BELLEVUE, WASH. — A Intracorp and equity partner HAL Real Estate have purchased a site that houses a vacant, 60,423-square-foot office building in Bellevue for $18 million. The site is located at 3190 160th Ave. SE in the Eastgate neighborhood. The building was constructed in 1982 and was previously leased to Washington Department of Ecology for several decades. Official plans for the site have not yet been announced, but the buyer may execute shorter-term leases at the existing office building until a redevelopment strategy is finalized. Pat Mutzel of Cushman & Wakefield’s Private Capital Group, in collaboration with Jeffrey Cole, Jeff Chiate, Bryce Aberg, Mike Adey, Nico Napolitano and Zach Harman of the firm’s West Coast Capital Markets Group, represented the seller, a private, high-net-worth investment group. Mutzel also advised the sale of the property in December 2019 for a price of $16.3 million.

Acquisitions

SAN DIEGO — Cabrillo Credit Union has acquired a 20,060-square-foot office building in the Kearny Mesa submarket of San Diego for $7.9 million. The building is located at 3710 Ruffin Road. It features solar panels, open ceilings, creative office space, private offices, conference rooms, and employee breakrooms and restrooms on each floor. The property was renovated in 2019. CBRE’s Phil Linton and Nick Bonner represented the seller, the Council of Community Clinics, which will lease back a quarter of the building.

FARMERS BRANCH, TEXAS — Fort Worth-based investment firm Fort Capital has acquired Spring Valley Tech Center, an industrial property that comprises nine buildings totaling 178,835 square feet in the northern Dallas metro of Farmers Branch. At the time of sale, the portfolio was 92 percent leased to 40 tenants in sectors such as retail, healthcare, technology, distribution and home services. The seller and sales price were not disclosed.

OKLAHOMA CITY — LSC Development has acquired a 161,190-square-foot retail building formerly occupied by Sears in Oklahoma City with plans to redevelop the property into a mixed-use facility with retail self-storage uses. The site is adjacent to a Walmart Neighborhood Market and across the street from the 31-acre INTEGRIS Southwest Medical Center. Michael Brewster, Drew Quinn, Brad Peterson, El Warner and Charley Simpson of Colliers represented the undisclosed seller in the transaction.

LOWELL, MASS. — Regional brokerage firm Northeast Private Client Group (NEPCG) has negotiated the $12.8 million sale of Willard Street Apartments, a 72-unit multifamily complex in Lowell, a northern suburb of Boston. The three-building property houses three studios, 24 one-bedroom units and 45 two-bedroom apartments. Francis Saenz, Drew Kirkland, Jim Casey, Brad Carlson and Brett Curtis represented the seller and procured the buyer, both of which requested anonymity, in the transaction. The new ownership plans to implement a value-add program.

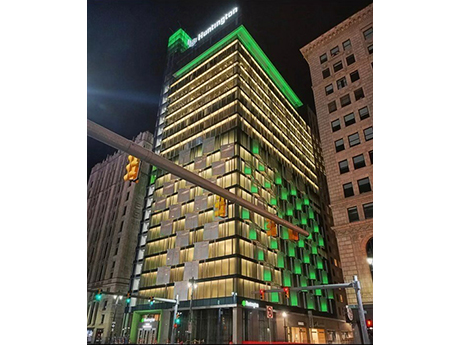

DETROIT — The Herrick Co. has acquired a 21-story office tower at 2025 Woodward Ave. in downtown Detroit for $150 million. Locally based architecture firm Neumann Smith designed the 421,481-square-foot building, which was delivered in fall 2022 and acts as a headquarters for Huntington National Bank’s (NASDAQ: HBAN) commercial division. The bank fully occupies the property on a triple-net-lease basis. The building features ground-floor retail space, including a Huntington Bank branch; 10 floors of structured parking; a cafe; and a rooftop terrace with space for movies or sporting events to be projected on the side of the tower. The deal is the largest building acquisition to close in Detroit since the start of the COVID-19 pandemic, according to Crain’s Detroit Business. The seller was not disclosed. Huntington acquired TCF Financial Corp. in 2020 for $22 billion. The combined company operates more than 1,000 branches in 11 states. The bank’s stock price closed at $11.42 per share on Wed. June 7, down from $13.10 one year ago. The Herrick Co. is a national real estate investment firm that has completed more than $6 billion in transactions. The company focuses on acquiring single-tenant buildings net leased to office, industrial and retail users, …

SANTA ANA, CALIF. — Hanley Investment Group Real Estate Advisors has brokered the $36.5 million sale of Bristol Place, a 61,454-square-foot retail center located in Santa Ana. Built in 1968, the property was renovated in 2019 and was 89 percent occupied at the time of sale. Matt Burnett, Kevin Fryman and Ed Hanley of Hanley represented the seller, a joint venture between an affiliate of Cadence Capital Investments and Oakwood Real Estate Partners. Ron Duong of Marcus & Millichap represented the buyer, a California-based private investor.

EL SEGUNDO, CALIF. — Diamond Realty Holdings has purchased an industrial flex/office building in El Segundo for $6 million. The property is located at the intersection of Lairport Street and East Mariposa Avenue. A long-term tenant currently occupies 2,400 square feet of the main, 14,400-square-foot structure. The remaining 12,000 square feet is available for lease and fully divisible. The new ownership plans to complete interior and exterior renovations to improve the façade and access to the site, as well as create open flex industrial space that can accommodate a variety of uses. CBRE’s Bob Healey, John Lane, Richard Melbye and Jane Healey represented both the buyer and the undisclosed seller in the transaction.

Dowd Cos. Arranges $16.3M Sale of Horizon Village Shopping Center in Suwanee, Georgia

by John Nelson

SUWANEE, GA. — The Dowd Cos., a boutique real estate investment sales firm based in West Palm Beach, Fla., has arranged the $16.3 million sale of Horizon Village Shopping Center in Suwanee. The 97,000-square-foot shopping center is located at 2855 Lawrenceville-Suwanee Road in metro Atlanta’s Gwinnett County. Movie Tavern and YouFit Health Clubs anchor the property, which was built in 1996, according to LoopNet Inc. John Dowd and Theresa Johnson of The Dowd Cos. represented the seller in the transaction. Both the buyer and seller requested anonymity.

SKOKIE, ILL. — JLL Capital Markets has brokered the $11.5 million sale of a 123,519-square-foot retail and industrial building in Skokie. Built in 1976 and renovated in 2013, the property is located at 3450 W. Touhy Ave. XSport Fitness is the anchor tenant at the fully occupied building. Other tenants include Skokie Cash & Carry and Howard Packaging. The property features three interior docks, four drive-in doors, an 84-space parking garage and a clear height of 30 feet. Michael Nieder of JLL represented the seller, CenterPoint Properties Trust. Skokie-based Bernard Capital Investment Partners was the buyer.