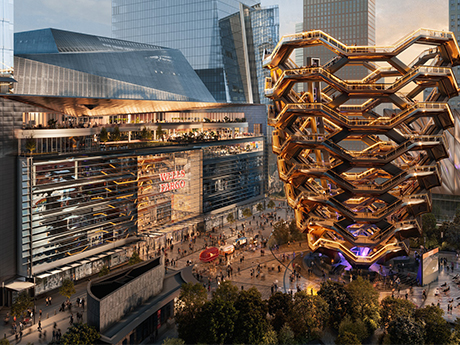

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group. Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020. Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property. “This investment further solidifies our longstanding commitment …

Development

Affordable HousingContent PartnerDevelopmentFeaturesLoansLumentMidwestNortheastSoutheastTexasWestern

How to Clear Affordable Housing’s Construction Financing Hurdle

Developers are finding it tougher than ever to finance affordable housing. And often, the biggest hurdle for the sector’s borrowers involves construction — either obtaining that initial loan at a manageable cost or qualifying for take-out financing after a protracted construction period — which has strained resources and delivery schedules for a number of developments. Limitations on rent increases make the industry especially vulnerable to rising costs, and expenses today have risen precipitously across the board. Rents have also grown, but not on pace with construction and operating costs driven up by inflation, wage pressures, soaring insurance premiums and a series of interest rate hikes, observes Tracy Peters, a senior managing director on Lument’s affordable housing production team. “Borrowers are squeezed by a number of things in this marketplace,” Peters says. “The fed funds rate climbing 5 percent over the last two years means the interest rates on construction loans have basically come up 5 percent or more over that time. Now folks who had budgeted for a much lower interest rate — if they are still in construction mode — are trying to figure out how to deal with these higher interest rates.” At the same time, the …

PTM to Develop 500,000 SF Second Phase of Mixed-Use EDGE Collective Project in St. Petersburg, Florida

by John Nelson

ST. PETERSBURG, FLA. — PTM Partners will expand EDGE Collective, a mixed-use development in St. Petersburg, with a 500,000-square-foot second phase. Phase II will feature 350 multifamily residential units in studio, one-, two- and three-bedroom layouts across two buildings, as well as 45,000 square feet of commercial and retail space and 260 parking spaces. The first phase of the development comprises a 163-room Moxy Hotel and a redevelopment of 1246 Central Avenue building, which features 16,000 square feet of office space that will be available for tenancy in early 2024 and 8,000 square feet of ground-floor food-and-beverage retail space.

MOBILE, ALA. — Topgolf has opened a new venue in Mobile, marking the third in Alabama for the Dallas-based brand. Situated within McGowan Park Shopping Center, the venue features 60 outdoor climate-controlled hitting bays across two levels, as well as a full-service restaurant, 22-foot video wall and more than 100 TVs. According to the company, Topgolf Mobile will employ roughly 200 associates and is the 95th outdoor Topgolf venue in the country.

SAN ANTONIO — Denver-based owner-operator H5 Data Centers will undertake an expansion project at its San Antonio campus, which is located at 100 Taylor St. in the downtown area. The expansion will add turnkey colocation space that can support an additional 340 cabinets and up to 1.5 megawatts of additional power capacity. A construction timeline was not disclosed. The campus currently consists of two buildings totaling 85,000 square feet.

ARLINGTON HEIGHTS, ILL. — Housing Trust Group (HTG) has opened Crescent Place, an $18.2 million affordable housing community in the Chicago suburb of Arlington Heights. The community marks HTG’s entry into the Illinois market. HTG developed the property in partnership with nonprofit developer Turnstone Development Corp. Crescent Place offers 40 units that are reserved for residents who earn up to 60 percent of the area median income. Monthly rents range from $621 to $1,489, while units range from 646 to 880 square feet. Amenities at the four-story development include a community room, library, computer café, fitness room, resident garden, outdoor patio, tenant storage compartments, bicycle storage and 80 outdoor parking spaces. Funding for Crescent Place included a $10.9 million construction loan and a $1.6 million permanent loan from BMO Harris Bank; $12.1 million in 9 percent Low Income Housing Tax Credit equity from National Equity Fund; $4 million from the COVID-19 Affordable Housing Grant Program provided by the Illinois Housing Development Authority; and a $110,214 ComEd grant for building according to Energy Star efficient standards. The project team included general contractor Henry Bros Co., civil engineer Groundwork, landscape architect Krogstad Land Design, architect UrbanWorks Architecture, interior designer Frosolone Interiors, …

SOUTHLAKE, TEXAS — A partnership between Constellation Real Estate Partners and Northwestern Mutual has acquired 33.7 acres in Southlake, located just outside the Dallas-Fort Worth International Airport campus, for the development of a 546,330-square-foot industrial project. Designed by Dallas-based Meinhardt & Associates, Constellation Mustang Crossing will comprise four buildings that will range in size from 102,957 to 188,132 square feet. Building features will include 28- to 32-foot clear heights, ESFR sprinkler systems and LED lighting. Joey Tyner and Tom Dosch of Dosch Marshall Real Estate represented Constellation in its purchase of the land. JLL will market the project for lease. Construction is scheduled to begin in the first quarter of next year and to last about 12 months.

DAYTON, TEXAS — OmniSource LLC, a subsidiary of Steel Dynamics, has acquired 55 acres within Gulf Inland Logistics Park, a 2,400-acre master-planned development located in the northeastern Houston suburb of Dayton, with plans to construct a new recycling facility. John Littman, Kelley Parker III and Coe Parker of Cushman & Wakefield represented the seller, Liberty Development Partners, in the disposition of the land. Michael Keegan and Andrew Laycock of Partners Real Estate represented OmniSource. A construction timeline was not disclosed.

CYPRESS, TEXAS — Fort Worth-based owner-operator Trademark Property Co. has purchased 37 acres in the northwestern Houston suburb of Cypress for the construction of a mixed-use project. The site is located within the 1,300-acre Dunham Pointe master-planned development, and preliminary plans for the project call for 225,000 square feet of retail, restaurant and entertainment space and 500 apartments. Trademark plans to start construction in the second quarter of 2025 and open the development in late 2026 or early 2027.

MONTEBELLO, N.Y. — A partnership between owner-operator FilBen Group and Dallas-based private equity firm RSF Partners is nearing completion of Braemar at Montebello, a $54 million assisted living facility in New York’s Lower Hudson Valley region. The site is located near Good Samaritan Hospital — Suffern, as well as numerous commercial establishments. The property will span 133,675 square feet and will feature one- and two-bedroom units with an average size of 500 square feet, as well as an array of entertainment- and wellness-based amenities. H2M Architects + Engineers designed the project, and McAlpine Contracting is handling construction. M&T Bank provided a $34.8 million construction loan for the project, completion of which is scheduled for next year.