LEWISVILLE, TEXAS — A partnership between Wan Bridge, a Texas-based developer of build-to-rent residential communities, and Centurion American Development Group will build Frontera Shores Townhomes, a 201-unit project that will be located in the northern Dallas suburb of Lewisville. The site spans 35.8 acres, and the community will offer two-, three- and four-bedroom townhomes. Amenities will include a pool, walking trails and a dog park. Vertical construction will begin over the summer, with the first homes expected to be available for occupancy before the end of the year. Full completion is slated for next December.

Development

HOPEWELL, N.J. — Locally based developer KRE Group has begun leasing The Hopewell Chapter, a 270-unit multifamily project in Central New Jersey. The property consists of six four-story buildings that house one- and two-bedroom units, 54 of which are reserved as affordable housing. Specific income restrictions were not disclosed. Amenities include a 6,500-square-foot clubhouse, resort-style pool, outdoor dining areas, a playground, dog park and walking trails. Monthly rents start in the mid-$2000s for a one-bedroom apartment.

FLORHAM PARK, N.J. — A partnership between two New Jersey-based firms, The STRO Cos. and KRE Group, is nearing completion of an industrial redevelopment project in the Northern New Jersey community of Florham Park. The project converted a former office building that sits on a 14.4-acre site at 19 Vreeland Road into a 136,714-square-foot warehouse with a clear height of 36 feet, 26 loading docks, one drive-in door and parking for 108 cars and 36 trailers. Construction began in June 2024. Cushman & Wakefield has preleased the entirety of the building to Johnstone Supply (42,000 square feet) and PIMS Inc. (94,714 square feet).

JLL, HJ Sims Secure $134.3M Bond Financing for Seniors Housing Development in Orlando

by John Nelson

ORLANDO, FLA. — JLL and HJ Sims have arranged $134.3 million in tax-exempt bond financing for a seniors housing development currently underway in Orlando. Dubbed Millenia Moments Orlando, the community will feature 151 independent living, 78 assisted living and 32 memory care units. Trinity Community Development Foundation, a nonprofit formed by Trinity Broadcasting Network (TBN), is the developer and borrower. Completion of the facility, which will total 316,900 square feet, is scheduled for 2027. The community will feature floorplans in one- and two-bedroom layouts. Memory care residences will include 26 private and six companion units. Amenities at the community will include a fitness center, theater, library, business center, art studio, dog park, game rooms, a beauty salon and an outdoor pool area. Vitality Senior Living will operate the community. JLL Securities and HJ Sims, in collaboration with JLL Capital Markets’ seniors housing team, acted as co-underwriters and arranged the fixed-rate financing, which comprises tax-exempt senior series 2025A bonds with a final maturity of 40 years.

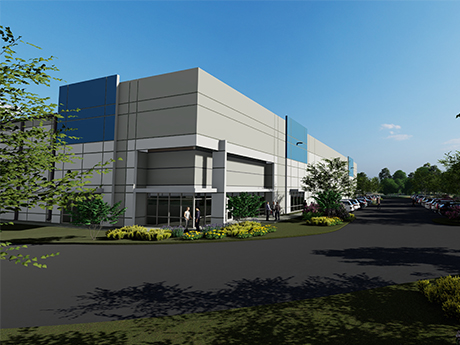

JOHNS CREEK, GA. — Dermody has broken ground on LogistiCenter at South Forsyth, a 93,960-square-foot industrial facility located at 7515 New Boyd Road in Johns Creek, a northern suburb of Atlanta. Located in the South Forsyth/North Fulton market, the Class A facility is situated on a 10-acre site within Johns Creek Technology Park. Reed Davis, Bob Currie, Brad Pope and Hannah Dillard of JLL are handling leasing for LogistiCenter at South Forsyth, which is available for preleasing and slated for occupancy in the fourth quarter. The facility will feature 2,500 square feet of speculative offices, 32-foot clear heights, 54- by 60-foot column spacing, 22 dock-high doors, two drive-in doors, 99 parking stalls, ESFR fire protection and LED lighting.

WENTZVILLE, MO. — McCarthy Building Cos. has broken ground on Mercy Hospital Wentzville, a 400,000-square-foot hospital in Wentzville, a far west suburb of St. Louis. The project marks Missouri’s first new acute care hospital campus in nearly a decade, according to McCarthy. The development will include 75 inpatient acute care beds and a 26-bed emergency department with two trauma areas and four behavioral health rooms. The advanced medical campus will offer a broad range of inpatient and outpatient care, including surgical and specialty options such as cardiovascular, cancer and orthopedics as well as outpatient imaging, diagnostic and treatment services. Crews began preparing the site in late March and will begin work on the central utility plant this summer, with the hospital tower work beginning in early 2026. Construction of the hospital is expected to be completed in four years. The project team includes CannonDesign for architecture and design and IMEG as engineer. Mercy is one of the 15 largest U.S. health systems.

CHICAGO — Aspire Properties is underway on a $13 million renovation of 25 E. Washington, a 20-story office tower in Chicago’s Loop. Aspire has handled management and leasing of the property since 1996. The owners are Amsterdam-based Kroonenberg Groep and Aventura, Fla.-based Trump Group. Designed by geniant + Eastlake Studio, the renovation is slated for completion in September. A 15,000-square-foot, seventh-floor amenity center will feature a 3,000-square-foot open-air courtyard, lounge, game room, conference center and fitness facility. With over 45,000 square feet of new and renewed leases in the first quarter of 2025, the Daniel Burnham-designed building now boasts an 85 percent occupancy rate. Recent leasing highlights include: Siteline, which renewed its 13,000-square-foot space; ATS Institute, which expanded by 10,000 square feet; National Community Investment Fund, which relocated from LaSalle Street into more than 4,600 square feet; Millennium Counseling Center, which signed a new 3,500-square-foot lease; and Gertie Enterprises, which leased 3,000 square feet of new space.

ATLANTA — Centennial Yards Co. has executed a long-term lease with event promoter Live Nation to operate a new live music and entertainment venue in downtown Atlanta. The 5,300-seat venue will anchor the under-construction sports and entertainment district within Centennial Yards, a $5 billion mixed-use project set to transform a long-underutilized section of the city into a walkable destination. The Live Nation theater will showcase a range of performances across genres, from global touring acts to national headliners and local artists. The facility will complement the city’s existing entertainment landscape, including Tabernacle concert hall, Fox Theatre and Buckhead Theatre as well as Mercedes-Benz Stadium (home of the NFL’s Atlanta Falcons and MLS’ Atlanta United) and State Farm Arena (home of the NBA’s Atlanta Hawks). “Centennial Yards is poised to be the epicenter of sports and entertainment for the southeastern United States, where people of all ages can enjoy concerts, sporting events, bars, restaurants and retail stores — all in one vibrant mixed-use district,” says Brian McGowan, president of Centennial Yards Co. “Partnering with Live Nation brings us one step closer to creating a thriving hub where unforgettable experiences happen. This new Centennial Yards entertainment venue is exactly what our region …

Roche, Genentech to Develop $700M Pharmaceutical Manufacturing Facility in Holly Springs, North Carolina

by John Nelson

HOLLY SPRINGS, N.C. — Genentech, a Bay Area-based biotech firm and member of the Switzerland-based Roche Group, plans to develop a $700 million pharmaceutical manufacturing facility in Holly Springs, approximately 20 miles southwest of Raleigh. The new 700,000-square-foot facility will create 400 high-wage manufacturing jobs and 1,500 construction jobs. The new facility will support Roche and Genentech’s portfolio of next-generation obesity medicines. The construction timeline for the new factory was not disclosed. Roche and Genentech’s current U.S. footprint includes 13 manufacturing and 15 R&D sites across the company’s pharmaceutical and diagnostics divisions. The companies have 25,000 employees in 24 sites across eight U.S. states.

KEY BISCAYNE, FLA. — Locally based Gencom has begun the $100 million overhaul of The Ritz-Carlton Key Biscayne, Miami resort. The 13-story, 275,000-square-foot hotel is located on a 17-acre site at 455 Grand Bay Drive on Key Biscayne, a barrier island situated south of Miami. Originally built in 2001, the property offers 420 guestrooms and 600 feet of direct beach access. The design team for the resort’s first major renovation includes Hart Howerton (master), Design Agency (public spaces) and Chapi Chapo Design (guestrooms). The overhaul includes new exterior paint and façade elements, a new glass façade in the lobby, redesign of the spa and a new restaurant that will join the existing lineup of eateries that will be refreshed: RUMBAR, Cantina Beach, Dune, Scoop, Stefano’s and Key Pantry. Amenities that will be overhauled include the resort’s swimming pools, fitness center, The Club Lounge and the Cliff Drysdale Tennis Center, which is the largest tennis facility of any Ritz-Carlton resort. Gencom, which co-developed the hotel, expects the renovations to conclude by the end of the year.