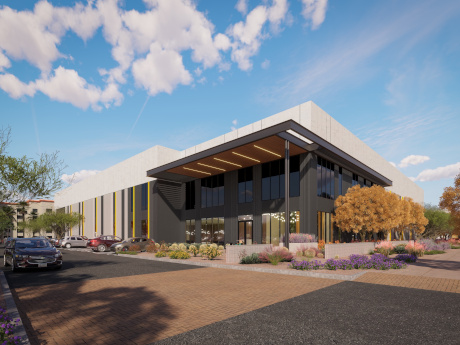

TEMPE, ARIZ. — Creation and LGE Design Build have broken ground on a 6-acre industrial development in Tempe. The project will encompass 120,000 square feet across two buildings, with joint venture partner Pacific Office Automation preleasing one building as its Southwest market headquarters. LGE Design Build is serving as architect and general contractor of the project, overseeing the ground-up construction of Pacific Office Automation’s 75,000-square-foot headquarters, in addition to a 45,000-square-foot building available for lease or sale. The development will feature 32-foot clear heights, a shared truck court and 185 parking spaces, including eight electric vehicle charging stations and 14 bike parking spaces. The project is located at 1400 W. 3rd St. Construction is underway, with completion slated for late 2026.

Arizona

Phoenix Commercial Advisors Brokers $25.9M Sale of Chandler Sunset Plaza Shopping Center in Arizona

by Amy Works

CHANDLER, ARIZ. — Phoenix Commercial Advisors has arranged the sale of Chandler Sunset Plaza, an entertainment- and fitness-anchored shopping center on 13 acres at the northeast corner of Rural and Ray roads in Chandler. The asset traded for $25.9 million, or $242 per square foot. Totaling 107,320 square feet, the property was 95 percent leased to a mix of national and local tenants, including Pickleball Kingdom, Jack in the Box, First Watch and Own Your Dream Sports Academy. John Schweikert and Chad Tiedeman of Phoenix Commercial Advisors represented the undisclosed seller in the deal.

— By Bryan Ledbetter of Western Retail Advisors — Phoenix’s retail market continues to surge. Vacancies are dipping below 5 percent, gross absorption is exceeding 1.5 million square feet in the third quarter and asking triple-net rates continue to increase, reaching into the mid-$50 to $60 per square foot range for newly constructed space. West Valley Leads the Charge in New Development After decades of limited retail construction, metro Phoenix — and the West Valley, in particular — are flush with new space. Projects like SimonCRE’s Prasada in Surprise and Vestar’s Verrado in Buckeye are among the major new developments providing the high-end availability that tenants and residents have been asking for. Although elevated debt and construction costs have tempered new development, more than 1.2 million square feet is still under construction. The lion’s share of that product is already pre-leased. This keeps developers and investors bullish on Phoenix, and on the lookout for the Valley’s next development frontier. Though the West Valley reigns as Phoenix’s latest retail boom market, outliers in the East Valley are teeing up for their turn in the spotlight. Apache Junction is a great example… Far Southeast Valley Emerges as a Growth EngineA neighbor of …

CHANDLER, ARIZ. — Park Senior Villas has announced plans for an expansion project at its senior living campus in Chandler. Originally opened in 2020, the property currently comprises seven villas, each of which features a great room and built-in amenity. Upon completion, which is scheduled for summer 2026, the expansion will add 21,000 square feet and occupancy for 48 additional residents. Each new building will include 10 bedrooms and options for both single and double occupancy. The groundbreaking is scheduled for Nov. 25. According to Park Senior Villas, which also operates communities in Goodyear, Houghton and La Cañada, Ariz., its Chandler property has had a 30-person waitlist for the entirety of this year.

PHOENIX — San Diego-based ColRich has acquired Camden Copper Square, a multifamily community in downtown Phoenix, from Camden Property Trust for $77 million. The secure, gated community features 332 apartments, two parking structures, two swimming pool areas with barbecue grills and seating, an outdoor lounge with panoramic views, indoor coworking spaces, a 24-hour fitness center and a dog park. Matt Pesch, Asher Gunter, Sean Cunningham and Austin Groen of CBRE represented the seller in the deal. Trevor Breaux and Troy Tegeler of CBRE arranged financing for the buyer.

PHOENIX — Gantry has secured an $8.5 million permanent loan to refinance the Rose Garden Apartments, located at 21008 N. 23rd Ave. in Phoenix. The Class B, garden-style apartment community features 55 one- and two-bedroom floor plans. Adam Parker, Chad Metzger and Andrew Christopherson of Gantry’s Phoenix production office represented the borrower, a private real estate investor. The Fannie Mae loan features a 10-year term, fixed interest rate and interest-only payments for half of the term prior to transitioning to a 30-year amortization schedule.

QUEEN CREEK, ARIZ. — Vestar has completed Queen Creek Crossing, a 400,000-square-foot retail development located in Queen Creek, approximately 40 miles southeast of Phoenix. Costco anchors the property, which is fully leased. Other tenants include Ashley Furniture, Hobby Lobby, BJ’s Restaurant and Brewhouse, Ono Hawaiian BBQ, Smoothie King, Sleep Number, Fleet Feet, Well Groomed Pets, Desert Financial Credit Union, Natural Pediatrix, Gallery Nails and Snip-Its. Additionally, The Habit Burger and Grill is scheduled to debut in December, while U.S. Bank is expected to open in late 2026. Vestar originally broke ground on the 31-acre development in 2022.

MESA, ARIZ. — Diversified Partners has announced plans to develop East Gate Plaza, a $60 million retail destination at the northeast corner of Elliot and Ellsworth roads in Mesa. Spanning approximately 7 acres, East Gate Plaza is located within the master-planned community of Eastmark and the emerging Superstition Vistas region, a planned 275-square-mile area of developable residential and commercial opportunities. East Gate Plaza will feature distinctive building designs, pedestrian-friendly layouts and a professional curated tenant mix. Current confirmed tenants include Starbucks Coffee, Einstein Bros. Bagels, Discount Tires, FitFX, WingSnob, Señor Taco, Farmer Boys, Zeitouna, Fresh Monkee, Port of Subs, Ono Hawaiian BBQ, Euphoria Nail Salon, Playa Bowls, Hand & Stone Spa, Kolache Café and Andi’s Hair Salon (AVEDA). Additional tenants will include a dental office, a veterinary practice, a med spa, family medicine practice and a restaurant with a bar. The project will also feature the Cambria Hotel. Construction is underway, with delivery slated for first-quarter 2026. Walt Brown Jr. and Robert Mayhew of Diversified Partners are leading the development team. Matt Pergola, Brandon Vasquez and Austin Payne of Diversified Partners CRE are handling brokerage services for the project.

PHOENIX — EMBREY has closed on the land and financing for 12th & Greenway, a Class A apartment property located near North 12th Street and Greenway Parkway in Phoenix. Construction will begin immediately, with first occupancy slated for third-quarter 2027. Situated on 7 acres, the four-story, wrap-style community will feature 340 apartments, including townhomes. Units will feature open-concept layouts with 9- to 10-foot ceilings, wood-style plank flooring, quartz countertops and stainless steel appliances. Additional features will include built-in desks, keyless entry and double vanities in select units. Onsite amenities will include a heated pool and hot tub with private cabanas, an outdoor kitchen and fireplace, fitness and yoga studios, a game room, conference and micro-office spaces and a secured 24-hour package room. Outdoor features will include several courtyards, a walking trail, dog park and shaded community spaces. Frost Bank, with support from private investors, provided financing for 12th & Greenway. EMBREY’s Garrett Karam and Jimmy McCloskey led the execution of the transaction.

TUCSON, ARIZ. — Lincoln Property Co. has completed I-10 International Phase I, the company’s first-ever ground-up industrial development in Tucson. Valued at $80 million, I-10 International Phase I sits on 79 acres at the southeast corner of Alvernon Way and Los Reales Road, two miles from an interchange at I-10 and Valencia Road, within the Tucson International Airport submarket. Totaling 373,811 square feet, the property includes the 158,944-square-foot Building B and the 214,867-square-foot Building C. A fully designed, 188,434-square-foot Building A and a 476,000-square-foot Building D will be developed in line with market demand, bringing the asset to more than 1 million square feet of Class A industrial space. Buildings at I-10 International Phase I are state-of-the-art cold capable with 32-foot clear heights, 14-foot glass entrances, full concrete truck courts, generous clerestory windows and an R-38 insulated roof deck system. The project team includes Brinkmann Constructors as general contractor and Butler Design Group and Ware Malcomb as the collaborative design team. Jesse Blum of Cushman & Wakefield | PICOR is handling leasing for the project.