ATLANTA — The University System of Georgia’s Board of Regents has approved a $117 million residence hall development on the Georgia Tech campus in Midtown Atlanta. The 191,000-square-foot community will offer 850 beds alongside collaborative learning spaces, community lounges and group kitchens. The project is being built to accommodate first-year student enrollment growth over the next 10 years, and to help relocate students during planned renovations to the university’s existing housing. The residence hall will be Georgia Tech’s first new construction since 2005 when 10th and Home opened according to Kasey Helton of Georgia Tech’s Campus Services division. Completion on the project is scheduled for fall 2026.

Development

FAYETTEVILLE, ARK. — The ITEX Group and Time Warp Enterprises have released plans for The Aronson, a build-to-rent (BTR) project in Fayetteville that will be anchored by a new moviegoing concept from Austin, Texas-based theater chain Alamo Drafthouse Cinema. The Aronson’s 214 units will be available as single-family, duplex or triplex configurations. Amenities will include a clubhouse, fitness center, pool, playgrounds, dog parks and bike parking. The project is anticipated to deliver by 2024. The Aronson will be home to Alamo Drafthouse Cinema + Drive-In, developed via a partnership among Catchlight Entertainment, ITEX and Time Warp. In addition to eight indoor movie screens, with a total of 798 reclining theater seats, the concept also includes a permanent outdoor drive-in theater with a beer garden and parking for cars and bikes. The Aronson is named for cinema pioneer and Arkansas native Max Aronson, whose screen name was Gilbert “Bronco Billy” Anderson. Aronson starred in several silent films in the early part of the 20th century as Bronco Billy. He also was a producer on “The Tramp,” a film released in 1915 and recognized as one of Charlie Chaplin’s first well-known performances.

CHARLOTTE, N.C. — The NRP Group has delivered a 180-unit affordable housing community located in northeast Charlotte at 2019 Aberdale Farm Lane. Dubbed Sundale Flats, the community is reserved for residents earning at or below 80 percent of the area median income (AMI) and comprises three four-story buildings with homes in two-, three- and four-bedroom layouts. Amenities include a fitness center, clubhouse and community lounge, business center, playground, outdoor grill and picnic area, onsite laundry room and onsite parking. Residents will also have access to a 16-foot-wide multi-use path that connects to a larger network of trails and will be part of the 26-mile Cross Charlotte Trail (XCLT). The City of Charlotte, The North Carolina Housing Finance Agency, Inlivian (formerly the Charlotte Housing Authority) and Bank of America provided financing for the project. Leasing is currently underway with a waitlist in progress.

GLEN CARBON, ILL. — The Goodwill store in Glen Carbon, about 14 miles northeast of St. Louis, has reopened following months of renovations. The store at 210 Junction Drive has been reconfigured from 12,500 square feet of retail space and 3,000 square feet of backend space to 10,000 square feet of retail space and 4,850 square feet of backend space. The expanded backend space will help with the increase in donations the store has received. Additional renovations to the exterior will be made this spring. An entirely new donation reception area will be built with the addition of two new docks and enhanced accessibility, as the drop-off area will no longer require the use of stairs.

Morgan Stonehill Breaks Ground on 360-Unit Seasons at Meridian Apartments in Metro Boise

by Amy Works

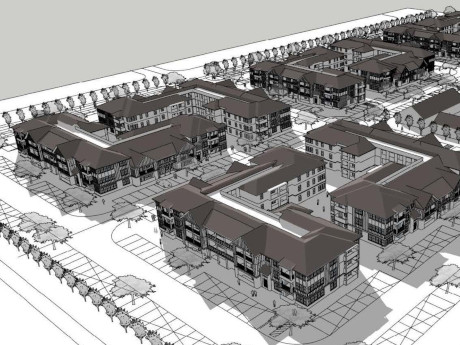

MERIDIAN, IDAHO — Developer Morgan Stonehill, with Los Angeles-based Newman Garrison + Partners as architect, has released plans for Seasons at Meridian, a 360-unit apartment community located at 2700 E. Overland Road in Meridian, a western suburb of Boise. The team broke ground on the development in January. Seasons at Meridian will feature 10 residential buildings arranged around an open-air courtyard space. Each building will offer a mix of studio, one-, two- and three-bedroom units ranging from 488 square feet to 1,328 square feet. The community will offer more than 30,000 square feet of amenity space, including a 10,000-square-foot clubhouse, a pool, park, community garden, fitness facility, bike maintenance room and barbecue areas. Additionally, the project is designed to provide direct pedestrian linkages to the adjacent commercial and retail developments with access to nearby recreational trails, landscaped areas and pocket parks. Completion is slated for second-quarter 2025.

Ridgeline Starts Construction of 1.5 MSF Midway Commerce Center in Vacaville, California

by Amy Works

VACAVILLE, CALIF. — Ridgeline Property Group, along with USAA Real Estate as capital partner and real estate investment manager, has started vertical construction for Midway Commerce Center Buildings A and C in Vacaville. Situated on 89.7 acres, the 1.5 million-square-foot industrial park is located off Eubanks Drive, a mile from the Midway Road and Highway 505 interchange and less than four miles from Interstate 80. The 198,490-square-foot, rear-loading Building A will offer 36-foot clear heights and mechanical dock levers at every other position. The 1.2 million-square-foot, cross-dock Building C will offer an internal clear height of 42 feet and hydraulic dock levels at all 209 positions. Both buildings will feature LED lighting, ample power and high-finish offices. Completion is slated for early this fall. Development costs were not released. HPA Architecture is serving as architect for the project. Brooks Pedder, John McManus and Tony Binswanger of Cushman & Wakefield are handling leasing for the project.

SCOTTSDALE, ARIZ. — Arizona-based Mark-Taylor Residential has opened San Bellara, a multifamily property located at 17800 N. 78th St. in Scottsdale. Mark-Taylor will manage the 180-unit community in-house. San Bellara features a mix of one-, two- and three-bedroom layouts with granite countertops, stainless steel appliances, walk-in closets, in-unit washers/dryers, air conditioning, private patios or balconies and direct-access garages. The pet-friendly property also offers a swimming pool, hot tub, fitness center, business center, outdoor cabanas with a poolside kitchen, an electric car station and a resident clubhouse with flat-screen TV.

JACKSONVILLE, FLA. — RangeWater Real Estate has purchased a 28.6-acre site in the San Jose neighborhood of Jacksonville for the development of a 280-unit multifamily community. Located at 3730 Dupont Ave., the property, dubbed The Maggie, will feature residences in one- and two-bedroom layouts, as well as a clubhouse with meeting space, resident’s lounge, fitness center, deck and grilling area, dog park and fountains. Delivery of the first units and clubhouse is scheduled for late spring 2024. ParkProperty Capital is partnering with RangeWater on the project, which will mark RangeWater’s sixth development in the Jacksonville area.

ATLANTA — Selig Enterprises has unveiled plans for the renovation and rebranding of Lenox Marketplace in Atlanta, now known as The Block at Phipps. Located in the Buckhead neighborhood at the confluence of Peachtree Road, Wieuca Road, Oak Valley Road and Prichard Way, the property comprises 9.4 acres. Renovations are scheduled to begin in the second quarter of this year. Capital improvements will include the addition of a 30-foot, open-air corridor to connect the sidewalk along Peachtree Road and the parking deck. Selig, which acquired the property with an investment partner in 2020, also plans to transform the space along Peachtree and Oak Valley roads with new façades, landscaping, programming and enhanced walkways. ASD|SKY is providing architecture and environmental design services for the project.

FRISCO, TEXAS — Locally based developer Stillwater Capital has broken ground on a 215-unit build-to-rent residential project in Frisco. The site is located within The Link, a 240-acre mixed-use development that is adjacent to the PGA of America’s headquarters campus. Information on floor plans was not disclosed. Amenities will include a pool, fitness center, resident lounge and a neighborhood park and walking trails. Stillwater Capital has partnered with Robert Elliott Custom Homes on the project, which is slated for full completion in late 2024.