MESA, ARIZ. — DWG Capital Partners has acquired a manufacturing and distribution facility, located at 260 S. Hibbert St. in Mesa, for $10 million in a sale-leaseback transaction. AirBagIt fully occupies the 72,780-square-foot property, which is a former concrete tilt-up cold storage facility situated on 1.9 acres. The building features 17-foot clear heights, three docks, one drive-in dock and three external dock levelers. The custom engineering company will continue to occupy the property under an 18-year, triple-net lease. The company specializes in manufacturing innovative motor vehicle parts and accessories. Glen Miles of Calgary, Canada-based Miles Capital Partners represented the seller in the off-market transaction.

Arizona

PEORIA, ARIZ. — CBRE has brokered the sale of Landmark on 67th, a Class A apartment community in Peoria. LM67 LLC acquired the asset from RET3 LLC for $16.23 million, or $289,857 per unit. Brian Smuckler, Jeff Seaman, Derek Smigiel and Bryson Fricke of CBRE in Phoenix represented the seller and buyer in the transaction. Located at 9160 N. 67th Ave., Landmark on 67th features 56 two-bedroom/two-bath apartments, each averaging 1,100 square feet. Units offer stainless steel appliances, white shaker-style cabinetry, quartz countertops and subway tile backsplashes. Situated on 4.1 acres, the residential units are spread across seven two-story buildings. Community amenities include a leasing office, swimming pool and spa, cabana-style seating, fitness center, covered playground and dog park.

ViaWest, Willmeng Break Ground on 1.2 MSF First Phase of Industrial Campus in Glendale, Arizona

by Amy Works

GLENDALE, ARIZ. — Phoenix-based ViaWest Group, as developer, and Willmeng Construction, as general contractor, have broken ground on The Base, Phase I. Located in Glendale, The Base will be a 144-acre industrial campus at full build out. The first phase will include seven buildings, spanning 1.2 million square feet. The buildings will range in size from 85,000 square feet to 309,000 square feet with divisibility down to approximately 20,000 square feet. The second phase is proposed to include eight buildings, totaling 780,600 square feet, and ranging in size from 41,000 square feet to 141,000 square feet. The buildings will feature heavy power, ESFR sprinkler systems, a combination of dock-high and grade-level loading, concrete truck courts, ample car parking, R-38 insulation and clear heights ranging from 28 feet to 36 feet. Completion of Phase I is slated for fourth-quarter 2024. DLR Group is serving as architect and Kimley-Horn as civil engineer for the project. CBRE will handle leasing for both phases. Will Strong, Kirk Kuller, Molly Hunt, John Alascio and TJ Sullivan of Cushman & Wakefield secured equity financing for the development. JLL Capital Markets arranged a $96.5 million construction loan for the project.

High Street Residential Completes 310-Unit Smith & Rio Apartment Community in Tempe, Arizona

by Amy Works

TEMPE, ARIZ. — High Street Residential (HSR), the residential subsidiary of Trammell Cros Co., has completed construction on Smith & Rio, a multifamily property located at 1979 E. Rio Salado Parkway in downtown Tempe. The five-story property features 310 apartments in a mix of studio, one-, one-plus-den and two-bedroom layouts. Community amenities include a fifth-floor sky lounge; two outdoor courtyards; a dog park; pet lounge; work-from-home area with individual workspaces; pool; spa; fitness center; clubhouse with multiple lounges and seating areas; fireplace; and demonstration kitchen.

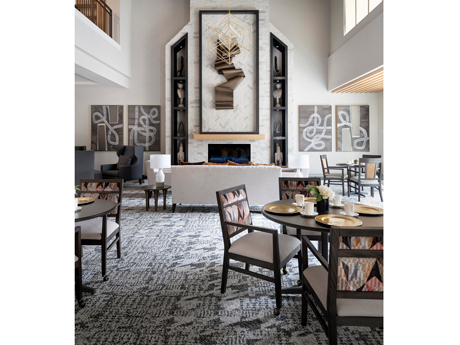

SCOTTSDALE, ARIZ. — Cogir Senior Living and Ryan Cos. US Inc. have opened ACOYA Shea, an independent living, assisted living and memory care community in the Phoenix suburb of Scottsdale. The community features 147 units in a four-story building. “ACOYA Shea is located right in the heart of Scottsdale, and residents will be able to enjoy the walkability of the community and the proximity to all that the area has to offer,” says Dave Eskenazy, chief executive officer of Cogir Management USA. Cogir Senior Living develops, owns and/or operates 60 communities throughout the United States.

Seven Hills Realty Trust Arranges $17.3M Recapitalization for Home2 Suites Hotel in Scottsdale, Arizona

by Amy Works

SCOTTSDALE, ARIZ. — Seven Hills Realty Trust (NASDAQ: SEVN) has arranged a $17.3 million first mortgage floating-rate bridge loan for the recapitalization of Home2 Suites by Hilton in Scottsdale. The borrower is a joint venture between Highgate and Rockpoint. Located at 20001 N. Scottsdale Road, the recently constructed hotel features 130 guest rooms. CBRE introduced SEVN’s manager, Tremont Realty Capital, to the transaction. Tremont Realty Capital is an affiliate of The RMR Group (Nasdaq: RMR).

SCOTTSDALE, ARIZ. — Miller Global Properties has completed the disposition of Canopy by Hilton Scottsdale Old Town, located at 7142 E. 1st St. in Scottsdale. Dynamic City Capital acquired the hotel for $102 million, according to local business journals. Built in 2020, Canopy by Hilton Scottsdale Old Town features 177 guest rooms and two restaurants — Outrider Rooftop and Cobre Kitchen. Additionally, the property is within walking distance to more than 100 restaurants, venues and art galleries. Rick Rush and Carter Gradwell of CBRE Hotels represented the seller in the transaction.

PHOENIX — Brinkmann Constructors, as general contractor, and Denver-based The X Co., as developer, have broken ground on X Roosevelt, a 19-story multifamily building in downtown Phoenix. Located in the Roosevelt Row Arts District, the 350,000-square-foot X Roosevelt will feature 370 apartments in a live, work and play environment. The community will also feature coworking space; a gym and fitness studio designed around classes; and 3,500 square feet of first-floor retail space. Chicago-based Lamar Johnson Collaborative is serving as architect for the project, which is slated for completion in fall 2025.

JLL Arranges $96.5M Construction Loan for The Base Logistics Development in Glendale, Arizona

by Amy Works

GLENDALE, ARIZ. — JLL Capital Markets has arranged $96.5 million in construction financing for The Base Phase I, a seven-building logistics development totaling 1.2 million square feet in Glendale. Kevin MacKenzie, Jason Carlos and Jarrod Howard of JLL Capital Markets Debt Advisory team secured the financing through Bank OZK for the borrower, ViaWest Group. Situated on 82.5 acres, the property will feature buildings ranging from 80,000 square feet to 310,000 square feet with clear heights up to 36 feet. In total, the development will offer 105 trailer parking spaces, 1,325 auto parking spaces, 236 dock-high doors and 38 grade-level doors in rear-load and cross-load configurations. The buildings are designed to accommodate a wide range of divisibility between 20,000 square feet and full-building users up to 310,000 square feet. The Base Phase I, is slated for delivery in the fourth quarter of 2024.

RIO RIO, ARIZ. — Omega Produce Co. has completed the sale of an industrial space at 891 E. Frontage Road in Rio Rio. Grower Alliance Properties acquired the asset for $3.6 million. Jose Dabdoub of Cushman & Wakefield | PICOR represented the seller in the deal.