Data center development is simultaneously growing by leaps and bounds as well as suffering from its own success. The easy-to-develop sites have been snapped up and demand for additional data and cloud services continues to grow, forcing developers to look beyond the obvious locations for sites. This can entail running into less-than-obvious delays in the development process. Data centers reliably store and transmit the deluge of information that makes modern life possible. The factors driving the need for data centers — enterprise demand for cloud services, dependence on 5G cell networks, artificial intelligence technology, edge computing capabilities, social media use and streaming needs — will continue to grow exponentially in the coming years. According to a September 2022 report by advisory company Arizton, approximately 2,825 megawatts of power capacity will be added to the data center market in the next five years. The same report forecasts the U.S. data center construction market will reach $25 billion by 2027, up from $20 billion in 2021. Data centers are utility-intensive property types, and the sites that can support their formidable power, communication and water needs often require high-level considerations right from the start. How can the development process for such projects be streamlined …

Features

The ‘work from home’ revolution has devastated office building values. By Jason Penighetti Of all the property types, office buildings may wrestle with the pandemic’s damaging consequences the longest. The fallout from COVID-19 will clearly have a lasting economic impact. During the government-mandated shutdowns, businesses — including brick-and-mortar retail stores, restaurants, movie theaters and gyms — suffered tremendous losses. With everyone except first responders and essential workers stuck at home, office occupancy rates plummeted as business districts, commercial developments, roads and public gathering places emptied. Many companies could not survive the shutdowns and were forced to lay off employees or permanently close their doors. During the throes of the pandemic, companies that remained in business were compelled to adapt and learn how to effectively put their employees to work from home. Virtual meetings eventually became commonplace and routine. Then as the pandemic waned, companies began to demand that employees return to the office. While some workers ventured back to the workplace, many expressed a desire to continue to work from home. This widespread sentiment has persisted. In fact, nearly 40 percent of workers would rather quit their jobs than return to the office full-time, and more than half would take …

By Julie Frazier, AIA, principal, Perkins & Will The past few years have shown that hospitals need to be more flexible and resilient to prepare for any situation, in addition to being calm, healing places for patients. As the healthcare industry continues to evolve, architects and designers are becoming increasingly responsible for responding to the ever-changing needs of the industry and rethinking how hospitals are designed. In 2023, key trends that will reshape healthcare include the prioritization of patient and caregiver wellness, sustainability-driven design and improvements in adaptability and resilience. Fostering Patient, Caregiver Wellness A hospital consists of many moving parts, and every department plays an important role in keeping the facility running efficiently to provide quality care. Implementing thoughtful design practices that improve mood and reduce stress can lead to better care, faster recovery and shorter stays for patients. Utilizing a restorative design approach can transform a clinical space from an institutional-like setting to a healing environment. Elements such as natural daylight, softer lighting, Zen spaces and gardens will continue to rise in popularity as healthcare professionals and operators introduce more wellness-based design strategies to enhance the clinical experience. One of the main goals in patient wellness is to …

Seniors Housing Occupancy Rises 90 Basis Points in Sixth Consecutive Quarterly Increase

by Jeff Shaw

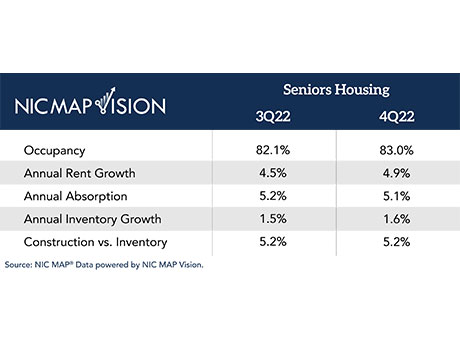

ANNAPOLIS, Md. — The national occupancy rate for private-pay seniors housing increased 90 basis points from 82.1 percent in the third quarter of 2022 to 83 percent in the fourth quarter of 2022, according to data from NIC MAP Vision. The occupancy rate has increased 520 basis points from a pandemic low of 77.8 percent in the second quarter of 2021. NIC MAP Vision is a product of the National Investment Center for Seniors Housing & Care (NIC), an Annapolis-based nonprofit firm that tracks industry data gathered from 31 primary metropolitan markets. Private-pay seniors housing comprises independent living, assisted living and memory care. The seniors housing occupancy rate increased for the sixth consecutive quarter due to continued strong demand that outpaced inventory growth. Because new inventory has been added during the pandemic, however, the occupancy rate has not yet reached pre-pandemic levels, according to NIC. On the inventory side, about 3,300 units were added within the 31 NIC MAP Primary Markets during this quarter, while more than 8,600 units were absorbed on a net basis. This robust demand led to a new record high total number of occupied units: within the NIC MAP Primary Markets, the total number of occupied …

Legal covenants often cause excessive property taxation for mall owners that are looking to redevelop. By Morris Ellison The repurposing of malls and anchor stores is a popular topic in community development circles, but legal restrictions make redevelopment extremely difficult. Often locked into their original use by covenants, malls and anchor stores are often grossly overvalued for property tax purposes. In pursuing a redevelopment, taxpayers should ensure the properties are fairly assessed and taxed. Debilitating obsolescence It is difficult to overstate the plight of malls and department store anchors. Gone are the halcyon days when the mall was everyone’s shopping destination. There is even a website, www.deadmalls.com, devoted to failed malls. Credit ratings of most anchor store operators have fallen below investment grade. Commentators usually blame the retail apocalypse on e-commerce and shifting consumer spending habits. COVID-19 exacerbated these trends and mall foot traffic has been slow to recover. Some chains, including Neiman Marcus and JCPenney, have filed bankruptcy. E-commerce volume surged in 2020 and 2021 before tapering in 2022. To date, e-commerce and brick-and-mortar sales have not yet reached an equilibrium. One in five American malls have fully closed and remain “zombies” without a redevelopment plan, estimates Green Street …

The mere flipping of the calendar to mark a new year has done nothing to inject certainty into the next 12 months. The higher cost of credit that muted commercial real estate investment sales in the second half of 2022 and the attitude of some sellers who refuse to recognize the new pricing reality remain in place in the new year. Many eyes are on the Federal Reserve, hoping for a respite in interest rate hikes after the central bank raised the effective benchmark federal funds rate some 400 basis points to 4.33 percent in less than a year, according to the Federal Reserve Bank of New York. Some investors are even hoping for a rate cut. Neither of those is likely, at least in the short term, observes Arthur Milston, a senior managing director of NAI Global in New York City. While inflation has cooled to an annual rate of 6.5 percent from a high of 9.1 percent in June, that’s still far off from the roughly 2 percent annual target that the Fed desires, he adds. That should translate into continued tightening, Milston says, although the question is, how long will the central bank keep raising rates, and …

Rising Interest Rates Bring Challenges for Student Housing Acquisitions, Refinancing in 2023

by Katie Sloan

Financing student housing might not be as bad as you might think. While the capital markets are in flux, purpose-built student housing has some of the strongest fundamentals in commercial real estate going for it. Robust pre-leasing, very healthy occupancy and rental rate increases are making the asset class attractive to lenders. The problem: getting today’s terms to pencil on some projects. “Borrowers should be prepared for lower leverage, higher pricing and fewer options to choose from when seeking financing,” says Timothy Bradley, founder of TSB Capital Advisors and principal of TSB Realty. “We are still getting deals done, but leverage has come down 5 percent to 10 percent on average while pricing has increased significantly over the second half of the year. Groups with long-standing institutional lending relationships are leaning on those sources heavily, but many banks are looking for ancillary business as a prerequisite to lend in this environment.” Loan Pricing For student housing investors who are acquiring properties, figuring out how much the loan is going to cost hasn’t been easy this year. Because of constant changes in the Treasury rate, pricing has been hard to nail down. What may be in place at contract may not …

Against the backdrop of higher interest rates and the collapse of commercial real estate investment transactions, large brokerages have begun to reduce staff and other expenses to weather growing uncertainty over property values. But executives at Lee & Associates Commercial Real Estate Services consider it an ideal environment to continue an expansion that has added more than ten new locations over the last few years. Earlier this month, Lee & Associates announced the opening of an office in Baton Rouge, La. In November, they opened an office in Calgary, Alberta. In the same month, a satellite office in Nashville, Tenn. transitioned to a freestanding office, a designation that provides brokers in the office with the opportunity to fully benefit from the Lee & Associates capital structure — namely, to participate in funding the brokerage’s future growth and reaping the potential rewards. Those additions followed new office expansions in downtown Los Angeles, San Francisco and Omaha, Neb., earlier in the year. The Southern California-based brokerage anticipates announcing two more openings in early 2023, eventually increasing its footprint to around 90 locations from more than 70 today, says Jeffrey Rinkov, CEO of Lee & Associates. “We see some of our competitors cutting …

By Jim Kornick and Mike Wilson of Avison Young After a historic run coming out of the COVID-19 pandemic, the medical office investment market cooled in the second half of 2022. But signs point to better times ahead. Right now, the cost of debt has not just doubled but has become harder to get. Healthcare providers have been hit hard by inflation and worker shortages. Tenant improvement costs are out of sight. A recession looms. Uncertainty dominates, and so many investors have gone “pencils down.” The good news: This will not persist, though it will put a downward pressure on pricing. As previous cycles and the pandemic demonstrated, demand for outpatient health services will continue to increase. The aging population, chronic disease and the drive for convenience and lowest cost of delivery continue unabated. As a result, the sector finds itself in the best position in history, with medical office building occupancy at its highest, above 92 percent nationally with rents continuing to rise. A slowdown in new medical building deliveries is anticipated. Patient demand is not inelastic, but most of it is not discretionary and tenants are very sticky. Sellers will be motivated to sell for the same motivations …

By Colin Grayson, Lument If you consider multifamily real estate assets to be a good investment, you are in good company. At mid-year, asset managers and private equity firms alone held an estimated $325 billion of levered dry powder set aside for this purpose, enough cash to finance nearly every acquisition closed in the United States in 2021, the highest investment sales volume on record. Despite nearly unanimous support for the asset class, however, multifamily transaction volume in the third quarter slumped year-over-year for the first time since the peak of the pandemic. The mainspring was a sharp rise in mortgage financing costs triggered by high inflation and the Federal Reserve’s commitment to raising rates to bring it under control. Generic rates for 65 percent loan-to-value (LTV) first mortgage debt stood on 5.71 percent at the end of November, representing an increase of 248 basis points since the beginning of the year. Even as financing costs soared, asset pricing changed very little. Initial net cash flow yields of transactions closed in the third quarter of 2022 averaged only 4.6 percent, according to Real Capital Analytics, an increase of 10 basis points from second-quarter 2022 levels. At the same time, cap …