SAN DIEGO — Marcus & Millichap has brokered the sale a retail property located at 1631 Sixth Ave. in downtown San Diego’s Cortez Hill submarket. Mills at Cortez LLC sold the asset to an undisclosed buyer for $1.9 million. 7-Eleven and Barber Craft Retail Condo occupy the 3,251-square-foot property. Reed Hamilton, Bill Rose and Parker Wada of Marcus & Millichap represented the seller in the deal.

California

Mesa West Capital Provides $43.5M Loan for Refinancing of Apartment Community in Los Angeles

by Amy Works

LOS ANGELES — Mesa West Capital has provided a joint venture between Alliance Residential and PCCP with $43.5 million in short-term, first mortgage debt to refinance Broadstone Los Feliz, a multifamily property located at 1800 N. New Hampshire in Los Angeles’ Los Feliz neighborhood. Troy Tegeler, Trevor Breaux, Ryan Greer and CJ Connolly of CBRE arranged the five-year, floating-rate loan. Built in 1986, Broadstone Los Feliz offers 134 studio, one- and two-bedroom apartments, a rooftop lounge and barbecue area, an indoor swimming pool and spa, a fitness center and electric vehicle charging stations. At the time of financing, the property was 95 percent occupied. Since acquiring the asset in 2022, the owners have invested more than $1 million to upgrade the common areas and renovate the interiors of 33 units with hardwood flooring, quartz countertops, stainless steel appliances and new wood-grain cabinets. The sponsor plans to renovate the remaining 45 units within the next two years.

LOS ANGELES — Los Angeles-based Prime Pizza, a rapidly expanding New York-style pizza restaurant, has signed leases for five new locations in Southern California. The locations are at Alicia Landing Shopping Center in Mission Viejo; Gaslight Square in Brea; Farmers & Merchants Bank Center in Torrance; and two freestanding locations, one in Thousand Oaks and another in Valley Village, Calif. Mark Seferian of RCI Brokerage represented Prime Pizza in the transactions, which ranged from 1,256 to 1,951 square feet. The Mission Viejo and Brea locations are slated to open in the fourth quarter of 2025, while the Valley Village, Thousand Oaks and Torrance locations will open during the second quarter of 2026.

Sack Capital Partners, Belveron Partners Buy 164-Unit Multifamily Property in San Jose, California

by Amy Works

SAN JOSE, CALIF. — A joint venture between Sack Capital Partners and Belveron Partners has acquired Fountain Park, an apartment community in San Jose. Terms of the transaction were not released. Located at 1026 S. De Anza Blvd., Fountain Park offers 164 studio, one- and two-bedroom units. Community amenities include a clubhouse, barbecue area, resort-style swimming pool with spa hot tub, sauna, covered parking with electric vehicle charging and a dog park. The new owners have a long-term commitment to convert a portion of the apartments into affordable housing. Sack will provide property management services for the asset.

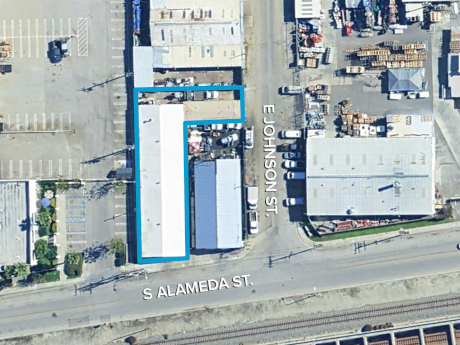

COMPTON, CALIF. — FallTech has purchased an industrial building located at 1414 S. Alameda St. in Compton from Accurate Glass & Mirror Corp. for $1.5 million. Situated on a 9,269-square-foot site, the 6,432-square-foot property features one ground-level door and a clear height of 14 feet. FallTech, which makes fall protection, will use the property to expand its operations. Scott Anderson of The Klabin Co. represented the seller, while Matt Stringfellow of The Klabin Co. represented the buyer in the transaction.

PINOLE, CALIF. — Step Up Housing has purchased Bayside Apartment Homes at 530 Sunnyview Drive in Pinole. Sack Capital Partners and Align Finance Partners arranged structured financing for the acquisition. Additionally, Sack will provide asset and property management for the 148-unit affordable housing community. Originally built in 1974 and renovated in 2017, Bayside features two- and three-bedroom apartments near the shoreline of San Pablo Bay at Point Pinole Regional Shoreline. Institutional Property Advisors, a division of Marcus & Millichap, represented the undisclosed seller in the transaction.

INGLEWOOD, CALIF. — KPC Development Co. has topped out the construction of Kali Hotel and Rooftop, Autograph Collection, a $300 million hotel in Inglewood’s 300-acre Hollywood Park mixed-use development. Crescent Hotels & Resorts will manage the hotel, which will be part of Marriott Bonvoy’s global portfolio. Slated to open in September 2026, Kali Hotel and Rooftop will offer 300 guest rooms, including 34 suites, an all-day dining concept, lobby bar, pool and yoga deck, spa, fitness center and nearly 20,000 square feet of meeting and event space. The project team includes Clayco as general contractor, Lamar Johnson Collaborative as architect and Sixteenfifty Creative Intelligence and Gensler as interior designers.

STOCKTON, CALIF. — CBRE has secured $50 million in refinancing for Park West Place, a retail power center in Stockton. The loan was arranged on behalf of Raider Hill Advisors and Farallon Capital Management with financing provided by a national bank. Richard Henry, Mike Ryan, Brian Linnihan and Shaun Moothart of CBRE represented the sponsorship in the transaction. Built in 2008 on 58.6 acres, Park West Place offers 554,438 square feet of retail space. At the time of financing, the property was 96.4 percent leased to 46 tenants, including Lowe’s, Kohl’s, Sportsman’s Warehouse, Ross Dress for Less and TJ Maxx, with more than 40 percent of the net rentable area leased to investment-grade tenants.

Alta West Partners, OlivePoint Capital Buy 104,795 SF Industrial Campus in Burbank, California

by Amy Works

BURBANK, CALIF. — An affiliate of Alta West Partners and OlivePoint Capital have acquired an industrial manufacturing campus at 100-104 E. Graham Place in Burbank for an undisclosed price. Jeff Sause, Alex Olson, Jalynn Borders and Thomas Gonzalez of JLL Capital Markets secured acquisition bridge financing through a debt fund to support the borrowers’ value-add business plan. Situated on 4.8 acres, the fully gated property offers 104,795 square feet of industrial space spread across five buildings. The asset features up to 28-foot clear heights in warehouse and manufacturing spaces, three grade-level doors and four dock-high loading doors. Additionally, the campus offers two vehicle access points and a configuration suited for both single- and multi-tenant scenarios. Haskel International, a wholly owned subsidiary of Ingersoll Rand, anchors the property for its American headquarters. Haskel, a global company in high-pressure fluid and gas handling solutions, has maintained operations at this location for more than 70 years.

Sonnenblick-Eichner Co. Arranges $126.1M Refinancing for Pacifica Hotels Portfolio in Southern California

by Amy Works

LOS ANGELES — Sonnenblick-Eichner Co. has arranged $126.1 million in first mortgage debt for Pacifica Hotels to refinance a portfolio of seven hotels in Southern California. The three- and five-year fixed-rate loans were funded by a Wall Street investment bank and an insurance company. Totaling 601 rooms, the portfolio includes The Wayfarer San Diego; Sandcastle Hotel on the Beach, Spyglass Inn and Cottage Inn by the Sea in Pismo Beach; Inn at Venice Beach, The Kinney Venice Beach in Venice; and The Belamar Hotel, a Tapestry Collection by Hilton, in Manhattan Beach.