WASHINGTON, D.C. — With many office buildings, hotels and shopping malls sitting vacant or underutilized, repurposing commercial properties into multifamily housing is growing more commonplace. A recently released report suggests that these conversions could be financially feasible across a broad range of markets and circumstances. “Conversions have existed for decades, but the pandemic has accelerated their growth potential by rendering more commercial properties obsolete,” says Anita Kramer, senior vice president of the ULI Center for Real Estate Economics and Capital Markets. “Our research demonstrates that there’s no ‘cookie-cutter’ formula for executing a successful project, but we do hope the insights that experienced developers shared with us can provide valuable guidance.” Behind the Facade: The Feasibility of Converting Commercial Real Estate to Multifamily was conducted by the National Multifamily Housing Council (NMHC) Research Foundation and the Urban Land Institute (ULI) Terwilliger Center for Housing. The report examines the viability of converting old or under-utilized commercial properties, with data gathered through interviewing the developers of 29 commercial-to-multifamily conversion projects. According to the report, costs can vary based on several factors, particularly the initial acquisition and the demographic the project targets once completed. Most developers reported successful returns on investment regardless of cost, however, …

Features

By Kul Wadhwa, founder & CEO, BeyondView It has been widely broadcasted that commercial leasing and office occupancy have struggled since the onset of the COVID-19 pandemic, with headlines including words and phrasing like “zombie,” “apocalypse,” “urban doom loop” and even “epic crash” routinely making the rounds. As employers, landlords and commercial real estate professionals all grapple with fully remote and hybrid work routines, proptech and its application of artificial intelligence (AI) can prove to be essential tools in accelerating commercial leasing activity and supporting property management. Simply put, digital twin technology looks amazing, is cost-effective and saves time. For real estate professionals looking to streamline processes, digital twin technology eliminates the need for multiple service providers, facilitates a streamlined decision-making process and is more visually appealing than other proptech on the market. In dealing with an uncertain economy, deploying new technologies will offer a smart and versatile troubleshooting platform all while allowing for significant savings. And this relatively new digital offering is only going to get better with time. Real estate’s use of digital twins is the property technology of the future. Digital twins provide an exact digital representation of a physical object and can be developed from various …

It is hard to imagine that anyone could be insulated from the strife currently pervading the economic landscape. Likewise, the rise of e-commerce has for years been permeating everyday life and discussions of commercial real estate. One might think that these two factors in combination would spell depressed retailer expectations. But the opposite turns out to be true: Nearly 70 percent of retail store managers say they are bullish on the current state of retail and its future going into 2023. That’s according to the most recent Outlook Retail Sentiment Survey by Levin Management Corp. (LMC), an owner of 120 shopping centers. Survey respondents are store managers from LMC’s over 1,100 individual tenants. Undeniable obstacles With inflation reaching a 40-year high in June, and the Consumer Price Index (CPI) registering a 9.1 percent increase, a full 80 percent of survey respondents say that they have had to raise prices, with 34.7 percent anticipating further increases. Inflation has now cooled somewhat, with the CPI clocking in at 6.4 percent in January of this year. Nevertheless, it is a factor that continues to put strain on consumers and retailers alike. Considering this, in conjunction with supply chain issues, low supply of labor …

By Rod Olivero, senior director at Getzler Henrich It appears that the hybrid workforce is here to stay, leaving the future of traditional office space largely unknown. As return-to-office policies continue to evolve, an increasing number of companies are either embracing, or adjusting to, the reality that accommodating some level of remote workforce is now an inevitability. When workers packed up their laptops and work documents and walked out of their offices in March 2020 in compliance with U.S. stay at home mandates, few employer/tenants, landlords or lenders could have imagined what would ensue. The state of the workforce today isn’t merely a function of employees not wanting to return to an office environment on either a full- or part-time basis. In more cases than one might imagine, companies are coming to realize that they can, in fact, operate effectively and with great efficiency under some level of remote worker scenario. Collectively, these businesses occupy tens of millions of square feet of office space in some of the nation’s most historically valuable urban real estate markets. Regardless of their motivation, as more companies embrace or acquiesce to the reality of remote work, companies have started to shrink their physical footprint …

Arbor Realty TrustBuild-to-RentContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Arbor Report Finds Rental Housing Insulated from Economic Contraction, Risk Factors Endure

— By Ivan Kaufman, founder, chairman and CEO of Arbor Realty Trust, Inc.; and Sam Chandan, a professor of finance and director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business Rental housing is uniquely positioned to withstand tremendous economic headwinds. Although some observers point to the slowdown in apartment rent growth as a sign of growing weakness, this trend is a cyclical feature that is not reflective of any structural change in the profile of demand or supply. It is normal to expect a period of slowing rent growth while there is uncertainty in the economic outlook. In-depth findings on these trends, plus a thorough economic outlook for 2023 and a complete breakdown of risk factors, are detailed in Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, from which this article is excerpted. While no asset class is immune from the challenges of higher interest rates, the presence of amortization, which spreads out a loan into a series of fixed payments over time, makes the multifamily sector less likely to see mounting distress. All Department of Housing and Urban Development (HUD)-conforming multifamily loans are fully amortizing. Moreover, Fannie …

The self-storage sector has historically been considered resilient and recession-resistant. This year, key trends are already emerging that will contribute to the health and performance of this $80 billion industry. Despite risks of oversaturation in some urban markets, 2023 promises to be a strong year for self-storage investments. Shined-up facilities What started in early 2000s continues to today. Where decrepit, one-story metal buildings with chain-link fences were the standard, now high-caliber, well-designed and polished facilities dot the landscape. Today, new development is almost exclusively Class A product. Intown and suburban communities demand it. And customers now expect professional lobbies with music and complimentary snacks and beverages, staffed by knowledgeable and skilled managers selling space that is clean, bright and secure. The once red-headed stepchild of commercial real estate is now the belle of the ball. The proof can be seen in the fervent attention from public REITs and private equity firms. Blackstone Real Estate Income Trust grabbed headlines in 2020 with its acquisition of Simply Self Storage for $1.2 billion. Smaller, yet just as notable, transactions also support increased valuation. In 2022, Space Shop Self Storage, one of the top 20 self-storage operators in the United State, sold two portfolios …

Prospective investors can finance acquisitions even when equity is scarce, explains Michael Klein, CEO and founding principal of Freedom Financial Funds. “The scarcity of equity is an old phenomenon; it’s a relatively new phenomenon that made equity plentiful. For most of history, it was hard work to find equity. However, even in a tight market, if there’s a compelling case for a project to result in success and there are multiple ways of protecting the equity and the debt, that deal will get done.” This is the outlook Klein brings to the 2023 MBA Commercial/Multifamily Finance Convention & Expo. Klein’s company, Freedom Financial Funds, LLC is a private REIT based in Los Angeles and operating in the western United States. The REIT specializes in providing capital to real estate professionals adding value to projects. Debt, Equity and Protecting Value Klein explains that with any type of financing, whether it be debt or equity, it is key to have a compelling story and facts to indicate that the borrower is going to provide a fair amount of value. “Protecting the investor from potential downside risks is an essential part of financing,” explains Klein. This sort of forethought requires thorough due diligence …

By Steven Schneider, Honigman LLP While taxpayers typically pay property taxes based upon their property’s market value, assessors frequently misapply evidence or even redefine market value to rake in excessive taxes. The recently resolved Michigan Tax Tribunal case of Menard Inc. vs. City of Escanaba illustrates several of these efforts to collect excessive taxes and suggests arguments a property owner can use to challenge them. What is market value? Market value is the price that willing, knowledgeable buyers and sellers in an arm’s-length transaction would agree the property is worth. Market value differs from insurance value or replacement value because it reflects what a typical buyer would pay for a property as it is. Market value also differs from value to the owner, which reflects how a particular property contributes to the owner’s business operation. Appraisers typically determine market value using one or more of three valuation techniques. The sales comparison approach adjusts sales of similar property to indicate the likely selling price of the subject property. The income approach values property by considering the present value of the income it would likely earn if rented, whether or not it actually is rented. The cost approach values property by considering …

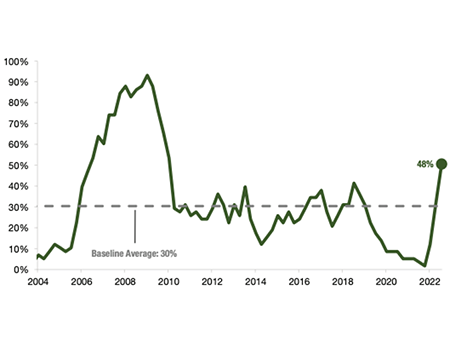

By Willy Walker, CEO of Walker & Dunlop Fed’s Recent Mistakes In a recent Walker Webcast, “Most Insightful Hour in CRE with Dr. Peter Linneman” part of our ongoing webinar series, renowned economist Dr. Linneman and I discussed his views on monetary policy, inflation and what the economic and commercial real estate landscape looks like for 2023. Throughout the past year, the Federal Reserve has been raising the federal funds rate faster than we have ever seen. This, of course, has led to a drastic increase in the cost of borrowing, the likes of which haven’t been seen in decades. In just one year, the effective federal funds rate has increased from 0.08 percent in February 2022, all the way to a target range of 4.5 to 4.75 percent in February 2023. This has led many to believe that the Fed has considerably overshot where rates should be since the market wasn’t given ample time to react to each rate hike. This rapid increase in interest rates has reduced lending activity in terms of new loans, leading to a sharp decline in demand for real estate, as well as major price corrections. Additionally, the rapid rise in borrowing costs has …

— By Dennis Richards Jr., Atlanta BeltLine Inc. — Rapid development of Class A apartments across major U.S. cities has left many community leaders struggling to create affordable housing for its citizens. Atlanta is no exception. City leaders recognize the demand for new housing supply, but they know that once new developments are delivered to areas in and around formerly underserved and underinvested neighborhoods, long-time residents are at greater risk of displacement due to rising rents or rising tax assessments. As we look to the future, it’s imperative that development projects advance equitably. Here in Atlanta, Mayor Andre Dickens pledged about $59 million from the city and in May assembled the Affordable Housing Strike Force, a task force comprised of leaders from government and nonprofit sectors. The group’s goal is to build and preserve 20,000 affordable housing units while also preventing the displacement of city residents. According to the city of Atlanta, 1,739 affordable units have been built and 3,940 are under construction since the mayor issued this mandate. Executing the Vision The Atlanta BeltLine Inc. (ABI) is the agency responsible for developing the Atlanta BeltLine, a 22-mile, multiuse trail that runs through the core of the city. This project includes programming …