AURORA, ILL. — Developers Atlantic Residential and Focus have completed Lumen Fox Valley, a 304-unit luxury apartment complex that repositioned a portion of the Fox Valley Mall in Aurora. Evanston-based Morgante Wilson Architects (MWA) completed the interiors of the property. MWA will also complete the interiors of Lucca Fox Valley, which will replace a former department store with 323 luxury apartment units as part of the second phase of the mall’s redevelopment. Lumen Fox Valley repurposed a vacant Sears store at the mall. MWA designed all common spaces and amenities, including a two-story lobby and lounge, private dining room, clubroom, game room, fitness and yoga studio, and pet spa. MWA also selected the unit finishes for kitchens, baths and flooring, and designed and furnished the model units. Torti Gallas + Partners and HKM Architects + Planners were the project architects. Focus was the general contractor, and USAA Real Estate provided financing. Monthly rents at Lumen Fox Valley start around $1,717. Residents can now earn a free month of rent on select one- and two-bedroom units if they move in by the end of February, according to the property’s website.

Development

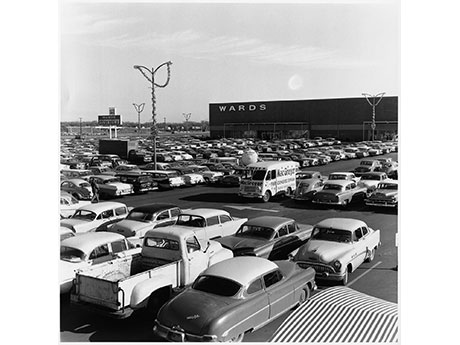

BLOOMINGTON, MINN. — Kraus-Anderson Realty & Development has begun to demolish the former Toys ‘R’ Us and Herberger’s buildings at Southtown Shopping Center in the Minneapolis suburb of Bloomington. Located at the corner of I-494 and Penn Avenue South, the shopping center opened in November 1960 and included a two-story, 150,000-square-foot Montgomery Wards, the largest in the retailer’s chain of 550 stores nationwide. The center also opened with 44 other shops, including Musicland, Red Owl, Walgreens and Texaco. The property has undergone numerous additions and renovations since then. Kraus-Anderson is demolishing the large vacant space on the northeast side of the center, often referred to as the old Herberger’s (originally Montgomery Wards) and Toys ‘R’ Us space. The demolition phase is expected to take approximately 12 weeks and is slated for completion at the end of March. The rest of the shopping center will remain open. Future plans regarding tenants or new uses were not released.

INGLEWOOD, CALIF. — JPI has broken ground on Jefferson Inglewood, a market-rate and affordable housing apartment project in Inglewood, just southwest of Los Angeles. Move-ins are scheduled to begin in early 2026. The eight-story, transit-oriented property will feature 222 studio, one- and two-bedroom apartments. Units will offer stainless steel appliances and full-size washers and dryers. Community amenities will include a pool, cabana, clubroom, fitness center and rooftop deck. Jefferson Inglewood is located three metro stops from El Segundo and one stop from Los Angeles’ The Automated People Mover, including an electric train system on a 2.25-mile elevated guideway with six stations. The project recently received $1 billion in federal funding and construction is scheduled to begin this year. The Jefferson Inglewood project team includes TCA Architects, Englekirk Engineering and Kimley Horn Associates Engineering.

YONKERS, N.Y. — Developers have released plans to build two new multifamily projects in Yonkers, about 20 miles north of New York City. The developments represent a total of $186.6 million in private investment and are expected to create 503 construction jobs. The Yonkers Industrial Development Agency recently granted final approval of financial incentives for both projects. Miroza Tower, which a subsidiary of Azorim Construction Co. Ltd. is developing, will rise 27 stories at 44 Hudson St. The $133.5 million project will comprise 250 apartment units, 25 of which will be designated as affordable housing. Amenities will include a party room, library, conference room, gym, two resident lounges, a rooftop garden and children’s playroom. The tower will also include 1,920 square feet of first-floor retail space and a 252-space parking garage. Azorim is receiving a sales tax exemption of $5.8 million, a mortgage recording tax exemption of $1.3 million and a 20-year payment in lieu of taxes (PILOT) agreement valued at $12.4 million. The project is expected to create 324 construction jobs. The Center for Urban Rehabilitation and Empowerment Inc. (CURE), a local nonprofit, and Conifer Realty LLC in partnership with the City of Yonkers are developing the second project, …

ECI Group, Griffin Fund Break Ground on $76M Apartment Community in Lawrenceville, Georgia

by John Nelson

LAWRENCEVILLE, GA. — ECI Group and joint venture partner The Griffin Fund have broken ground on The Averly Collins Hill, a $76 million apartment development in Lawrenceville, a northeast suburb of Atlanta in Gwinnett County. The 300-unit, eight-building project will be situated on 22 acres at 700 Collins Road. ECI Construction is the general contractor for the project, and Synovus Bank is providing $46 million in construction financing. The project is planned to deliver concurrently with the nearby 15-story Northside Hospital Gwinnett healthcare tower, as well as a planned active adult housing development. Upon completion, The Averly Collins Hill will feature one-, two- and three-bedroom floor plans, as well as a clubhouse with a clubroom, fitness center, lounge areas and coworking space. Other amenities will include a pool, dog play area and a coffee bar.

Ryan Cos. Completes 59,657 SF Publix Store at Master-Planned Development in Wesley Chapel, Florida

by John Nelson

WESLEY CHAPEL, FLA. — Ryan Cos. has opened a new Publix grocery store that serves as the anchor tenant of Innovations Commons, a retail center within the 900-acre Epperson Ranch master-planned development in Wesley Chapel. The city in Pasco County is part of the Tampa Bay metro area. In addition to Innovations Commons, Epperson Ranch will feature 4,000 single-family homes, a 200-room hotel and more than 500 apartments at full build-out. Innovation Commons will also include three outparcel developments slated for additional retail, restaurants and professional services.

GERMANTOWN, MD. — Bethesda, Md.-based Rock Creek Property Group has delivered two life science facilities at 20430 and 20440 Century Blvd. in Germantown, a suburb of Washington, D.C. Situated off I-270 in Rock Creek’s Precision Labs campus, the former office buildings span 32,000 and 52,000 square feet, respectively. Architectural firm Ware Malcomb designed the office-to-life sciences conversion project, which involved upgrading the buildings’ electrical, mechanical and wastewater infrastructure. The single-story facility at 20430 Century Blvd. features move-in ready space suitable for a single headquarters and includes offices and flexible space for laboratory, research-and-development and cGMP (current Good Manufacturing Practice) manufacturing. The two-story facility at 20440 Century Blvd. features six wet laboratory suites.

FULTON, MD. — A joint venture between St. John Properties Inc. and Greenebaum Enterprises has purchased a 12.5-acre site within Montpelier Research Park, a business park in the Baltimore-Washington submarket of Howard County. The duo plan to develop two single-story, flex industrial facilities on the site spanning 70,000 square feet combined. Located adjacent to Maple Lawn and the Johns Hopkins University Applied Physics Laboratory in Fulton, the acquired site currently features a 32,488-square-foot office building that the new ownership is marketing for lease. Abby Glassberg and Don Schline of KLNB represented the seller in the land transaction. St. John and Greenebaum estimate they’ll deliver the two industrial facilities in 2026.

MESQUITE, TEXAS — Dallas-based CapStar Real Estate Advisors will develop a 765,668-square-foot industrial project on a 40.4-acre site at 2800 Skyline Drive in the eastern Dallas suburb of Mesquite. The facility is already fully preleased to Canadian Solar, which will use the facility for distribution support for its manufacturing operation next door at 3000 Skyline Drive. Building features will include 40-foot clear heights, 190 dock-high doors and parking for 351 cars and 134 trailers. Jody Thornton, Trent Agnew, Tom Weber and Greer Shetler of JLL arranged joint venture equity for the project with an undisclosed partner on behalf of CapStar. Construction is scheduled to begin in the first quarter and to last about 12 months.

California Commercial Investment Group Plans 300-Unit Seniors Housing Community in Woodland Hills, California

by Amy Works

WOODLAND HILLS, CALIF. — California Commercial Investment Group has acquired a 19-acre site adjacent to the iconic Motion Picture & Television Fund campus in Woodland Hills for $30 million. The buyer plans to develop a luxury senior living community encompassing approximately 300 units on the site. Construction is scheduled to begin in 2026 with completion planned for 2028. The property is located in the Santa Monica Foothills approximately 30 miles west of Los Angeles. It is just steps from the Calabasas farmers’ market adjacent to the Motion Picture & Television Fund campus. JLL’s Bryan Lewitt represented the seller, Motion Picture & Television Fund. Michael Slater of CBRE represented the buyer.