WINTHROP HARBOR, ILL. — Quantum Real Estate Advisors Inc. has brokered the sale of a single-tenant retail property occupied by Dollar General in Winthrop Harbor, a city in Northeast Illinois. The sales price was undisclosed. The building was constructed in 2013 and is located at 914 Sheridan Road. Dollar General signed a 15-year lease in 2013. Daniel Waszak of Quantum represented the buyer, a New York-based investor. An Illinois-based investor was the seller.

Acquisitions

POTTSTOWN, PA. — CBRE has brokered the $5.2 million sale of a 60,000-square-foot industrial property in Pottstown, a northwestern suburb of Philadelphia. Built in 2000, the facility sits on a 10.3-acre site within Pottstown Industrial Park. Stephen Marzullo, Adam Silverman and Paul Touhey of CBRE represented the seller, an entity doing business as Wynnestay LLP, in the transaction. A subsidiary of TMC Properties LLC purchased the asset, which was fully leased at the time of sale to Eastwood Co., an e-commerce firm in the automotive space, for an undisclosed price.

NEW YORK CITY — Locally based brokerage firm GFI Realty Services has negotiated the $3.2 million sale of a 23-unit multifamily building located in the Midwood area of Brooklyn. Built in 1928, the property consists of four studios, 11 one-bedroom apartments, seven two-bedroom units and one three-bedroom apartment. Matthew Sparks of GFI Realty represented the seller, Santa Rosa Realty, in the transaction. Moshe Goldberger, also with GFI Realty, represented the buyer, Aida Abba Realty.

PHOENIX — Whitestone REIT has acquired Arcadia Towne Center, a 70,000-square-foot retail center in Phoenix, for $25.3 million. A Safeway, not included in the sale, anchors the center. Tenants at the property include CVS/pharmacy, Tutor Time, Mathnasium, Over Easy, Sole Ports and Puff & Fluff Grooming. The seller was not disclosed.

Marcus & Millichap Negotiates $6M Sale of Mountain View RV & Mini Storage in Madras, Oregon

by Jeff Shaw

MADRAS, ORE. — Marcus & Millichap has arranged the sale of Mountain View RV & Mini Storage in Madras. The original developers sold the 49,675-square-foot self-storage facility to an out-of-state buyer for $6 million. It features 358 self-storage units. The asset was constructed in two phases in 2020 and 2022 at 2086 NW Andrews Drive. The successful sale highlights the ongoing demand and investment opportunities in the self-storage sector, according to Marcus & Millichap. Christopher Secreto and Samuel Olson of Marcus & Millichap’s Seattle office exclusively listed and marketed the property on behalf of the sellers.

For real estate investors who have an acquisition teed up or who need to refinance, the prospects of finding debt today are arguably the bleakest they have been since the financial crisis 15 years ago. Higher interest rates and concerns over growing distress convinced banks and other lenders to move to the sidelines several months ago, thwarting commercial real estate investment sales. In turn, that is fueling broad uncertainty over what properties are really worth, which only begets more unease among banks. But private debt funds, which typically provide short-term rate bridge loans, are more likely to make deals when banks will not, says Jeff Salladin, a managing director with Dallas-based debt fund Revere Capital. That’s because debt funds like Revere raise capital from sophisticated investors to fund their loans, he says, while banks rely on deposits. That subjects banks to stringent regulatory oversight, which is especially intense in today’s debt climate. “All investors dislike uncertainty, and banks are investors by another definition,” states Salladin, who oversees real estate lending for Revere. “As a result, we could be in the first inning of a golden era for debt funds like ourselves, because we’re more flexible in way banks can’t be.” …

NEW KENT, VA. — Texas-based Buc-ee’s has purchased 27.7 acres off I-64 in the Richmond suburb of New Kent, with plans to develop the brand’s first location in Virginia. Upon completion, the Buc-ee’s Super Center will comprise 75,000 square feet of retail space, 120 fueling stations, electric vehicle chargers and more than 650 parking spaces. Construction on the project is scheduled for completion within the next 24 months. Nathan Shor of S.L. Nusbaum Realty Co. represented both the seller and Buc-ee’s in the land acquisition.

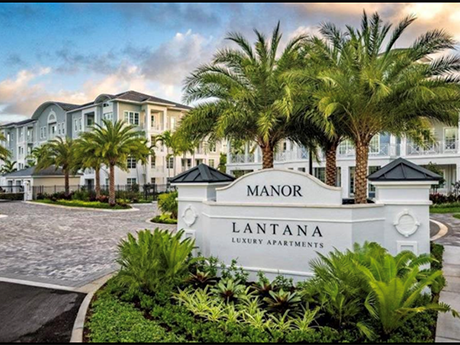

LANTANA, FLA. — The Praedium Group has acquired Manor Lantana, a 348-unit multifamily community located in Lantana, a city in South Florida’s Palm Beach County. Built in 2022, the property comprises four four-story buildings, 18 two-story villas featuring tuck-under garages and a two-story clubhouse. Apartments at the community average 1,164 square feet. Amenities include a spa, golf simulator and a fitness center. The seller and sales price were not disclosed.

Cushman & Wakefield | Thalhimer Brokers $8.2M Sale of Turnberry Crossing Shopping Center in Newport News, Virginia

by John Nelson

NEWPORT NEWS, VA. — Cushman & Wakefield | Thalhimer’s Capital Markets Group has brokered the $8.2 million sale of Turnberry Crossing, a retail center in Newport News. Located at 12638 Jefferson Ave., Goodwill anchors the 53,775-square-foot center, which was 95 percent leased to 17 tenants at the time of sale. Other tenants include Hertz, Papa John’s and DaaBIN Store. Catharine Spangler of Thalhimer arranged the transaction on behalf of the seller, Stavins & Axelrod. Raleigh-based Prudent Growth Partners acquired the property.

THE WOODLANDS, TEXAS — SVN | J. Beard Real Estate – Greater Houston has brokered the sale of a 10,406-square-foot retail building in The Woodlands, about 30 miles north of Houston. Constructed in 1974, the building houses the inline space of Grogan’s Mill Village Center. Jeff Beard of SVN | J. Beard represented the seller, a locally based limited liability company, in the transaction. The Howard Hughes Corp. purchased the asset for an undisclosed price.