By Will Raines, Esq. of Evans Petree PC Benjamin Franklin has been credited (dubiously) with the saying, “in this world nothing can be said to be certain, except death and taxes.” The Greek philosopher Heraclitus has been credited (also dubiously) with the saying, “the only constant in life is change.” To synthesize dubious quotes from two brilliant minds, “you will certainly have to pay taxes, and they will constantly change.” With property tax bills subject to constant change, property owners hoping to predict and plan for future tax liability have their work cut out for them. Here are the chief factors taxpayers should consider in tax planning: Track reassessments Governments base property taxes on two things: assessed value and tax rate. Both elements change on a regular basis, and it can be mind-boggling for taxpayers to stay on top of just exactly when and by how much their properties’ taxes will increase. Reappraisal systems vary. While most jurisdictions reappraise either annually or on a regular, multiyear cycle, some jurisdictions do not. Famously, California’s Proposition 13 requires reappraisal based on changes in ownership and other triggers, rather than on any regular cycle. A jurisdiction’s reappraisal history is no guarantee of its …

Features

By Wilson Ding, Related Midwest The integration of sustainable features in affordable housing often comes with a perceived conflict: the expense of green technologies versus tight operating margins. However, innovative financing strategies and open dialogue with government agencies can bridge the gap, making sustainability more achievable for these projects. By their very nature, affordable housing developments tend to be very complex, often with a number of public and private stakeholders and a multifaceted capital stack. Securing additional resources for the implementation of sustainable technologies in both new and existing communities adds another layer of intricacy, contributing to the sector’s lag behind market-rate in this area. Yet while the installation of sustainable technologies may require a higher upfront investment of time and money, their ability to reduce ongoing expenses makes them a smart long-term strategy. Tax incentives, grants and other subsidies can also help make these projects feasible. Round Barn Manor My firm, Related Midwest, recently finished a $6.8 million renovation of Round Barn Manor, a 156-unit affordable seniors housing community in Champaign, Illinois. Completed in September 2024, the renovation was part of a broader $38.6 million recapitalization initiative carried out in collaboration with Related Affordable, our national affordable housing arm …

Gerald Divaris, chairman and CEO of Divaris Group of Companies and a panelist at last week’s Entertainment Experience Evolution (EEE) conference, produced by France Media’s Shopping Center Business and InterFace Conference Group, has a Shakespearean take on today’s retail environment. It’s that all the (retail) world’s a stage. “Retail is essentially entertainment,” he told a crowd of 500 attendees during the Leading Retail Landlords Panel at EEE, which was held Feb. 25-26 at the J.W. Marriott LA Live. “Otherwise, you’d be buying on Amazon.” Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Divaris expanded upon this notion, citing that even supermarkets have entertaining “stations,” TJ Maxx provides the opportunity to treasure hunt and Barnes & Noble has made a major comeback by doing little more than allowing guests to thumb through books. Panel moderator Nick Egelanian, president of SiteWorks, noted much of the current retail experience can be divided into two categories, though it may not be an even split. There are the items consumers want to buy quickly and easily (and arguably cheaply) online, and …

By Taylor Williams Sometimes, you just know when it’s time. For all the number crunching, quantitative analysis and formulaic modeling that their job demands, commercial real estate lenders are harnessing the qualitative and intangible factors as they prepare to boost deal volume in 2025. Vibe, sentiment, intuition — call it what you want, but there’s an emerging sense within the commercial lending community that the new year holds strong opportunity to deploy capital and deliver financing solutions. And that’s great news for an industry that has spent the last two years wallowing in a sort of interest-rate purgatory. Recent reports from the CRE Finance Council (CREFC) and Mortgage Bankers Association (MBA) substantiate this notion. Earlier this year, CREFC released its Fourth-Quarter 2024 Board of Governors Sentiment Index survey results, which found that “while higher-for-longer interest rates remain the primary concern, the industry appears to be adapting to this new environment.” In addition, the report stated that “an overwhelming 95 percent of respondents expect CRE transaction volume to increase by at least 10 percent in 2025, suggesting growing confidence in market activity despite rate challenges.” The MBA released a statement on Feb. 10 that forecasts total commercial and multifamily mortgage lending …

Emerging Tech, Workplace Design Are Top Priorities for Office Executives, Says Envoy Survey

by John Nelson

SAN FRANCISCO — Employers around the country are monitoring modern office trends as the country’s return-to-office (RTO) movement gains some momentum. Envoy, a San Francisco-based tech company specializing in workplace solutions for office workers and their clients, has produced its annual Workplace Predictions report, which found that the U.S. office sector is a “workplace in flux.” The company surveyed nearly 500 executives from across various roles, including HR, IT and management, as well as across generations — from Gen Z to baby boomers — to collate the data. Envoy partnered with Hanover Research for the report. The Workplace Predictions survey found that participants expect for emerging technologies such as AI and machine learning to play a key role in reshaping office environments — both physical and virtual — moving forward. Another key finding is that different generations of office workers have different needs when it comes to how they value their physical office environments. Larry Gadea, founder and CEO at Envoy, said that modern workplaces are “rapidly evolving,” thus the findings from this report are “critical” for companies that are rethinking how to boost morale, work culture and employee engagement at the property level. “The conversation about the workplace of tomorrow …

By Randy Shearin Deals are getting done in the net lease retail sector, just not with the volume or velocity that industry veterans would like to see. Higher interest rates have hampered transactions in most commercial real estate sectors, leading to a slowdown in 1031 exchange deals, which this sector is extremely dependent upon. Those in the industry are positive about 2025, however. With the Federal Reserve Bank cutting interest rates in late 2024 — and potentially embracing further cuts ahead — the winds appear to be in favor for the sector. To learn more, Shopping Center Business recently spoke with a number of net lease industry executives for its annual roundup. Putting Wind In The Sails For the past two years, the net lease retail market has been somewhat stymied by higher interest rates. Because most assets in the sector sell for under $15 million, the sector is heavily dependent on 1031 buyers — those selling from a commercial real estate asset and moving to another — and financing to lever those acquisitions. Because transaction volume has slowed in sectors like multifamily and office, 1031 transactions have slowed their pace. Higher interest rates directly impact an investor’s yield, often …

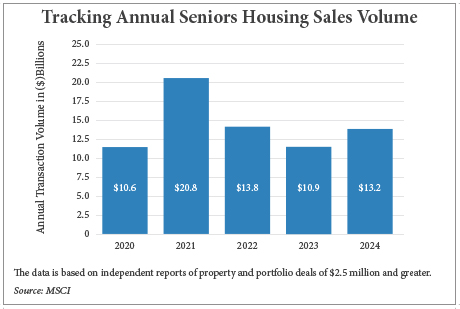

By Hayden Spiess To say that the seniors housing sector has encountered strong headwinds over the past few years would be an understatement. The property sector was uniquely impacted by the COVID-19 pandemic. It scarcely had a chance to recover and enjoy rebounding occupancy before being faced with the reality of heightened interest rates. Amid all the challenges, industry professionals adopted a motivational yet pragmatic mantra and strategy: “Stay Alive Until ’25.” Now that 2025 has arrived, the sentiment among seniors housing investors is one of growing optimism. Brokers and investors alike say that more favorable conditions are leading to an uptick in transaction activity, even as some debt difficulties linger. Azhar Jameeli, managing director of investments at IRA Capital and head of the firm’s seniors housing segment, is particularly bullish on the current prospects for the sector. “I don’t think that the opportunity has ever been better than what it is today,” asserts Jameeli, who has multiple decades of experience in seniors housing and cites the supply-demand balance as one of the main sources of his confidence. Data from MSCI supports this optimism. U.S. property and portfolio sales totaled $13.2 billion in 2024, up from $10.9 billion the prior …

By Shawn Reed of FK Architecture A focus on wellness and lifestyle is among the top 10 senior housing trends for 2025, according to the Seniors Blue Book. With an increased focus on wellness spaces, community gardens and outdoor areas that can be utilized for different activities, seniors now have more opportunities to live healthier, more satisfying lives. Landscape architects are uniquely suited to provide ways for seniors to experience the outdoors in a safe, accessible way. Ideally, this involves targeted, evidence-based design that emphasizes connection to nature while meeting seniors’ preferences for where they prefer to be and interact with others. Focusing on the important aspects of amenity design can improve health, foster a broader sense of community and increase positive interactions among seniors of all ages. Strategic Amenity Location The “attention restoration theory” research conducted by Stephen and Rachel Kaplan shows the benefits humans get from being more in touch with nature. In seniors, increased time outdoors can result in health benefits such as better sleep, decreased incontinence, pain reduction and longevity. Granting residents proper amenity access to the outdoors also promotes mental acuity and psychological wellbeing. Landscape architects have the opportunity to create amenities such as onsite …

WASHINGTON, D.C. — The Mortgage Bankers Association (MBA) is forecasting that total commercial and multifamily mortgage borrowing and lending will rise to $583 billion in 2025, which is a 16 percent increase from 2024’s estimated total of $503 billion. The Washington, D.C.-based organization made the announcement at its 2025 Commercial/Multifamily Finance Convention and Expo (CREF) event taking place in San Diego. Multifamily lending, which is calculated into the total figure, is expected to rise to $361 billion in 2025 — also a 16 percent increase from last year’s estimate of $312 billion. MBA anticipates originations in 2026 will increase to $709 billion in total commercial real estate lending, with $419 billion of that allocated to multifamily lending. “Given the strong pickup in origination activity at the end of 2024, it appears that at least some borrowers and lenders are ready to move,” said Mike Fratantoni, MBA’s senior vice president and chief economist. “MBA is forecasting that interest rates are going to stay within a trading range for the next few years. We expect an increase in originations across property types and capital sources, but certainly recognize the additional challenges posed by the large number of loans scheduled to mature in …

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Report: Final Quarter 2024 Net Absorption Trends in Industrial, Office Likely Temporary; Multifamily, Retail Net Absorption Trajectories Stickier

Lee & Associates’ 2024 Q4 North America Market Report looks back at the tenant demand, absorption rates and vacancy trends for industrial, office, retail and multifamily sectors nationwide to extrapolate what might be on the horizon for 2025 and beyond. While net absorption in industrial and retail is down from the same period in 2023, the reasons — too much supply in the pipeline versus too little — are opposite for each sector. Similar mirroring due to reverse factors can be seen in the net positive absorption last quarter in office and multifamily. Net industrial absorption was down 45 percent in the last quarter of 2024, compared to the same quarter in 2023. However, vacancy rates are likely to decline this year due to a lower volume of construction starts completing in 2025. New in-office policies among prominent companies contributed to the office market’s second consecutive quarter of positive absorption, but overall, office vacancy numbers are expected to continue rising until 2026. Low vacancy and factors challenging development meant very few options for retail tenants seeking new, high-quality space. Retail tenants in the food and beverage arena have been taking advantage of increased national spending on food outside the home …