TAUNTON, MASS. — Ferguson Enterprises, a distributor of plumbing and HVAC supplies, has opened a 234,282-square-foot warehouse in Taunton, a southern suburb of Boston. The facility houses a 5,743-square-foot retail store, 30,000 square feet of offices and training space for employees and a designated pick-up and will-call area. Building features include a clear height of 40 feet, three exterior loading ramps and a floor-to-ceiling racking system. Ware Malcomb designed the project, and Connolly Brothers provided construction management services.

Development

Mohr Capital, Standard Real Estate to Develop 180,000 SF Industrial Facility in Reno, Nevada

by Amy Works

RENO, NEV. — Mohr Capital has partnered with Standard Real Estate Investments, as equity joint venture partner, to develop a single-story, multi-tenant industrial facility in Reno. Situated on 11 acres at 9865 N. Virginia St., the 180,000-square-foot property will offer large grade-level, drive-in doors; 32-foot clear heights; options to build office spaces on the end caps and in-line; 25 dock positions outfitted with 40,000-pound levelers and seals; motion-sensing LED light fixtures; ESFR fire protection sprinkler system; and roof-mounted, gas-fired make-up air units. Completion is slated for summer 2025. The project team includes FCL Construction as general contractor, Techtonics Design Group as civil engineer and architect and Stearns Bank as construction loan lender.

CHESTERFIELD, MO. — Keystone Construction Co. will build the new $60 million CarShield Sportsplex AAA Hockey & Futbol facility in the St. Louis suburb of Chesterfield. The development will accommodate the growing CarShield AAA Hockey & Futbol clubs, which serve more than 500 children and 45 teams in metro St. Louis. The 325,000-square-foot facility will offer four indoor turf soccer fields, two indoor ice rinks, team locker rooms, a pro shop, training and fitness spaces, a restaurant, bar, concessions and classrooms. Outside, there will be three turf soccer fields, concessions, a dining patio and children’s playground. Construction is scheduled to begin in October and wrap up in January 2026. The project team includes civil engineer Stock & Associates and architect Gray Design Group.

CHICAGO — Ryan Cos. US Inc. has formed a joint venture with Washington Capital Management Inc. to build a 170,000-square-foot speculative industrial facility at Pullman Crossings in Chicago. Pullman Crossings is a 50-acre industrial park that is part of Pullman Park, a 180-acre mixed-use project being developed by Chicago Neighborhood Initiatives. The new facility marks Ryan’s third phase of Pullman Crossings with the fourth and final phase expected to kick off later this year. The 10-acre site is located in the historic Pullman neighborhood near I-57. The building will feature outdoor eating areas, exterior bike racks, ESFR fire protection and a clear height of 32 feet in the warehouse. Ryan is serving as developer and builder. Bankers Trust Co. is providing construction financing. Completion is slated for the first quarter of 2025. Since 2017, Ryan has developed and built three industrial facilities totaling 685,000 square feet at Pullman Crossings, including a Whole Foods Market distribution center, a SC Johnson warehouse and an Amazon last-mile distribution center.

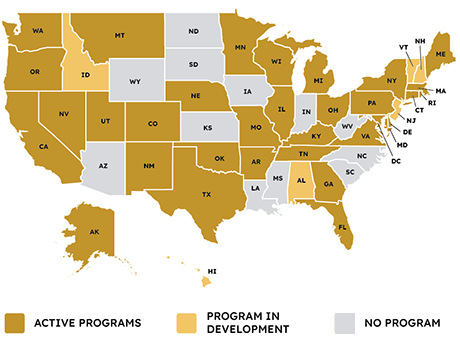

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

FORT WORTH, TEXAS — Nashville-based developer Southern Land Co. has completed Deco, a 27-story apartment building located at 969 Commerce St. in downtown Fort Worth. The 567,000-square-foot building spans 302 units and includes ground-floor retail space that is preleased to Broadway 10 Bar & Chophouse. Units come in one-, two- and three-bedroom floor plans, as well as penthouse configurations, and range in size from 700 to 2,800 square feet. Amenities include a pool and poolside bar, rooftop lounge, fitness center, demonstration kitchen, outdoor grilling and dining stations, package room and a lobby lounge with a bar. Rents start at approximately $2,000 per month for a one-bedroom apartment.

GEORGETOWN, TEXAS — Houston-based developer Fidelis has broken ground on Berry Creek Business Park, a three-building, 520,571-square-foot industrial project located in the northern Austin suburb of Georgetown. The development will consist of two rear-load buildings ranging in size from 126,722 to 140,685 square feet with 32-foot clear heights and one cross-dock building that will span 253,164 square feet and feature 36-foot clear heights. Project partners include GSR Andrade (architect), Gordon Highlander Construction (general contractor), Westwood Civil (engineer) and Transwestern (leasing agent). Delivery is slated for early 2025.

PHILADELPHIA — Pennsylvania-based multifamily developer Toll Brothers Inc. (NYSE: TOL) has completed Broad + Noble, a 344-unit apartment community in Philadelphia’s Center City District. The 19-story building includes underground parking spaces and street-level commercial space. Amenities include music, media and podcast rooms, conservatory and private dining rooms, a fitness center with yoga and spin studios and a sky lounge with an outdoor deck area. Barton Partners served as the project architect, and O’Donnell & Naccarato handled engineering initiatives. Wells Fargo provided construction financing for the project, which Toll Brothers developed in partnership with Utah-based investment firm Sundance Bay.

PACE Loan Group Originates $7.1M C-PACE Loan for Construction of Senior Living Facility in Minnesota

ST. FRANCIS, MINN. — PACE Loan Group has provided a $7.1 million C-PACE loan for the construction of Vista Prairie at Eagle Pointe, a 134-unit senior living community in St. Francis, a northern suburb of Minneapolis. The 20-year loan complements a $30 million qualified tax-exempt loan on the project using Series 2023A Bonds with Sunrise Bank as the senior lender. Located at 23440 Ambassador Blvd., the property will feature 49 independent living units, 43 assisted living units, 24 memory care units and eight care suites. Completion is slated for 2025. Total project costs are estimated at $47.6 million. The PACE proceeds will be used to finance energy conservation and renewable energy measures, including the building envelope, Energy Star windows, HVAC, high-efficiency plumbing and lighting systems and controls. The renewable and energy conservation measures are expected to save $368,613 annually with payback in 20 years. Vista Prairie Communities is both the property manager and services provider for the project. Additional project partners include Pope Architects and Bauer Design Build.

Joint Venture Acquires Boathouse Apartments in DC for $67.5M, Plans to Reposition for Student Housing

by John Nelson

WASHINGTON, D.C. — A joint venture between Up Campus Student Living, Palmor Capital, BridgeInvest and Sabal Investment Holdings has purchased Boathouse, a 250-unit multifamily community located at 2601 Virginia Ave. NW in Washington, D.C.’s Foggy Bottom neighborhood. An undisclosed seller sold the property for $67.5 million. The new ownership is embarking on a redevelopment plan to convert and rebrand Boathouse to off-campus housing for students, faculty and staff for nearby George Washington University. Planned renovations to the 10-story property include updated amenities, common areas and fully furnishing all 250 units. The property, which features retail space and two levels of underground parking, was recently renovated by the previous ownership.