The editors of REBusinessOnline.com are conducting a brief online survey to gauge market conditions in 2024, and we welcome your participation. The survey should only take a few minutes to complete. Questions range from property sectors that you are most bullish on heading into 2024 to trends in deal volume to your outlook for interest rates. The results of our 13th annual survey will be compiled and published in the January issues of our regional magazines. Conducting these surveys is part of our mission at France Media to provide readers with indispensable information, and we couldn’t do it without your help. To participate in our broker/agent survey, click here. To participate in our developer/owner/manager survey, click here. To participate in our lender/financial intermediary survey, click here. (Note: Please remember to click on “done” to properly submit the survey.)

Heartland Feature Archive

FeaturesHeartland Feature ArchiveMultifamily & Affordable Housing Feature ArchiveNortheast Feature ArchiveSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

By Harrison Pinkus, Interra Realty Though many multifamily investors have been able to close transactions in today’s less-than-ideal economic climate, high interest rates remain a challenge for some. However, there is one strategy that can propel a deal over the hurdle of high interest rates and across the finish line: assuming the seller’s loan. With plenty of investors looking to acquire assets despite elevated rates, loan assumptions offer a win-win opportunity, as long as the buyer and seller surround themselves with a knowledgeable team of brokers, attorneys and lenders. The biggest advantage for buyers is a lower financing rate than what is currently available on the market. Buyers also benefit from lower closing costs and no appraisal. Meanwhile, loan assumptions at a lower rate provide sellers with the leverage to command a higher asking price for their property. Loan assumptions are by no means the only route to closing a deal in today’s environment. After all, investors can always move ahead with a purchase now and finance at current rates with a plan to refinance later if rates improve. But, since the buyer must be able to acquire debt financing and carry a higher rate for a year or more …

By MaCauley Studdard In the last two-plus years, rent growth and net absorption have both reached new heights, fueled by record levels of demand as a result of surging e-commerce sales. While e-commerce sales growth and the ongoing operational trend of maintaining higher inventory volumes has provided a tailwind to industrial fundamentals, there is also a third critically important component of demand growth that could continue to have an outsized influence on the industrial market in the months and years ahead: onshoring supply chain operations. Understanding the broader dynamics behind the onshoring trend is important to accurately measure its influence on the industrial market. Slowing trade growth The rapid pace of growth in global trade has been one of the most significant economic trends of the last half century: the defining characteristic of modern economies. The percentage of the world’s economy attributed to international trade nearly doubled between 1973 and 2008, growing from approximately 30 percent to 59 percent. While international trade remains the single most influential factor in the global economy, that figure has remained somewhat static in the last 15 years. Several factors have contributed to slowing global trade growth, including: • Growing demand for skilled labor • …

By Jerome Wallach, The Wallach Law Firm Owners of large commercial real estate portfolios typically have internal staff to deal with assessed property values and the resultant taxes on a regular basis. But what about owners of small- or medium-value properties? How can a taxpayer, without knowledgeable staff or outside assistance, determine whether their assessment is fair or if they should seek an adjustment? And if seeking a reduction seems appropriate, going it alone through discussion with the assessor may be productive. Any such informal review or discussion should be the result of careful consideration and preparation. The following points are essential in that review and will help the taxpayer build and present a strong case for a reduced valuation. Getting started A government representative, usually the county collector, issues a property tax bill based on the value the county assessor has placed on the taxpayer’s real estate. The property owner may launch an appeal to contest that assessed value. However, in many states, the tax bill arrives after the due date for appealing the assessor’s valuation. Owners should review their property’s assessed value each year. Begin the process as soon as the assessor posts new values to its website, …

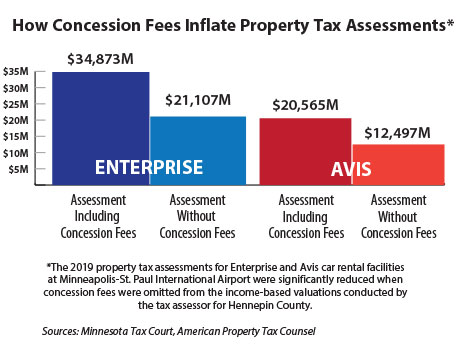

By Timothy Rye, Larkin Hoffman A recent Minnesota Supreme Court ruling requires tax assessors to exclude an airport’s concession fees from rent-based valuations for property tax purposes. The case offers a flight plan to lower taxes at many of the nation’s transportation hubs and underscores the importance for all taxpayers to exclude business value from taxable property value. Every major airfield collects fees from food-and-beverage providers, retailers, banks and other businesses that provide goods or services on airport property. Concessionaires, or those who pay the concession fees to the property owner, commonly pay these charges in addition to rent owed for the real estate where they operate. Many of these businesses are also responsible for property tax that passes through to tenants in a commercial lease. The cases leading up to the March 29 state Supreme Court decision involved two car rental companies that challenged their 2019 tax assessments, claiming the assessor’s office had overstated their property values by including concession fees in its income-based valuation. High-Flying Fees Both Enterprise Leasing Co. of Minnesota and Avis Budget Car Rental pay a concession fee equal to 10 percent of gross revenues in addition to real estate rent for their operations at …

The future of retail has been questioned many times in the last few years, but the sector continues to evolve and overcome any obstacles that arise. Today’s consumers want a gathering place to dine, drink and be entertained, especially after the isolation and stay-at-home mandates they endured throughout the pandemic. With that in mind, owners are redeveloping many underutilized retail properties into new concepts that invigorate the towns in which they reside. Take ROECO, for example, a project that aims to transform a former Sears Roebuck location in Lansing, Michigan, into a retail and entertainment destination. Owner Gillespie Group purchased the property about 10 years ago when Sears was still operating. Sears opened the property in 1953 and vacated it about four years ago. Most recently, a local hospital utilized the site for COVID-19 testing. Pat Gillespie, CEO of Lansing-based Gillespie Group, says his firm is actively marketing the project and has about seven to eight letters of intent with retailers. Gillespie’s main focus is retail and entertainment, but the firm is having conversations about hospitality or housing for the far northeast corner of the 14-acre property. Gillespie says the design of ROECO will have a retro feel to play …

Multifamily transaction activity slowed in the second half of 2022 and continues to remain muted due to pricing uncertainty. U.S. multifamily sales totaled $187 billion in 2022, down 16.1 percent from $222.9 billion in 2021, according to Yardi Matrix. The Federal Reserve has raised its key short-term rate, the federal funds rate, nine times over the past year for a total of 475 basis points in an aggressive move to fight inflation. The Fed’s actions have led to a sharp rise in commercial mortgage rates, which have a significant impact on pricing, states Yardi Matrix. The 10-year Treasury yield, the benchmark for permanent, long-term financing, is now hovering around 3.5 percent, up from 2.3 percent one year ago. “In the current climate with inflation and rising interest rates, we’re a bit more cautious, but no less active in scouring the market for great investments,” says Tim Donovan, director of investments for Midloch Investment Partners. “Investment sales are happening in this market, including by us, but it’s generally taking longer for buyers and sellers to agree on a price, and for buyers to raise the equity required to meet lender terms for permanent financing.” In January, the Consumer Price Index rose …

By Steven Schneider, Honigman LLP While taxpayers typically pay property taxes based upon their property’s market value, assessors frequently misapply evidence or even redefine market value to rake in excessive taxes. The recently resolved Michigan Tax Tribunal case of Menard Inc. vs. City of Escanaba illustrates several of these efforts to collect excessive taxes and suggests arguments a property owner can use to challenge them. What is market value? Market value is the price that willing, knowledgeable buyers and sellers in an arm’s-length transaction would agree the property is worth. Market value differs from insurance value or replacement value because it reflects what a typical buyer would pay for a property as it is. Market value also differs from value to the owner, which reflects how a particular property contributes to the owner’s business operation. Appraisers typically determine market value using one or more of three valuation techniques. The sales comparison approach adjusts sales of similar property to indicate the likely selling price of the subject property. The income approach values property by considering the present value of the income it would likely earn if rented, whether or not it actually is rented. The cost approach values property by considering …

FeaturesHeartland Feature ArchiveNortheast Feature ArchiveOtherSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

Forecast Survey: What’s Your Take on Commercial Real Estate in 2023?

by John Nelson

The editors of REBusinessOnline.com are conducting a brief online survey to gauge market conditions in 2023, and we welcome your participation. The survey should only take a few minutes to complete. Questions range from property sectors that you are most bullish on heading into 2023 to trends in deal volume to your outlook for interest rates. The results of our 12th annual survey will be collated and published in the January issues of our regional magazines. Conducting these surveys is part of our mission at France Media to provide readers with indispensable information, and we couldn’t do it without your help. To participate in our broker/agent survey, click here. To participate in our developer/owner/manager survey, click here. To participate in our lender/financial intermediary survey, click here. (Note: Please remember to click on “done” to properly submit the survey.)

CHICAGO — As shovel-ready projects get put on hold, seniors housing developers are looking 24 months ahead, hoping that by then the economic outlook will have improved. For now, they worry about a possible recession and rising costs for everything from debt financing to building materials as they turn their immediate focus to repositioning opportunities. “The industry has been hit with macro-economic shocks,” said Adam Heavenrich, managing director at Heavenrich & Co., a Chicago-based investment brokerage firm. “What you hear is that if you’re developing now, you’re crazy.” Heavenrich gave these opening remarks as moderator of a panel discussion on development at France Media’s sixth annual InterFace Seniors Housing Midwest conference, held Oct. 20 in Chicago. The day-long event featured six panel discussions on topics relevant to industry stakeholders, along with networking opportunities. The development panel included experts who analyzed the smartest plays for the upcoming year. They recounted a growing list of barriers to new construction. The industry is still clawing its way back from the occupancy declines due to the pandemic. Seniors housing occupancy stood at 82.2 percent at the end of the third quarter of 2022, according to data analytics firm NIC MAP Vision. Inflation, last pegged …