NEWPORT, KY. — Cincinnati-based North American Properties (NAP) has partnered with Galley Group, a Pittsburgh-based food hall operator, to open a new food hall and bar at Newport on the Levee, a mixed-use destination along the Ohio River in Newport. The 7,900-square-foot venue, dubbed The Galley on the Levee, will feature four restaurants and a signature bar that will be able to accommodate 200 patrons. Designed by Reztark Design Studio, the food hall will open onto Bridgeview Box Park, an open-air shipping container park that opened in 2020 as part of NAP’s redevelopment of Newport on the Levee, which originally opened in 2001. The Galley on the Levee is set to open in summer 2023 and will mark Galley Group’s entry into the Kentucky market. In addition to the food hall, several other restaurants are currently under construction at the mixed-use development, including Shiners on the Levee, 16 Lots Brewing Co. and Amador. Shiners will soft-open during Thanksgiving week and host grand opening festivities in early December, while 16 Lots and Amador are slated to open next spring, according to NAP.

Development

KITTERY, MAINE — Private equity real estate firm Jones Street Investment Partners has received a $70 million construction loan for the development of Seacoast Residences, a 282-unit multifamily project in Kittery, located in the southern coastal part of Maine. The five-building community will offer amenities such as a pool, fitness center, dog park and nature trails. KeyBank provided the loan, and Colliers arranged a $7.9 million preferred equity investment with an undisclosed partner. Construction is slated for an early 2024 completion.

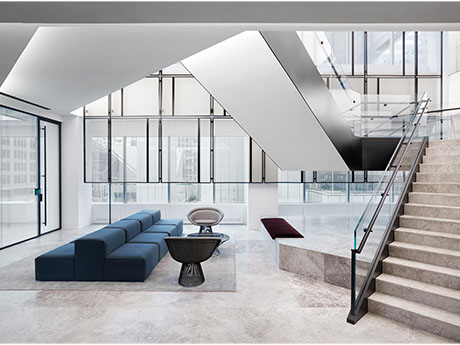

NEW YORK CITY — Global law firm Shearman & Sterling has completed the renovation of its 340,000-square-foot office headquarters space at 599 Lexington Avenue in Midtown Manhattan. The redesigned workspace houses apportioned offices, improved boardroom acoustics, new artwork and various health and wellness features. Perkins & Will served as the architect of the project, which was conceived in advance of the pandemic and took approximately two years to complete. L&K Partners served as the construction manager, and MEP provided engineering services.

PHILADELPHIA — Developer LCOR has topped out The Ryland, a 267-unit apartment building in Philadelphia’s Society Hill neighborhood. The property will offer a mix of studio, one- and two-bedroom units, as well as two- and three-bedroom penthouses. The amenity package will comprise an outdoor pool, fitness center, multiple lounges, a rooftop deck, a children’s play area and concierge services. Hunter Roberts Construction Group is the general contractor for the project, which is scheduled for a fourth-quarter 2023 completion.

TREXLERTOWN, PA. — Home Depot (NYSE: HD) will open a 136,000-square-foot store at Macungie Crossing, a 182,000-square-foot shopping center that is under construction in the Lehigh Valley community of Trexlertown. New York City-based RD Management is developing the project, construction of which is underway and expected to be complete next summer. The Atlanta-based home improvement retailer now operates about 70 stores in Pennsylvania.

IndiCap, AECOM-Canyon Partners Break Ground on 1.6 MSF Eastmark Center Industrial Park in Mesa, Arizona

by Amy Works

MESA, ARIZ. — IndiCap and AECOM-Canyon Partners have broken ground on Eastmark Center of Industry, a 113-acre industrial park in Mesa’s Gateway Airport submarket. Upon completion, the park will total 10 buildings offering more than 1.6 million square feet of mid-bay and cross-dock Class A industrial space. Situated in the Elliot Road Technology corridor, Eastmark Center of Industry will offer buildings ranging from 83,200 square feet to 426,400 square feet with 30-foot to 36-foot clear heights and 160-foot to 500-foot building depths. Future phases may include the opportunity for build-to-suit facilities. The project team includes Layton as general contractor, Kimley Horn as civil engineer and Deutsch Architecture as architect. IndiCap acquired the project site in April 2022 for $48 million. Steve Larsen, Pat Harlan and Jason Moore of JLL are handling leasing for the project.

Delayed Payments Result in $208B Cost Impact for U.S. Construction Industry in 2022, New Report Reveals

by Jeff Shaw

AUSTIN, TEXAS — Delayed payments for wages and invoices are projected to represent an estimated $208 billion in excess costs to the construction industry this year, up 53 percent from $136 billion in 2021, according to a newly released report from Rabbet, an Austin-based construction finance software provider. Rabbet’s 2022 Construction Payments Report surveyed 137 general contractors and subcontractors across the U.S. about the speed of payments in the industry and examined the growing impact on the cost for the broader sector. The report studied how general contractors and subcontractors across the country managed working capital, bidding decisions and project risks in the face of slow payments during the last 12 months. The survey was conducted online in September. Forty-nine percent of subcontractors reported that over the past 12 months, they waited longer than 30 days on average to receive payment from general contactors. Thirty-seven percent of respondents indicated that work had been delayed or stopped in the last 12 months due to delays in payments to crew members, up from 28 percent in 2021. Additionally, 27 percent of subcontractors reported having filed a lien in the last 12 months to keep possession of a property until their firm received payment …

Highwoods Selects Toro, Ignite Realty to Co-Develop Mixed-Use Ovation Campus in Suburban Nashville

by John Nelson

FRANKLIN, TENN. — Highwoods Properties has selected Toro Development Co. and Ignite Realty Partners to develop Ovation, a mixed-use community located on a 145-acre site in the Nashville suburb of Franklin. Specific plans and construction timelines were not released as the project is in the planning stages, but Toro and Ignite will partner to transform a 60-acre portion of the Ovation campus into a walkable village that will feature shops, restaurants, apartments and lodging. Highwoods, which developed and owns the Mars Petcare headquarters on the Ovation site, will develop the office component of the project. Open Realty Advisors LLC, a Newmark company led by Mark Masinter, will serve as the leasing agent for Ovation.

Duncan Brokers Sale of Historic Distillery Commons Complex in Louisville, Buyer Plans $75M Adaptive Reuse Project

by John Nelson

LOUISVILLE, KY. — Duncan Commercial Real Estate (DCRE)/CORFAC International has brokered the sale of Distillery Commons, a historic distillery complex located at Lexington and Payne streets in Louisville’s Irish Hill neighborhood. The buyer, St. Louis-based Bamboo Acquisitions LLC, an affiliate of Intelica Commercial Real Estate, plans to redevelop the red-brick complex into a mixed-use project housing residences, offices, shops and restaurants. Barrel House Investments sold Distillery Commons to Bamboo for an undisclosed price. In 2019, the seller purchased the complex from Kinetic Properties, which had owned the site since the mid-1970s. The Courier-Journal reports that Distillery Commons operated as a bourbon warehouse that was constructed in the 1890s and that the proposed mixed-use development carries a price tag of $75 million. The City of Louisville recently condemned the rickhouse (Building 100 of the property), which was demolished last month.

Philadelphia Phillies Purchase Distressed Shopping Center Near Metro Tampa Ballpark for $22.5M

by John Nelson

CLEARWATER, FLA. — An affiliate of the Philadelphia Phillies has purchased the Clearwater Collection, a distressed shopping center spanning 13 acres at 21800 U.S. Highway 19 N in the Tampa suburb of Clearwater, for $22.5 million. The 134,362-square-foot property is located adjacent to BayCare Ballpark, a city-owned baseball arena that the Phillies lease for its Spring Training operations, as well as its Minor League Baseball affiliate team, the Clearwater Threshers. Control of the underlying land affords the Phillies the opportunity to plan for future redevelopment near the park. Michael Vullis of Avison Young was the court-appointed receiver of Clearwater Collection, which recently went into bankruptcy. Vullis and Avison Young colleagues John Crotty, Michael Fay, David Duckworth, Nick Robinson and Brian de la Fé represented the seller, an entity doing business as Clearwater Collection 15, in the transaction. Floor & Décor is the sole occupant of the shopping center and currently occupies 49 percent of the property’s leasable area.