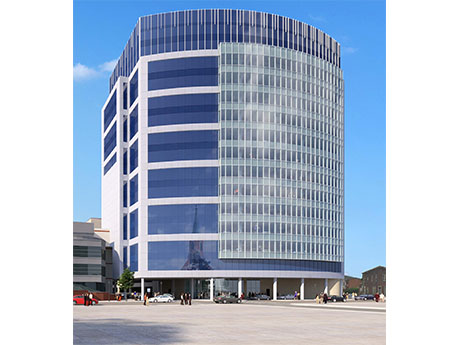

NEW BRUNSWICK, N.J. — New Jersey-based developer AST has topped out a 229,000-square-foot healthcare project in the Central New Jersey community of New Brunswick. The 15-story ambulatory medical pavilion is situated within the Robert Wood Johnson University Hospital campus. Upon completion, which is scheduled for the second quarter of 2023, the facility’s outpatient access to care and clinical experts supporting existing RWJBarnabas Health hospital services will be expanded.

Development

CHARLESTON, S.C. — RangeWater Real Estate has purchased 17 acres at the intersection of Bees Ferry Road and Bluewater Way in Charleston’s West Ashley submarket. The Atlanta-based company plans to develop 155 build-to-rent units at the site in a community named Bellerose at Bees Ferry, a Storia neighborhood. The property will comprise three-bedroom, two- bathroom townhomes that include one-car garages, 9-foot ceilings, gourmet kitchens with high-end appliances and stone countertops. The community will also feature an open-air club house, pool and firepits. RangeWater plans to break ground this month, and first move-ins are slated for October 2023.

BAY SHORE, N.Y. — New York City-based Rockefeller Group is underway on construction of a 172,622-square-foot speculative distribution center in the Long Island community of Bay Shore. The property at 55 Paradise Lane will feature a clear height of 36 feet, 40 dock doors, 270 car parking spaces, 40 trailer parking stalls and 7,317 square feet of mezzanine-level office space. Manhattan-based KSS Architects designed the project, and Aurora Contractors is handling construction. Completion is slated for the first quarter of next year.

Branch Signs Two Restaurants to Join Tenant Roster at Shopping Center Underway Near Pensacola

by John Nelson

MILTON, FLA. — Branch Properties has signed two restaurants to join the tenant roster at Merganser Commons at Dogwood Estates, a 66,912-square-foot shopping center under construction in Milton, a Florida Panhandle city located about 24 miles east of Pensacola. The Atlanta-based developer plans to open the Publix-anchored center later this summer. The new eateries joining Merganser Commons include RibCrib, a fast-casual barbecue restaurant that will occupy 4,750 square feet, and Teriyaki Madness, an Asian concept. Both restaurants are operated by Panhandle Restaurant Group. The center is currently 92 percent preleased to tenants including Domino’s Pizza, Great Clips, Japanese restaurant Nikko Sushi, nail salon Grand Nail Lounge and ice cream shop Scoops Ice Cream and Sweets. A local medical provider will occupy a 7,500-square-foot outparcel at the center.

BOSTON — JLL has arranged a $585 million construction loan for Allston LabWorks, a 580,905-square-foot life sciences, retail and multifamily project in the Allston neighborhood of Boston. The borrower and developer is a joint venture between Boston-based King Street Properties, Brookfield and Mugar Enterprises. Allston LabWorks will feature 534,000 square feet of lab space, 20,000 square feet of retail space and 35 multifamily units, about 25 percent of which will be reserved as affordable housing. The development will also house a 5,000-square-foot outdoor event area and a 668-space parking garage. The site, which spans 4.3 acres at 305 Western Ave., is situated adjacent to Harvard University’s 350-acre Allston campus, which is home to the newly opened John A. Paulson School of Engineering & Applied Sciences. The area is also near the campuses of Boston University and Boston College, with multiple MBTA Green Line stops nearby. Greg LaBine and Amy Lousararian of JLL arranged the four-year, floating-rate loan through an undisclosed institutional debt fund. Construction of the project is underway, but a timeline for completion was not disclosed. “The fact that we were able to move quickly on this loan in today’s market conditions speaks to the level of interest and …

AMARILLO, TEXAS — Dallas-based Mycon General Contractors is underway on construction of a 781-unit self-storage facility for U-Haul in Amarillo that will also offer truck and trailer rental services. The four-acre site at 5316 Canyon Drive already houses several U-Haul facilities, and the new three-story building will add 83,000 square feet of net rentable, climate-controlled space and 11,267 square feet of box storage space to the existing complex. Full completion is slated for December. In addition to the construction of the new building, the existing paving, landscaping and onsite ingress/egress points will also be renovated.

AUSTIN, TEXAS — Locally based investment and development firm Stratus Properties (NASDAQ: STRS) has received a $56.8 million construction loan for The Saint George, a 316-unit multifamily project that will be located near the University of Texas at Austin. Comerica Bank provided the four-year loan, and an undisclosed equity partner is funding the majority of the remaining development costs. Ten percent of the units at The Saint George will be reserved as affordable housing. Amenities will include a pool, fitness center, rooftop deck and communal workspaces. Stratus expects to begin construction in the coming days and for the project to be substantially complete by mid-2024

TERRELL, TEXAS — A partnership between multifamily development and management firm Ventures Development Group and Atlanta-based Batson-Cook Development Co. (BCDC) has broken ground on The Southerly at Crossroads. The 300-unit apartment community will be located about 30 miles east of Dallas within the Terrell Market Center master-planned development. Amenities will include a pool, outdoor kitchen, fitness center, game room, dog park and a coworking lounge. Texas-based Arrive Architecture Group is designing the project, and Construction Enterprise Inc. is the general contractor. First Horizon Corp. provided senior construction financing. The first units are slated for a fourth-quarter 2023 delivery.

WAUWATOSA, WIS. — M&R Development has broken ground on 2929 on Mayfair, a 258-unit luxury apartment project in the Milwaukee suburb of Wauwatosa. M&R is co-developing the project with Campbell Capital Group. Completion is slated for August 2023. Located at 2929 N. Mayfair Road, the development will rise five stories with a variety of floor plans. The center of the community will be a three-story clubhouse and adjoining courtyard with an outdoor pool, grilling stations, pickleball court, fire pits and lounge seating. The clubhouse will feature an entertainment kitchen, coffee bar, lounge, clubroom, fitness center, yoga room, business center, pet washing station and package room. A three-level parking garage will include a car wash, electric vehicle charging stations, storage lockers and bike storage. Madison, Wis.-based Stevens Construction is the general contractor and Midlothian, Va.-based Poole & Poole Architecture is the architect. RMK Management will handle leasing and property management.

GREEN BAY, WIS. — TWG has begun development of The Fort at the Railyard, a $59 million mixed-income apartment community in Green Bay. The project is a redevelopment of the historic Larsen Canning property. The 223-unit apartment community will rise five stories with 1,300 square feet of commercial space. Of the 233 units, 187 will be reserved for residents earning up to 60 percent of the area median income. Amenities will include a workout room, business center, coworking lounge, dog run and pet washing station. Merchants Bank served as the low-income housing tax credit investor and Western Alliance Bank provided construction financing. Completion is slated for the third quarter of 2024.