By Marcia Kaufman, CEO, Bayport Funding Multifamily and fix-and-flip property owners know the pressure — there are five weeks left on the bridge loan, but there’s six months’ worth of work that still needs to be done. It’s quite understandable: these kinds of projects now take much longer to complete than they used to, whether due to supply chain issues, the size of the project, permit holdups or any number of surprises that unfold during a remodeling or construction project. Simply put: The clock is ticking, and time isn’t on the owner’s side. While needing more time is standard as far as construction goes, lenders are much less forgiving. Many value-add or multifamily investment projects are funded with short-term bridge loans that come with 12- or 18-month terms. These loans may allow one short extension, but most don’t. Financial institutions are already hesitant to approve extensions, and those slim chances become more unlikely at year’s end, when banks begin to offload loans. They’re already constrained by their credit facility’s guidelines and have little wiggle room to work with borrowers, no matter how reasonable the request. This situation is, unfortunately, not uncommon. Yet it does not, and should not, reflect poorly …

Features

PHILADELPHIA — Andrew Carle believes that university retirement communities (URCs) represent a potential game-changing opportunity not only for the seniors housing industry but also for universities and retirees, if executed properly. Yet, URCs are also extraordinarily complicated to operate, cautions the founder of UniversityRetirementCommunities.com, the first directory and information resource of its kind, which lists more than 85 such communities nationwide. “It doesn’t get more difficult than trying to merge big, large, bureaucratic state universities that move very slowly and who live in a bubble of 20-year-olds with the senior living industry that’s very fast-paced, investor-oriented and focused on 80-year-olds. If you had to think of an odd couple, that would be it,” said Carle, an adjunct faculty member at Georgetown University and president of Carle Consulting. His comments came at the InterFace Seniors Housing Northeast conference on Dec. 5. at the Live! Casino & Hotel Philadelphia, where he was the keynote speaker. Up until the last 15 years, there were only a handful of URCs nationwide, but today it’s among the fastest growing segments in the senior living industry, said Carle. While the vast majority of URCs are loosely connected to institutions of higher learning, the top dozen or so …

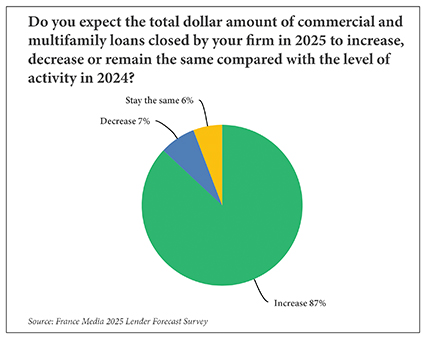

Lenders and financial intermediaries are much more confident about the prospect for business growth in 2025 than they were heading into 2024, according to France Media’s 14th annual forecast survey conducted nationally. A massive 87 percent of debt providers and arrangers of capital expect the total dollar amount of commercial and multifamily loans closed by their firm in 2025 to be higher than in 2024, versus 7 percent who expect a decrease, according to the survey findings. Another 6 percent anticipate no change (see above chart). The sentiment is much more bullish than it was heading into 2024 when 58 percent of survey respondents projected an increase in deal volume, 24 percent predicted a decrease and 18 percent said deal volume would remain the same. Among those who expect a rise in annual deal volume in 2025, 43 percent predicted the increase will be by more than 20 percent. Another 17 percent of survey participants expect the increase in deal volume to range between 16 and 20 percent, and 15 percent of survey respondents expect an increase of 11 to 15 percent. Slightly more than half of respondents (52 percent) said that refinancing activity will make up the bulk of …

As the student housing sector readies for a new generation of students to enter campuses — Generation Alpha — a few of the ‘tried and true’ amenity spaces that were hot with millennials or Gen Z have fallen by the wayside. Golf simulators, movie theaters and bohemian styling with baskets and lots of greenery are just a few of the once popular design choices that are now on the outs, according to Lucy Harrison, brand marketing manager with SouthPark Interiors. Gone, too, are the days of designing one ‘Instagramable’ moment for your building and calling it a day, says Chelsea Kloss, executive vice president of design and curation with LV Collective. “Students want to live in a building that is beautiful and inspiring from all angles — not just with one space built for ‘the gram,’” she says. “They want not only to capture more organic content to share, but to experience it real-time. As designers, that challenges us to push the envelope on experiential design and the importance of finishing all aspects of a built environment.” Students’ desires for their fitness and wellness spaces have also seen a shift over the past few years, according to Kloss. “Designing …

Housing affordability continues to be a pressing issue across the country. According to the National Low Income Housing Coalition, the U.S. has a shortage of 7.3 million rental homes affordable and available to renters with extremely low incomes. There are 34 affordable and available rental homes for every 100 extremely low-income renter households, which are defined as households either at or below the federal poverty guideline or 30 percent of the area median income (AMI), whichever is higher. “The country is facing a severe shortage of high-quality affordable housing, with demand far exceeding supply in the Midwest and every market we serve across the country,” says Geoff Milz, director of development for Ohio with Pennrose, which maintains eight offices across the U.S. “The housing crisis, compounded further by inflation and the rising cost of living, spans all demographics, geographies and family types.” In short, the need for affordable housing “has never been more critical,” adds Milz. Affordable housing developers are eager to build, but they must get creative to obtain the necessary financing for new projects. Due to the restricted rents, affordable housing properties are unable to generate as much income as market-rate assets. “The primary tool that we use …

InterFace Panel: Slow and Steady Wins the Race for Student Housing Preleasing, Rent Growth in 2025

by John Nelson

CHARLOTTE, N.C. — As the clock struck midnight on New Year’s Eve, the 2025-2026 academic year moved further into focus. What can the industry expect to see this year from a preleasing perspective? Are rents expected to keep growing? And by how much? All of these questions and more were discussed during a kick-off panel at the 2024 LeaseCon/TurnCon conference by InterFace Conference Group, which took place this past December in Charlotte. As of Dec. 3, student housing properties across the country were 36.6 percent preleased on average — a 1.3 percent decline from rates seen at the same time in 2023, according to moderator Charlie Matthews, founder and CEO of data provider College House. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Of markets across the United States, the Southeast led the way with the highest preleasing percentage at 43.5 percent. Asking rents have congruently grown by 4.9 percent across the country as of early December, according to Matthews, with average rents at $990. Leading the way in rent growth for the 2025-2026 academic year …

By Nellie Day The multifamily investment market has provided some mixed signals over the past year. There have been the ebbs and flows in the 10-year U.S. Treasury bond yield and interest rates, a moderating level of inflation (the Consumer Price Index rose 2.7 percent in November on an annual basis), and a hard-fought presidential election with Donald Trump emerging as the victor. Despite the volatility in the debt markets, the overall sentiment among investors remains positive. CoStar Group notes that multifamily transaction volume nationally rose 18 percent year over year in the third quarter of 2024, reaching $74 billion. CoStar adds, however, that momentum noticeably slowed toward the end of the quarter, when fixed-rate borrowing costs climbed in step with the rising yield on the 10-year U.S. Treasury note. “This trend is underscored by a 4 percent decline in quarter-over-quarter transaction volume — a contrast to the typical seasonal uptick in the third quarter — following stronger activity in the first two months of [the fall season],” says Chad Littell, national director of U.S. capital markets analytics at CoStar. Pickup in Transactions Littell observed that the U.S. multifamily investment market “somewhat mirrored” the movement of the 10-year U.S. Treasury yield, …

By Matt Valley PHILADELPHIA — Despite industry-wide improvement in operating performance, many senior living providers are still finding it difficult to secure bank financing. Kathleen Shields, founder and president of Health Financing Consultants, said there are three root causes of the problem, starting with insufficient cash flow. “Operators have done a good job of pushing through [rental] rate increases in order to keep up with inflation and higher interest rates. So, the margins are normalizing and getting a little bit better. But banks are looking for historical cash flow of at least six months, if not 12, at coverage levels that they’re comfortable with. And I’m not hearing 1.25 anymore [for the debt-service coverage ratio]. I’m hearing more like 1.4,” explained Shields, a panelist at the InterFace Seniors Housing Northeast conference, which took place Dec. 4-5 in Philadelphia. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “It depends on the lender, but you do need to have a track record of historical cash flow that supports your request, and that’s not easy,” emphasized Shields. The other two main …

By Leah LaFramboise, partner at Frost Brown Todd LLP When COVID-19 became a global pandemic, commercial real estate developers saw unprecedented disruptions. Materials became both more expensive and harder to come by. Even those developers that could source supplies had to reckon with labor shortages as workers sheltered at home. Construction projects had to be put on hold indefinitely to comply with new public health restrictions, ballooning budgets and timelines. What’s more, elevated interest rates — stemming from the turbulent economic landscape during the pandemic — made obtaining financing more expensive and difficult. While lockdowns may be long over, the lasting effects of the pandemic and a more difficult financing environment are still posing challenges for developers. Fortunately, there are plenty of ways they can adapt. A One-Two Punch While the most dire construction material shortages during the pandemic have largely abated, many materials are still in short supply — and are much pricier. According to the National Association of Home Builders, for example, steel mill product prices are still 65 percent higher than pre-pandemic levels, while drywall is 42 percent more expensive than in 2020. Commercial contractors, meanwhile, continue to face a significant worker shortage. Demand in key segments …

Security is a top priority in the multifamily industry. Monitoring and controlling access to a property protects owners and their residents from the impacts of violent crime, theft, vandalism and trespassing. The benefits of an effective security, monitoring and access system run deep. “Access control is not just about security,” says Roger Solomon, a senior associate at Trio Advisory Group. The company offers consulting services on access control, video surveillance and other technologies for commercial real estate properties. “Access control is also about ensuring convenience for residents and staff, enhancing the overall quality of life at a community and future-proofing assets against technological advancements,” says Solomon. “The right access control system will add real value to both the property and for its residents.” The type of access control system an owner-operator installs can increase operational efficiency and net operating income, free up staff, reduce costs and lower resident turnover rates. Locks and Keys Still Popular Option The benefits of an old-fashioned lock-and-key system are clear. Mechanical locks are weatherproof and do not require electrical power or Wi-Fi connectivity. Key-controlled locks also are relatively affordable to install. According to a report from the National Apartment Association (NAA), 53 percent of property management …