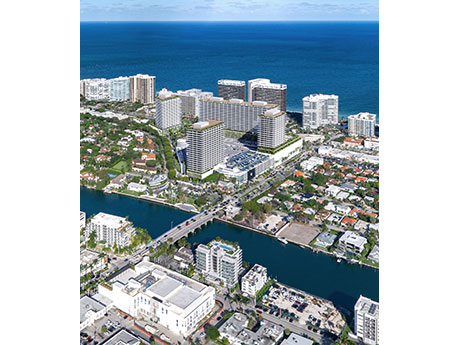

MIAMI — Whitman Family Development has submitted plans for a mixed-use project at its Bal Harbour Shops in Miami’s Bal Harbour village. Plans call for 600 apartment units, 40 percent of which are earmarked for workforce housing and 60 percent of which will be luxury housing. There will also be a 70-room, 20-story hotel and an additional 45,700 square feet of retail space. Bal Harbour Shops comprises more than 100 shops, restaurants and entertainment options. The open-air, luxury retail center, which is home to brands such as Chanel, Gucci, Tiffany & Co. and Valentino, is currently undergoing a $550 million retail expansion that will add about 250,000 square feet, nearly doubling the center’s current retail space. The expansion will accommodate the addition of 35 new upscale stores and restaurants. The new housing development is made possible by Florida’s Live Local Act, a bipartisan bill passed by the Florida legislature last year in response to the critical need for affordable and attainable housing statewide. The legislation enables developers to build at higher density and building heights, so long as they commit to including attainable housing units. The law requires that local municipalities approve mixed-use residential projects in any area zoned commercial …

Affordable Housing

EAST CANTON, OHIO — BWE has arranged a $1.1 million loan for the construction of HOPE Senior Village in East Canton, about 30 miles southeast of Akron. Bob Morton of BWE structured the USDA RHS 538 GRRHP loan, which features a 40-year, fixed-rate term and a 40-year amortization schedule. The development will consist of eight buildings, each containing five one- and two-bedroom units. Of the 40 units, seven are designated for residents earning up to 30 percent of the area median income (AMI), 17 are reserved for those earning up to 50 percent AMI and 16 are designated for residents earning up to 60 percent AMI. The project received additional financing through the use of 9 percent Low-Income Housing Tax Credits.

MADISON, WIS. — Associated Bank and Johnson Financial Group have originated a $13 million construction loan and a $41.6 million tax-exempt bond loan for the development of Rise Madison. The Wisconsin Housing Preservation Corp. is developing the affordable housing project in the state’s capital. The 4 percent Low-Income Housing Tax Credits project will provide affordable housing for both seniors and families. The senior financing structure will take the form of tax-exempt bonds issued by the Wisconsin Housing and Economic Development Authority and held by both Associated Bank and Johnson Financial Group. Bryan Schreiter of Associated Bank and Steve Sosnowski of Johnson Financial Group handled the loan arrangements and closing. The four-building project is situated on Rise Lane. Units will be offered to tenants with income levels at or below 80 percent of the Dane County median income. Two five-story buildings will be marketed for families. One will have a total of 110 units while the other will feature 77 units. A three-story building will have a total of 46 units designed for senior living. The fourth building will consist of 12 two-story townhomes. Older buildings on the project site have been demolished, and phased construction is underway. The first building …

SAN ANTONIO — An affiliate of locally based investment firm LYND Group has purchased Culebra Commons, a 327-unit mixed-income apartment community in San Antonio’s Far West submarket, for $76.2 million. The garden-style property was originally developed in 2021 by a different affiliate of LYND Group and offers one-, two- and three-bedroom units with an average size of 835 square feet. About half the units have been reserved as affordable housing. Amenities include a pool, fitness center, clubroom, resident lounge, catering kitchen, playground and a dog park. Origin Strategic Credit Fund is a preferred equity investor in the deal.

MINNEAPOLIS — Colliers Mortgage has provided a $10.8 million HUD 221(d)(4) loan for the rehabilitation of Labor Retreat Apartments in Minneapolis. The 77-unit Section 8 property features one- and two-bedroom units. Amenities include a community room, onsite management office, outdoor patio, lounge area and laundry rooms. In addition to the HUD-insured first mortgage, the project will utilize 4 percent Low-Income Housing Tax Credits and tax-exempt bonds, which were underwritten by affiliate Colliers Securities LLC. The loan features a 40-year term and 40-year amortization schedule. The borrower was Labor Retreat Housing Partners LLC, an affiliate of Vitus Group LLC.

MONROEVILLE, PA. — KeyBank has provided $90.7 million in financing for the acquisition and rehabilitation of Cambridge Square Apartments, a 204-unit affordable housing property in Monroeville, an eastern suburb of Pittsburgh. The financing consists of a $35 million construction loan, an $18 million Fannie Mae permanent loan, $15.7 million in Low-Income Housing Tax Credit (LIHTC) equity and $22 million in tax-exempt bonds that were sold by KeyBanc Capital Markets. Cambridge Square Apartments consists of eight three-story buildings in one-, two- and three-bedroom floor plans, with 97 percent (198) of the units subject to a 20-year Section 8 Housing Assistance contract. Residents have access to services such as healthcare education, financial and computer literacy, childcare, youth activities, nutritional services, disability services, tenant homeownership training and parenting programs. Anna Belanger and Jonathan Wittkopf of KeyBank structured the tax credit equity and debt financing for the transaction. Robbie Lynn of KeyBank structured the tax-exempt bonds, which were marketed for sale by Sam Adams of KeyBanc Capital Markets. The sponsor is Community Preservation Partners.

Hunt Capital Transfers Ownership of 76-Unit Affordable Seniors Housing Community in Biloxi, Mississippi

by John Nelson

BILOXI, MISS. — Hunt Capital Partners has transferred ownership of Cadet Point Senior Village, an affordable seniors housing community in Biloxi, back to Biloxi Community Development Corp., the nonprofit arm of the Biloxi Housing Authority. Developed in 2007, the property comprises 76 units. Hunt Capital transferred ownership back to the civic organization in late November following negotiations accounting for the operational expense challenges at the property. According to Hunt Capital, Cadet Point has experienced insurance premium increases totaling more than 65 percent over the past five years due to its exposure to hurricanes. Biloxi Community Development will have full control of development and operational decisions at Cadet Point.

NEW YORK CITY — A partnership between locally based developer Slate Property Group and RiseBoro Community Partnership has purchased the 350-room JFK Hilton Hotel in Queens with plans to convert the property into a 318-unit affordable housing complex. The partnership purchased the hotel, which was originally built in 1987 and is located about half a mile from JFK International Airport, for $64 million. The new complex will be known as Baisley Pond Park Residences and will house studio, one- and two-bedroom units and amenities such as a fitness center, computer lounge and multiple common rooms. Monthly rents will range from $784 for a studio to $1,493 for a two-bedroom apartment. As part of the conversion, the development team will replace all major building and mechanical systems, including new all-electric heating and cooling systems to reduce emissions. Aufgang Architects is designing the project, which has a total price tag of about $167 million and is expected to take about 21 months to complete.

CHICAGO — Habitat and P3 Markets have topped off construction of the second apartment building at 43 Green, a $100 million mixed-income development in Chicago’s Bronzeville neighborhood. The transit-oriented development is centered around the 43rd Street Green Line L station. The new building rises 10 stories with 80 units, 44 of which will be designated as affordable. Completion is slated for late summer 2024. The developers have fully leased the first apartment building, which also rises 10 stories. The 99-unit property consists of 50 affordable units for households earning up to 60 percent of the area median income. Located on a long-vacant, city-owned lot on the northeast corner of East 43rd Street and Calumet Avenue, the first building is the largest of three planned buildings at 43 Green. Amenities include a fitness center, business center, picnic area, community room with kitchen, two rooftop terraces, laundry facilities and bicycle storage. The second building will have similar amenities.

Related Cos., Sterling Equities Break Ground on 2,500-Unit Willets Point Affordable Housing Project in Queens

by Katie Sloan

NEW YORK CITY — Queens Development Group, a joint venture between Related Cos. and Sterling Equities, has broken ground on the first phase of a 2,500-unit affordable housing project in the New York City borough of Queens. The project, named Willets Point, will be the city’s largest affordable housing development in 40 years, according to the joint venture. Wells Fargo has arranged a total of $360 million in financing for Phase I of the development, with a $236.5 million construction loan and $123.5 million Low-Income Housing Tax Credit investment. Phase I of the development will feature two mid-rise buildings offering a combined 880 units of affordable housing. Forty percent of units will be reserved for residents earning at or below 60 percent of the area median income, and 15 percent of units will be set aside for tenants that formerly experienced homelessness. Amenities will include a landscaped inner courtyard, laundry facilities, lounge space with access to outdoor terraces, bicycle storage and ground-floor retail space. The development will also include infrastructure investments like new streets, signage, sidewalks, trees, lights, drainage, stormwater management, water hydrants, sewers and utilities. Future components of the development will include a 650-seat standalone public school, New York …