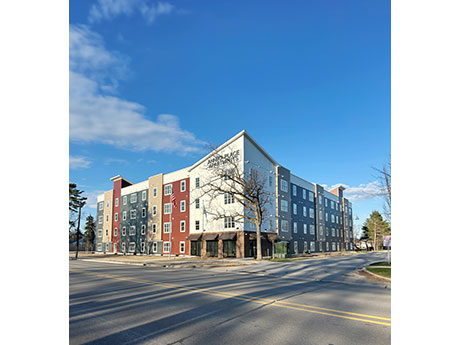

TRAVERSE CITY, MICH. — Woda Cooper Cos. Inc. has opened Annika Place, a 53-unit affordable housing community in Traverse City. The $14.7 million project offers 29 one-bedroom units and 24 two-bedroom units for residents who earn 30 to 80 percent of the area median income. Rental rates range from $377 to $1,125 per month, depending on the income restriction and size of unit. The Traverse City Housing Commission will provide rental assistance for eight units to be occupied by formerly homeless residents. The four-story development features amenities such as a community kitchen, fitness center, rooftop terrace, patio, picnic table, grill, park benches and playground. Annika Place is made possible with funding supported by Low-Income Housing Tax Credits allocated by the Michigan State Housing Development Authority. Affordable housing finance syndicator CREA LLC invested in the credits to provide equity financing. Huntington Bank provided a construction loan and permanent financing. The project honors the memory of U.S. Coast Guardsman Douglas Munro, who lost his life at the Guadalcanal on Sept. 27, 1942, because of heroic measures with his Higgins boat that shielded and saved the lives of 500 Marines. He is the only Coast Guard member to receive the Medal of Honor. …

Affordable Housing

There are a common set of headwinds — such as high construction costs and interest rates — facing the commercial real estate industry at large. But affordable housing development and operations also come with a unique set of challenges all their own. Despite this, panelists at the InterFace Affordable Housing Southeast conference, held May 9 at the Cobb Galleria Centre in Atlanta, expressed an optimistic outlook for the sector. Closing out the day’s events, speakers on the “Southeast Regional Housing Authorities & Legal Update” panel shared strategies for surviving within the current affordable housing landscape and highlighted the importance of planning ahead to succeed in the sector. The devil’s in the details Most crucial to navigating the sometimes tumultuous waters of affordable housing is engaging in thorough — even painstaking — preparation, concurred each of the panelists. This is especially true given the current macroeconomic climate and its difficulties. When asked how her organization confronts these challenges, Yvonda Bean, chief executive officer with Columbia Housing, identified an emphasis on facilitating communication within the project team for planning purposes. More specifically, Bean reported that Columbia Housing connects the “general contractor with the architect to work on design plans” early on, such that when …

Related Urban, Tampa Housing Authority Break Ground on 234-Unit Mixed-Income Housing Project

by John Nelson

TAMPA, FLA. — A public-private partnership between Related Urban Development Group, the Tampa Housing Authority and the City of Tampa has broken ground on Gallery at Rome Yards, an 11-story mixed-income housing project located south of Columbus Drive between Rome Avenue and the Hillsborough River. Eighty percent of the property’s 234 units will be reserved as affordable and workforce housing while the remaining 20 percent will be market-rate apartment homes. Additionally, five apartments on the ground level will be designated as live/work units designed with local artists and entrepreneurs in mind, complete with a storefronts and working areas. Amenities will include a fitness center, walking path with distance markers, workspace for students and remote workers, communal club room, dog park with a nearby dog wash area, ground-floor retail space and a workforce training/small business success center. Related Urban expects to complete Gallery at Rome Yards in December 2026. The property represents Phase I of the Rome Yards master plan, which is the redevelopment of a vacant 18-acre maintenance yard into nearly 1,000 apartments and 33,604 square feet of commercial space.

Integral Group Breaks Ground on 99-Unit Affordable Seniors Housing Community in Metro Miami

by John Nelson

OPA-LOCKA, FLA. — The Integral Group has broken ground on Wellspring Apartments, an affordable seniors housing community in the Miami suburb of Opa-Locka. Wellspring Apartments will feature 99 units, 67 of which are reserved for residents earning below 50 percent of the area median income (AMI), and the remaining 32 units are for residents earning below 60 percent AMI. The 81,350-square-foot property will feature a computer and library room, fitness center, community center with a full kitchen, and covered terrace. The project is a public-private partnership between Integral, Miami-Dade County, the City of Opa-Locka and local businesses. PNC Bank is also a partner on the project, providing $13.4 million in equity through Low-Income Housing Tax Credit (LIHTC) funds.

Red Oak Capital Provides $7.7M Loan for Ocean Shores Apartments in D’Iberville, Mississippi

by John Nelson

D’IBERVILLE, MISS. — Red Oak Capital Holdings LLC has provided a $7.7 million loan for Ocean Shores Apartments, a 128-unit affordable housing community located at 10472 Gorenflo Road in D’Iberville, about three miles north of Biloxi. The fixed-rate loan is interest-only and carries a two-year term, with an all-in interest rate of 9.5 percent. Craig Hall of CBRE brought the opportunity to Red Oak Capital. Jeff Joyner, Hermann Wendorff and Jesus Martinez of Red Oak Capital originated the loan. The borrower, an entity doing business as Ocean Shores Property Owner LLC, will use the loan to acquire the garden-style property and complete renovations begun by the seller, including new flooring and paint, as well as HVAC maintenance, reglazing existing kitchen countertops and replacing appliances in most of the units. The property, which was 94 percent occupied at the time of financing, operates under a land use restrictive agreement (LURA) through 2047 that requires the units to be rented to households earning less than the area median income (AMI). After the renovations, the borrower plans to boost rental rates by using vouchers that allow for rents greater than those imposed by the LURA. Situated on 11 acres, Ocean Shores features one-, …

CPP Acquires 102-Unit Corinthian House Affordable Seniors Housing Community in San Jose

by Amy Works

SAN JOSE, CALIF. — Community Preservation Partners (CPP) has purchased Corinthian House, an affordable seniors housing property in San Jose. CPP’s total development investment is approximately $38 million, which includes the purchase price of $21 million and an estimated per-unit renovation cost of $85,000. Built in 1982, Corinthian House comprises two elevator-served, three-story buildings on 1.7 acres. Located at 250 Budd Ave., the 102-unit property offers studio and one-bedroom layouts designated for seniors age 62 and older earning between 30 and 60 percent of the area median income. Planned renovations include vinyl plank flooring, cabinets and countertops, modern appliances, water-saving toilets, vanities and mirrors, and energy-smart lighting. Common-area renovations will include updates to the community room, laundry rooms, salon and leasing and management office. Additionally, the property will receive a new fitness center. Renovations are slated for completion by December. The property’s Housing Assistance Payment (HAP) Section 8 contract was set to expire, but with CPP’s involvement, the contract will be preserved for another 20 years. Partners on the project include California Tax Credit Allocation Committee, which issued 9 percent Low-Income Housing Tax Credits; Comerica Bank, which will provide the acquisition and rehabilitation loan; CitiBank, which will provide the permanent loan; …

VALPARAISO, IND. — Evergreen Real Estate Group has completed Green Oaks of Valparaiso, a $30 million assisted living community for low-income seniors in Valparaiso, a city in northwest Indiana. The three-story project includes 120 units and is located at 2550 W. Morthland Drive. All residences are reserved for seniors age 62 and older, with incomes at or below 60 percent of the area median income. A financial assistance program is available for qualified applicants. Evergreen Construction Co., a division of Evergreen Real Estate Group, served as the general contractor on the development, which received 90 pre-leases prior to opening. Managed by Gardant Management Solutions, Green Oaks of Valparaiso is licensed and regulated as a residential care facility by the Indiana Department of Health and approved as an assisted living Medicaid-waiver provider by the Indiana Family and Social Services Administration. The community is staffed 24 hours by certified nursing assistants who monitor and assess resident health and assist with bathing, grooming, dressing, medication management and other daily needs. Additional offerings include transportation, laundry, weekly housekeeping and onsite beauty/barber services. The onsite dining room provides residents with three meals per day plus snacks. Units include a kitchenette, individually controlled heating and …

NEW HAVEN, CONN. — Nonprofit owner-operator Beacon Communities has broken ground on a 76-unit affordable housing project in New Haven. The project will convert a parking lot on State Street and vacant upper-floor spaces on Chapel Street into a complex with studio, one- and two-bedroom apartments and ground-floor commercial spaces. The majority (60) of the units will be affordable to households earning between 30 and 60 percent of the area median income. The other 16 units will serve households that are currently or at risk of experiencing homelessness. Beacon Communities is financing construction of the project through a mix of federal and state tax credits, as well as local incentives and subsidies.

ORLANDO, FLA. — BWE has secured $24 million for the construction and permanent financing of Barnett Villas, an affordable housing development in Orlando. Peter Borstelmann and Jim Gillespie of BWE arranged the financing in the form of the purchase of tax-exempt bonds issued by the Florida Housing Finance Corp. (FHFC). The bonds feature a fixed interest rate, as well as three years of interest-only payments. Upon completion, Barnett Villas — which will be located at 1050 Barnett Villas Drive — will comprise 156 units in one-, two- and three-bedroom layouts. Of the units, 78 will be reserved for residents earning up to 60 percent of the area median income (AMI), 39 will be designated for residents earning up to 50 percent of AMI and 39 will be reserved for residents earning up to 70 percent of the AMI. Amenities at the property will include a fitness center, lounge and surface parking. The total project cost is $44.9 million, including $18.2 million in Low-Income Housing Tax Credit (LIHTC) equity syndicated by Enterprise Housing Credit Investments. A construction timeline was not disclosed.

GMD Development, WNC & Associates to Develop 182-Unit Victory Northgate Affordable Housing Project in Seattle

by Amy Works

SEATTLE — GMD Development and WNC & Associates have closed a deal to begin construction on Victory Northgate, a six-story affordable housing developing in north Seattle. Located at 1000 Northeast Northgate Way, Victory Northgate is slated for completion in April 2026. The community will offer 13 studios, 101 one-bedroom units, 17 two-bedroom units and 51 three-bedroom units, as well as 6,800 square feet of commercial space with 77 underground parking stalls. The 182 affordable apartments are targeted for families earning up to 60 percent of the area median income. The first-floor commercial space is tentatively reserved for a daycare facility run by the YMCA of Greater Seattle. Victory Northgate will meet all mandatory criteria required by the Evergreen Sustainable Development Standard, Washington State’s sustainable building framework. Sustainable features will include Energy Star-rated appliances; high-efficiency mechanical systems, windows and insulation; low-flow plumbing components; LED lighting throughout the property; and 90 percent drought-tolerant landscaping. The deal was structured with 4 percent LIHTC equity, a construction and permanent loan through Citi Community Capital and a $25.5 million soft loan from the City of Seattle. AOF/Pacific Affordable Housing Corp. is participating as the nonprofit co-general partner.