FORT LAUDERDALE, FLA. — Housing Trust Group (HTG) and Mount Hermon African Methodist Episcopal (AME) Church have opened Mount Hermon Apartments, a new affordable seniors housing community in Fort Lauderdale. Development costs totaled $43.5 million. Monthly rental rates at the community, which features one- and two-bedroom apartments, range from $433 to $1,422 per month. Units are reserved for seniors earning at or below 25 and 60 percent of the area median income (AMI). According to Apartments.com, the average rental rate for a one-bedroom apartment in Fort Lauderdale is $2,222. Amenities at the property include a rooftop terrace, fitness center, clubroom and community gathering space. Services offered at the community include 24-hour assistance, adult literacy training and support with light housekeeping, grocery shopping and laundry. Financing for the development included $32.6 million in 9 percent low-income housing tax credit (LIHTC) equity syndicated through Raymond James; a $33 million construction loan from TD Bank; a $7.5 million permanent Freddie Mac loan provided and serviced by Berkadia; and a $640,000 loan from the City of Fort Lauderdale. HTG Gomez Construction served as the project’s general contractor. The project team also included architect REP-R-TWAR, civil engineer Thomas Engineering and interior design firm B. Pila …

Affordable Housing

CLEVELAND — KeyBank Community Development Lending and Investment (CDLI) has provided a $12 million construction loan and invested $16.1 million in Low-Income Housing Tax Credit equity for the construction of Churchill Gateway II, a 70-unit affordable housing project in Cleveland. KeyBank Commercial Mortgage Group (CMG) also arranged a $5.6 million Freddie Mac permanent loan for the project, which will be built at 10526 Churchill Ave. and received an additional $1.7 million in funding from the Ohio Housing Finance Agency. Churchill Gateway II is the second phase of the anchor development along the East 105th corridor, creating a connection between the Glenville neighborhood to the north and the job center at University Circle to the south. The project will consist of a four-story building with one-, two- and three-bedroom units for residents earning 30 to 60 percent of the area median income and will contain 19 units supported by project-based subsidies. The NRP Group is the developer. The May Dugan Center will provide supportive services. Seaver Rickert and Ryan Olman of KeyBank CDLI structure the financing, while Robbie Lynn of KeyBank CMG arranged the permanent loan.

NEW YORK CITY — Locally based developer BFC Partners has landed a $250 million construction loan for 1709 Surf Avenue, a 420-unit affordable housing project on Coney Island. The project marks the third and final phase of a 1,242-unit, three-building affordable housing development along Surf Avenue that is valued at approximately $700 million. Income restrictions across the three buildings range from 30 to 130 percent of the area median income. Project partners include the New York City Department of Housing Preservation and Development, the New York City Housing Development Corp. and Citi Community Capital. Construction is slated for a 2028 completion.

Affordable HousingConference CoverageFeaturesMultifamilyNorth CarolinaSoutheastSoutheast Feature Archive

Lenders Are Back in Action for Multifamily Development Deals, Says InterFace Panel

by John Nelson

CHARLOTTE, N.C. — In its first-quarter report, property management research firm RealPage stated that the “supply wave for multifamily was cresting” as the U.S. apartment sector set a record in terms of units absorbed (138,302), outpacing deliveries (116,092). A year prior, RealPage reported that deliveries (135,652) outstripped absorption (103,826) in first-quarter 2024. Will Block, partner and co-founder of Olympus Development Co., said that the flip in the U.S. apartment market’s supply-demand dynamic the past 12 months has made all the difference in terms of lenders’ perception. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “It couldn’t be more different what it looked like a year ago trying to capitalize deals in tertiary markets,” said Block. “Last year we would call 50 lenders with the hope of one to get to do it at terms that we didn’t like with ridiculous deposit requirements. I probably get four or five cold calls a week from bankers now.” Block’s comments came during the development panel at InterFace Carolinas Multifamily, an annual networking and information conference held on May 21 …

Wespac Residential Breaks Ground on First Affordable Housing Project in Sedona, Arizona

by Amy Works

SEDONA, ARIZ. — Wespac Residential, as general contractor, has broken ground on The Villas on Shelby, an affordable multifamily property in Sedona. Project partners include HS Development Partners, the City of Sedona, Athena Studio and the Arizona Department of Housing. The Villas on Shelby will be Sedona’s first-ever affordable housing community and will be funded through federal Low-Income Housing Tax Credits (LIHTC). Situated on a 1.2-acre site acquired by the City of Sedona, the three-story apartment complex will feature 30 affordable rental homes, including 24 one-bedroom units and six three-bedroom units. The development will include covered parking, a community room with a kitchen, fitness room, playground and elevator access. Additionally, the property will feature future-ready infrastructure with stubs in place for electric vehicle charging stations. Construction is underway, with completion and tenant move-in scheduled for May 2026. In addition to federal LIHTC, the project is being funded via an investment from the State Housing Trust Fund, part of Governor Katie Hobbs’ allocation toward addressing Arizona’s housing crisis.

WYOMING, MICH. — Cherry Health and Woda Cooper Cos. Inc. have broken ground on Shea Ravines, a 56-unit affordable housing community adjacent to Cherry Health’s Wyoming Community Health Center. The four-story building will offer 40 one-bedroom units and 16 two-bedroom residences for singles, families and seniors who earn up to 80 percent of the area median income. There will be 20 Permanent Supportive Housing units reserved for renters exiting homelessness. Those units are supported by rental assistance provided by the Grand Rapids Housing Commission. Nonprofit services provider Community Rebuilders of Grand Rapids will coordinate supportive services to assist these residents. Amenities will include a multipurpose room, playground and bike storage. The US Green Building Council expects the property to be certified LEED Zero Energy. The project is named in honor of prior Cherry Health CEO Chris Shea. Additional phases of development are planned, for a total of 112 affordable housing units on the campus. The City of Wyoming approved a 3 percent Payment in Lieu of Taxes, which helped make the project possible. In 2024, the Michigan State Housing Development Authority (MSHDA) allocated housing tax credits to Shea Ravines to support the development financing. Earlier this year, MSHDA allocated housing …

ORANGE COUNTY, VT. — M&T Realty Capital Corp. has provided $5 million in equity for Chelsea Williamstown Apartments, an affordable housing redevelopment project in Vermont’s Orange County. The project involves the rehabilitation and adaptive reuse of two noncontiguous properties that will add 61 rent-restricted units, many of which will be marketed to seniors, to the local supply. Northfield Savings Bank is financing construction, which is expected to be complete next spring. The owner was not disclosed. M&T also provided a $5.6 million Fannie Mae M.TEB forward commitment as part of the capital stack.

PHILADELPHIA — A partnership between Pennrose and the Philadelphia Chinatown Development Corp. (PCDC) has delivered Man An House, a 51-unit affordable seniors housing project in the latter entity’s namesake neighborhood. The site is located within an opportunity zone and formerly housed a parking lot. The five-story building features studio, one- and two-bedroom units that are reserved for renters aged 62 and above and who earn between 20 and 60 percent of the area median income.

NEW HAVEN, CONN. — A partnership between two affordable housing development and management companies, Community Preservation Partners (CPP) and Beacon Communities, has acquired the 104-unit Brewery Square Apartments in New Haven. The new ownership plans to invest about $43 million in the rehabilitation of the two-building complex, which was originally constructed in 1896 as a brewery and converted to housing in the 1980s. The partnership will upgrade units’ appliances, bathrooms, countertops, windows and floors, as well as enhance the landscaping and security systems. Renovations will serve to extend the affordability status of the property, which houses 41 one-bedroom units, 55 two-bedroom residences and six three-bedroom units. The renovation will transition 84 of the 104 units into the Low-Income Housing Tax Credit program, with affordability levels ranging from 30 to 80 percent of the area median income.

NYC Planning Commission Approves Midtown Manhattan Rezoning Proposal to Add Thousands of New Residences

by Abby Cox

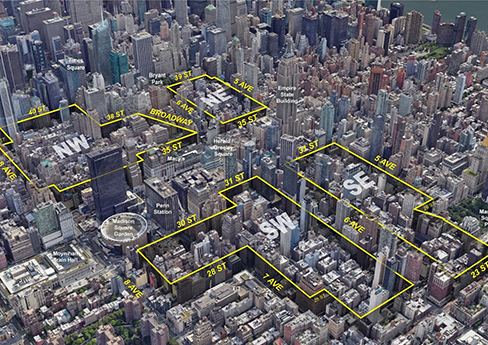

NEW YORK CITY — The New York City Planning Commission has approved the Midtown South Mixed-Use Plan (MSMX), a rezoning initiative that could ultimately facilitate the creation of as many as 9,700 new residences across a 42-block section of Midtown Manhattan. The MSMX plan covers four areas centered around Herald and Greeley Square, located between West 23rd and West 40th streets, as well as Fifth and Eighth avenues. The area today is largely defined by commercial and industrial uses, with current land-use rules restricting new housing development. Midtown South is currently home to more than 7,000 businesses, 135,000 jobs and various public transportation hubs, but the neighborhood has struggled to rebound in the aftermath of the COVID-19 pandemic as hybrid work schedules have become more entrenched. In addition to these commercial vacancies, the submarket is subject to restrictive zoning rules that limit opportunities for New Yorkers to live near their jobs. “For far too long, outdated zoning policies have limited the potential of this well-resourced area to help address New York City’s urgent housing needs,” says Rachel Fee, executive director of the New York Housing Conference, nonprofit affordable housing policy and advocacy organization. “In the midst of a dire housing crisis, …