PHILADELPHIA — Locally based developer NewCourtland has completed a 178-unit mixed-income adaptive reuse project in Philadelphia’s East Falls neighborhood. The project converted the former Eastern Pennsylvania Psychiatric Institution, which originally opened in 1956 and has been vacant since 2013, into a 12-story residential complex that includes 40 affordable housing units for seniors. NewCourtland won a bid for the 14-acre site in 2015 and subsequently brought in architecture firm Looney Ricks Kiss to facilitate the transition of the site into a mixed-income property.

Affordable Housing

COLUMBUS, OHIO — CASTO has begun development of Westrich, a $70 million multifamily project that is an expansion of the River & Rich apartment community in the Franklinton neighborhood of Columbus. This second phase of development includes 234 units on vacant land adjacent to River & Rich. Completion is slated for 2026. Westrich will be marketed as a separate entity from River & Rich. In addition to CASTO and the Columbus Metropolitan Housing Authority (CMHA), funding partners include The Robert Weiler Co., The Kelley Cos. and Mark Cain of S. Cain Development and Construction. CMHA provided the majority of the construction financing through the issuance of $47.2 million in CMHA general revenue bonds. The project team includes CK Construction, Dimit Architects, landscape architect REALM Collaborative and civil engineer EMH&T. Plans for Westrich include a four-story building with 114 units and a five-story building with 120 units atop 8,000 square feet of first-floor commercial spaces. There will be 229 parking spaces in a garage and adjacent surface lot. A private pedestrian walkway will connect the two buildings and provide access to the amenity deck. The majority of the new units at Westrich will be designated for households earning below 100 percent …

TRAVERSE CITY, MICH. — Greystone has provided a $28.2 million HUD-insured 221(d)(4) loan for the construction of Corners Crossing in Traverse City. Wallick Communities and Homestretch Nonprofit Housing Corp. are co-developing the 192-unit, $45 million multifamily community. Plans call for 96 one bedrooms, 78 two bedrooms and 18 three-bedroom units across eight buildings. Units will be designated for those earning between 80 and 120 percent of the area median income. Corners Crossing will also feature a clubhouse with an onsite management office and resident amenities, including a fitness center, computer center and patio. Construction is expected to take approximately 24 months and be completed in the second quarter of 2026. Brian Jones of Greystone originated the loan on behalf of JHT Wallick Holdings LLC. In addition to the loan from Greystone, the property will be financed with funds from the American Rescue Plan Act awarded by Grand Traverse County and the Michigan State Housing Development Authority. Additionally, Blair Township passed its first-ever Payment in Lieu of Taxes ordinance for the project, creating a fixed rate for the development’s real estate taxes.

DULUTH, MINN. — Standard Communities led a public-private partnership in acquiring Lenox Place Apartments in Duluth, an eastern Minnesota city along Lake Superior. The transaction is capitalized at $37.1 million. Built in 1980 and located at 701 W. Superior St., the affordable housing property features 152 units. There are 143 one-bedroom units and nine two-bedroom residences for seniors and individuals with disabilities. Standard will extend the affordability of Lenox Place Apartments for 30 years, with resident income restricted to 60 percent of the area median income. Funding for the acquisition included Low-Income Housing Tax Credits secured through the Minnesota Housing Finance Agency, and the Housing Redevelopment Authority of Duluth issued tax-exempt bonds. Huntington Bank provided the tax credit equity. Standard will significantly renovate the 14-story property at a cost of approximately $12 million. Residents will not be relocated during the renovations.

LONG BEACH, CALIF. — Los Angeles-based Meta Housing Corp., in partnership with Foundation for Affordable Housing, has broken ground on 1400 Long Beach, an affordable housing community in Long Beach, a suburb south of Los Angeles. Located at 1400 Long Beach Blvd., the development will be a six-story residential building offering 163 one-, two- and three-bedroom units. Onsite amenities will include a community room, technology hub and private courtyard. The project will offer housing for low- and moderate-income family households earning between 30 percent and 70 percent of the area median income. Project partners include Foundation for Affordable Housing, California Housing Finance Agency, Bank of America, Century Housing Corp., California Tax Credit Allocation Committee and California Debt Limit Allocation Committee.

PITTSBURGH — New Jersey-based Tryko Partners has completed Cedarwood Homes, an age-restricted affordable housing project located at the site of the former Fairywood School in Pittsburgh. The majority (39) of the property’s 46 one-bedroom units are reserved for renters earning 60 percent or less of the area median income. Merchants Capital provided $11 million in financing for Cedarwood Homes, and The Pennsylvania Housing Finance Agency awarded 9 percent Low-Income Housing Tax Credits to the developer to fund the project. Construction began last summer, and leasing commenced in February.

AUSTIN, TEXAS — Comunidad Partners, an investment firm that specializes in affordable and workforce housing, has acquired the 358-unit Toscana Apartment Homes in northwest Austin. Built in 2001, the property features one-, two-, and three-bedroom units that are reserved for households earning between 60 and 120 percent of the area median income. Residences are furnished with stainless steel appliances, faux wood flooring, stone countertops and individual washers and dryers. Amenities include a pool, playground and a pet park. Comunidad Partners plans to implement a capital improvement program that elevates common areas and living spaces, including installing a pickleball court and adding private yards. The seller and sales price were not disclosed.

SG Holdings Delivers 578-Unit Affordable Seniors Housing Community in Miami’s Overtown Neighborhood

by John Nelson

MIAMI — SG Holdings, a partnership between Swerdlow Group, SJM Partners and Alben Duffie, has completed the housing component of Sawyer’s Walk, marking the delivery of the largest affordable senior living community in the United States within the last decade, according to the developer. The studio, one- and two-bedroom housing units, which are designated for seniors earning at or below an average of 60 percent of the area median income (AMI), sit atop Sawyer’s Walk’s shops and parking garage. Sawyer’s Walk, a $350 million mixed-use development, is underway in the Overtown neighborhood of Miami. Upon full build-out it will total 1.5 million square feet, including the 578 residential units completed that will be home to low-income seniors; 175,000 square feet of retail space committed to tenants including Target (50,000 square feet) and Aldi (25,000 square feet); a 25,000-square-foot public plaza; and 130,000 square feet of office space acquired by MSC Group that will anchor its North American cruise division headquarters. The retail component is slated to open this fall. SG Holdings broke ground on the 3.4-acre, mixed-use development in June 2021. The public-private partnership was made possible through a collaboration with the City of Miami’s Southeast Overtown/Park West Community Redevelopment …

KeyBank Funds $45.4M Financing for Camas Flats Affordable Housing Project in Oak Harbor, Washington

by Amy Works

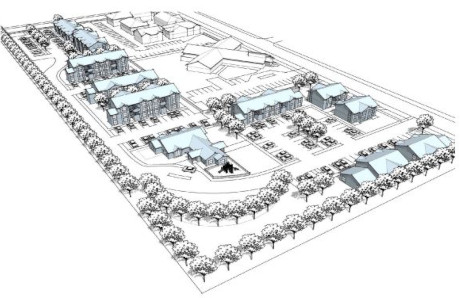

OAK HARBOR, WASH. — KeyBank Community Development Lending and Investment (CDLI) has provided $17.9 million in federal Low Income Housing Tax Credit equity and a $19.3 million construction loan for the construction of Camas Flats, an affordable residential property in Oak Harbor, located on an island north of Seattle. KeyBank Commercial Mortgage Group also arranged an $8.2 million Fannie Mae MTEB permanent loan for the project. Shelter Resources Inc., a Bellevue-based affordable housing developer, is the borrower. Additionally, Opportunity Council (OC) will service as the nonprofit general partner for the project, providing supportive services and case management to tenants on site. Camas Flats will consist of 10 garden-style, walk-up apartment buildings offering a mix of one-, two- and three-bedroom units, as well as one manager’s unit. Community amenities will include a playground, park and community building. The community will provide 81 affordable housing units for residents earning between 30 percent and 80 percent of area median income. Camas Flats will also include eight units that are specifically Permanent Supportive Housing (PSH) for those experiencing homelessness and two units for veterans. For the PSH units, OC will offer full-time case management services that are focused on wellness, medical health and behavioral health …

DETROIT — The Community Builders has broken ground on Phase I of Preserve on Ash, which will consist of a 69-unit mixed-income housing development in Detroit. The new development marks the first groundbreaking for what will ultimately comprise nearly 600 new and preserved units of affordable housing in the greater Corktown area made possible thanks to a $30 million Choice Neighborhoods grant that the U.S. Department of Housing & Urban Development awarded to the city in 2021. The city had sought the grant anticipating the rising rents that would be coming to Corktown as a result of Ford’s revitalization of Michigan Central Station. Preserve on Ash Phase I will include five buildings and more than 5,800 square feet of retail space. Of the 69 units, 48 will be reserved for those who earn up to 60 percent of the area median income. Phases II and III of Preserve on Ash are expected to begin construction next year.