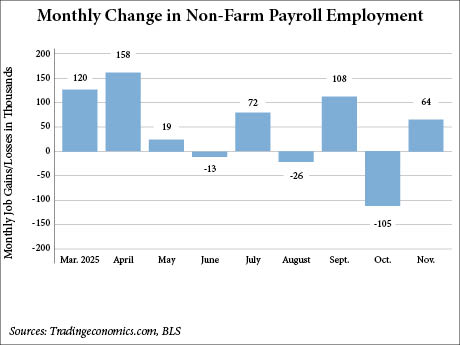

WASHINGTON, D.C. — The U.S. economy has added 64,000 non-farm payroll jobs in November and lost 105,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). The BLS included the October figures into the November report due to complications with the federal government shutdown, which lasted for 44 days in October and early November. The bureau, which also delayed the release of the consumer price index and producer price index in October, plans to release the December jobs report on Jan. 9, 2026. The November figure was higher than the 45,000 estimate from Dow Jones economists, according to CNBC. The news outlet also reported that the economists didn’t make an official estimate for the October report but were largely anticipating a drop in employment. In addition to the delayed report, the BLS also revised downward the employment figures for August, from a loss of 4,000 jobs to -26,000, and September, from 119,000 jobs to 108,000. The U.S. unemployment rate also ticked up 20 basis points from September to 4.6 percent in November, its highest level since September 2021. Federal government employment continued to decrease in November with a loss of 6,000 jobs. This follows a decline of …

Features

By Taylor Williams DALLAS — Technological innovation has long been a cornerstone of managing and leasing multifamily properties, and that feature of the business has only been augmented in the era of artificial intelligence (AI). But for all the operational conveniences and efficiencies that AI potentially brings to the table, multifamily management has not yet reached the point of phasing out the human element. Almost immediately after the members of the leasing and management panel at the annual InterFace Multifamily Texas conference had introduced themselves, this fundamental premise of multifamily management was put forth to a crowd of several hundred real estate professionals — men and women who have built careers based on human relationships. The message to those at the conference, which took place in late September at the Westin Galleria Hotel in Dallas, seemed to be one of reassurance, that even as AI seemingly infiltrates every aspect of human life and threatens to void millions of jobs, the human principles that have long governed real estate transactions remain intact. At least for now. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements …

InterFace Panel: Multifamily Operators Are Charting a Path from Oversupply to Opportunity in 2026

by Abby Cox

ATLANTA — The multifamily market in the Southeast still prevails as one of the nation’s most dynamic real estate ventures, but one aspect in particular is casting a dark shadow — the cultivation of oversupply in the region. When the demand for housing during and after the COVID pandemic increased, developers energetically responded with an aggressive building boom. However, when new supply began to outpace demand, vacancy crept up and concern for the market became more prominent. “We put shovels in the ground and started developing — and now we’re paying for that sin,” said Greg Mark, executive managing director at Cushman & Wakefield. “Across the board, we’re just not seeing the same kind of returns.” Mark’s comments came at the operations panel during the 2025 InterFace Multifamily Southeast conference, which was held at the InterContinental Buckhead in Atlanta. Co-hosted by France Media’s InterFace Conference Group and Multifamily & Affordable Housing Business magazine, the two-day event attracted a little more than 300 attendees. Ed Wolff, CEO of Dallas-based Aerwave, moderated the panel. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Karen Key, Southeast …

ATLANTA — For many multifamily professionals, 2025 is a year to forget. Paul Berry, president and chief operating officer of Mesa Capital Partners, said that U.S. multifamily investment sales are on track to close out the year at $125 billion, which represents a 25 percent decline from an average pre-COVID year and a little more than a third of 2021’s total (a torrid $354 billion). Andrew Zelman, senior vice president of Southeast investments at Boston-based GID Multifamily, said that owners are doing “everything they can to hold out for a profit.” Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “As simplistic as this is, sellers will avoid transacting at less than peak values at any cost,” said Zelman, who added that owners are essentially kicking the can down the road by recapitalizing their assets or stopping and starting the marketing process if their pricing expectations aren’t being met. Zelman’s comments came during the opening panel on Tuesday, Dec. 2, at the 2025 InterFace Multifamily Southeast conference, which was held at the InterContinental Buckhead in Atlanta. Co-hosted …

By Aron Schreier of Cresa and Gabe Hernandez of Design Republic Leaders often obsess over KPIs (key performance indicators) and will spend six figures on Salesforce licenses and sales training boot camps. But walk into most offices in 2025, and you’ll find sales teams working in spaces that actively undermine everything those investments are meant to achieve. Having spent careers straddling both worlds — commercial real estate and sales training — it’s easy to see how the right environments can create positive energy and how the wrong ones quietly drain it. Let’s review why space is perhaps the most strategic asset in all of sales. Space Drives Mindset Sales is a game of psychology as much as skill. Top performers need natural light that regulates energy throughout the day, sight lines that create productive visibility without surveillance and collision spaces where quick wins get celebrated spontaneously. These aren’t luxury amenities; they’re pieces of performance infrastructure. Contrast that with fluorescent-lit cubicle farms with tall, opaque barriers. These spaces don’t just fail to inspire — they actively communicate that energy should be contained. They set a tone that seeps into calls and meetings and ultimately erodes confidence over time. Your office layout either …

ATLANTA — Andrew Layton, chief acquisition officer for Atlanta-based Student Quarters, knows that from a commercial real estate investment standpoint, the student housing sector possesses a key advantage: the relative permanence of many flagship universities nationally. “There is no risk of the University of Kentucky uprooting itself from Lexington and moving to Frankfort anytime soon. In the conventional multifamily world, neighborhoods come, neighborhoods go. What was hot yesterday may not be so hot today. What was cold yesterday may be the flaming new market tomorrow. That’s just not the case in what we do,” emphasized Layton, who leads the origination and underwriting efforts involving both the acquisition and development of student housing assets for the Student Quarters’ investors. “There’s a sense of permanence [surrounding these academic institutions], and if you can get on the ground and do your due diligence, you can figure out relatively easily where things work and where things don’t work in a student housing market.” Student Quarters owns and operates over 13,000 beds nationally, stretching east to west from Clemson, South Carolina, to Tempe, Arizona; and north to south from East Lansing, Michigan, to Tallahassee, Florida. The insights from Layton, who’s worked in the student housing …

Higher rents and lower turnover are a few of the key advantages build-to-rent (BTR) properties have over traditional multifamily product, according to investors. Meanwhile, the sector continues to experience strong demand from tenants priced out of the housing market as well as renters by choice who prefer flexible, maintenance-free living. BTR units typically have all the perks of a single-family home — privacy, garages and yards — without the hassles of landscaping or property maintenance. “The BTR sector is experiencing significant growth because it addresses a genuine need in today’s housing market,” says Khrista Villegas, managing director of Material Capital Partners (MCP), a Charleston, South Carolina-based development and investment firm focused on BTR communities in the Southeast and Midwest. “Many prospective residents are moving away from traditional apartments, seeking the space, privacy and community feel of a single-family home without the commitment and burden of ownership. This trend is especially pronounced among millennials and Gen Z renters who value lifestyle flexibility, outdoor space and neighborhood connectivity — features that traditional apartments often lack,” explains Villegas. (Gen Z, the demographic cohort succeeding millennials, includes persons born between approximately 1997 and 2012.) Many millennials and Gen Zers are postponing family formation, but …

AcquisitionsFeaturesIndustrialLeasing ActivityLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasVideoWebinarWestern

Webinar: From Hype to Readiness — How Commercial Real Estate Firms Are Preparing for AI

The November 18 France Media webinar “From Hype to Readiness — How Commercial Real Estate Firms Are Preparing for AI,” hosted by France Media and sponsored by Defease With Ease | Thirty Capital, offered a look at the realities of artificial intelligence (AI) within the industry. What can a year of AI use in commercial real estate tell us about implementation and tactics? Panelists touched on the limitations of general-purpose tools, as well as trending topics including safeguards, data privacy, accuracy and institutional control. For professionals engaged in commercial real estate, the session highlighted practical ways AI can elevate both day-to-day efficiency and organizational sophistication (especially if efforts are backed up by a unified library of proprietary portfolio data). Panelists discussed how purpose-built platforms can support underwriting, refinancing, internal reporting and ongoing asset optimization by using secure, updated data. The expert presenters gave concrete examples on how AI can act as an effort multiplier: it can strengthen accuracy, surface risks earlier and broaden the capabilities of team members. The included case study underscored real-world advantages, including improved reporting integrity, stronger oversight and better workflow automation. Register here to watch this brief webinar to gain helpful insights on integrating new technology …

FeaturesHeartland Feature ArchiveNortheast Feature ArchiveSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

Forecast Survey: What’s Your Take on Commercial Real Estate in 2026?

by John Nelson

The editors of REBusinessOnline.com are conducting a brief online survey to gauge market conditions in 2026, and we welcome your participation. The survey should only take a few minutes to complete. Questions range from property sectors that you are most bullish on heading into 2026 to trends in deal volume to your outlook for interest rates. The results of our 15th annual survey will be compiled and published in the January issues of our regional magazines. Conducting these surveys is part of our mission at France Media to provide readers with indispensable information, and we couldn’t do it without your help. To participate in our broker/agent survey, click here. To participate in our developer/owner/manager survey, click here. To participate in our lender/financial intermediary survey, click here. (Note: Please remember to click on “done” to properly submit the survey.)

Commercial real estate is in the middle of one of its biggest transitions. For years, the challenge was finding data. Now, the challenge is knowing what to do with it. Artificial intelligence (AI) is starting to change that. The conversation has shifted from if we should be using AI to how we can use it in a way that actually improves business outcomes. REBusinessOnline recently spoke with Rob Finlay, founder and CEO of Defease With Ease | Thirty Capital, and Trevor Albarran, VP of product at Lobby AI, about how AI is changing decision-making in commercial real estate (CRE), what early adopters have learned and what leaders should be focusing on next. REBusinessOnline (REBO): What’s the biggest opportunity facing CRE executives today? Rob Finlay: It depends on the context, but right now, AI is the most powerful tool a real estate executive can have in their arsenal. AI finally gives principals — the people paid to think — the space to actually do that. When I started in real estate, I was paid to do. But as my role evolved, my value shifted to thinking — being strategic, motivating teams, and making high-level decisions. AI amplifies that ability. It takes …