The build-to-rent (BTR) property type has gained significant traction in the commercial real estate market due to increasing interest from tenants, investors and developers. Developers moving into the BTR market before 2020 originally focused on this sector as an “in between” product for future home buyers who weren’t ready to commit to a single location but wanted additional space and amenities. The pandemic fueled tenants’ desires for more privacy and space without the long-term commitment of homeownership, which ignited growth in the sector. As costs for single-family homes continue to rise, the BTR niche also increasingly attracts would-be homeowners who are priced out of the homebuying market — and the growing demand for BTR properties draws the attention of more and more investors and developers. But not all stakeholders are immediately on board with development of BTR properties. The concept is rather new in some markets and local communities have questions about the zoning and operation of these hybrid communities, which are an intriguing mix of single-family concept and multifamily operations. Developers often need to educate municipalities about the BTR concept — and they need to plan BTR properties that work for the local community. This is where Bohler — a land …

Affordable Housing

Affordable HousingBohlerBuild-to-RentContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

EVANSTON, ILL. — Evergreen Real Estate Group and Council for Jewish Elderly, doing business as CJE SeniorLife, have completed Ann Rainey Apartments, a $25 million affordable seniors housing community in Evanston. The 60-unit project is located at 1011 Howard St. next to the existing CJE SeniorLife Adult Day Services Center, which provides programming and socialization opportunities for seniors who require supervision. The new community is named for Ann Rainey, who served as alderman of Evanston’s 8th Ward for more than three decades. Units at the property are restricted to residents who earn up to 60 percent of the area median income. Amenities include a community room, fitness center, outdoor terrace, second-floor deck and lounge areas. Housing and Human Development Corp., a Chicago-based nonprofit that serves low-income seniors and families, will provide a part-time social service coordinator for the property. Evergreen Construction Co., a division of Evergreen Real Estate Group, served as general contractor. Architecture firm UrbanWorks designed the community, which is anticipated to receive LEED Silver certification. A partnership between Evergreen, CJE and U.S. Bancorp Community Development Corp. owns Ann Rainey Apartments. Financing for the project came from IFF, provider of the pre-development loan; U.S. Bank, provider of the construction …

SUNDERLAND, MASS. — MassHousing has provided $41.2 million in permanent financing for North 116 Flats, a newly built residential community in Sunderland, located in the northern central part of the state. Of the property’s 150 units, 38 are reserved for households earning 80 percent or less of the area median income. The remaining 112 market-rate units feature 329 beds that serve students at the nearby University of Massachusetts at Amherst. Amenities include a community building with common, entertainment, fitness and study areas, as well as dog parks, grilling stations and fire pits. Stuart I. Roosth designed the property, and Western Builders served as the general contractor. The borrower and developer was Landmark Properties Inc.

Enterprise Community Development Sells Auburn Pointe Apartments in Newport News for $28.7M

by John Nelson

NEWPORT NEWS, VA. — Enterprise Community Development, a nonprofit affordable housing owner and developer based in Silver Spring, Md., has sold the 274-unit Auburn Pointe Apartments in Newport News. An affiliate of Bethesda, Md.-based RailField Partners purchased the property on behalf of its RLM Preservation Fund, which focuses on preserving affordable housing, for $28.7 million. Berkadia represented the seller in the transaction, and Answer Title provided title and escrow services. Built in 1972 at 496 Catina Way in Newport News’ Denbigh neighborhood, Auburn Pointe is located off of I-64. The property’s amenities include a pool, laundry facilities, playground and a fitness center. The buyer will keep units at Auburn Pointe affordable for the foreseeable future.

JLL Arranges $19.5M Acquisition Financing for Metro D.C. Affordable Housing Community

by John Nelson

LEXINGTON PARK, MD. — JLL Capital Markets has arranged a $19.5 million acquisition loan for River Bay Townhomes, a 173-unit affordable housing community in Lexington Park. JLL arranged the floating-rate loan through Sound Point Capital Management on behalf of the borrower, Linden Property Group. Developed using Low-Income Housing Tax Credits (LIHTC) in 2004 and 2005, River Bay Townhomes consists of three-bedroom, two-bath units an average square footage of 1,291, making them some of the largest units available in metropolitan Washington, D.C., according to JLL. Of the 173 units, 155 units are set aside for tenants who make no more than 60 percent of the area median income (AMI). Situated at 48100 Baywoods Drive, the property is located within St. Mary’s County in southern Maryland at the confluence of the Chesapeake Bay, the Potomac River and the Patuxent River. The area includes multiple military bases and defense contractors, St. Mary’s College of Maryland and the University of Southern Maryland.

NEW YORK CITY — A partnership between multifamily owner-operator Asland Capital Partners and locally based investment firm Pembroke Residential Holdings has received $100 million in financing for the development of a 154-unit affordable housing project in the Soundview neighborhood of The Bronx. Residences will be reserved for renters age 62 and above with income levels that represent various percentages of the area median income. In addition, 30 percent of the units will be set aside for seniors who were formerly homeless. Completion of the 14-story building is scheduled for fall 2024. The $100 million construction loan was procured through a combination of both taxable and tax-exempt bonds issued by the New York State Housing Finance Agency, with credit enhancement in an equal amount provided by Goldman Sachs. Goldman Sachs is also providing tax credit equity for the development.

Affordable HousingFeaturesMidwestMultifamilyNortheastSeniors HousingSoutheastStudent HousingTexasWestern

Four Ways Technology Can Keep Onsite Multifamily Staff Happier During the Great Resignation

by Jaime Lackey

The Great Resignation. The Big Quit. Call it what you will. The widespread trend of employees leaving their jobs in 2021 and 2022 has placed a burden on onsite property management staff at multifamily communities. Like other industries nationwide, the multifamily industry has been hit hard by this period where record numbers of employees are leaving their current positions. According to the National Apartment Association (NAA), rental owners and operators have reported up to 70 percent of their workforce resigning during this period. Historically, employee turnover ranges from 30 to 50 percent annually. In roles that often require wearing many hats to keep up with prospective renters and resident requests, leasing teams are feeling added pressure. With technology solutions that alleviate daunting tasks for onsite staff, you can save your staff valuable time and unnecessary manual effort. Your leasing team can simplify tour scheduling, automate routine communications, and set up seamless multifamily marketing campaigns that free up time for staff to better connect with renters. Here are four steps operators can take to maximize efficiencies and achieve better outcomes. 1. Automate Apartment Tour Scheduling The first step to helping your team thrive during a spike in renter demand is understanding …

NASHVILLE, TENN. — Amazon plans to invest a total of $10.6 million to help build and renovate more than 130 affordable housing units in Nashville. The investment is in partnership with the Metropolitan Development and Housing Agency (MDHA) and supports the social work of the local nonprofit CrossBridge Inc., which provides housing and supportive services to adults overcoming addiction. The investment is part of the Amazon Housing Equity Fund, which has earmarked more than $2 billion to create and preserve 20,000 affordable homes in Nashville, Washington state’s Puget Sound region and the Arlington, Va., region, which is home to Amazon’s HQ2 campus. The Seattle-based e-commerce giant has committed more than $94 million over the past two years to affordable housing efforts in Nashville. Amazon’s commitment to MDHA consists of a $7.1 million low-rate loan to support the construction of Cherry Oak Apartments, a mixed-income residential development in the Cayce Place neighborhood of east Nashville. Cherry Oak will feature 96 apartments, including 53 that are affordable at or below 80 percent of area medium income (AMI). MDHA has a 99-year ground lease at the site. Amazon is also providing a $3.5 million grant to support CrossBridge’s housing projects on Lindsley Avenue …

CHESTER, PA. — Locally based brokerage firm Starkman Realty Group has arranged the $3.1 million sale of Buckman Meadows, a 42-unit affordable housing building in Chester, a southwestern suburb of Philadelphia. The property was originally constructed in 1917 to house shipbuilders during World War I and subsequently converted to a veterans’ hospital and then an affordable housing complex for veterans in 2015. New Jersey-based Tunic Group purchased Buckman Meadows from an undisclosed partnership. Jason Starkman of Starkman Realty Group represented both parties in the deal.

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

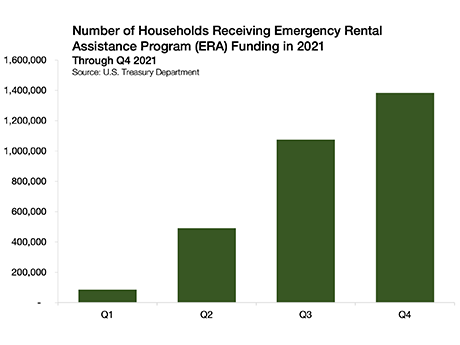

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …