By Barry B. Scherr, co-founder of the Sundar Corporation The biggest real estate opportunity of our time is to re-establish human connection as an essential part of everyday life. Developers everywhere are trying to understand what comes next. After decades of escalating amenities, bigger gyms, curated rooftops, spas, lounges, wellness centers, coworking labs, landscaped lawns, and multisensory lobbies, the industry has reached a plateau. The arms race for “more” has begun to feel like diminishing returns. What people are seeking now is not another feature, but another feeling: less isolation disguised as privacy, and more meaningful human presence; fewer transactional touchpoints, and more belonging woven into everyday experience. The market is signaling a shift: the true differentiator has become intention over amenities. We are not lacking infrastructure, we are craving a new way to approach place, purpose, and the role of real estate itself. The Impossible Equation of Modern Life Society today asks us to do it all. Work full time. Commute long distances. Raise families. Stay fit. Stay connected. Cook meals. Sleep. Recharge. And somehow flourish. The truth is stark: the structure of modern life is impossible to sustain. And the way we’ve built our real estate is partly …

Features

By Mark McDonald, president of visual lease and CoStar real estate manager The recent shift back to in-person work isn’t a mere passing trend, and it’s forcing companies to reassess their office leases and how they manage them. According to resume.org, industry estimates suggest that around 75 percent of companies that were formerly remote have now implemented some version of RTO (return-to-office) since the pandemic. Many large, publicly traded companies spanning various industries, including tech (Amazon, Dell) and financial services (J.P. Morgan), are requiring employees to work onsite full time. As RTO continues to gain traction, more organizations are closely evaluating their real estate strategies, looking not only at how much space they need, but also where, when and under what terms they need those spaces. As leaders make these difficult and often high-stakes decisions, many executives are recognizing the importance of quality lease portfolio management. This involves tracking, analyzing and optimizing an organization’s leased properties with actions like consolidating space, exiting underused locations or renegotiating existing terms. So how exactly is RTO reshaping lease management, and why is accurate, real-time lease data now a critical asset for fast, informed business decisions? Rethinking Lease Management in the Era of RTO …

Conference CoverageFeaturesGeorgiaLoansMultifamilyMultifamily & Affordable Housing Feature ArchiveSoutheastSoutheast Feature Archive

InterFace: Multifamily Finance Pros Explain Where Capital Providers Are Placing Their Bets in 2026

by John Nelson

ATLANTA — Multifamily borrowers have a plethora of financing options at their beck and call, both from traditional debt sources and alternative platforms. With the competition among capital sources on the rise, sponsors are in an advantageous position. “More lenders are chasing multifamily since they’ve taken three commercial real estate food groups off the table — office, retail and hospitality,” explains Shawn Townsend, president and chief investment officer at Ease Capital. However, financing challenges remain. “But by and large the cost of debt capital has not gone down,” Townsend adds. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Townsend’s comments came during the capital markets panel at InterFace Multifamily Southeast, a two-day event held Dec. 1-2 at the Intercontinental Buckhead hotel in Atlanta. InterFace Conference Group and sister publications Multifamily & Affordable Housing Business and Southeast Real Estate Business hosted the networking and information conference. Stephen Farnsworth, senior managing director of real estate finance at Walker & Dunlop, moderated the session, which featured five lenders and financial intermediaries. Farnsworth opened by touching on the ebbs and …

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNortheastRegions Real Estate Capital MarketsSoutheastWestern

Navigating Fannie Mae, Freddie Mac Small Balance Multifamily Loan Programs

By Ann Atkinson, Regions Real Estate Capital Markets Most multifamily real estate owners need to finance or refinance their apartment community at some point. Many utilize the small balance multifamily loan programs available through Fannie Mae and Freddie Mac to do so. Understanding how lenders navigate each phase of the loan cycle can give owners a strategic advantage, especially in a time of elevated rate volatility. A significant amount of multifamily debt is maturing in 2026. Borrowers should not wait to refinance to avoid the concentrated competition later in the year when lenders are faced with refinancing demand. In addition, modest rent growth today offers refinancing upside; and finally, Fannie Mae and Freddie Mac have higher production caps in 2026, providing more runway for lending. The following overview, based on Regions Real Estate Capital Markets’ experience, outlines five key phases of the process, with helpful tips throughout: 1. Screening and Term Sheet Loan screening kicks off the relationship between borrower and lender. The lender’s production representative often conducts an introductory call with the borrower, who completes an application and provides due diligence items. Access a checklist of items to provide to Regions for screening here. Tip #1: Get all required (and …

ATLANTA — In today’s multifamily development world, architects, designers and general contractors do everything in their power to avoid the one thing they dread most — going back to a developer mid-project to ask for more money. These “uncomfortable moments,” as Lori Ann Dinkins, president and CEO of Mood Interior Design, called them, happen more often these days thanks to rising costs, tariffs and collaboration snafus. Dinkins led a panel of architects, interior designers and general contractors through a bevy of topics — good, bad and ugly — that define the current state of building and designing apartments at InterFace Conference Group’s Multifamily Southeast event. The event took place over the course of two days at the InterContinental Buckhead in Atlanta. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Residents and developers alike are taking a more practical, less playful approach when it comes to stylizing apartments. Gone are the days of “those huge show-stopper, Instagram-moment amenity spaces,” said Ian Hunter, regional director at Atlanta-based Dwell Design Studio. “They’re out. And they’re out for a couple of reasons. Not …

ATLANTA — Jason Nettles, managing director at Northmarq’s Atlanta office, is well-versed on the recent history of U.S. apartment deliveries, knowledge that came in handy for launching discussion among developers at the 16th annual InterFace Multifamily Southeast conference. Nettles moderated a panel of five regional developers, all of whom also share keen awareness of just how much new multifamily product U.S. markets — particularly those in the highly desirable Sun Belt regions — have added in recent years. In these areas, supply growth is both a dominant narrative on the surface of the multifamily development scene and an invisible hand that guides business decisions behind that scene. Massive blips in supply, whether positive or negative, impact key facets of underwriting, including rent growth assumptions and concessions, as well as financing terms on both the debt and equity sides of the capital markets. Those figures and assumptions must then be evaluated against hard costs of development, which as a rule do not decline over time, but rather grow at varying paces. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. All …

By Cliff Booth, founder & chairman, Westmount Realty Capital Shallow bay industrial, often defined as product with suites between 2,000 and 30,000 square feet, has proven to be a resilient and attractive commercial real estate investment for the past four decades. Today, a combination of persistent tenant demand, flexible space configurations, favorable lease structures and limited new supply continues to drive investor interest in this subcategory of industrial product, including increased institutional capital flows. Shallow bay industrial remains a standout in commercial real estate portfolios — here’s why. Consistent Tenant Demand, Diversification Shallow bay industrial properties cater to a broad spectrum of users, ranging from local contractors and logistics providers to regional distributors and e-commerce firms. These tenants are drawn to highly functional suites that support frequent changes in business operations, from manufacturing to last-mile delivery. Research from JLL shows that over the past decade, the annual average leasing volume in the shallow bay category has been about 250 million square feet, evidencing stable demand through multiple economic cycles. The multi-tenant structure of shallow bay buildings reduces single-tenant risk and enhances asset stability. A project might host five to 50 tenants, with no single occupant accounting for more than 10 percent …

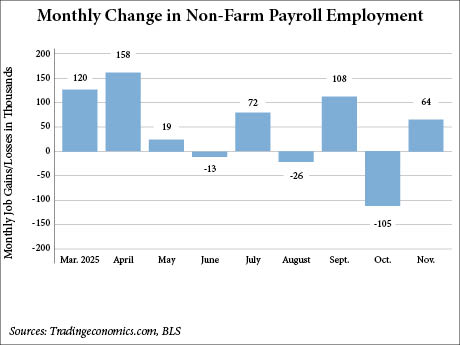

WASHINGTON, D.C. — The U.S. economy has added 64,000 non-farm payroll jobs in November and lost 105,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). The BLS included the October figures into the November report due to complications with the federal government shutdown, which lasted for 44 days in October and early November. The bureau, which also delayed the release of the consumer price index and producer price index in October, plans to release the December jobs report on Jan. 9, 2026. The November figure was higher than the 45,000 estimate from Dow Jones economists, according to CNBC. The news outlet also reported that the economists didn’t make an official estimate for the October report but were largely anticipating a drop in employment. In addition to the delayed report, the BLS also revised downward the employment figures for August, from a loss of 4,000 jobs to -26,000, and September, from 119,000 jobs to 108,000. The U.S. unemployment rate also ticked up 20 basis points from September to 4.6 percent in November, its highest level since September 2021. Federal government employment continued to decrease in November with a loss of 6,000 jobs. This follows a decline of …

By Taylor Williams DALLAS — Technological innovation has long been a cornerstone of managing and leasing multifamily properties, and that feature of the business has only been augmented in the era of artificial intelligence (AI). But for all the operational conveniences and efficiencies that AI potentially brings to the table, multifamily management has not yet reached the point of phasing out the human element. Almost immediately after the members of the leasing and management panel at the annual InterFace Multifamily Texas conference had introduced themselves, this fundamental premise of multifamily management was put forth to a crowd of several hundred real estate professionals — men and women who have built careers based on human relationships. The message to those at the conference, which took place in late September at the Westin Galleria Hotel in Dallas, seemed to be one of reassurance, that even as AI seemingly infiltrates every aspect of human life and threatens to void millions of jobs, the human principles that have long governed real estate transactions remain intact. At least for now. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements …

InterFace Panel: Multifamily Operators Are Charting a Path from Oversupply to Opportunity in 2026

by Abby Cox

ATLANTA — The multifamily market in the Southeast still prevails as one of the nation’s most dynamic real estate ventures, but one aspect in particular is casting a dark shadow — the cultivation of oversupply in the region. When the demand for housing during and after the COVID pandemic increased, developers energetically responded with an aggressive building boom. However, when new supply began to outpace demand, vacancy crept up and concern for the market became more prominent. “We put shovels in the ground and started developing — and now we’re paying for that sin,” said Greg Mark, executive managing director at Cushman & Wakefield. “Across the board, we’re just not seeing the same kind of returns.” Mark’s comments came at the operations panel during the 2025 InterFace Multifamily Southeast conference, which was held at the InterContinental Buckhead in Atlanta. Co-hosted by France Media’s InterFace Conference Group and Multifamily & Affordable Housing Business magazine, the two-day event attracted a little more than 300 attendees. Ed Wolff, CEO of Dallas-based Aerwave, moderated the panel. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Karen Key, Southeast …