For more than seven months in 2024, the commercial real estate investment market remained on a sluggish path. High interest rates continued to not only challenge many asset owners who needed refinancing, but also buyers and sellers looking to make deals. For instance, some $174.7 billion in property investment sales during the first half of the year was 7 percent below a year earlier, according to MSCI Real Assets. In such uncertain times, it’s not unusual for the commercial real estate market to experience bouts of bifurcation. Typically, those are marked by trends such as rising demand for higher quality offices during economic slumps when tenants can fetch discounted rents. Early in the recovery phase, it’s not unusual for investment to flow into tech-oriented metros at the expense of other cities. The Federal Reserve’s aggressive hike of the federal funds rate has created another category of bifurcation, especially as it relates to floating-rate bridge debt and how lenders are managing their loan portfolios. That is, the difference between the performance of assets depending on when owners financed the properties, says Jeff Salladin, a managing director with Dallas-based private debt fund Revere Capital. “It’s a question of vintage,” he explains. “Loans …

Content Partner

Content PartnerDevelopmentFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

Multifamily Markets See Silver Lining Despite Economic Headwinds

Like other property sectors, rental housing assets have experienced big swings in fortunes over the past few years. Historically high rent growth during the pandemic came to a halt amid new supply in many markets. And the end of cheap debt has stymied investment sales and is stressing investors who paid handsomely for apartments using short-term financing. But the situation could be worse. Housing remains in high demand, and despite higher mortgage rates and a collapse in home sales, a severe lack of inventory on the market continues to prop up home values and price out would-be buyers. In May, home prices across the country increased 5.9 percent over the previous year, according to the latest S&P CoreLogic Case Shiller U.S. National Home Price NSA Index. Rental housing owners and operators are the obvious beneficiary of those challenges, says Ivy Zelman, executive vice president and co-founder of Zelman & Associates, a Walker & Dunlop company that provides housing research, analysis and consulting. Move-outs attributed to home purchases clearly illustrate the trend. An apartment and single-family rental operator in Phoenix recently told Zelman that such move-out activity has dropped to about 13 percent from an historical average of 30 percent, she …

Content PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastPavlov MediaSoutheastTexasWestern

Cost-Effective Strategies, Future-Proofing for Multifamily Internet Infrastructure

In the rapidly evolving landscape of multifamily technology, owners and operators face a critical challenge to staying competitive. As demand for high-speed internet and robust connectivity grows, it is essential to adapt quickly. However, constantly upgrading infrastructure can be prohibitively expensive and time-consuming. The solution lies in future-proofing properties — building an adaptable infrastructure that can support unknown future technological needs. “Future-proofing is a matter of having infrastructure capable of supporting what we don’t know we will want later,” says Matt Williamson, lead sales engineer at Pavlov Media, which provides Wi-Fi, fiber-optic internet service and managed digital services to multifamily properties. Future-proofing involves implementing scalable and flexible communication systems that accommodate both current and emerging digital demands. By focusing on future-proofing, multifamily properties can meet residents’ increasing expectations for high-speed internet and comprehensive Wi-Fi coverage while also reducing operational costs and enhancing overall efficiency. Balance Current Needs with Future Trends “Multifamily residents now expect extremely high-speed internet connections in their units and throughout the entire property, including common areas like gyms, conference rooms, pools and walking paths,” Williamson says. Residents want robust internet connections for activities such as streaming, video calls and remote home monitoring. The importance of upload speeds …

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Second Quarter Report: Industrial, Office Market See Continued Challenges While Retail, Multifamily Trends Follow Region-Specific Patterns

In the first half of 2024, high interest rates led to decreased demand, higher vacancy rates, reduced construction starts and lower property sales in industrial and office, according to Lee & Associates’ 2024 Q2 North America Market Report. Meanwhile, retail saw minimal development and continued low vacancies. Retail rent growth was particularly strong in the South and Southwest. Finally, high demand for multifamily, coupled with a sudden influx of supply in the second quarter of the year, has created a market where outcomes are highly tied to region. Midwest and Northeast multifamily markets have remained stronger than their counterparts in the South and Southwest, while Western markets saw mixed growth. Lee & Associates has made their full market report available here (with complete breakdowns of cap rates by city, market rents, vacancy rates, square footage information and more). The summaries for the industrial, office, retail and multifamily sectors below provide detailed insight into the trends and trajectories likely through the end of 2024. Industrial Overview: Activity, Growth Checked by High Interest Rates Industrial market performance across North America continued to downshift in the first half of this year. Although net absorption remains positive, demand for industrial space has fallen to the lowest levels …

Affordable HousingBohlerContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

Cracking the Code: Winning Strategies for Affordable Housing in Any Market

Frustrated by high costs and a lending crunch for market-rate multifamily projects, savvy mainstream developers are seeking opportunities to build affordable housing. But what constitutes opportunity in a sector reliant on agency lending, community stakeholders and controlled rents? Definitions of “opportunity” in affordable housing vary widely, and favorable elements often involve additional and unique challenges. Not only must developers identify opportune site conditions, but they must also evaluate prospects to compete for funding, secure municipal approvals and win community support. And they need to complete the project within required timeframes in order for the asset to qualify as a good opportunity. REBusiness asked experts from two firms at the forefront of affordable housing development about what affordable housing “opportunity” looks like — and about the strategies they use to transform promising sites into viable projects. Beacon Communities is an established developer of affordable, market-rate and mixed-income housing, while Bohler’s land development consulting and site design services have helped clients identify and act on commercial real estate opportunities for more than 35 years. “We look at any development opportunity through three lenses,” says LeAnn Hanfield Curtin, vice president of development at Beacon. “Those are the availability of sites, ability to get …

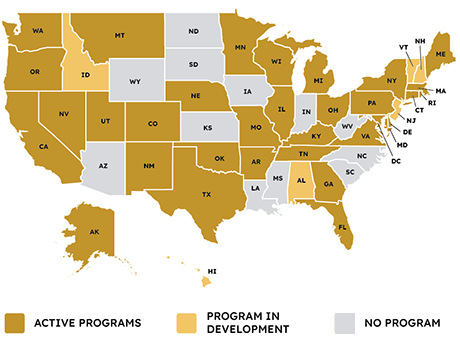

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

Last fall’s ebullience over the Federal Reserve’s likelihood of cutting the federal funds rate early and frequently in 2024 quickly faded as inflation remained too high for the Fed’s liking. Wall Street traders who make wagers on the Fed’s actions keep pushing their rate cut bets further into the year, according to CME Group, a derivatives marketplace. In early March, for example, nearly 75 percent of traders wagered on a rate cut in June. As of early June, less than 2 percent expected one. The most recent Fed meeting, on June 13, has confirmed this assumption that a rate cut is at least months away, if not longer. If and when the central bank cuts rates this year, the cost of capital is unlikely to approach the historically low levels of the last few years. As a result, the growing interest rate mantra of “higher for longer” may be finally convincing commercial property buyers and sellers to meet on pricing. New York-based research organization MSCI Real Assets recently noted that commercial property sales continued to slow in the first quarter of 2024 — a year-over-year decline of 16 percent to $78.9 billion. But it suggested that investors might be encouraged …

Content PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastPavlov MediaSoutheastTexasWestern

How Developers Use Mix of Technology, Amenities to Attract Residents

The multifamily industry faces a major challenge. Final construction costs have grown 33 percent since 2019 interest rates and operational expenses are sky high; and rents may need to increase, where possible, to make deals feasible — an off-putting reality for residents. One developer solution is smaller apartments, which make units cheaper. There is also a push to add more common-space amenities that are both valuable and less costly to include. These features include rooftop spaces, green areas and decks. However, to make these spaces truly usable for today’s multifamily residents, it is important to make them technologically flexible and to offer easy internet connection. “The floor plans of most new-construction multi-dwelling units (MDUs) today are shrinking, and their amenities are expanding,” says Bryan Rader, president of MDU at networking and internet service company Pavlov Media. According to RentCafe, the average size of newly constructed apartment units fell by almost 6 percent in a decade, with half of that change occurring in the last year. Rader likens it to the “resort-style community” approach, where hotel rooms are small, and guests are encouraged to spend time everywhere else on the property. Similarly, multifamily developers create shared amenities such as comprehensive fitness …

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Report: Industrial, Office Sectors Face Challenges as Retail, Multifamily Show Positive Trends

Economic headwinds such as elevated interest rates and persistent inflation led to mixed outcomes in the first quarter for industrial, office, retail and multifamily sectors, with market observers anticipating a contracting economy, as outlined by Lee & Associates’ 2024 Q1 North America Market Report. On the industrial front, market pressures — including interest rates and supply chain challenges — led to higher vacancy in the United States in the first quarter of the year. U.S. office space experienced its fifth consecutive year of contraction, as office worker attendance stagnated. Additional challenges, in the form of loans maturing in a high-rate environment, signal further challenges in the near future for the office landscape. Continued merchant demand, reduced closures and bankruptcies and limited supply converged to create a feeding frenzy for retail space, with vacancies at historic lows. And finally, geographically based factors drove multifamily markets, many of which (especially in the Midwest and Northeast) experienced a rebound in apartment demand fueled by rising consumer sentiment and moderating inflation, despite supply outpacing demand. Lee & Associates has made their full, first-quarter report available here (with breakdowns of cap rates by city, vacancy rates, market rents, inventory square footage and more). The summaries from each sector …

With elevated prices on everything from land to debt financing, insurance, building materials and labor, developers face an uphill climb attempting to pencil out multifamily projects at a profit. That’s why in 2024, developers are opting for practical and convenient amenities over luxury and choosing builder-friendly suburban locations over complex urban sites. And with diminishing room to raise rents on market-rate apartments, many investors and developers are shifting their attention to affordable and workforce housing, where incentives offset some expenses and, ideally, help position projects to deliver positive returns. “Market-rate developers in our region are starting to change their model to embrace more of an affordable product,” confirms Chad Riddle, Atlanta branch manager at Bohler. “Unfortunately, that puts them behind the eight ball because they may not know the tricks of the trade and they are competing with affordable housing developers that already know the business and are thriving.” There is no single strategy to pencil out a profitable multifamily project, but developers are achieving success by sticking to proven, cost-effective design elements and amenities, avoiding costly missteps and cutting down unnecessary spending throughout the development process. Drawing on affordable housing specialists and other in-house experts, Bohler helps clients avoid …