By Barry Caylor, vice president of business development, Outside the Lines Inc. From the rise of online shopping to the pandemic to inflation, retail real estate has weathered a series of challenges in recent years. Yet, despite being knocked down multiple times, the owners and operators of brick-and-mortar retail keep discovering new ways to adapt to shifting demands and needs, especially as consumers spend more on services and experiences than physical goods. One way in which retail owners can continue to keep their centers relevant is by leaning into what attributes make them different. By continually supplying the market with fresh concepts and new ways of presenting them, landlords can keep consumers coming back again and again, generating foot traffic and sales for tenants and driving ROI for investors. In addition, shopping centers can distinguish themselves by providing consumers with something they can’t get anywhere else. As a design-build construction company that specializes in delivering one-of-a-kind water features, rockwork and themed environments, our company has seen retail centers transformed by incorporating unique offerings that consistently draw people in from miles around. Here are a few ways brick-and-mortar retail owners can stay ahead of the game as the sector continues to …

Features

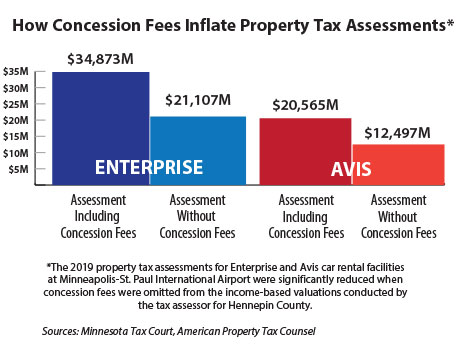

By Timothy Rye, Larkin Hoffman A recent Minnesota Supreme Court ruling requires tax assessors to exclude an airport’s concession fees from rent-based valuations for property tax purposes. The case offers a flight plan to lower taxes at many of the nation’s transportation hubs and underscores the importance for all taxpayers to exclude business value from taxable property value. Every major airfield collects fees from food-and-beverage providers, retailers, banks and other businesses that provide goods or services on airport property. Concessionaires, or those who pay the concession fees to the property owner, commonly pay these charges in addition to rent owed for the real estate where they operate. Many of these businesses are also responsible for property tax that passes through to tenants in a commercial lease. The cases leading up to the March 29 state Supreme Court decision involved two car rental companies that challenged their 2019 tax assessments, claiming the assessor’s office had overstated their property values by including concession fees in its income-based valuation. High-Flying Fees Both Enterprise Leasing Co. of Minnesota and Avis Budget Car Rental pay a concession fee equal to 10 percent of gross revenues in addition to real estate rent for their operations at …

Life sciences-anchored innovation districts are becoming increasingly popular as hubs for research and development in the biotech and pharmaceutical industries. These districts, also known as “innovation districts,” are characterized by clusters of companies, research institutions, supporting organizations, living areas, amenities and offices all located in close proximity. This grouping requires detailed planning and design strategies to maximize their potential for scientific exploration and success on an enormous, ambitious scale. Master planning and engaging site civil engineering partners early on in the process can save time and money once a project reaches the design stage. This article is the first installment in a two-part series on life sciences innovation districts to discuss, first, the planning, and, then, the design elements required by these districts. Read about design in Part 2, here. Fostering innovation, collaboration and productivity is at the heart of planning for life sciences innovation districts. The successes of famous examples such as North Carolina’s Research Triangle Park, Kendall Square in Cambridge, Mass. and Mission Bay in San Francisco indicate how beneficial a melting-pot mix of residential, commercial and research spaces can be when they concentrate talent from research institutions, life sciences innovators, universities and the surrounding community. “Many life …

The future of retail has been questioned many times in the last few years, but the sector continues to evolve and overcome any obstacles that arise. Today’s consumers want a gathering place to dine, drink and be entertained, especially after the isolation and stay-at-home mandates they endured throughout the pandemic. With that in mind, owners are redeveloping many underutilized retail properties into new concepts that invigorate the towns in which they reside. Take ROECO, for example, a project that aims to transform a former Sears Roebuck location in Lansing, Michigan, into a retail and entertainment destination. Owner Gillespie Group purchased the property about 10 years ago when Sears was still operating. Sears opened the property in 1953 and vacated it about four years ago. Most recently, a local hospital utilized the site for COVID-19 testing. Pat Gillespie, CEO of Lansing-based Gillespie Group, says his firm is actively marketing the project and has about seven to eight letters of intent with retailers. Gillespie’s main focus is retail and entertainment, but the firm is having conversations about hospitality or housing for the far northeast corner of the 14-acre property. Gillespie says the design of ROECO will have a retro feel to play …

Wellness Amenities, Updated Technology are Top Priorities for Student Housing Projects, Says InterFace Panel

by Katie Sloan

With some markets today saturated with new student housing development, differentiating your project has become of paramount importance. One of the primary ways of doing that is by keeping in touch with the wants and needs of today’s student — and specifically a community’s surrounding demographic. This was discussed at length during the kick-off panel for InterFace Student Housing, which took place in April in Austin, Texas. In preparation for the panel — titled “What’s Trending in New Development: A Survey of 2023 New Deliveries & How Developers and Operators Aim to Address the Needs and Wants of Today’s Students” — a survey was sent out by uForis to 500 Gen Z students ranging in age from 18 to 24 years old regarding their wants, needs and preferences when looking for their next place of residence. The primary takeaways from this year’s survey were the impact of regional differences due to weather and year-round use of amenities; the shift away from entertainment towards health and wellness for shared amenity spaces; and the increasing impact of tech offerings like digital touring and online leasing, according to panel moderator TJ Chambers, owner and founder of Chambers Real Estate Advisors. “During pre-development at …

Content PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ First-Quarter 2023 Sector-by-Sector Analysis Indicates Market-Wide Cooling

High interest rates and economic uncertainty in the first quarter of this year contributed to lower absorption and declining rent growth in industrial, retail and multifamily sectors across the country, with some regional exceptions, according to Lee & Associates’ 2023 Q1 North America Market Report. Meanwhile office continues to struggle. The sector experienced its third-largest quarterly contraction since the beginning of the pandemic, as work-from-home preferences decoupled office occupancy from job growth numbers. The full Lee & Associates report is available (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city) here. The analysis below provides an overview of four major commercial real estate sectors alongside trends, economic background and exceptions within each sector. Industrial Overview: Sharp Decline Hits First-Quarter U.S. Demand There was a sharp first-quarter decline in U.S. tenant demand for industrial space as wholesalers and retailers reconsider their inventory levels out of caution over the economic outlook. Net absorption in the first quarter totaled 39.4 million square feet, a 57 percent drop from the record set a year ago. The overall U.S. vacancy rate settled at 4.4 percent, an increase of 40 basis points from the close of 2022, comfortably …

On the April 12 episode of “The Most Insightful Hour in CRE” webcast, Willy Walker, CEO of Walker & Dunlop, spoke to renowned economist Dr. Peter Linneman, founding principal of Linneman Associates, about pressing issues facing the economy, pandemic repercussions, market predictions and much more. The discussion began by diving into the economy and real estate market in its current state of flux, with many challenges facing both investors and developers. Walker outlines the unease created by the recent Silicon Valley Bank and Signature Bank crises. “One of the data points announced by the Fed is that since the crisis, bank lending in the United States has gone down by $110 billion over the two weeks since the Silicon Valley Bank collapse. Banks borrowed $160 billion in the two-week window prior. There’s a big drive toward liquidity; and yet there’s no new liquidity going out into the market.” “There’s 4.4 trillion dollars of commercial real estate (CRE) loans outstanding across all lending sources — CMBS, life insurance companies, banks, etc.,” continues Walker. “About half of that is non-multifamily properties. Banks hold about 40 percent of total outstanding loans on commercial properties.” If banks were to pull back from holding 40 percent …

By Marcia Kaufman, CEO of Bayport Funding Heightened real estate investment activity in the single-family rental (SFR) market in recent years has resulted in limited supply and commensurate pricing elevations across the country. Today, institutional investors with portfolios exceeding 1,000 units own approximately 3 percent of the 14 million SFR properties nationwide, or roughly 420,000 homes. Per a recent analysis conducted by Stateline, the nonprofit news service of Pew Charitable Trusts, as of 2022, both institutional and non-institutional investors own approximately 25 percent of all single-family homes (SFHs). Statistics provided by Redfin shed further light on these figures. A record-breaking 80 percent increase in SFH investment activity occurred between 2020 and 2021 in conjunction with lower mortgage rates at that time. By contrast, 2023’s combination of a cooling market, high interest rates, increasing prices and recession fears are leading many of the nation’s larger institutional investors — many of whom purchased during the pandemic — to offload their inventory with an urgency not seen in decades. This is resulting in opportunities for individual investors to build their SFR portfolios at a time in which demand is particularly high. The climate for growing an SFR portfolio is made more auspicious when …

Pavlov Media is accelerating the expansion of its fiber network and fiber-to-the-home initiatives with a key investment from the world’s largest infrastructure investor, Macquarie Asset Management. The funding will help Pavlov Media augment its coverage of student and multifamily housing, developing and broadening resident access to high-speed Internet across a variety of property types. “We are ramping up our growth plans with a combination of building municipal fiber networks in college towns and extending service to underserved areas adjacent to our core markets,” says Glenn Meyer, board member and president of Pavlov Media. “It’s basically more of what we have already been doing but on a larger scale.” Pavlov Media is already the nation’s largest private provider of fiber-based Internet and video services to off-campus student housing, connecting properties in more than 150 U.S. markets and Canada to its national backbone via its own last-mile, municipal fiber networks and third-party circuits. The Champaign, Illinois-based company serves approximately 1,000 multifamily and student buildings encompassing more than 285,000 beds, and in recent years has begun extending fiber to customers in areas adjacent to its core student-housing markets. Now the broadband service provider is poised to quicken the pace of its growth with …

Rental, Occupancy Rate Growth Bring Benefits and Potential Pitfalls for Student Housing Sector

by Katie Sloan

From a leasing and rental rate perspective, the outlook couldn’t be brighter in the student housing space. Yardi’s National Student Housing Report saw 96.6 percent of beds leased and an annual rent growth of 4.1 percent for the fall 2022 preleasing season at its ‘Yardi 200’ universities. These numbers are, for obvious reasons, a boon for the industry at large — particularly following several abnormal years surrounding the COVID-19 pandemic. But it isn’t all sunshine and roses where higher rental rates are concerned. Raising the price to live in your properties is a delicate balance, and while there are many inherent benefits to owners and operators, there are also a number of issues that need to be considered — chiefly as it relates to a higher level of expectations from both students and parents. Levels On The Rise The industry’s performance ahead of the fall 2022 semester was nothing short of robust, and Casey Petersen, chief operating officer of PeakMade Real Estate, anticipates rent growth going into the 2023-2024 academic year to be even stronger. “We’ve budgeted for higher rent growth this year, and based on current velocity, we expect to significantly outperform,” he says. This experience is not unique to PeakMade; …