ALEXANDRIA, VA. — The Arlington Partnership for Affordable Housing (APAH), along with its development partners, has opened Oakwood Meadow Senior Residences in Alexandria. The affordable housing development features 150 one- and two-bedroom apartments for qualifying adults ages 62 and older who earn between 30 and 60 percent of the area median income (AMI). Located on a site that was formerly a stormwater retention pond, this project is part of a public-private partnership between APAH and Fairfax County Redevelopment and Housing Authority (FCRHA). In addition to the contribution of public land, Fairfax County and the FCRHA invested $5.3 million in local Housing Blueprint funding, nearly $12.6 million in bond financing and an undisclosed amount in project-based vouchers. Additional financing includes both 4 and 9 percent Low-Income Housing Tax Credits (LIHTC) awarded by Virginia Housing and nearly $30 million in equity investments from Bank of America.

Development

HOUSTON — Regional lender Amegy Bank has provided a $25 million construction loan for NHH Gray, a 135-unit affordable housing project that will be located in Houston’s Northline neighborhood. The property will offer one-, two- and three-bedroom units that will be reserved for low- to moderate-income residents and amenities such as a community kitchen, lounge, library and meeting/social service offices. The building will also house a preschool that residents’ children can attend free of charge. The borrower is New Hope Housing. Construction is scheduled to begin in October and to be complete in summer 2025.

Developer Receives $52M Construction Loan for The Somm Hotel and Spa in Woodinville, Washington

by Amy Works

WOODINVILLE, WASH. — Developer Woodinville Hotel Partners has received a $52 million loan for the construction of The Somm Hotel and Spa, Autograph Collection in Woodinville, approximately 20 miles northeast of Seattle. The 164-room resort will feature a 5,661-square-foot spa; full-service restaurant with a private dining room; 3,000-square-foot rooftop bar with view of Mount Rainier; meeting space; and 9,000 square feet of retail space. The hotel will be the centerpiece of Harvest Wine Village, a 20-acre, master-planned development with nearly 100,000 square feet of retail space and a variety of residential spaces. Dallas-based HALL Structured Finance originated the loan for the borrowers. Brian Holstein of US Hotel Advisors brokered the financing.

DALLAS — Mexican investment firm Grupo Haddad has completed the $8 million renovation of a 110,000-square-foot office building located at 2501 Cedar Springs Road in Uptown Dallas. The seven-story building was originally constructed in 1982. The renovation delivered an upgraded lobby, ground-floor restaurant with patio seating, tenant conference center, upgraded parking garage and enhanced common areas and restrooms. Significant improvements were also made to the building’s systems and equipment. Grupo Haddad has tapped Newmark to lease the newly renovated space.

CHICAGO — The development team of Mavrek Development, GW Properties, Luxury Living and Double Eagle Development, alongside general contractor Lendlease, have topped off construction of The Saint Grand, a 21-story mixed-use building in Chicago’s Streeterville neighborhood. Office tenant build-outs are scheduled for later this year, with residential deliveries expected in early 2024. The project will consist of 248 luxury apartment units, 45,000 square feet of office space and 7,500 square feet of street-level retail space. Amenities will include a package receiving service, coworking lounge, fitness center and outdoor pool deck. Office tenants will enjoy all building amenities as well as a private outdoor space.

CHICAGO — BGO has launched Move-In Ready Offices (MIRO) to provide small and medium-sized businesses with immediate access to adaptable workspaces. Current MIRO suites range from 1,000 to 18,000 square feet and offer immediate occupancy and flexible lease terms. BGO currently has MIRO suites available in Chicago, New York, Boston, San Francisco and Washington, D.C. The firm plans to deliver more prebuilt suites across its entire U.S. office portfolio. Gensler and Michaelis Boyd designed the spaces. MIRO offers both private workstations and collaboration spaces. Tenants also benefit from access to amenity centers, townhalls and various perks. As of June 30, BGO had $83 billion of assets under management.

WHITEHALL, OHIO — Woda Cooper Cos. Inc. and co-developer IMPACT Community Action have broken ground on The Enclave on Main, a 102-unit affordable housing community in Whitehall, an eastern suburb of Columbus. Located at 3540 E. Main St., the project will offer one-, two- and three-bedroom layouts. Units will be restricted for residents who earn 30 to 80 percent of the area median income. There will also be several units adapted for those with mobility challenges and sight or hearing disabilities. Amenities will include a community room with kitchenette and a management office for an onsite community manager. There will also be dedicated space for assisting residents with supportive services such as case management, workforce development and employment training, emergency assistance and financial literacy to be coordinated by IMPACT. The Ohio Housing Finance Agency (OHFA) provided a tax-exempt bond issuance and allocated 4 percent Low-Income Housing Tax Credits and soft funds to the development through its bond gap financing program. Alliant Capital invested in the tax credits to provide equity financing. CF Bank will provide a permanent mortgage and construction loan, through the purchase of the tax-exempt bonds issued by OHFA. Franklin County is providing an additional soft mortgage through …

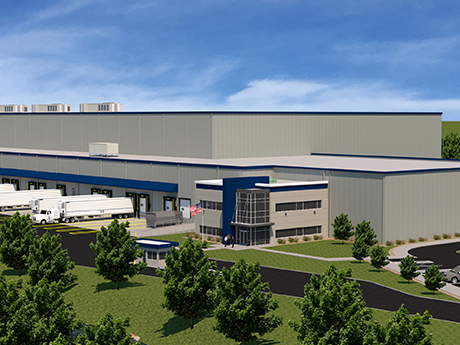

CLAYMONT, DEL. — Georgia-based owner-operator Agile Cold Storage will open a 275,000-square-foot facility in Claymont, Del., about 25 miles southwest of Philadelphia. The site is located within First State Crossing, an industrial park that is a redevelopment of a former steel mill. Agile Cold Claymont is expected to create 130 new jobs and involve capital investment of more than $170 million over the next five years.

POUGHKEEPSIE, N.Y. — Locally based developer PAZ Management has begun leasing The Flats at Raymond, a 39-unit multifamily project located north of New York City in Poughkeepsie. The property features one- and two-bedroom units ranging in size from 706 to 1,098 square feet. The Flats at Raymond is one of two complexes that comprise the first phase of a larger development known as The Arlington of Poughkeepsie. The second property, a 24-unit adaptive reuse project known as Lofts at The School, began welcoming residents earlier this year and is now 90 percent occupied. Rents at The Flats at Raymond start at $1,975 per month.

CEDAR PARK, TEXAS — A joint venture between three Austin-based real estate firms — Cordova Real Estate Ventures, Riverside and Live Oak — has broken ground on Phase I of New Hope, a $250 million mixed-use project located in the Austin suburb of Cedar Park. The first two phases of the project are being developed across six parcels on New Hope Drive. Phase I will include three Class A industrial buildings totaling 271,689 square feet. The second phase of development will include an additional 213,700 square feet of industrial space. The project is also set to include a 32-acre development named The District at New Hope. This portion of the project is still in design, but could include a mix of retail, entertainment, restaurant, hospitality, office space, and research-and-development space. A timeline for the development was not announced. The project team for New Hope includes Zapalac/Reed Construction Co., McFarland Architecture and Malone Wheeler. Live Oak will market and lease the project’s industrial space, and Travis Robertson with JLL has been tapped to handle leasing of retail and restaurant space. A number of industrial developments are currently underway in suburban Austin, including 5900 Ben White, an industrial project also by Riverside …