Amazon recently reconfigured and consolidated its network of warehouses, and many other retailers followed suit. The result? The outlook for industrial real estate, particularly retail warehouses, is now more difficult to interpret. Many retail clients are repositioning their supply chains to help avoid slowdowns and a potential International Warehouse Logistics Association (IWLA) union strike on the West Coast. This change has merged with a corporate need to find additional options for shipping and transport (especially as prices for transportation and industrial rents rise). The demand for industrial space has increased rapidly in less “congested” areas. As economic uncertainty continues, there is a shift towards tertiary markets for industrial real estate. This change provides significant opportunities for industrial investors, says Steve Pastor, VP of global supply chain, and ports/rail logistics/consultant at NAI James E. Hanson, who serves as NAI Global Industrial Council Chair. Investors and developers may be able to take advantage of a pause in a highly competitive field, in tertiary markets that have been traditionally less expensive than major and core markets. Amazon’s Impact News of Amazon’s plans to scale back its acquisition of industrial space (and to sublease its existing property to other retailers) has given some users opportunities …

Content Partner

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

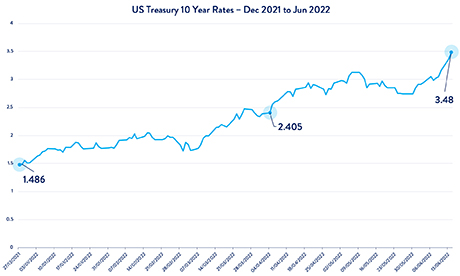

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

Content PartnerFeaturesIndustrialLeasing ActivityLee & AssociatesLife SciencesMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ Second-Quarter 2022 Economic Rundown by Sector

Rising interest rates, inflation and general economic uncertainty altered the patterns and outlooks for the industrial, office, retail and multifamily sectors across the United States. As Lee & Associates’ recent Q2 2022 North America Market Report reveals, certain sectors like industrial and multifamily, that were white hot last year, have begun to cool slightly. Meanwhile, retail is making historic gains in the face of decreasing interest in ecommerce. The full Lee & Associates report is available (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city) here. The analysis below provides an overview of four major commercial real estate sectors alongside economic factors impacting each. Industrial Overview: Record Low Supply, Rent Growth Demand for industrial space eased slightly from its record-setting growth of last year but remained strong through for the first half of 2022 as annualized rent growth moved into double digits and the overall vacancy rate fell to 3.9 percent, a record low. Net absorption through June totaled 192.2 million square feet. It was the second highest two-quarter total on record and more than the 170 million square feet of tenant growth for all of 2019. It was exceeded only by 297.8 …

Developers have seen permitting and entitlement timelines lengthen exponentially over the past few years. What is causing increased timelines and how do developers overcome challenges and avoid unnecessary delays? If expanded timelines are inevitable in some cases, how can developers ensure that slowdowns do not spread to other aspects of development? Many municipalities have been overwhelmed by an explosion in projects and applications in the development queue, and the issues are compounded by employee turnover within these organizations. Municipal slowdowns in upgrading utility capacities have further stalled the process of development. Additionally, the process for obtaining permits and entitlements has grown increasingly complex in certain regions, regardless of property type. REBusiness Online spoke with experts at Bohler, a land development design and consulting firm, to learn the best practices for keeping delays and budgets under control in the face of growing timeline uncertainties. To avoid problems before they begin, these experts recommend early due diligence and local expertise, as well as an approach that incorporates the community, local agencies and the authority having jurisdiction at crucial points. Bohler’s team also emphasizes the importance of working through waiting periods and working on different elements of a project concurrently, so that if …

Last year, a city known more for music than multifamily development led the nation in new construction growth rates, with luxury high rises popping up from downtown to the Gulch to along the Cumberland River. Nashville, attracting an abundance of debt and equity funding from sources old and new, is now considered an institutional-grade market. The driving force behind this growth: technology. Today, singers, songwriters and studio artists share the city with a growing number of software developers, systems architects and startup founders — and all of these innovators need a place to live, work, shop and play. Nashville’s tech evolution started from a solid foundation in healthcare, automotive and education, including HCA Healthcare and its associated startups, spinoffs and subsidiaries and an automotive hub that includes North American headquarters for Nissan and Korean tire manufacturer Hankook, as well as EV and battery cell manufacturing plants for GM. Twenty nine institutions of higher education, including Vanderbilt University, further helped develop a strong pipeline of tech talent. This ecosystem and a business-friendly climate have attracted some of the nation’s top tech employers: Amazon, who chose the metropolitan area for its much-coveted Center of Excellence; Oracle, relocating from Austin; and Capgemini, whose …

What should potential landlords know about leasing space for cell towers or renegotiating their legacy leases? “Landlords need to understand what economic opportunity they have available to them,” says David Moore, CEO and principal at NAI Global Wireless. Involving cell tower lease consultants, especially for existing leases, and considering cell site buyouts are two powerful tools available to cell site landlords today. For decades, Moore explains, property owners have been willing to sign less-than-ideal agreements with carriers and tower companies. Over the years, landlords, thinking that just because these cell tower sites are small and out of the way or because they did not want to turn down “free money,” were willing to sign disadvantageous lease agreements. Landlords often do not understand the impact of signing a lease agreement with a potential term of 30 years (made up of five-year terms), especially when tenants might use leases to constrain certain real estate negotiations (including rights like tenant approval for buyers, rights of first refusal and noncompetition clauses). In many cases, tenants have the unilateral right to terminate their lease without notice, a right about which landlords frequently aren’t aware. Rent escalations, terms and conditions, inflation and more need to be …

Content PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

Walker & Dunlop: Spring Multifamily Market Contends with Inflation, Housing Bubble Fears

By Walker & Dunlop’s Research Department Inflation and a New Era of Monetary Tightening Amid 40-year high inflation rates, home prices that have surged by over 40 percent in the past three years and double-digit price increases in basic necessities such as food, gas and electricity, the United States seems to be beset on all sides. Inflation has become the question of the day with little relief even after monetary tightening began earlier in the year. After a quarter point increase in the Federal Reserve target rate in March, the Fed implemented a whopping 50 basis point increase in the target Federal Funds rate in May after April inflation remained at 8.2 percent, near the March high of 8.6 percent.[1] The central bank’s goal is to reduce inflation to an annual rate of approximately 2 percent. The employment base, the Fed’s other prime objective, seems to remain strong. Unemployment (at 3.6 percent in April) remains low and employment growth of 390,000 in May beat economist expectations. The Fed’s job now is to beat inflation and prevent it from becoming embedded in consumer expectations. Why? Because once inflation becomes embedded in expectations, it changes consumer behavior and becomes somewhat of a …

Build-to-RentContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastNorthmarqSingle-Family RentalSoutheastTexasWestern

Build-to-Rent (BTR) Property Type Offers Positive Demand Outlook

By Jeff Erxleben, president, debt & equity at Northmarq Liquidity and an incredibly positive outlook for single-family build-to-rent (BTR) properties is helping to offset some of the turbulence developers are experiencing from rising interest rates. Developers have been ramping up the pace of single-family BTR construction over the past five years with forecasts that call for a record high 60,000 new units to be completed in 2022. That volume shows a steady increase over the 53,000 units completed in 2021 and 49,000 in 2020, according to Northmarq’s recently released Single-Family Build-to-Rent Properties Special Report. Although financing across all property types has been impacted by upward movement in both short- and long-term borrowing rates, the BTR sector is in a good position to shake off those challenges and maintain its growth momentum. Higher construction and financing costs are being offset by rising rents with year-over-year rent increases, that in many areas of the country, are quite substantial. Developers also are finding good access to both debt and equity. The number of lenders that are active in the space is expanding as developers move into new markets and continue to prove out business models and performance with successful lease-up and dispositions. For …

Content PartnerFeaturesLeasing ActivityMidwestMixed-UseNAINortheastRestaurantRetailSoutheastTexasWestern

Which Way is the Retail Pendulum Swinging?

Although the pandemic wreaked havoc on the retail sector in general, the culling of weak concepts has left space for strong retailers to flourish. The retail industry is seeing an explosion in experiential retail, medical/dental space is ubiquitous and non-traditional tenants are jumping at opportunities to secure prime locations. As a result, shopping centers have proven very resilient, says George Macoubray, vice president of retail brokerage with NAI Elliott in Portland, Oregon. “Today’s centers continue to evolve and to address what consumers need in terms of a place for people to congregate and participate in the activities that are important to them.” The entertainment sector was hit hard by the pandemic, he notes. “But now those operators seem to be out looking for locations, and they’re seeing the light at the end of the tunnel. People want to gather. They want to be entertained. They want to go out and do activities. Those kinds of experiences are happening more and more often in shopping centers — and you can’t buy those activities on Amazon.” Exciting new in-person experiences are helping to elevate shopping centers. “There’s an influx of experiential retail. From golf simulator experiences to ping-pong places to axe-throwing activities, …

Capitalizing on a changing marketplace and employing technology to streamline processes are essential strategies in helping small balance clients meet their goals. Ana Ramos, managing director and regional production head at Walker & Dunlop, emphasizes the importance of speed, creativity and using technology to assist in mortgage lending processes. She also emphasizes the centrality of teamwork, company ethos and technology to put a big emphasis on small balance loans. Walker & Dunlop defines “small loan” as up to $15 million for multifamily properties with five or more units. These clients are usually composed of smaller individual investors who need attention and education when it comes to mortgage lending. “It’s really hard for a large producer to think small, but it’s really easy for small producer to think big,” Ramos says. “It’s difficult for producers who are accustomed to institutional lending, with its higher fees and complex vesting structures to consider the credit parameters that are necessary in small balance loans. Small loans is a niche type of mortgage lending, and it only works if you have a company within a company, like Walker & Dunlop with its dedicated small loan team that works together through application, underwriting and closing.” Tech’s …