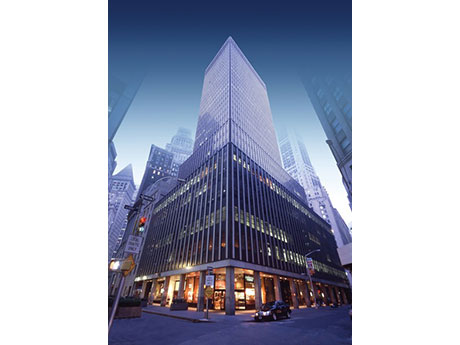

NEW YORK CITY — JLL Capital Markets has arranged $220 million in financing for the conversion of 55 Broad Street in New York City’s Financial District into 571 luxury apartment units. Conversion of the 30-story office tower will occur in phases. JLL arranged the four-year, floating-rate loan through Mexico City-based Banco Inbursa on behalf of the borrower, a partnership between Metro Loft Developers LLC and Silverstein Properties. JLL also advised on the procurement and structuring of equity for the deal. The Rudin Family sold the building to the developers for about $173 million, according to Crain’s New York Business. Upon completion, 55 Broad Street will feature studios, one-, two- and three-bedroom units along with roughly 17,000 square feet of amenity space. Amenities will include a rooftop pool, fitness center, coworking facilities and sports simulators. The project will be one of the first fully electric residential buildings in Manhattan, leveraging self-contained heating and cooling systems. Mechanical renovations will bring the building to 100 percent carbon neutral and will enable the creation of additional amenities and rentable floor area. Located less than two blocks from the Bowling Green subway station, 55 Broad Street offers connectivity to destinations across the city and the …

Development

JERSEY CITY, N.J. — Slate Property Group and McCourt Partners have provided a $59 million bridge loan for a 285-unit multifamily project in the McGinley Square area of Jersey City. The borrower, a partnership between Sequoia Development Group and Bushburg Properties, will use the proceeds to complete construction, lease-up and stabilization of the 16-story building. Units will come in studio, one-, two- and three-bedroom floor plans. Amenities will include a dog run, fitness center, coworking lounge, conference room and an indoor/outdoor rooftop deck, as well as 5,109 square feet of commercial space. Sam Rottenberg of SPR Group arranged the two-year, floating-rate loan on behalf of the developers. Full completion is slated for the first quarter of 2024.

HILLSBOROUGH, N.J. — New Jersey-based developer Adoni Property Group has completed The Franklin at Hillsborough, a 44-unit multifamily project in Northern New Jersey. The property, which is now 90 percent occupied, offers one- and two-bedroom units ranging in size from 1,000 to 1,300 square feet that are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Rents at the remaining two-bedroom units start at $2,900 per month.

Freedom Financial Provides $5.9M Construction Loan for Medical Office Building in Jacksonville

by John Nelson

JACKSONVILLE, FLA. — Freedom Financial Funds has provided a $5.9 million construction loan for a single-tenant medical office building located in Jacksonville. The build-to-suit project is for an entity controlled by a national retail and single-tenant developer. The 15-month loan features two six-month extension options and was underwritten at an 80 percent loan-to-cost ratio. The construction timeline and address for the project were not disclosed.

LENEXA, KAN. — Copaken Brooks is set to begin development of Restaurant Row at Lenexa City Center. Located on the corner of 87th Street and Renner Boulevard, the project is adjacent to AdventHealth’s 13-building campus that is currently under construction. The first phase of Restaurant Row will include two restaurant concepts set to open in fall 2024, with two remaining spaces available for lease. Cactus Grill TexMex & Tequila, a local Kansas City restaurant that has operated for more than 30 years, will occupy 5,000 square feet. Restaurant Row will be Cactus Grill’s third location, following its original restaurant in Leawood and its newest in BluHawk. North Carolina-based Tupelo Honey will occupy 5,700 square feet. The Southern food chain currently operates 21 locations across the United States with six additional planned to open in the next 18 to 24 months. John Nolan of Crossroads Real Estate Group represented Cactus Grill, while Howard Zoldessy of Hatcher-Hill Brokerage LLC represented Tupelo Honey.

Shopping center owners and property managers throughout the United States are exploring opportunities to increase foot traffic by transforming excess parking into restaurants, entertainment venues, neighborhood amenities and even multifamily uses. “In our experience, nearly every shopping center that’s not grocery-anchored is going through a process to reassess the amount of parking they have, the amount of parking they need and alternative ways to develop those parking areas to add value,” says Cornelius Brown, a principal in the Pennsylvania offices of Bohler, a land development consulting and site design firm. With more than 30 offices across the Eastern and Central United States, Bohler has helped many of its clients with parking conversions ranging from single pad site creation to comprehensive, property-wide redevelopment. Municipalities Onboard Landlords have been carving out parcels for standalone retailers, restaurants and other uses for years, but the trend is accelerating as more and more municipalities ease minimum parking requirements. Parking-reduction advocates have argued that offering fewer spaces reduces environmental impacts associated with heat islands and stormwater runoff. Others contend it promotes the use of mass transit and ridesharing, which can reduce vehicle emissions and, in the case of bars and restaurants, may reduce incidents of impaired …

ORLANDO, FLA. — Tavistock Development has announced plans for Lake Nona West, a 405,000-square-foot shopping center to be located in the Lake Nona master-planned community in Orlando. Upon completion, the development will be situated on a 54-acre parcel and feature open-air shops, ground-level parking, outdoor entertainment spaces and public art. Tavistock has submitted site plans to the City of Orlando, and construction is scheduled to begin in 2024, with completion planned for fall 2025. Tenant announcements are expected this winter.

Bluegrass Supply Chain Completes 100,000 SF Expansion of Industrial Facility in Franklin, Kentucky

by John Nelson

FRANKLIN, KY. — Bluegrass Supply Chain has completed a 100,000-square-foot expansion of its industrial facility located in Henderson Industrial Park in Franklin. Situated at 805 Garvin Lane and now totaling 200,000 square feet, the building was purchased in 2021 and originally comprised 100,000 square feet. The expansion will create 20 to 25 jobs, according to Shawn Hart, vice president of operations with Bluegrass Supply Chain.

ATLANTA AND NEW YORK CITY — Chick-fil-A has announced plans for two new restaurant concepts. Beginning in 2024, the brand will open an elevated drive-thru concept in metro Atlanta as well as a walk-up restaurant in New York City. Both concepts are designed to enhance efficiency and convenience, with plans for the drive-thru restaurant including a kitchen built above the drive-thru lanes and dedicated lanes for mobile orders. Targeted toward urban areas with heavy foot traffic, the walk-up concept will allow guests to order through the Chick-fil-A app and pick up items at the walk-up windows. “Digital orders make up more than half of total sales in some markets… so we know our customers have an appetite for convenience,” says Khalilah Cooper, Chick-fil-A’s executive director of restaurant design. “The locations for these tests were intentionally selected with the customers in mind, giving them more control over their desired experience and cutting down wait time.” The locations of the two new concepts were not disclosed. Chick-fil-A is a privately held, family-owned fast-casual restaurant chain based in Atlanta. The company employs more than 170,000 team members at more than 2,700 restaurants across 47 states, Washington, D.C., Puerto Rico and Canada.

TERRELL, TEXAS — Kansas City-based developer VanTrust Real Estate has acquired two industrial development sites totaling 60.4 acres in Terrell, an eastern suburb of Dallas. The company plans to develop two speculative buildings totaling 702,000 square feet. Building 1 will be a 196,560-square-foot, rear-load facility. Building 2 will total 505,440 square feet and feature a cross-dock configuration. Both buildings will be marketed to e-commerce and third-party logistics users alike. Demian Salmon of Stream Realty Partners represented the undisclosed seller in the land deal. A construction timeline was not disclosed.