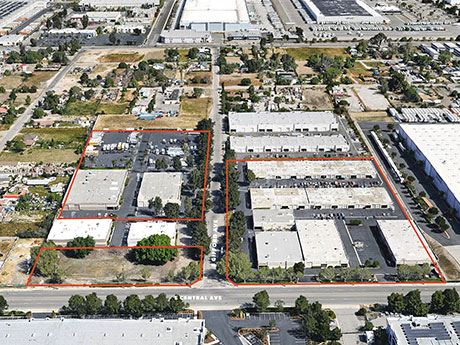

SAN BERNARDINO, CALIF. — Kidder Mathews has arranged the sale of the seven-building Gifford Business Park in San Bernardino for $26 million. The multi-tenant industrial property is located at 750-760 East Central Ave. and 765-791 South Gifford Ave., 2.5 miles from San Bernardino International Airport. It was built in 1989. The seller, Positive Investments, undertook capital expenditures, including roof replacement on five of the seven buildings, exterior paint on the entire property and parking lot re-slurry. The business park is currently 93 percent leased with more than 50 tenants. In-place rents are nearly 20 percent below market rates. Alan Pekarcik of Kidder Mathews represented the seller, while Christopher Smith of Colliers represented the buyer, MIG RE Investors I LLC, in the transaction.

Acquisitions

WESTLAKE VILLAGE, Calif. — LTC Properties Inc. (NYSE: LTC), a Westlake Village-based REIT, has sold two skilled nursing centers in New Mexico. The two centers, totaling 235 beds, were sold for $21.3 million, generating proceeds of $20.8 million. The proceeds will be used to pay down the company’s unsecured revolving line of credit. LTC anticipates recording a gain on sale of approximately $15 million in first-quarter 2023. As a result of the sale, the two properties were removed from the operator’s master lease, and LTC provided a rent decrease of 7.5 percent of the net proceeds, or approximately $1.5 million of cash rent, to the operator. The centers were built in 1975 and 1985. “As part of our active asset management program, we identify opportunities to reduce the age of our portfolio and provide us with capital that can be better deployed through new investments or deleveraging our balance sheet,” says Wendy Simpson, LTC’s chairman and CEO. “This sale was in the best interest of LTC and the operator, and we look forward to continue working with them through the four skilled nursing centers and one behavioral hospital they continue to operate under the master lease.”

Standard Communities Acquires 3,200-Unit Affordable Housing Portfolio in Florida, Georgia

by Jeff Shaw

LOS ANGELES — Standard Communities, an affordable housing developer and investor based in Los Angeles, has acquired controlling interest in an affordable housing portfolio of approximately 3,200 units in Florida and Georgia. The seller and price were not disclosed. This is Standard Communities’ largest acquisition to date. The portfolio includes the firm’s first acquisitions in Florida and first affordable housing acquisitions in Georgia. “Standard is expanding its portfolio in the Southeast to foster more thriving communities in the region,” says Jeffrey Jaeger, co-founder and principal of Standard Communities. “High-quality, well-maintained affordable housing is crucial to the well-being and livelihood of so many people.” Standard Properties is partnered with Apartment Life, a Dallas-based nonprofit organization that works to increase renters’ access to education and healthcare, foster community engagement, reduce food insecurity and provide opportunities for economic mobility. The firm plans to invest $25 million in capital improvements across the portfolio. Apartment Management Consultants and Arco Management Corp. will manage the properties. Also in Georgia, Standard Communities recently broke ground on a project in Savannah that will convert a 1920s-era Atlantic Coast Line Railroad office building into a 219-unit market-rate apartment community. — Channing Hamilton

PLEASANTON, CALIF. — A joint venture comprising Shopoff Realty Investments, Praelium Commercial Real Estate and an affiliate of Singerman Real Estate LLC has purchased an 8.4-acre property in Pleasanton that was formerly home to a Nordstrom department store. Located at Stoneridge Mall, the property marks the fourth mall purchase for Shopoff in recent years, according to the company’s president and CEO. Shopoff is currently exploring potential uses — including residential, mixed-use and office — for the space. Stoneridge Mall is one of the sites identified for redevelopment by the City of Pleasanton’s 2023-31 Housing Element Plan.

POWAY, CALIF. — SENTRE has acquired Parkway Commerce Center, a 147,907-square-foot, multi-tenant industrial park in Poway, for $21.4 million. The facility comprises two warehouse/distribution buildings and two industrial/flex buildings, which are leased to a diverse roster of tenants. The property features 19- to 25-foot clear heights and a total of 21 dock-high doors, 36 drive-in doors and 316 parking spaces. JLL’s Bob Prendergast, Lynn LaChapelle, Ryan Spradling and Zach Saloff represented the seller, an institutional investor.

ORANGE, CALIF. — MCA Realty has sold Struck Business Park, a 42,750-square-foot, two-building industrial property in Orange, for $13.5 million. The all-cash buyer utliized a 1031 Exchange for the transaction. Struck Business Park features 16 industrial units ranging from 1,461 square feet to 11,420 square feet. It is located at 1523 & 1547 W. Struck Ave. MCA purchased the asset in August 2021 and repositioned the property. This included a new paint scheme, landscape upgrades, asphalt repairs and new signage. Mike Hefner, Hayden Socci and Tom Terry of Voit Capital Markets team arranged the sale.

TAMPA, FLA. — Walker & Dunlop has negotiated the $76 million sale of the DoubleTree by Hilton Tampa Rocky Point Waterfront, a 291-room hotel located on Tampa’s Rocky Point peninsula. The waterfront hotel was originally built in 1986 and recently underwent a $17.9 million renovation. Sean Reimer of Walker & Dunlop’s New York team represented the buyer, BlackPearl Hospitality LLC, in the transaction. Walker & Dunlop also arranged an undisclosed amount of acquisition financing for BlackPearl. The seller was not disclosed. The DoubleTree by Hilton hotel features an outdoor swimming pool, fitness center, onsite restaurant, business center, meeting rooms and complimentary Wi-Fi, according to the hotel website.

HOUSTON — Locally based brokerage firm NewQuest Properties has negotiated the sale of a 60,000-square-foot office building in Houston’s Greenspoint neighborhood. The six-story building at 11947 North Freeway was 29.5 percent leased at the time of sale. John Nguyen of NewQuest Properties represented the seller, an entity doing business as Contender Two LLC, in the transaction. Albi Neziri of Texas Advantage Realty represented the buyer, which plans to occupy the majority of the office space and offer the balance for multi-tenant use.

CORPUS CHRISTI, TEXAS — Locally based brokerage firm Cravey Real Estate Services has arranged the sale of a 34,165-square-foot industrial property in Corpus Christi. The property consists of four buildings on a 13.6-acre site that formerly housed the operations of Orion Drilling Co., the seller of the property that previously filed for bankruptcy. John Foret of Cravey Real Estate Services represented the buyer, CoFlow Compression LLC, in the transaction. George Clower of Clower Co. represented Orion Drilling.

FAYETTEVILLE, N.C. — StoutCap, a real estate investment firm specializing in raising capital from passive investors, has closed on its $9.2 million acquisition of Treetop Apartments in Fayetteville. The seller was not disclosed. The buyer plans to renovate the interiors of all 146 apartments, as well as upgrade the property’s amenities and exteriors. Treetop is situated on 10.4 acres and features a pool, lounge area, onsite laundry facilities, picnic area with grills and onsite property management and maintenance. StoutCap expects the value-add acquisition to double the return for investors in six years. The buyer plans to return 100 percent of capital to its investors in three years.