CAROL STREAM, ILL. — Development Solutions Inc. (DSI) has completed a 200,000-square-foot warehouse and showroom expansion for Frain Industries at 245 E. North Ave. in Carol Stream. The addition brings Carol Stream-based Frain’s facility to a total of approximately 530,000 square feet. The project enhances Frain’s capabilities in packaging and processing equipment solutions.

Development

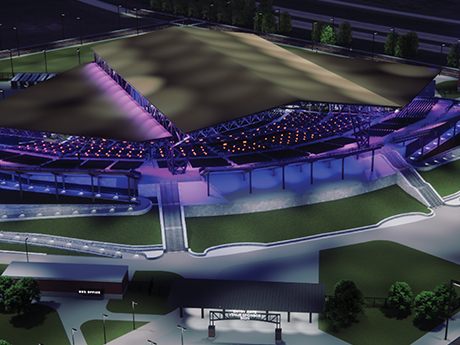

WEBSTER, TEXAS — Venu, a hospitality and entertainment owner-operator based in Colorado, has signed a letter of intent to open a 12,500-seat amphitheater in Webster, a southeastern suburb of Houston. According to local media sources, including Community Impact Newspaper and CultureMap Houston, the project is valued at $150 million. Known as Sunset Amphitheater Houston and spanning 34 acres, the venue will be located within Flyway, an 80-acre entertainment district that is anchored by Great Wolf Lodge. Former Dallas Cowboys quarterback Troy Aikman is a partner on the project via the Aikman Club, a 350-seat, membership-based elevated space that will be located at the center of the venue.

ROUND ROCK, TEXAS — Minnesota-based Broadway Street Development has completed The Preserve at Mustang Creek, a 252-unit affordable housing project in the northern Austin suburb of Round Rock. Designed by Merriman Anderson Architects and built by Cadence McShane, the property offers one-, two-, three- and four-bedroom units that are reserved for households earning between 30 and 60 percent of the area median income. Amenities include a pool, outdoor grilling and dining stations, a playground, fitness center, café kitchen and an activity room. The Texas Department of Housing and Community Affairs provided partial funding for the project. Construction began in fall 2023.

ARLINGTON, VA. — A joint venture between Crescent Communities and Rockefeller Group has closed on the land acquisition for NOVEL Arlington, a 530-unit apartment community located in Arlington, approximately five miles from downtown Washington, D.C. Situated on about 5.5 acres along South Glebe Road, NOVEL Arlington will include 493 multifamily residences and 37 townhomes across studio, one-, two- and three-bedroom floorplans, including both market-rate and affordable units. Designed around the concept of the “power to play,” the complex will feature 20,000 square feet of amenities such as a golf lounge with a full-swing simulator; clubroom with indoor-outdoor connectivity; private dining and watch-party room; courtyard with firepits, game zones and landscaping; rooftop resort-style swimming pool with cabanas; fitness center, solo fitness studio, sauna and recovery spaces; coworking nooks and social lounges; a record listening lounge; pet retreat and pet spa; resident market; and a privately programmed courtyard and public-private park with walking trails. The joint venture secured equity financing from Shimizu Realty Development and Mitsubishi Estate New York, a U.S. affiliate of Tokyo-based Mitsubishi Estate Co. Additionally, Sumitomo Mitsui Trust Bank, Limited New York Branch (SMTB) provided construction financing for the development. Other project partners include Bohler D.C. (civil engineer), Hord …

Foundry, Principal Asset Management to Break Ground on 237,000 SF Industrial Development Near Charlotte

by Abby Cox

UNION COUNTY, N.C. — A partnership between Foundry Commercial and Principal Asset Management has closed on the land purchase in Union County for 74 Junction, a two-building, industrial development. Construction is slated to begin in the coming months, with delivery scheduled for the third quarter. The project team will consist of Edifice (general contractor), 9G Studio (architect) and Thomas & Hutton (civil engineer). Located roughly 30 miles southeast of Charlotte, the facility will include two rear-load industrial buildings totaling more than 237,000 square feet. Both buildings, which will measure 120,000 square feet and 117,000 square feet, will feature 32-foot clear heights and modern specifications aligned with current market requirements that will accommodate a range of light industrial, distribution and service-oriented tenants.

NEW YORK CITY — Newmark has arranged $218 million in financing for the acquisition and office-to-residential conversion of 101 Greenwich Street in downtown Manhattan. Apollo Global Management provided the funds to the borrower, a partnership between Quantum Pacific and MetroLoft Developers. According to the property website, 101 Greenwich Street was originally constructed in the early 20th century and spans 480,000 rentable square feet. Neither a timeline for construction nor information on residential floor plans or amenities was announced, but the New York Business Journal reports that the new complex will have 614 units. Jordan Roeschlaub, Christopher Kramer and Holden Witkoff led the debt placement efforts for Newmark on behalf of ownership. Adam Spies and Adam Doneger, also with Newmark, represented the seller, institutional investment firm BentallGreenOak, in the $105 million sale of the property. According to the deal team, 101 Greenwich Street is a viable office building for residential conversion due to certain design features, such as U-shaped floor plates, extensive window lines, strong natural light and above-average ceiling heights. — Taylor Williams

NEW YORK CITY — Locally based developer The Moinian Group has provided updates on its speculative office project at 220 11th Ave. in the West Chelsea area of Manhattan. The project was originally announced in February 2020, but construction was delayed until early 2022. The foundation of the nine-story, 210,000-square-foot building is now complete, and Moinian Group has appointed Newmark as the new leasing agent. Designed by David Burns Studio Architecture, the building will feature two sculptural terraces, a 12,470-square-foot landscaped rooftop and two penthouse terraces totaling 2,200 square feet. At street level, an 11,920-square-foot duplex space offers the potential for flagship retail or flexible commercial use. An expected completion date was not announced, but the project team says that a prospective anchor tenant can commence its interior buildout within 18 months of lease execution.

ARCADIA, CALIF. — O&I Development, with R.D. Olson Construction as general contractor, has broken ground on The Ivy Arcadia, a seniors housing property in Arcadia within San Gabriel Valley. The three-story, $33 million project will feature 100 assisted living and memory care apartments. Completion is slated for fall 2027. The property will offer comprehensive fire and life safety systems, including advanced alarms, sprinklers and rated corridors; backup power and medical gas provisions to ensure uninterrupted care; and a secure outdoor area designed for safe, independent mobility. Community amenities will include a fitness center and specialized treatment rooms for memory core and mobility support; sensory-friendly design featuring distinct colors and intuitive wayfinding to reduce confusion; multiple communal spaces, including dining areas, a reading room, bar and lounge and salon; open-air patios and secure walking paths to promote healthy habits; and 70 parking spaces to accommodate family visits and staff. The project team includes b.hills architecture and STUDIOSIX5.

MEDFORD, ORE. — LRE & Co has announced plans to develop a 10,000-square-foot commercial project in Medford. Located along Crater Lake Highway (Highway 62) in the Tower Business Park, the project will offer 10,000 square feet of commercial space, including a 4,000-square-foot quick-service restaurant with a drive-thru and a 6,000-square-foot multi-tenant retail building with a drive-thru. The property will also include approximately 98 parking spaces. LRE & Co is currently working through the city’s entitlement process, including site plan review with the Medford site plan and architectural commission. Tenant announcements and construction timelines will be released as the project advances through the city’s approval process.

TDC Selects Mainsail Lodging as Hotel Development Partner at Medley Project in Johns Creek, Georgia

by Abby Cox

ATLANTA — Toro Development Co. (TDC) has selected Mainsail Lodging & Development as the development partner and operator for the hotel component at Medley, a 43-acre mixed-use development under construction in the north Atlanta suburb of Johns Creek. The 150-room hotel will be integrated within the mixed-use development and will front the 25,000-square-foot greenspace at the property. The hotel, which is slated to open in 2028, will feature modern guestrooms, a signature restaurant and approximately 5,000 square feet of meeting and event space that connects to the green space and lobby. Along with the new hospitality component, Medley includes 164,000 square feet of retail, restaurant and entertainment space; 883 luxury apartments; and 110,000 square feet of office space. Medley will officially open on Oct. 29.