TORONTO AND WASHINGTON, D.C. — Avison Young has entered into an agreement to acquire Madison Marquette’s retail platform for an undisclosed price. The acquisition will include the Washington, D.C.-based firm’s retail property management, marketing and leasing services throughout the United States; and a portfolio comprising more than 6.1 million square feet of properties managed and leased by Madison Marquette. Madison Marquette teams will integrate with those of Toronto-based Avison Young in Los Angeles, New Jersey, Philadelphia, Indiana, Arkansas, Maryland, Virginia, Atlanta and Florida, and the acquisition expands Avison Young’s presence to Seattle. In 2022, Avison Young acquired Madison Marquette’s office and industrial property management, agency leasing and project management service lines. “Avison Young is going all-in into the retail sector, and I am eager to take the firm’s vision of expanding its retail platform to the next level with the help of our strong team of retail leasing, management, marketing and market intelligence experts and Avison Young’s innovative data capabilities,” says Gavin Farnam, principal and managing director of U.S. retail services with Madison Marquette. Farnam will lead Avison Young’s U.S. retail property management and leasing teams.

Company News

OAK BROOK, ILL. — The Inland Real Estate Group of Cos. Inc. has agreed to acquire a majority interest in the business of Devon Self Storage Holdings LLC. Financial terms of the agreement were not disclosed. Devon manages 202 properties totaling roughly 109,000 units nationally. Founded in 1988 by Ken Nitzberg, Devon has owned, managed or developed more than 350 self-storage facilities in 27 states and three European countries throughout its history. Since entering the self-storage sector in 2016, Oak Brook-based Inland has amassed a $1.7 billion self-storage portfolio of both stabilized assets and development projects across 30 states. Inland plans to grow Devon’s third-party management and development platform.

PFLUGERVILLE, TEXAS — Peinado Construction, a Texas-based general contractor that specializes in industrial projects, has opened a new office in the northern Austin suburb of Pflugerville. Peinado first established its presence in the region with industrial projects for major end users like Caterpillar and Carrier Corp. and most recently completed a 141,282-square-foot data center project in Pflugerville for Skybox and Prologis. Ed Motley will lead the new office as executive vice president.

Blackstone Acquires 20 Percent Stake in $16.8B FDIC-Run Signature Bridge Bank Portfolio

by Jeff Shaw

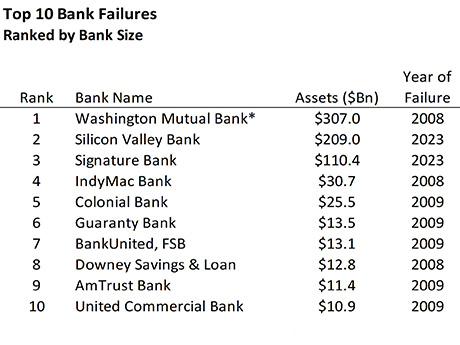

WASHINGTON, D.C. — The Federal Deposit Insurance Corp. (FDIC), as receiver of Signature Bridge Bank, has sold 20 percent of its equity stake in the defunct bank. The agency received the loan portfolio after the failure of Signature Bank in March. Hancock JV Bidco L.L.C. (Hancock), an entity indirectly controlled by Blackstone Inc. and other investors, paid $1.2 billion for a 20 percent equity interest. The portfolio consists of approximately $16.8 billion in commercial real estate loans collateralized by office, retail and market-rate multifamily assets. FDIC will retain an 80 percent equity interest in the venture. Hancock will be responsible for the management, servicing and liquidation of the venture’s assets. The entity will also be required to manage the portfolio in accordance with the terms of the transaction, subject to monitoring and oversight by FDIC. The New York State Department of Financial Services (DFS) took possession of Signature Bank on March 12. The bank failed after depositors withdrew substantial amounts of money in the wake of the collapse of Silicon Valley Bank on March 10. DFS named FDIC as receiver, and FDIC in turn transferred all deposits of Signature Bank to a new entity called Signature Bridge Bank. The bridge bank …

PHILADELPHIA — PREIT (OTCQB: PRET), a mall REIT giant based in Philadelphia, has filed for Chapter 11 bankruptcy protection. The “prepackaged” bankruptcy was agreed to ahead of time by PREIT’s creditors, which will shorten the duration of the company’s bankruptcy proceedings. PREIT expects it will be able to emerge from bankruptcy by early February 2024. PREIT owns and operates 18 malls in New Jersey, Pennsylvania, Massachusetts, Maryland, Virginia, Michigan, North Carolina and South Carolina. The company has also expanded in recent years to the multifamily, hotel and healthcare sectors. According to PREIT’s third-quarter financial results, the company’s same-store net operating income declined 5.3 percent year-over-year. Additionally, its total mall occupancy was 93.6 percent, a decrease of 70 basis points from third-quarter 2022. Joseph Coradino, chairman and CEO of PREIT, cites a trifecta of COVID-19 disruptions, inflation and rising interest rates as leading to its voluntary filing with the U.S. Bankruptcy Court for the District of Delaware. “Following the pandemic disruption, PREIT has worked tirelessly to enhance the portfolio, dramatically improve occupancy and diversify its tenancy,” says Coradino. “However, unusual economic conditions have limited the company’s options with respect to its debt obligations as meaningful achievements on the operating front were …

NEW YORK CITY — An investor group comprising Arkhouse Management and Brigade Capital Management has made a bid to buy out Macy’s (NYSE: M) for $5.8 billion, according to The Wall Street Journal. The offer from two of the retailer’s largest shareholders would include taking the company private. Real estate investment firm Arkhouse and global asset manager Brigade submitted the acquisition proposal Dec. 1, according to the publication. Macy’s boasts a total real estate portfolio value of $8.5 billion, according to J.P. Morgan analysts cited by Reuters. Equating to $21 per share, the offer follows six quarters of net sales declines, reports Reuters. Shares are down roughly 15.8 percent this year and closed at $17.39 Friday, but saw a surge Monday following the news, trading at $20.13. Adjusted net income in the third quarter of this year was reported as $59 million by the retailer, including all Bloomingdale’s stores, marking a year-over-year decline of $84 million. Net sales for the quarter totaled $5 billion, down 7 percent from the third quarter of 2022, with comparable decreases to both digital and brick-and-mortar sales. Recently, the Macy’s retail strategy has included partnerships with Toys “R” Us, as well as a focus on the introduction of …

McDonald’s to Test Small-Format, Beverage-Led CosMc’s Concept with First Location in Metro Chicago

by Katie Sloan

BOLINGBROOK, ILL. — McDonald’s (NYSE: MCD) has announced plans to test CosMc’s, a new smaller format concept featuring a beverage-led menu with new food and drink items. The first location will open this month in the Chicago suburb of Bolingbrook, where the first McDonald’s franchise location opened in 1955. By the end of 2024, the company plans to open 10 pilot locations for the concept, with target markets set to include the Dallas-Fort Worth and San Antonio metropolitan areas. CosMc’s will offer digital and drive-thru ordering formats only, with dynamic menu boards, cashless payment devices and pick-up windows. The concept’s menu will be beverage-focused, including specialty lemonades and teas, blended beverages and cold brew coffees. Drink offerings — which will include churro- and s’mores-flavored coffees, sour cherry energy drinks and lemonades — will be customizable, to include the addition of boba, energy and Vitamin C shots. CosMc’s locations will also feature a small lineup of food items, including new offerings like a spicy queso sandwich and pretzel and hash brown bites, alongside traditional menu standbys like Egg McMuffin sandwiches and McFlurrys. The new concept is named after CosMc, a mascot that McDonald’s launched in the late 1980s. Chicago-based McDonald’s is …

NEW YORK CITY — Coworking and office-sharing pioneer WeWork Inc. (NYSE: WE) has filed for Chapter 11 bankruptcy protection. WeWork also plans to file similar protectionary measures in Canada. WeWork has entered into a restructuring support agreement with its creditors representing approximately 92 percent of its secured notes to “drastically reduce” the company’s existing funded debt and expedite the restructuring process. Reuters reports the debt-for-equity swap deal with its creditors totals $3 billion. The New York City-based company plans to continue operations and “further rationalize its commercial office lease portfolio” with its network of office landlords. WeWork’s locations and franchisees outside of the United States and Canada are not part of this process. According to the company website, WeWork operates more than 320 locations globally across various workplace solutions platforms. As part of the filing, WeWork is requesting the ability to reject the leases of certain locations that are “non-operational,” all of which have affected members that have received advanced notice. The company has retained Hilco Real Estate, an Illinois-based real estate restructuring and advisory firm, to assist with lease renegotiations. “WeWork has a strong foundation, a dynamic business and a bright future,” says David Tolley, CEO of WeWork. “Now …

Hilton Grand Vacations Agrees to Acquire Bluegreen Vacations for $1.5B, Including 48 Club Resorts

by John Nelson

ORLANDO AND BOCA RATON, FLA. — Orlando-based Hilton Grand Vacations has entered into a definitive agreement to acquire Bluegreen Vacations, a time-share resort company based in Boca Raton. The all-cash transaction is valued at $75 per share, or $1.5 billion, including debt. The merger agreement will add more than 200,000 members and 48 club resorts in 14 new geographies for Hilton Grand Vacations. Additionally, Hilton Grand Vacations has reached a 10-year marketing agreement with Bass Pro Shops, which formerly had an exclusive marketing agreement with Bluegreen Vacations that includes a joint venture for four outdoor-themed resorts. The Bluegreen Vacations acquisition is expected to close in the first half of 2024.

ST. PETERSBURG, FLA. — Mel Sembler, founder of St. Petersburg-based retail real estate development firm The Sembler Co., has passed away at the age of 93, according to a statement from the company. Sembler founded his eponymous real estate company in 1962. To date, it has completed more than 350 developments totaling 29 million square feet. Additionally, the company manages and leases 10 million square feet of retail real estate and has offices in St. Petersburg, Atlanta and Puerto Rico. In a prepared statement, The Sembler Co. stated “his indelible mark will continue to guide us as we honor his legacy. He was the truest friend and leader to all.” Currently, The Sembler Co.’s portfolio includes Belmont Shopping Center in Ruskin, Fla., and North Macon Plaza in Macon, Ga. Sembler is also underway on the development of The Preserve Marketplace in Odessa, Fla., and West Villages Marketplace in Venice, Fla. In metro Atlanta, the company developed The Prado in 2008 and Town Brookhaven in 2010. The retail centers total 345,000 and 441,217 square feet, respectively. Sembler also previously served as U.S. Ambassador to Australia and Nauru from 1989 to 1993 and to Italy from 2001 to 2005. He also served …