DENTON, TEXAS — General contractor Balfour Beatty has completed construction of three elementary schools in the North Texas city of Denton. Designed by Pfluger Architects, Hill Elementary, Martinez Elementary and Reeves Elementary are all part of the Denton Independent School District (ISD) and can each support about 750 students. At each school, a central hub merges the library, dining and outdoor spaces and functions into one open core from which classrooms and areas for special programs extend.

Civic

CLOQUET, MINN. — Kraus-Anderson Construction has broken ground on a new $18.9 million fire and ambulance headquarters serving the Cloquet Area Fire District in Cloquet, a city in northeastern Minnesota. Designed by LHB Architects, the 35,700-square-foot facility will feature an eight-stall apparatus bay for ambulance, fire and rescue vehicles and equipment. The building will house a two-story administrative and dormitory area, training tower and elevator. The first floor will include offices, conference rooms, a training room, fitness room and personal protective equipment storage. The second floor will include 11 dorms, a kitchen, dining room and day room. A new paved area will be used for training. The project is slated for completion by December 2026.

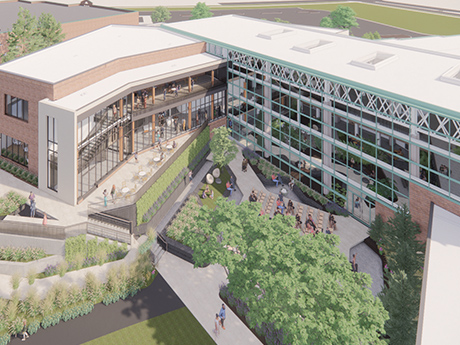

WOODBURY, MINN. — Kraus-Anderson has completed a $42.3 million revitalization of Woodbury Central Park, which is located at 8595 Central Park Place in Woodbury. Designed by HGA Architects, the three-story, 62,708-square-foot project included enclosing the existing amphitheater, a new multipurpose space addition, expanded public gathering areas and an updated Lookout Ridge indoor playground. Improvements also increased parking and pedestrian access, added art installations and space for public art and enhanced accessibility with ADA updates. Sustainability was a core focus of the project, including the integration of a Darcy Geothermal Well system, solar energy and other energy-efficiency initiatives to reduce environmental impact and operating costs. Construction began in April 2024.

SAN ANTONIO — International developer Skanska has topped out a $35 million project at the University of Texas at San Antonio (UTSA). The 52,000-square-foot building will serve as a practice facility for the university’s men’s and women’s basketball and volleyball teams. The facility will have separate practice courts for each program, as well as locker rooms, film review rooms, team lounge areas and office space for UTSA coaching staff. Shared amenities will include strength and conditioning areas, hydrotherapy spaces and equipment and laundry rooms. Completion is slated for summer 2026.

BUFFALO, N.Y. — Lee & Associates has brokered the $33.2 million sale of a 102,000-square-foot academic building located at 75 W. Huron St. in Buffalo. The Buffalo School of Culinary Arts & Hospitality Management occupies the entirety of the seven-story building, which was originally built in the late 19th century as a horse livery and was later used as a multi-story parking garage before being transformed into a school. Dave Carswell and Ben Tapper of Lee & Associates represented the seller, locally based firm McGuire Development Co., in the transaction. Carswell also assisted the buyer, Mercer Street Partners, in securing acquisition financing for the deal.

ALEDO, TEXAS — Elmore Investments has purchased land in Aledo, located west of Fort Worth, with plans to open a new sports facility. The 5.4-acre site at 400 Bailey Ranch Road is adjacent to Aledo High School, and the new facility will feature pickleball courts, tennis and padel courts, softball and baseball training facilities, a pro shop and a restaurant. Kristen Fegley and Ben Gehrke of LanCarte Commercial Real Estate represented the seller, an entity doing business as The Groves of Aledo, in the transaction. A construction timeline was not disclosed.

REDWOOD FALLS, MINN. — Kraus-Anderson has completed the new $46.6 million Redwood Valley Elementary School at 201 McPhail Drive in southern Minnesota’s Redwood Falls. Designed by Wold Architects and Engineers, the 85,639-square-foot, two-story project features classrooms, early childhood education, special education, a media center, flex spaces, a gym, cafeteria, storm shelter and secured entries. There are three outdoor play spaces as well as a bus loop, parent drop-off area, parking lots and sidewalks. Construction began in May 2024.

SEDALIA, MO. — Nabholz Construction Corp. has broken ground on a new fire station, training facility and bowling alley in central Missouri’s Sedalia. Hoefer Welker designed the facilities. The 8,585-square-foot fire station will replace the previous facility. it will feature a three-bay fire apparatus facility with six bunk rooms, a dayroom and a fitness room. The station will be built with a hot zone design approach, decreasing firefighters’ exposure to smoke, carcinogens and toxic chemicals, according to Hoefer Welker. There will also be a dedicated gear decontamination area and advanced air pressurization and thermal comfort systems. Adjacent to the new fire station, the 2,749-square-foot fire training facility will house two fire apparatus bays and include a workshop and restrooms within the pre-engineered metal building. A separately designed burn tower will serve as a comprehensive classroom. The project will also include an 18,775-squarefoot, 16-lane bowling alley with a commercial kitchen and e-sports center. The bowling alley is being funded through a combination of city funds and a donation from Sue Heckert, a notable donor to several city projects, including the Heckert Community Center. Additional project partners include BHC Engineering, Landworks Studio, Bob D. Campbell & Co. and IMEG.

DEL VALLE, TEXAS — General contractor American Constructors has broken ground on a 473,338-square-foot academic project for the Independent School District of Del Valle, located just south of Austin. The site is located within the $2 billion Whisper Valley master-planned community. The project is a new high school campus that will expand career and technical education programs and facilities for students pursuing careers in robotics, technology and manufacturing. In addition to a main academic building, the project team will also deliver a field house, concession stand and baseball/softball facilities. Pfluger Architects is designing the project, completion of which is slated for August 2027.

NEW YORK CITY — A partnership between Slate Property Group and Evenhar Development Corp. has broken ground on a medical office and civic facility at 1578 Lexington Ave. in Upper Manhattan’s Carnegie Hill neighborhood. Designed by Kutnicki Bernstein Architects, the 13-story building will feature 150,000 square feet of medical office space that will be occupied by providers within the Mount Sinai Health System. In addition, the facility will feature an employee daycare center, an 18,978-square-foot community hub that will be operated by Children’s Aid and a new facility for Life Changers Church. Financing for the project includes a $119 million construction loan from J.P. Morgan and a $40 million preferred equity investment by GoldenTree Asset Management. Occupancy is slated for spring 2028.