FORT WORTH, TEXAS — A partnership between Columbia Residential and Renaissance Heights Foundation has broken ground on Columbia Renaissance Square III, a 100-unit affordable seniors housing project in southeast Fort Worth. The project represents the third and final phase of a larger mixed-income development. A portion of those residences will be reserved for renters earning between 30 and 80 percent of the area median income, and 16 units will be set aside as permanent supportive housing. Phase I of Columbia Renaissance Square totaled 140 units, and Phase II featured 120 age-restricted units.

Development

PHILADELPHIA — Affinius Capital has provided a $170 million construction loan for a 431-unit multifamily project that will be located in Philadelphia’s Northern Liberties neighborhood. The project represents Phase II of a larger development known as Piazza Alta and will consist of two buildings that will rise eight and 16 stories. Units will come in studio, one-, two- and three-bedroom floor plans and will be furnished with stainless steel appliances and individual washers and dryers. Amenities will include a rooftop lap and lounge pool, grilling stations, fire pits, a fitness center with a yoga studio and coworking spaces. Russell Schildkraut of Ackman-Ziff arranged the loan on behalf of the borrower, locally based developer Post Brothers.

DURHAM, N.C. — ZOM Living, in partnership with AEW Capital Management, has delivered Maizon Durham, a 248-unit luxury apartment community located at 500 E. Main St. near the historic American Tobacco Campus in Durham. The project team included architecture firm Hord Coplan Macht and interior designer One Line Design. Maizon Durham offers one-, two- and three-bedroom floorplans ranging in size from 558 to 1,450 square feet. Amenities include a swimming pool with a sundeck and lounge seating and a fitness center with a dedicated recovery room and spin studio. Additional community spaces include a pet spa, coworking areas, conference rooms, private offices, quiet zones, a resident café and a 24-hour marketplace, as well as 13,000 square feet of street-level retail space.

STATE COLLEGE, PA. — A joint venture between Georgia-based developer Landmark Properties and Liberty Mutual Investments will develop The Mark State College, a 515-bed student housing project for students at Penn State University. Designed by Cube3 Architects, The Mark State College will be a 12-story building that will be located on East College Avenue, adjacent to campus. Amenities will include a sky deck, rooftop pool and hot tub, fitness center and sauna, clubhouse, grilling area, sports simulator, study lounge, café, computer lab and fire pits. TSB Capital Advisors arranged construction financing for the project. A tentative development timeline was not announced.

Capstone Development, Colorado School of Mines Complete 1,058-Bed Student Housing Project in Golden

by Amy Works

GOLDEN, COLO. — A public-private partnership between Capstone Development Partners and the Colorado School of Mines has completed Village at Mines Park, a 1,058-bed student housing community located on the university’s campus in Golden. The property — which is the redevelopment and expansion of an existing community, Mines Park — offers affordable housing for upper-division undergraduate and graduate students, as well as students with families. Fully furnished units are offered in studio, one-, two-, three- and four-bedroom configurations. Shared amenities include a fitness center, dining options, recreational green space, an outdoor amphitheater and community gathering and study spaces. The property is also home to residence life and management offices and features on-site parking and electric car charging spaces. The development team for the project included design-builder Milender White Construction and architectural firm SAR+. Capstone Management Partners will provide facility maintenance, custodial and asset management services for the community. The project was financed by the university.

HILLSBORO, ORE. — Trammell Crow Co. (TCC) and joint venture partners Mar-Gulf Management and MDI Capital, the international subsidiaries of Kuwait Financial Centre, have broken ground on VanRose Technology Center, a speculative logistics building in Hillsboro, approximately 20 miles west of Portland. Slated for delivery by July 2026, VanRose Technology Center will offer 303,969 square feet of cross-dock logistics space. Situated on 16 acres at 2625 N.E. Huffman Road, VanRose Technology Center will feature a clear height of 36 feet, 234 automobile stalls, 64 dock doors, four drive-ins and 33 trailer stalls. VanRose Technology Center can be demised to fit up to four tenants. Project partners include Mackenzie Inc. as architect, Perlo Construction as general contractor and Citizens Bank as lender. Macadam Forbes is marketing the property for sale or lease.

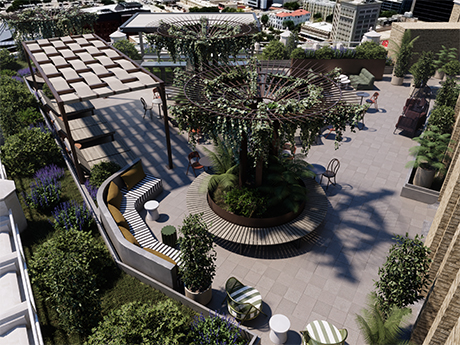

SAN ANTONIO — Locally based development and investment firm McCombs Enterprises will undertake a multifamily conversion project in downtown San Antonio. The project will transform the historic 31-story Tower Life Building at 310 S. Saint Mary’s St., which was originally built in 1929, into a 242-unit apartment complex. The development will be known as Tower Life Residences and will include penthouses and retail space. Amenities will include a library, lounges, bar spaces, workspaces, entertainment areas and private event rooms, as well as 5,000 square feet of rooftop gardens. McCombs is redeveloping the building in partnership with J. Jeffers Co. Project partners include Front Porch Design Group, Alamo Architects and Jordan Foster Construction. The first residences are expected to be available for occupancy next fall.

HOUSTON — New York-based global investment firm GTIS Partners has completed Port 225 Commerce Center, a 484,070-square-foot industrial project located near Port Houston. The 26-acre development consists of a 355,071-square-foot, cross-dock building and a 128,999-square-foot, rear-load facility. Building features include 36- and 32-foot clear heights, respectively, and combined parking for 382 cars and 93 trailers. Project partners included Angler Construction, Powers Brown Architecture, Langan Engineering and Cushman & Wakefield as the leasing agent. Construction began in February 2024.

Creation Breaks Ground on Two-Building Harbor Park Industrial Complex in Glendale, Arizona

by Amy Works

GLENDALE, ARIZ. — Creation, in partnership with QuarterMoore, has broken ground on Harbor Park, a two-building industrial complex on 9.7 acres in Glendale. Located on Glen Harbor Boulevard within the Glen Harbor industrial submarket, Harbor Park will feature two single-story industrial buildings totaling 163,364 square feet. Completion is slated for third-quarter 2026. One building is being constructed as a 108,865-square-foot build-to-suit for PODS Phoenix, a local franchise division of PODS Moving & Storage. The second building will offer 54,499 square feet of speculative industrial space with a clear height of 24 feet, 25 dock-high doors, four grade-level doors and 106 parking spaces. The asset is already 67 percent leased to PODS Phoenix, with the second building available for lease or purchase. LGE Design Build is spearheading the construction and design of Harbor Park. Anthony Lydon, John Lydon, Kelly Royle and Hagen Hyatt of JLL are handling leasing efforts for the property.

COLUMBUS, OHIO — Merchants Capital has secured $35.1 million in tax credit equity financing for Lofts at 40 Long, a project involving the adaptive reuse of a vacant YMCA building in Columbus into affordable housing. Woda Cooper Cos. Inc. and IMPACT Community Action are co-developing the property. Merchants Capital secured $18.5 million in 4 percent low-income housing tax credit (LIHTC) equity, $11.4 million in federal historic tax credits and $5.2 million in Ohio LIHTC. Ohio Housing Finance Agency allocated the federal and state housing tax credits, and the National Park Service allocated the federal historic credits. Other funding sources included the city and county, as well as agency and private sources. The project will convert a vacant YMCA building into 121 apartment units, including one studio, 72 one-bedroom units, 38 two-bedroom units and 10 three-bedroom units. The residences will be restricted to families earning between 30 and 80 percent of the area median income. The project will include the demolition of the existing boarding rooms, restroom facilities and common spaces, except for the historic areas, which will be restored according to historic requirements. Common amenities will include a basketball court and indoor play area in the former gym area, indoor …