WASHINGTON, D.C. — Greystar’s Jackie Rhone, a 35-year veteran of the multifamily industry, cut right to the chase when describing how the active adult niche differs from the traditional apartment sector in one big way for owners and operators. “This is the only time in my career that I’ve sold a lifestyle. I’m not selling four walls. They don’t care what your backsplash looks like. They want it to be nice, but that’s not what’s driving them,” said Rhone, referring to prospective residents of active adult communities. “What’s driving them is a lifestyle that you’re creating, and you can’t create that unless there are people living in your building that are showcasing that lifestyle.” Rhone, who earlier this month celebrated her 21st year with Greystar, serves as executive director of US Real Estate Services – Active Adult for the company. Under her watch, since mid-2019 Greystar’s active adult portfolio has grown from about 5,000 units and 27 properties to 17,000 units and 95 properties across 24 states. Her remarks came Wednesday during a panel discussion titled “Rational Exuberance: Investing in the Rapidly Growing Active Adult Segment” on the opening day of the 2022 NIC Fall Conference. Approximately 2,800 professionals descended …

Features

As the commercial real estate market adjusts to how much of an effect higher interest rates will have on investment sales and property values, the rental housing sector continues to witness robust resident demand and rent growth as home ownership has become even more difficult for first-time buyers. According to a recent report by the National Multifamily Council (NMHC) and the National Apartment Association (NAA), by 2035 the U.S. needs to build 4.3 million new residential rentals to meet housing needs amid shifting demographics, the existing shortage and the loss of 4.7 million affordable units with monthly rental rates of $1,000 or less, the organizations report. “We’re just not seeing enough new apartments being built, and as a result, we’re seeing significant demand in the rental housing market,” says Hugh Cobb, a principal of Asset Living, one of the nation’s largest property managers of multifamily, affordable, student, active adult, single-family rentals and build-to-rent housing. “Because we’re seeing a decrease in demand in the single-family sales market due to higher mortgage rates, people are staying in apartments longer. And as their families grow, they’re looking for alternative rental housing, such as the build-to-rent space,” says Hugh Cobb. “Through our proprietary data …

ATLANTA — After a quarter characterized by rising costs of living and mounting inflation, “recession” is the word on everybody’s lips. But Roger Tutterow, professor of economics at Kennesaw State University in Georgia, states that “it is not a foregone conclusion that we’re in a recession today or that we’ll get there in the next several months.” The official definition of a recession is not two consecutive quarters of negative growth in gross domestic product (GDP). “Most of the time it works out that way,” Tutterow said, “but the technical definition of a recession is a period of diminishing activity in production, trade, employment and income.” Tutterow noted that looking at these four components of economic activity and comparing them to today indicates a softening economy and an elevated risk of recession, but he does not believe that the economy is necessarily contracting. He puts the risk of a recession in the next 12 months as roughly one chance in three. Tutterow’s assessment of the current state of the economy and his near-term outlook came during a keynote address Tutterow delivered at the ninth annual InterFace Seniors Housing Southeast, a networking and information conference hosted by France Media’s InterFace Conference …

Construction firms are eager to hire more employees, but a dearth of qualified workers has stymied their efforts, according to an annual workforce survey conducted by the Associated General Contractors of America (AGC) in conjunction with Autodesk. Among firms with job openings, 91 percent report they are having a hard time filling some or all positions. A total of 1,266 individuals from a broad range of construction firm types and sizes participated in the workforce survey conducted in July and August. Some 77 percent of contractors report there are few workers available who meet the minimum qualification standards, including being able to pass a drug test, which is something insurance companies require for all workers in the industry. With the unemployment rate in the construction industry hovering around 4 percent, finding qualified applicants is sure to remain a challenge in the near term, says Ken Simonson, AGC’s chief economist. “Construction workforce shortages are severe and having a significant impact on construction firms of all types, all sizes and all labor arrangements. These workforce shortages are compounding the challenges firms are having with supply chain disruptions that are inflating the cost of construction materials and making delivery schedules and product availability …

AcquisitionsCaliforniaContent PartnerDevelopmentFeaturesLeasing ActivityMultifamilyWalker & DunlopWestern

LA Multifamily Investment Deals See Volume Normalization, Pricing Resets for Select Assets

Multifamily investment transaction volume had an unprecedented year in 2021, and the first six months of 2022 were quite robust. Now, economic uncertainty in the form of rising interest rates and a cooling economy has created some hesitancy on the part of investors. “Some normalization is occurring in the market now, in addition to a pullback because of what is going on in the capital markets and economy,” says Paul Darrow, a managing director of Walker & Dunlop’s investment sales team based out of Los Angeles. Walker & Dunlop is one of the largest providers of capital to commercial real estate industry in the United States. Darrow sat down with REBusinessOnline to talk about multifamily investment sales trends in the Los Angeles area and the opportunities he sees for investors down the road. REBusiness: Investor interests have shifted in the past few months. What kinds of properties are investors most interested in now? Darrow: It’s a mixed bag when it comes to investor appetite. Those who raised money to buy specific types of buildings are obviously guided by what they’ve promised their investors in the form of return profiles and risk. Core funds, for example, can’t just switch to value-add or …

By John Stark, Popp Hutcheson Student housing valuation is often saddled by two common units of comparison that multiply the opportunities for confusion and disagreement in appraising value for property taxation. For a more convincing property tax appeal, it is important for the taxpayer to ensure their property’s valuations line up on both a per-square-foot and a per-bed basis. This article will discuss the importance of a proper unit mix and rent roll analysis to reconcile values between these units of comparison. We will also discuss current trends in student housing, including free services and concessions designed to boost occupancy, that should be accounted for in an income analysis to make sure appraisal districts do not overvalue the real estate. Price Per Square Foot vs. Price Per Bed Although student housing owners typically lease their properties by the bed and calculate investment value by that metric, many appraisal districts value student housing on a price per-square-foot basis. This can lead to errors in an assessor’s potential gross income assumptions. Further exacerbating overvaluations, many appraisal districts do not distinguish lease-per-bed student housing from traditional, lease-per-unit multifamily apartments. This failure to differentiate leads to erroneous assumptions of market rents and cap rates. …

By Taylor Williams The multifamily management industry has been beset by labor shortages for years, which has in turn prompted the rise of numerous technological platforms designed to streamline, automate and simplify daily work. But the business of running apartment communities carries an inherent and irrevocable human element, and the cost of acquiring and maintaining that service is about to go up. As an industry, multifamily management is hardly alone on this front. Businesses in countless sectors across the country are deadlocked in labor battles. While overall unemployment remains low at 3.7 percent, at 62.4 percent, the labor force participation rate remains about 100 basis points below its pre-pandemic mark, according to data from the Federal Reserve. In addition, according to the Society for Human Resource Management, resignations hit record highs in 2021, with some 4 million Americans quitting their jobs every month. With much of the labor supply in flux and potentially looking to shift careers, the advantage shifts to deep-pocketed, well-capitalized employers who can not only offer higher salaries, but also greater workplace flexibility. As such, multifamily management firms will likely be competing for talent among one another in 2023, as well as sparring with recruiters from completely …

ATLANTA — Delays in the arrival of building materials — everything from windows and roof trusses to microchips for electrical panels — is one of the biggest hurdles slowing down new seniors housing developments, according to Kristin Kutac Ward, CEO of Solvere Living. Ward’s comments came during the ninth annual InterFace Seniors Housing conference. The event, which took place Aug. 17 at the Westin Buckhead in Atlanta, was hosted by France Media’s InterFace Conference Group and Seniors Housing Business and drew 324 attendees. Joining Ward on the development panel was Tod Petty, vice chairman with Lloyd Jones Senior Living; Matthew Griffin, senior vice president, eastern states, with Griffin Living; and Jim Vogel, president of Solvida Development Group. Rick Shamberg, managing director of Scarp Ridge Capital, served as the moderator. Despite the challenges in today’s building environment, there is pent-up demand and plenty of excitement regarding new seniors housing projects, said Ward. As baby boomers age, there will be a need for seniors housing care for about 50 million more people in the U.S., according to Shamberg. There’s ample opportunity for developers to fill that void in housing. According to Petty, the need for seniors housing units will be most pronounced …

Multifamily Market Experiences Increased Demand Despite Rising Rents and Interest Rates, Berkadia Poll Shows

by Jeff Shaw

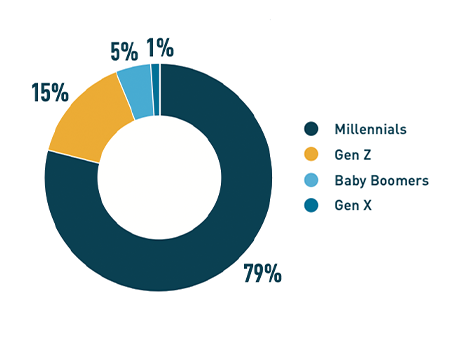

NEW YORK CITY — Berkadia’s newly released 2022 Mid-Year Powerhouse Poll reveals that the multifamily market continues to experience increased demand among investors and renters despite rising rents and interest rates. The survey respondents included 123 Berkadia investment sales agents and mortgage bankers across 65 offices, 80 percent of whom reported that they expect multifamily rental demand to continue to outpace supply for the remainder of 2022. The survey was conducted in July. Nearly 80 percent of Berkadia mortgage bankers and investment agents responded that millennials, persons born roughly between 1981 and 1996, are likely to be the generation that will make up the highest percentage of multifamily renters in the next one to two years. An even greater percentage of Berkadia professionals in the Western region (88 percent) report that the majority of their current renters are millennials. The survey results also revealed that baby boomers tend to rent single-family rental/build-for-rent (SFR/BFR) housing most commonly, while Gen Z typically rent workforce housing. Seventy-two percent of advisors reported that, besides cost, location is most important to renters today. While movement away from metropolitan areas continues — a trend made popular during the COVID-19 pandemic as renters sought more space — 59 percent of …

BohlerContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Multifamily Developers Must Find Balance Between Density, Amenities

Finding a balance between density and amenities has never been simple for residential developers, but rising interest rates, density restrictions and an increased desire to solidify multifamily projects within the community mean that there is much to be gained from creative approaches to this old problem. Starting the process of planning early, using zoning to the developer’s advantage and creating an adaptable, sustainable and welcoming place for tenants can allow for a successful project with a lower overall price tag. This method can solve some of the trickier problems faced by multifamily developers, including density, parking and zoning considerations. Starting Off Right — Creating a Master Site Plan Success in multifamily is easier to achieve if the project starts with a shared team vision from the outset, says Bill Rearden, principal at Bohler, a land development design and consulting firm. Rearden explains that Bohler has its own planning, landscape architecture and survey teams and works with many industry partners for environmental and geotechnical due diligence. “We work with these teams in the very early stages to understand what the configuration of a property is and what its constraints are. We know upfront any underlying zoning a property might have, so …