READINGTON, N.J. — New Jersey-based developer Larken Associates is nearing completion of The Ridge at Readington, a 254-unit multifamily project located about 50 miles southwest of Manhattan. The Ridge at Readington will feature a mix of market-rate and affordable units in one- and two-bedroom formats across nine buildings. Residences will be furnished with stainless steel appliances and quartz countertops. Amenities will include a pool, fitness center, lounge and wet bar, outdoor pavilion, dog park and walking trails. The first move-ins are scheduled for the fourth quarter.

Development

WOODBRIDGE, VA. — The Prince William County Board of Supervisors has unanimously approved the development of Riverside Station, a 19.2-acre mixed-use development located at the intersection of U.S. Route 1 and Route 123 in north Woodbridge. The co-developers, The IDI Group Cos. and Boosalis Properties, expect the town center-style development to bring over $380 million in capital investment to the area. The proposal includes up to 970 housing units and a minimum of 130,000 square feet of commercial space, primarily comprising dining and retail, as well as green spaces and a pedestrian bridge over Route 1. Eight percent of the project’s apartments are set to be affordable to households earning between 60 percent and 100 percent of the area median income. Riverside Station will be developed in three phases, with construction of the first phase, containing up to 330 apartments and 40,000 square feet of commercial space, slated to begin in mid-2023 and deliver in 2025. The current assemblage includes two parcels, one a former car dealership and the other housing a Food Lion-anchored shopping center that will be demolished. Riverside Station is expected to house the relocated Food Lion, according to a source familiar with the development. Once complete, …

PHILADELPHIA — The Chatham Bay Group has acquired a former factory located at 2019-53 E. Boston St. in Philadelphia’s East Kensington neighborhood for $9.6 million. The Delaware-based investment firm plans to implement an adaptive reuse program that will convert the facility into a 178-unit apartment complex. Philadelphia-based architecture firm Designblendz is designing the project. Phil Sharrow and Craig Thom of Scope Commercial represented Chatham Bay and the seller, Viking Mill Associates LLC, in the transaction.

Landmark, Atlantic American Partners Break Ground on 702-Bed Student Housing Project Near FSU

by John Nelson

TALLAHASSEE, FLA. — A joint venture between Landmark Properties and Atlantic American Partners has broken ground on The Metropolitan at Tallahassee, a 702-bed student housing development near Florida State University. The community will be located at 1701 W. Pensacola St. near the university’s Doak S. Campbell Stadium. The development is set to offer two- to four-bedroom, fully furnished units. Shared amenities will include an outdoor putting green, 24-hour study lounge, computer lab, fitness center, resort-style swimming pool and a grilling area. Landmark Construction will serve as the general contractor for the project, which is scheduled for completion in August 2024.

ATLANTA — GID, the developer of the $2 billion High Street mixed-use project in Atlanta’s Central Perimeter district, has executed a lease with Parker Hospitality to bring a Hampton Social restaurant to the development. The coastal-inspired restaurant chain is part of the first phase of the 36-acre project and is set to open in 2024. Hampton Social will span 10,455 square feet across two levels and serve cocktails, its famed “rosé all day” menu and seasonal seafood food for lunch, dinner and weekend brunch. The Hampton Social has locations throughout the United States including Illinois, Florida and Tennessee, and High Street will be its first location in Georgia. Led by GID, High Street’s first phase is under construction and encompasses approximately 150,000 square feet of entertainment-driven retail and restaurant space, a central events plaza, 600 luxury apartments, 90,000 square feet of loft offices and 222,000 square feet of existing office space. Earlier this year, GID announced Puttshack as an entertainment anchor for High Street’s first phase. Molly Morgan is leading the retail leasing assignment for High Street, along with Allie Spangler and 10Twelve, JLL’s boutique agency leasing team.

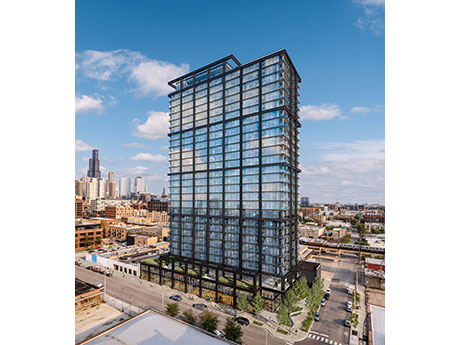

CHICAGO — Sterling Bay has broken ground on 225 N Elizabeth, a $155.6 million apartment development in Chicago’s Fulton Market district. The developer received $91.7 million in construction financing from Citizens and Old National Bank. The 28-story building will feature 350 units, 20 percent of which will be designated as affordable housing. Plans also call for roughly 9,000 square feet of retail space, 95 parking spaces and indoor and outdoor amenities on the third and top floors of the building. Sterling Bay is developing the project in partnership with Ascentris, a Denver-based private equity firm. Chicago-based McHugh Construction is the general contractor and Hartshorne Plunkard is the lead architect. Completion is slated for the second quarter of 2024.

As the commercial real estate market adjusts to how much of an effect higher interest rates will have on investment sales and property values, the rental housing sector continues to witness robust resident demand and rent growth as home ownership has become even more difficult for first-time buyers. According to a recent report by the National Multifamily Council (NMHC) and the National Apartment Association (NAA), by 2035 the U.S. needs to build 4.3 million new residential rentals to meet housing needs amid shifting demographics, the existing shortage and the loss of 4.7 million affordable units with monthly rental rates of $1,000 or less, the organizations report. “We’re just not seeing enough new apartments being built, and as a result, we’re seeing significant demand in the rental housing market,” says Hugh Cobb, a principal of Asset Living, one of the nation’s largest property managers of multifamily, affordable, student, active adult, single-family rentals and build-to-rent housing. “Because we’re seeing a decrease in demand in the single-family sales market due to higher mortgage rates, people are staying in apartments longer. And as their families grow, they’re looking for alternative rental housing, such as the build-to-rent space,” says Hugh Cobb. “Through our proprietary data …

Starbucks Plans to Open 2,000 New Stores by 2025, Invest $450M in Existing US Locations

by Katie Sloan

SEATTLE — Starbucks Coffee (NASDAQ: SBUX) has announced plans to open 2,000 stores by 2025 and invest $450 million in its North American real estate, which will include the modernization of existing locations across the United States. The announcement took place during the company’s 2022 Investor Day conference in Starbucks’ hometown of Seattle. The company’s reinvention plan includes the implementation of a store design that streamlines work behind the counter, enabling better connection with the customer. Starbucks also plans to reorganize its real estate portfolio to include a greater number of pick-up stores and drive-thru-only and delivery-only locations. “When we think about our existing store portfolio and our investments, they must deliver in a few critical areas,” said John Culver, group president for North America and chief operating officer. “Reducing the level of complexity and making work easier for our partners; enabling stronger engagement and connection between our partners and the customers they serve; and delivering experiential convenience.” Starbucks also plans to expand its mobile order offerings via the company’s app, allowing customers to know when their order is ready and making the process of mobile ordering easier and more efficient during peak hours. Mobile ordering will also be extended to the …

Parkview Financial Funds $35M Loan for CMNTY Culture Campus Development Project in Hollywood

by Amy Works

LOS ANGELES — Parkview Financial has provided a $35 million loan to CMNTY Culture for the acquisition of a land assemblage situated at the northeast corner of the intersection of Sunset Boulevard and Highland Avenue in Los Angeles’ Hollywood district. The site comprises four contiguous parcels totaling 1.88 acres at 1518-1836 N. Highland Ave. and 6751-6767 W. Sunset Blvd. One parcel at 6767 W. Sunset Blvd. was purchased in July 2021 for $9.1 million. Parkview provided the loan to facilitate the acquisition of the three remaining parcels, which were recently purchased for $44 million. Once fully rezoned and entitled, the ownership plans to construct CMNTY Culture Campus that will include two towers – one 13 stories and one 14 stories – totaling approximately 500,000 square feet of creative office and studio/production space with six subterranean parking levels. The four parcels consist of U-shaped land that currently features a strip retail center, live performance venue, plant nursery and two surface parking plots. The owner plans to demolish the buildings for the new development. HKS Architects is serving as project architect and Oakland-based Hood Design Studio is serving as landscape designer.

FORNEY, TEXAS — A partnership between Holt Lunsford Commercial Investments (HLCI) and Principal Real Estate Investors will develop Gateway Crossing Logistics Park, an approximately 1.7 million-square-foot industrial project that will be located in the eastern Dallas suburb of Forney. The development will consist of three buildings ranging in size from roughly 1 million to 265,000 square feet on a 127-acre site along State Highway 80. Building features will include 36- to 40-foot clear heights, 185-foot truck court depths, built-to-suit office space and ample car and trailer parking. Construction is slated to begin within the month and to be complete in late 2023. Holt Lunsford’s leasing division will market the property.