Sampson of Avison Young represented the building’s seller, 5045 Associates LLC. Renovations are underway, with the project slated for completion by the end of this year.

Newmark Arranges Sale of 1,557-Bed Student Housing Community Near Florida State University

by John Nelson

TALLAHASSEE, FLA. — Newmark has arranged the sale of Seminole Grand, a 1,557-bed student housing community located near the Florida State University campus in Tallahassee. Ryan Lang, Jack Brett, Ben Harkrider and Avery Klann of Newmark represented the seller, The Collier Cos., in the disposition of the property to FPA Multifamily. The sales price was not disclosed. Located at 1505 W. Tharpe St., the garden-style community offers a mix of two-, three- and four-bedroom units with bed-to-bath parity. Shared amenities include a resort-style swimming pool, fitness center, yoga studio, sound-proof study rooms and a multimedia gaming center. The property also features a bus stop for the Florida State University line.

WEST PALM BEACH, FLA. — Harbor Group International (HGI) has acquired Pine Ridge, a 288-unit multifamily community in West Palm Beach. Developed by Resia earlier this year, the property features apartments in one- and two-bedroom layouts. Community amenities include a fitness center, basketball court, clubhouse, swimming pool and children’s play area. HGI will assume the in-place, floating-rate construction debt on the property, with plans to refinance with permanent fixed-rate debt once leasing is completed. Hampton Beebe and Avery Klann of Newmark brokered the transaction. The sales price was not disclosed.

Capstone Arranges Sale of 319-Unit Apartment Development Underway in Asheville, North Carolina

by John Nelson

ASHEVILLE, N.C. — Capstone Cos. has arranged the sale of Creekside Luxury Apartments, a multifamily development project located at 2177 Brevard Road in Asheville. Upon completion, which is scheduled for the end of 2025, the property will comprise 319 units. Austin Heithcock, Adam Klenk, Jordan Arand and Josh White of Capstone represented the seller, Advantis, in the transaction. URS Capital, in partnership with PREG-Advantis and its construction arm, BCC Construction Inc., acquired the property for an undisclosed price.

ORLANDO, FLA. — CBRE has brokered the $23.1 million sale of Windermere Storage, an 89,145-square-foot self-storage facility located at 8550 Old Winter Garden Road in Orlando. CBRE’s Self Storage Advisory Group represented the seller, locally based Schrimsher Properties, in the transaction. Wentworth Properties was the buyer. Built in the second quarter of this year, Windermere Storage features a two-story building comprising 609 climate-controlled units ranging in size from 25 to 450 square feet, as well as a 2,000-square-foot office building and 351 parking spaces.

DALLAS — Texas-based investment firm SPI Advisory has acquired Ivy Urban Living, a 228-unit apartment community located just north of downtown Dallas. Built in 1988, the property offers one-, two- and three-bedroom units that are furnished with stainless steel appliances, quartz countertops, tile backsplashes and private balconies/patios. Amenities include a pool, fitness center, business center, pet park and access to package lockers. The seller and sales price were not disclosed.

SAN ANTONIO — Partners Real Estate has arranged the sale of a 27,478-square-foot retail building located in the Mission San Jose neighborhood of San Antonio. According to LoopNet Inc., the property at 3371 Roosevelt Ave. was built on two acres in 1965. Phil Crane and Dan Gostylo of Partners represented the buyer, Garcia Properties Inc., in the transaction. Andrew Price of CBRE represented the undisclosed seller.

FORT WORTH, TEXAS — Marcus & Millichap has brokered the sale of Sycamore Village Shopping Center, a 26,148-square-foot retail property in Fort Worth. The site at 3515 Sycamore School Road spans 2.6 acres and is located on the city’s southwest side. Tenants at the property include Cricket Wireless, H&R Block and The UPS Store. Joe Santelli of Marcus & Millichap represented the undisclosed seller in the transaction.