Following a similar move in June and July, the Fed implemented its third consecutive interest rate hike of 75 basis points in mid-September. This is the biggest three-month interest rate swing since 1994. What does this all mean for investors in the small balance lending (SBL) segment of the multifamily sector? The combination of rising interest rates, inflation and market uncertainty tempts borrowers to sit on the sidelines until conditions improve. Turbulent markets also limit financing options, as many lenders and capital sources tend to become cautious and pull back. But the need for capital transcends market cycles and seasoned multifamily investors know that rate hikes are nothing new. We’ve been here before with interest rates of nearly 7 percent in the 2000s and a record high of nearly 20 percent in the 1980s. The business of real estate investing never stops. New acquisition opportunities arise as distressed owners are forced to sell, cap rates settle to more conservative levels and the market shifts in the buyer’s favor. All things considered, now is the time to seek new investment opportunities. In fact, Warren Buffett once offered the timeless advice that it is wise for investors to be “fearful when others …

Features

AcquisitionsContent PartnerDevelopmentFeaturesLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

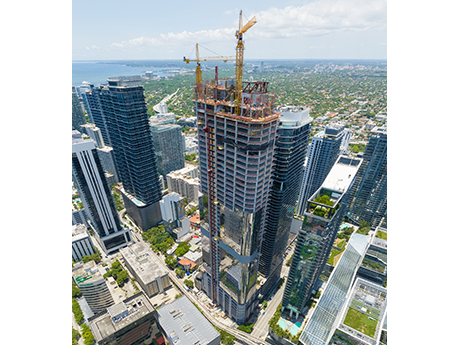

WASHINGTON, D.C. — In the face of economic insecurity, high living costs and inflation, some cities are considering implementing rent control measures. Municipalities in New York and California have taken steps toward enacting further rent control measures, while other states, such as Nevada, are shooting down these ideas entirely. Rent control measures are government regulations that place a limit on the amount a landlord can charge to lease a home or renew a lease. These regulations are intended to keep living costs affordable for renters, particularly for tenants earning lower incomes. Once signed by a governor or passed through referendum, rent control regulations are legal and binding. As of 2022, only five states — California, Maryland, New Jersey, New York, Oregon and Minnesota — and the District of Columbia have rent control laws in place. Thirty-one states have pre-emptions that prevent rent control policies, including Florida, whose state law bans local governments from controlling the price of rent except in certain cases. But according to the Washington, D.C.-based National Multifamily Housing Council (NMHC), several cities in Florida have nonetheless been working to place a rent control referendum on their November ballots. In both Tampa and St. Petersburg, city councils rejected these efforts, but …

By Angela Adolph, Esq., of Kean Miller LLP For traditional manufacturers, the Inflation Reduction Act of 2022 (IRA) offers a mixed bag of carrots and sticks to support its green energy goals. Signed by President Biden on Aug. 16, 2022, the bill includes numerous tax credits and other incentives promoting clean energy investment. One of the IRA’s stated purposes is to incentivize and revitalize domestic manufacturing, and many of its tax credits and incentives are focused on clean energy manufacturing. The IRA directs some specific tax outcomes, like tax credits for manufacturing green components. Other outcomes may be consequential or indirect, like increased local tax revenues due to higher wages or an expanded property tax base. First, the Carrots One of the most significant benefits of the IRA is the expansion of the Advanced Energy Project Tax Credit. This provision credits up to 30 percent of the investment in property used in a “qualifying advanced energy project” that is certified by the Department of Energy, and that is placed in service within two years from certification. The IRA expands the definition of a qualifying advanced energy project to include initiatives at manufacturing facilities that reduce their greenhouse gas emissions by …

CHICAGO — Despite economic pressures such as inflation, supply chain issues and workforce shortages, the construction industry continues to experience strong demand. Andrew Volz, construction research lead at JLL, estimates that several areas of real estate development are going to see sizable increases in economic activity. “There’s demand for product across a range of sectors, and there’s a need for a renewed, reimagined built environment coming out of COVID,” said Volz. “We’re seeing that strong momentum going into any sort of economic crisis that may be coming.” Volz made the comments during a Sept. 27 Construction Outlook webinar from Chicago-based JLL. Volz additionally emphasized the importance of infrastructure investments, which have a notable impact on the country’s gross domestic product (GDP). He estimates that for every dollar spent on infrastructure, the GDP will increase by $1.60 to $1.80. Infrastructure investments also create viable spaces for new investment by creating new access and supplying necessary support structures for businesses. “We are in a wide reshuffling of demographics and population, as well as the built environment,” he explained. “Infrastructure creates new priorities and allows new opportunities to emerge.” The risks of high demand Julie Hyson, managing director of project and development services at …

Combinations of offices with laboratories, research and development spaces and/or manufacturing areas make life sciences facilities highly customizable. These multipurpose, technical spaces are in high demand from companies seeking first-class facilities for research-based advancements. Low vacancies, high rents and the chance to convert unused office or retail spaces on a faster timeline have prompted some creative approaches to retrofit existing space to fulfill the needs of science and technology tenants. In other instances, facilities must be built from the ground up to conform to best practices. But what factors matter most to the life sciences field? And how can developers increase their speed to market? Read on for tips and checklists for developers hoping to speed up the process of building or retrofitting these facilities. Industry Drivers: Speed to Market and Flexibility Office conversions into life sciences facilities offer a variety of options. Life sciences facilities often do not need to accommodate large trucks (eliminating circulation and loading dock concerns), they use office components and (most importantly) office conversions offer faster speed to market than other types of conversions. “Speed to market is most important for these developers/tenants. There is a shortage of space, so a well-designed, spec building will …

By Stephanie Cramer, senior vice president of human resources, MGAC There is currently a demonstrable aging out of the construction workforce, and amid fierce competition for talent, the industry is facing headwinds of changing dynamics. Similarly, leaders are also recognizing that a younger and more diverse workforce is needed to stay relevant and to capably handle the challenges of tomorrow. As a result, construction recruiters are looking for ways to show students and young professionals that the architecture, engineering and construction (AEC) industries are truly becoming technology-driven fields in which they can feel supported and grow. As workforce strategy leaders at an international AEC-focused firm, we see every day what kinds of opportunities younger and more diverse professional populations are looking for — and what they’re not looking for. Meeting The Candidate One employable tactic is to reach new prospects at their level. In order to get in front of them, you must be able to reach them where they are, a process that typically means increasing social media engagement. By expanding their presences on a variety of channels — whether on LinkedIn, Twitter or Instagram — employers may be able to plant seeds that allow potential hires to feel …

Elizabeth Barnes, COO of NAI Plotkin, knows property management is always a labor- and people-intensive profession, no matter the day or time of year. In that regard, the pandemic did not change the best practices for the Springfield, Mass.-based full-service brokerage and management company. “The number-one best practice has always been — and remains to this day — to manage the property as if you own it, with the awareness that you don’t,” Barnes says. Treat the Asset as Your Own For Barnes, this means focusing on the asset’s value at all times. “Common area maintenance (CAM) reconciliation, capital planning, value engineering options — they need to be front and center,” she continues. “It’s not just about cutting expenses. Look at how you can add value or reduce upfront costs.” All this should be done, she states, with the owner’s goals for the property in mind. Those goals may differ based on whether the owner is, for example, looking to divest the asset. Or if the tenant’s space has gone dark. Or if a pandemic is occurring. “There is a definite focus on health and safety now, regardless of the product type,” Barnes says. “Many owners wanted HVAC and air-handling …

SANTA BARBARA, CALIF. — After a long period of growth, U.S. multifamily asking rents seem to have finally hit a wall, according to Santa Barbara-based Yardi Matrix’s monthly National Multifamily Report. U.S. multifamily asking rents declined $1 to $1,718 in August — the first month-over-month period since June 2020 without significant growth. “The economy is starting to feel the effects of higher interest rates, while migration is slowing, and the increasing lack of affordability is affecting high-growth metros,” states the report. Asking rents increased in only 10 of Yardi Matrix’s top 30 markets in August, with Philadelphia, San Francisco and Nashville all showing a 0.5 percent growth rate. Metros with the largest decreases in asking rents included Raleigh (-1.3 percent), Seattle (-1.1 percent) and the Inland Empire and Las Vegas (both -0.8 percent). Yardi Matrix attributes this deceleration to multiple factors, including seasonality, cooling in markets that saw rents increase at extraordinarily high rates over the past two years and, most importantly, slowing migration and population figures. With a decreasing population growth rate and legal immigration dropping to its lowest level in decades, the report emphasizes that rent growth in the future is likely to be increasingly defined by migration …

CALABASAS, CALIF. — While the widespread adoption of the hybrid work-from-home model resulting from the COVID-19 pandemic is having a dampening effect on demand for office space, it also is proving to have a positive impact on certain segments of retail. Those were some of the key takeaways from a webcast hosted by Marcus & Millichap that featured Dr. Lawrence Summers, former secretary of the U.S. Department of the Treasury, who offered his insights on timely commercial real estate issues and the near-term outlook for the U.S. economy. Moderated by Marcus & Millichap CEO Hessam Nadji on Tuesday, Sept. 13, other featured speakers during the hour-long webcast included Conor Flynn, CEO of Kimco Realty Corp. (NYSE: KIM), and Swarup Katuri, managing partner at Brookfield Asset Management. The webinar, which was geared toward current and prospective investors in commercial real estate, attracted several thousand viewers, according to Marcus & Millichap, which is headquartered in Calabasas. “I think the sign is clear: Nobody is going to be going into the office more than they were before [the pandemic], and a lot of people are going to be going in less. Less because there’s going to be more flexibility, less because there’s some …

The landscape of multifamily Internet access is changing rapidly, driven by evolving resident expectations. No longer merely a utility, reliable Wi-Fi and Ethernet connections are essential for attracting and retaining residents, along with cutting operation costs. Expanding connectivity needs, work-from-home (WFH) culture and growing interest in smart-home applications are all driving residents’ Internet requirements. The centrality of Internet access for multifamily residents was inevitable in the long run, according to Bryan Rader, president of Multi-Dwelling Units (MDU) at Pavlov Media. COVID lockdowns accelerated an already burgeoning trend: bulk-managed Internet designed to improve connections and simplify growing demand. Bulk-managed connectivity offers a variety of solutions for on-site managers, residents and owners, as well as cost savings in unexpected areas. This approach provides building-wide Internet connections through a single provider, rather than asking residents to sign up individually with one of several Internet providers. The bulk Internet management company may also install and manage the building’s connection infrastructure. The simplicity of bulk-managed Internet (which started as bulk-managed Wi-Fi in student housing) is becoming increasingly practical for multifamily buildings. In the last four or five years, the traditional multifamily industry is starting to follow the same model that became standard in student housing …