Entertainment is playing an increasingly important role in the industry, anchoring both new and redeveloped projects and bolstering efforts to backfill large-format boxes. Shopping Center Business recently sat down with Nicole Poole, vice president of hospitality and entertainment at HFA Architecture + Engineering, to chat about design trends in this fast-growing segment. The veteran hospitality architect helped Topgolf develop its concept and currently works with the likes of Home Run Dugout, Blue Jeans Golf, Happy Dave’s, WorldSprings and Smash Park. SCB: What are some emerging design considerations in this category? Poole: Integrating tech and AI continues to be a big subject. But it’s interesting, I just hosted a roundtable discussion at SCB’s Entertainment Experience Evolution (EEE) conference, and there was a lot of interest in getting back to what is sometimes described as human-centric design. It’s what you traditionally see in hospitality, right? Maybe you check in at a nice hotel and notice that there’s a welcome message for you on the flatscreen TV in the lobby. Or when you come back down, the receptionist waves and greets you by name. As we design the next generation of tech- and activity-driven entertainment concepts, it’s important to stay cognizant of the …

Features

The U.S. retail market is currently on a long stretch of rock-solid performance at the property level. The national vacancy rate is at a healthy 4.1 percent, according to first-quarter 2024 research from CoStar Group. This comes one quarter after a stellar 4 percent vacancy rate at year-end 2023. What’s more is net store openings are on pace to be positive for the third consecutive year, according to research from Cushman & Wakefield. There have been more than 1,700 announced retail store closures thus far in 2024, with recent examples including Family Dollar, Express, Macy’s and 99 Cents Only. However, the number of announced closures has been outpaced by the more than 3,000 announced openings this year, including from the likes of Walmart, Academy Sports + Outdoors, Aldi and Target. With tight occupancy, due in large part to limited retail deliveries compared to historical norms, plus the influence of stubbornly high inflation, rental rates are also peaking. Rental rates ended the year at about $25 per square foot, which is a 3 percent increase year-over-year, according to CoStar. Matthew Mousavi, managing principal at SRS Real Estate Partners, says that retail real estate is performing so well that it now …

By Sonya Haffey, CEO of V Starr In today’s bustling real estate landscape, the multifamily sector holds as a beacon of opportunity amid the evolving demands of modern living. As urban areas continue to expand and diversify, the need for appealing residential spaces becomes more critical. However, with competition at its peak, developers and their design partners face the challenge of distinguishing their offerings in a crowded market. To thrive in this environment, those groups must adopt innovative strategies that captivate potential residents. The key? Thoughtful, strategic branding that distinguishes our properties, promising a realm of elevated modern living. To craft a distinctive brand identity tailored to each property, our team at V Starr undertakes a meticulous analysis of the desires, needs and lifestyles of the target demographics. By crafting detailed personas representing a spectrum of tenants — from recent graduates seeking their first studio apartments to young, growing families occupying two- to three-bedroom units — we gain invaluable insight into their daily lives. This foresight allows us to anticipate their needs and sensibilities, ensuring that our properties exceed their expectations of urban living. This approach allows us to deliver sharp aesthetics and tailored amenities that resonate deeply with residents. …

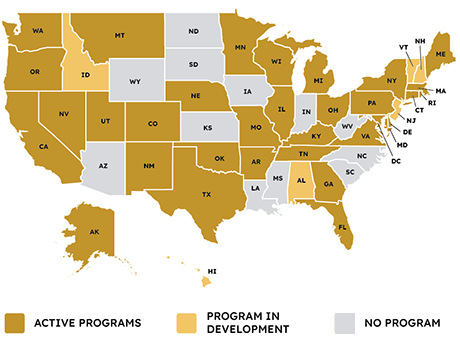

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

Ask any student housing operator what Gen Z is after, and they’ll tell you this — Gen Z wants what it wants. This generation isn’t afraid to say it, nor are they afraid to voice their displeasure or seek out alternatives if they don’t feel the current offering aligns with their values. And they certainly have values. “As the largest, most-educated and most ethnically diverse generation in American history, Gen Z has a deep understanding and passion for social justice, are always seeking to learn, and are keen on inclusivity, paying it forward and doing the right thing,” says Michele Bettinazzi, customer experience manager at PeakMade Real Estate. Laura Formica, senior managing director of operations at Core Spaces, believes resident priorities can be met by operators if these attributes are boiled down a little further. “Today’s residents want to be seen, heard and taken care of,” she says. “Operating in student housing is much like operating a restaurant…there’s a lot of responsibility that comes with that. We lead with kindness and care, anticipate our residents’ needs and try to create memorable moments for them every day.” Johanna Adolfs, director of sales and marketing at Cardinal Group, whittles it down even …

— By Bendix Anderson — Empty nesters and millennials with children are increasingly drawn to new subdivisions of build-to-rent (BTR) houses for lifestyle and financial reasons. These professionally managed BTR homes come in many shapes and sizes. For a growing family, a new three- or four-bedroom rental house might be the ideal fit. Renters who don’t need a lot of space, but who value private parking and a modest backyard, can move into a one- or two-bedroom cottage-style home. These properties provide more living space and privacy than a typical apartment and at a more affordable cost than a for-sale home. New BTR developments of single-family rental (SFR) homes are finding renters in every region of the country. Developers define “BTR” in different ways, but all of them create new subdivisions of single-family homes offered as rentals. Urban Townhouses Draw Families In April, workers finished the first units at Oxenfree at WeHo, a new development of SFR townhouses in the Wedgewood-Houston neighborhood of Nashville. In May, the paint was finally dry on the model unit. By the beginning of June, work had finished on 10 new single-family townhouses. In the past month, Oxenfree has hosted nearly 50 in-person tours and …

By John Nelson Lending activity in the multifamily divisions of Fannie Mae and Freddie Mac is in the midst of a prolonged slump. The 2023 multifamily loan volumes for the government-sponsored enterprises (GSEs) were down significantly year-over-year, with Fannie Mae at $52 billion last year (compared to $69 billion in 2022) and Freddie Mac at $48 billion (compared to $73.8 billion in 2022). And it doesn’t appear that deal volume will return to the frothy levels achieved in 2022 this year. Fannie Mae executed $10.1 billion in loans during the first quarter of 2024, which is almost identical to its first-quarter 2023 production. Freddie Mac generated $9 billion in multifamily loans in the first quarter — up significantly from $6 billion in first-quarter 2023 — but down nearly 45 percent from fourth-quarter 2023. While the GSEs freely acknowledge the slowdown in business, they are more than holding their own when it comes to serving borrowers. The Mortgage Bankers Association (MBA) reports that multifamily loan originations totaled $264 billion in 2023, with the agencies accounting for 38 percent of all multifamily originations. By comparison, the share of overall multifamily originations was closer to 29 percent for Fannie Mae and Freddie Mac …

By Chris Cordes, real estate portfolio manager, PPR Capital Management When seeking a sponsor for multifamily partnerships, it’s critical to consider one that offers worthy qualities for the joint venture, since this individual or company will be in charge of managing the property on behalf of the partnership. Worthiness is measured by the ability to be resourceful and versatile. When determining the worthiness of a sponsor, there’s an old expression that can be helpful to keep in mind: “You’re only worth as much as the pocketknife that you carry.” The pocketknife is a simple tool that offers incredible assistance when utilized for daily tasks. While this device is particularly useful when completing common tasks, it’s important to select the right type of pocketknife. Often, a knife with a single blade will not always get the job done, and you’ll need something else to finish a task. The iconic Swiss Army Knife solves that issue. The historic and versatile multi-use device is known for including varying types of pivoting tools that offer a secured level of preparedness in a compact way. During the sponsor screening process, the main equity partner should examine the qualities a sponsor presents and determine whether the …

By Jason Penighetti, Esq., of Forchelli Deegan Terrana Valuing contaminated properties presents numerous challenges due to the complexity and uncertainty that contamination entails. The presence of hazardous substances or pollutants can affect both a property’s value and potential uses. As an assessment must reflect market value, contamination can significantly impact taxable valuation. Determining the extent of that impact requires careful consideration of legal, technical and economic factors as the valuation of contaminated properties is governed by a combination of statutory law, regulatory guidance and case precedents. Yet these are the fields that taxpayers with contaminated real estate must tread to evaluate assessments for fairness and, if necessary, to appeal an unfair assessment. Tax assessment review proceedings are crucial mechanisms for all property owners to ensure fair and accurate assessments. These proceedings provide avenues to challenge property assessments that owners believe are incorrect or unfair. Understanding the process, timelines and legal considerations involved is essential for property owners, assessors and legal professionals alike. Most real estate taxes in the United States are ad valorem or “according to value.” Thus, the owner of a high-value property would expect to pay more real estate taxes than the owner of a lower-value asset. While …

Inland Ports Serve As Vital Link in Supply Chain for Industrial Users, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Inland ports are a growing transportation option in the national supply chain. These facilities provide users — including automotive suppliers, retailers, manufacturers and agricultural producers — an option to import and export their wares to seaports via shipping containers by rail as opposed to trucking their products directly to a port terminal. One of the more prominent inland ports in the country is Inland Port Greer in Upstate South Carolina. The facility’s anchor client is BMW, which operates its mega manufacturing campus in nearby Spartanburg, S.C. Class I freight railroad operator Norfolk Southern Corp. provides rail services from the inland port to the Port of Charleston. Brian Gwin, senior industrial development manager for Norfolk Southern, said that when the railroad operator and the South Carolina Ports Authority (SCPA) established Inland Port Greer in 2013, it was apparent almost immediately that they had a behemoth on their hands. “We knew it was going to be mostly BMW, but we designed Inland Port Greer for 50,000 lifts a year,” said Gwin, referring to the number of shipping containers moved on or off Norfolk Southern trains at the inland port. According to multiple media outlets, the inland port exceeded 100,000 …