New income limits for low-income and very-low-income housing in 2023 represent a mixed blessing for the industry’s providers, who gain more potential renters but face ubiquitous caps that restrain their ability to adjust rents. The U.S. Department of Housing and Urban Development (HUD) publishes the income limits annually based on changes in each housing area’s median income, and typically places caps on outlier markets to prevent wide year-to-year swings. From 2010 through 2021, about 10 percent of areas were capped each year. Also in that period, the caps predictably checked the increase in an area’s qualifying income levels to no more than double the annual percent change in national median income. HUD published national median income based on three-year-trailing American Community Survey (ACS) data that HUD adjusted forward using the Consumer Price Index (CPI). In 2022, however, HUD omitted the CPI factor and based limits on historical survey data alone, producing lower results for median incomes and a smaller percentage change to be doubled into a cap. Even so, calculated incomes rose significantly, spurring HUD to cap increases in 57 percent of areas. Industry experts had predicted HUD would add the CPI adjustment back into its calculations in 2023, resulting …

Features

Affordable HousingContent PartnerDevelopmentFeaturesLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

Shopping center owners and property managers throughout the United States are exploring opportunities to increase foot traffic by transforming excess parking into restaurants, entertainment venues, neighborhood amenities and even multifamily uses. “In our experience, nearly every shopping center that’s not grocery-anchored is going through a process to reassess the amount of parking they have, the amount of parking they need and alternative ways to develop those parking areas to add value,” says Cornelius Brown, a principal in the Pennsylvania offices of Bohler, a land development consulting and site design firm. With more than 30 offices across the Eastern and Central United States, Bohler has helped many of its clients with parking conversions ranging from single pad site creation to comprehensive, property-wide redevelopment. Municipalities Onboard Landlords have been carving out parcels for standalone retailers, restaurants and other uses for years, but the trend is accelerating as more and more municipalities ease minimum parking requirements. Parking-reduction advocates have argued that offering fewer spaces reduces environmental impacts associated with heat islands and stormwater runoff. Others contend it promotes the use of mass transit and ridesharing, which can reduce vehicle emissions and, in the case of bars and restaurants, may reduce incidents of impaired …

Where is third-party management headed? This is a loaded question in 2023. The economic environment alone presents its fair share of challenges. An indirect result of fewer properties transacting in the student housing sector is that properties are changing management firms less often. This doesn’t mean that third-party managers are resting on their laurels, however. They are continuing to enhance operations to create a better experience for guests while becoming more efficient for their property owner clients. Instead, operators are using this time to hone their craft, and there is much to ponder. Which COVID-19 protocols should remain from an on-site perspective? Should they look at centralizing some processes? And how can the implementation of AI help streamline processes without taking away the personal element? All of these questions — and more — are currently being assessed by third-party managers heading into the all-important turn season this summer. But unlike the temperatures outside, operators are keeping their cool with a focus on what they do best — customer service. Meeting Current Challenges The sector — and commercial real estate at large — is facing a number of hurdles, many of which are being exacerbated by the looming turn cycle. “It seems each …

Content PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ Second-Quarter 2023 Economic Review by Sector

Lee & Associates’ newly released 2023 Q2 North America Market Report outlines industrial, office, retail and multifamily outlooks trends in the United States. This sector-based review of commercial real estate trends for the second quarter of the year examines the difficulties facing each property type and where opportunities in the landscape may be emerging. Troubles with absorption dogged each sector, with the exception of retail, throughout the first half of 2023. Scheduled deliveries for industrial, office and multifamily indicate this trend will continue throughout much of the United States for the foreseeable future. Lee & Associates has made the full market report available here (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city). The summaries from each sector below provide high-level considerations of the overall outlook and challenges in the market. Industrial Overview: Industrial Growth on Track for Least Gain in Years In a reversal from the ballooning logistics capacities required during the pandemic, demand for industrial space has slowed across North America. After continuously rebuilding inventories from the fall of 2021 through the third quarter of last year, many retailers and wholesalers are taking a breather, pausing further inventory accumulation out of caution over …

By Taylor Williams HOUSTON — Industry professionals say that while the fundamentals that underlie multifamily properties in major Sun Belt markets are quite healthy, the broader conditions of the U.S. capital markets are so choppy and disruptive that lending volumes are depleted across the board. The dearth of deals isn’t exclusively attributable to the Federal Reserve raising interest rates, which has now happened 11 times in 17 months. The nation’s central bank is now targeting a short-term benchmark range from roughly 5.25 to 5.5 percent, the highest level since 2001. Underwriting standards are tightening as owners reckon with serious increases in property taxes and insurance, among other items. Major banks are scaling back their originations in favor of keeping more reserves on hand in anticipation of exposure to defaults on office loans that are coming due within the next 12 to 18 months. The wounds of the collapses of regional lenders Silicon Valley Bank and Signature Bank in March are still fresh, and the country is scarcely a year removed from what will assuredly be a heated and divisive presidential election. For debt providers, the combined effect of those factors is major reluctance to transact. Lenders and investors have largely shifted …

— By Mark Wolf, AHV Communities — As we approach the second half of the year, much has transpired across the economy, the real estate sector and the single-family rental (SFR) arena. We’ve witnessed the negative impacts of record inflation, slowed investment activity accompanying the Federal Reserve’s continued interest rate hikes and the second and third largest bank failures in U.S. history. With real estate lending now hampered across all asset classes, rippling effects are being witnessed across SFRs as well. Although make no mistake — the sector will emerge stronger. The single-family, build-to-rent (BTR) model is only about a decade old and was spawned following a global financial crisis. The few that introduced the concept of SFR communities purpose-built from the ground up will attest that the first several years in the business were challenging. BTR got off to a choppy start Convincing institutional capital of the merits of the business model proved an uphill battle. It wasn’t until just the past few years that investment in the BTR sector ultimately exploded, resulting in both an onslaught of new communitydevelopments, as well as multitudes of players joining the sector looking to capitalize on the opportunity. Unfortunately, many of these …

The U.S. economic picture is an opaque one for lenders and borrowers alike as inflationary pressures persist and the massive swings in interest rates are still working their way through the economy. At its May meeting, the Federal Open Markets Committee (FOMC) raised the federal funds rate for a 10th consecutive time to a target range of 5 to 5.25 percent. The fed funds rate is the interest rate that U.S. banks charge each other to lend funds overnight. This time a year ago, the short-term benchmark rate was at a range of 0.75 percent to 1 percent. Raising the feds fund rate is the primary way that the Federal Reserve combats inflation, which was at a 3 percent annual rate in June, according to the Bureau of Labor Statistics’ Consumer Price Index (CPI). The CPI is at its lowest level in more than two years, which is generally viewed as a positive sign for economic stability, though the June figure is 100 basis points more than the Fed’s target inflation goal of 2 percent. Jason Scott, managing director and head of conventional loan production at Regions Bank, estimates that it can take six to eight months for each interest …

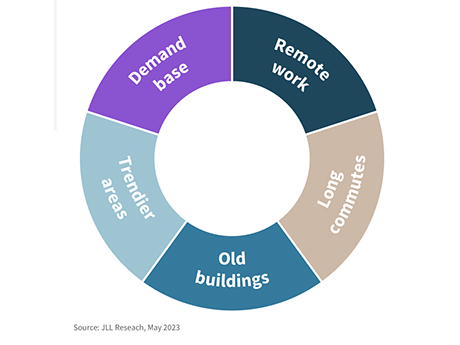

It will likely surprise no one, given the wealth of coverage on the issue of reduced office usage, that office vacancy is the top challenge currently facing central business districts (CBDs) worldwide, according to a recent report by JLL. Long and costly commutes, property obsolescence, competition from other submarkets and unstable demand are the other top hurdles for CBDs. Far from pessimistic though, the report — The Future of the Central Business District — says that CBDs can and will adapt to the new landscape, with government officials and commercial real estate players holding the power to “unlock the future potential of CBDs.” Hybrid work presents a hindrance According to research presented in the report, roughly 60 percent of workers “expect flexible arrangements” when it comes to their presence in their offices, with hybrid working arrangements (comprising schedules that are partly remote and partly in-office) becoming increasingly popular. Workers, the report states, now spend an average of 2.3 days of the week remotely, and office vacancy in the United States sits at 20.2 percent. Aside from the implications for the office sector, the woes of which are well documented, the absence of workers from offices translates to reduced foot traffic in retail …

By Jerome Wallach, The Wallach Law Firm Owners of large commercial real estate portfolios typically have internal staff to deal with assessed property values and the resultant taxes on a regular basis. But what about owners of small- or medium-value properties? How can a taxpayer, without knowledgeable staff or outside assistance, determine whether their assessment is fair or if they should seek an adjustment? And if seeking a reduction seems appropriate, going it alone through discussion with the assessor may be productive. Any such informal review or discussion should be the result of careful consideration and preparation. The following points are essential in that review and will help the taxpayer build and present a strong case for a reduced valuation. Getting started A government representative, usually the county collector, issues a property tax bill based on the value the county assessor has placed on the taxpayer’s real estate. The property owner may launch an appeal to contest that assessed value. However, in many states, the tax bill arrives after the due date for appealing the assessor’s valuation. Owners should review their property’s assessed value each year. Begin the process as soon as the assessor posts new values to its website, …

Deciding where to eat out is a conundrum familiar to many an American consumer. The plethora of food-and-beverage concepts now dotting the retail landscape complicate the question. Food halls embody a sort of paradox — they act as a microcosm of all this variety, while simultaneously removing the need to select a single restaurant. As Michael Morris, chief executive officer of Food Hall Co. puts it, consumers “can come in with various different dietary restrictions or desires and find something for everyone.” Nearly five years ago, founders Jack Gibbons and Randy DeWitt of Front Burner Restaurants (also known as FB Society) were approached by a Plano, Texas, developer interested in establishing a food hall. This resulted in the company’s first location — Legacy Food Hall — and the genesis of Food Hall Co. itself. A food hall located at Fifth and Broadway in Nashville, dubbed Assembly Food Hall, has since joined the portfolio, and though the company’s footprint currently stands at two, Morris says this won’t be the case for long. Everything’s Bigger in Texas One aspect of Food Hall Co.’s locations that distinguishes them from other food halls is their sheer size. While Morris says that the typical food …