DALLAS — Completing the lease-up and stabilization of new communities in a timely and cost-efficient manner is the most difficult aspect of developing active adult properties in the current environment. Such is the assertion of developers that are immersing themselves more deeply in this fast-growing sector of commercial real estate, which lies somewhere in between traditional multifamily and independent living on the spectrum of residential uses and services provided. The challenges of fast and effective lease-up programs are attributable to several factors that are unique to the emerging asset class, which also tussles with obstacles like rising construction and operating costs that are impacting all product types in all major markets. A panel of industry professionals with experience in developing and operating both traditional multifamily and seniors housing properties spoke to these challenges during the second-annual InterFace Active Adult conference on June 2. Held at the Dallas Downtown Marriott Hotel, the event also featured insight and analysis from lenders, investors and architects that are active in the space, as well as active adult renters themselves. Ryan Maconachy, vice president at Newmark, moderated the development panel, which kicked off the main day of the conference with a discussion of what the …

Conference Coverage

By Taylor Williams As a subcategory of multifamily that is currently experiencing record rent growth, student housing is increasingly becoming a sought-after commodity in the world of institutional investment, according to a panel of industry experts. More institutional love for student housing is also arriving at a time in which concerns about COVID-19’s impact on enrollment and on-campus learning at the nation’s colleges and universities are largely being laid to rest. The verdict is in on whether students overwhelmingly prefer to live and learn on campus — they do. Capital sources are responding accordingly. At France Media’s 14th annual InterFace Student Housing conference, held May 3-4 at the J.W. Marriott Hotel Austin (Texas) Hotel, a group of industry veterans laid out the drivers behind the sector’s growth on institutional radars. As an affirmation of this trend, the “state of the industry” panel pointed to the $12.8 billion acquisition of Austin-based student housing developer and operator American Campus Communities (NYSE: ACC) by real estate giant Blackstone (NYSE: BX). Panelists implied that that deal, which was announced in April and will take ACC private, serves as a watershed moment for the asset class to institutional investors. As such, the transaction, which is …

Investment in Student Housing Remains Robust Despite Volatility in Debt, Equity Markets, Says InterFace Panel

by Katie Sloan

AUSTIN, TEXAS — As we move toward the start of a new academic year, the outlook in the student housing industry keeps getting brighter, according to experts within the industry. All signs point to further movement out of the COVID-19 pandemic — a testament to which was seen at the 14th annual InterFace Student Housing conference in Austin, where over 1,300 attendees gathered last week at the JW Marriott downtown. The sector’s resilience during the pandemic was once again a major topic at this year’s conference, particularly during the ‘Power Panel,’ which brought together a consortium of high-level executives to discuss industry trends and the outlook for the upcoming academic year. “Evidenced once again by a packed house in this room, the sector is demonstrating continued strength, resilience and sustainability as a niche real estate asset class,” began moderator Peter Katz, executive director with Institutional Property Advisors (IPA), a division of Marcus & Millichap. “While 2021 was a record year for many asset classes, one constant that we can expect in life is change,” he continued. “Over the past 90 days, we’ve seen a huge turn of events in the global economic platform. The impact of the COVID-19 pandemic has …

Build-to-RentConference CoverageDevelopmentFeaturesMultifamilyNorth CarolinaSingle-Family RentalSouth CarolinaSoutheastSoutheast Feature Archive

Speed to Market is ‘Almost the Only Priority’ for Multifamily Developers Looking to Avoid Cost Risks, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Multifamily developers are pushing their chips in and aggressively looking for new development deals, especially for sites in and around high-growth markets in the Southeast. Michael Tubridy, senior managing director of Crescent Communities, said his firm isn’t leaving anything to chance and is looking to move quickly on development opportunities. “We’re trying to get as many units on the ground today as possible, because tomorrow will be more expensive,” said Tubridy. “I like the chances of today’s cost environment a lot better than I like the unknown of where we’ll be a year from now or two years from now. Putting a premium on speed to market is something that we are much more focused on; it’s almost the only priority right now.” Tubridy’s comments came during the development panel at InterFace Carolinas Multifamily 2022. The half-day event was held on April 14 at the Hilton Uptown Charlotte hotel and attracted more than 260 attendees from all facets of the multifamily industry in North Carolina and South Carolina. Michael Saclarides, director of Cushman & Wakefield’s Multifamily Advisory Group, moderated the discussion. Crescent Communities is far from the only multifamily developer pursuing ground-up construction opportunities in earnest. In …

Conference CoverageFeaturesMultifamilyNorth CarolinaSouth CarolinaSoutheastSoutheast Feature Archive

Multifamily Operators Battle Fraud, Labor Shortages on the Front Lines, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Property managers are navigating a minefield of issues in today’s apartment market. Analyzing renter applications for fraud, collecting overdue rent and turning over units from freeloading tenants are all in a day’s work for savvy apartment operators. Amanda Kitts, senior vice president of property management at Northwood Ravin, a multifamily owner and operator based in North Carolina, said that part of the role of an operations professional today entails poring over documents like check stubs, IDs and employment records to make sure the prospective resident is creditworthy. She said that fraud is more prevalent in some markets than others, so it’s imperative that property managers are adequately trained. “Charlotte still is a very big market for fraud, but Durham not so much. Chapel Hill is squeaky clean; nobody does anything wrong in Chapel Hill,” joked Kitts. “We have these applications and check stubs, and maybe one could be off, and you have to investigate and Google. We’re almost mini-FBI investigators.” Kitts’ comments came during the leasing and operations panel at France Media’s InterFace Carolinas Multifamily, which took place April 14 at the Hilton Uptown Charlotte. The networking and information conference drew more than 260 attendees from all facets …

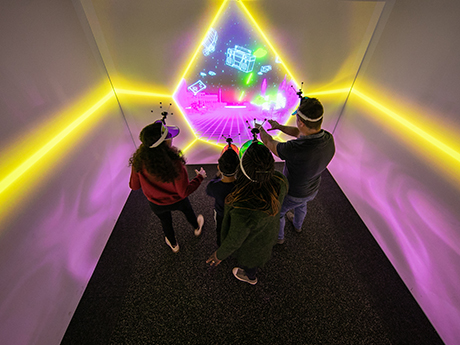

LOS ANGELES — After a two-year slog through COVID-19, consumer demand for shopping, dining and entertainment experiences has become a cresting tidal wave ready to descend upon the shore. The term “pent-up” is frequently used to describe this mentality, but industry professionals know that cliché doesn’t really do justice to the degree of concentrated demand for just about any form of dining out, barhopping, gaming and fraternizing. To this end, the National Retail Federation (NRF) projects that total retail sales across both digital and brick-and-mortar forums will grow between 6 to 8 percent year over year in 2022. And yet, to invoke another nautical metaphor, this scenario is not necessarily a rising-tide-lifts-all-boats phenomenon — at least not in the long run. The reality for developers and operators of shopping, dining and entertainment properties is that in order to win customer loyalty in the long haul and infuse a center with true cross-shopping potential and destinational status, they have to create a legitimately unique draw. This notion, while not necessarily revelatory and Earth-shattering in the current brick-and-mortar retail market, has only been more deeply ingrained by the events of the last 24 months. At the seventh-annual Entertainment Experience Evolution conference that …

Electric Vehicle Manufacturing Powers Real Estate Activity Along I-85 Industrial Corridor, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — The Southeast has long been home to automotive giants such as Honda, Hyundai, Toyota and Mercedes-Benz, as well as their large network of suppliers. In 2021, BMW led the nation in automotive exports by value, the eighth consecutive year the German automaker held that distinction. BMW produced and exported $10.1 billion worth of cars and SUVs from its mega campus in Spartanburg, S.C., last year, and the company recently announced two new facilities — one on its campus and the other across Interstate 85 — that will total $300 million in investment. Similarly, Hyundai Motor Manufacturing Alabama, the regional headquarters and only U.S. plant for the South Korean auto giant, announced last week that it planned to invest $300 million to expand and improve its Montgomery plant. The initiative will create 200 jobs and accommodate the manufacturing of the hybrid Santa Fe vehicle line and launch of the first Electrified Genesis GV70 SUV. Hyundai Motor Group said it aims to sell 1.87 million battery electric vehicles (BEVs) annually by 2030 in order to secure a 7 percent global market share of BEVs sold. The automaker announced on April 12 that it plans to invest $7.4 billion in …

AlabamaConference CoverageFeaturesGeorgiaIndustrialNorth CarolinaSouth CarolinaSoutheastSoutheast Feature ArchiveVirginia

I-85 Corridor Markets See Explosion of Industrial Development, But InterFace Panelists Wonder if Housing Will Follow

by John Nelson

CHARLOTTE, N.C. — During the closing panel at France Media’s InterFace I-85 Industrial Corridor conference, brokers from the major markets along the 666-mile interstate gave updates about developments and opportunities in their territories. Brockton Hall, vice president of Colliers’ Upstate South Carolina office, said that the Greenville-Spartanburg industrial market in South Carolina had 16 million square feet of industrial space under construction, which represents an inventory growth of approximately 7.4 percent. Graham Stoneburner, senior vice president of Cushman & Wakefield, said that the Richmond, Va., market currently had 11 million square feet underway, which represents an inventory growth of 11 percent. Similarly Robbie Perkins, shareholder and market president at NAI Piedmont Triad, said North Carolina’s Triad region had 8.7 million square feet in the development pipeline, a nearly 11 percent growth rate compared to the market’s 80 million-square-foot inventory. During nearly every panel throughout the conference, which was held on Wednesday, April 13 at the Hilton Uptown Charlotte, brokers, investors and developers described the industrial growth along the I-85 Industrial Corridor as “unprecedented.” “There’s a real lack of supply at the moment, but we have a lot coming,” said John Montgomery, managing director of Colliers’ Upstate South Carolina office, during …

By Taylor Williams With the COVID-19 pandemic largely in society’s rearview mirror and warm weather months approaching, Americans are fired up to recoup lost time at their favorite restaurants, bars and entertainment venues. But the collision of this pent-up demand with 40-year inflationary highs means that many consumers are going to be more selective about where they eat, drink and source entertainment. To that end, meals, drinks, games and activities must offer a truly unique experience to justify consumer spending of their stretched dollars and to capture the Holy Grail of repeat spending/visits. That’s not to say that run-of-the-mill, traditional food and beverage (F&B) and entertainment concepts won’t rebound to some extent. But the concepts that deliver their offerings to customers in ways that are truly unique and memorable will be the ones that recognize the strongest sales growth and build the most enduring brand loyalties. Strategies, philosophies and exemplary practices that go into making this endeavor a reality were at the forefront of a panel discussion at the seventh-annual Entertainment Experience Evolution conference that took place in mid-March in Los Angeles. Hosted by Shopping Center Business, the flagship publication of Atlanta-based France Media Inc., the event drew more than …

LOS ANGELES — After bottoming out at 78.7 percent in the second quarter of 2021, private-pay seniors housing occupancy has been on a slow, steady climb, according to data from the National Investment Center for Seniors Housing and Care (NIC). The most recent data — for the fourth quarter of 2021 — showed occupancy at 81 percent. However, the pace of recovery varies widely among individual markets, individual companies and even individual properties. “Some people are able to manage the turmoil. Some are even thriving, or at least doing pretty well,” said J.P. LoMonaco, president of Valuation & Information Group. “Other people are really floundering. The questions I’m getting all revolve around occupancy, inflation, maintaining margins and revenue growth.” LoMonaco’s comments came as moderator during a panel titled, “The Power Panel: CEOs Discuss the State of the Industry” at France Media’s InterFace Seniors Housing West conference in Los Angeles on Feb. 24. Nearly 225 industry professionals attended the event. Other panelists included Chris Belford, CEO, Sinceri Senior Living; Rob Leinbach, principal, Cadence Living; Bill Pettit, president, R.D. Merrill Co.; Courtney Siegel, president and CEO, Oakmont Management Group; and Dave Sedgwick, president and CEO, CareTrust REIT. All the panelists reported their …