By Barry Manuel, CIO, MEB Management Services Did you know that 39 percent of energy-related carbon dioxide emissions are generated through manufactured buildings? We spend the majority of our lives using indoor spaces to gather, work, socialize and live, which means multifamily developers and managers need to consider environmentally friendly options that don’t contribute to the global climate crisis. It’s the right thing to do, and we’re not the only ones who know that. Residents are getting wise to the impact their buildings play in the climate crisis. Creating A Solution With this in mind, we recently created the MEB Sustainability Committee to address environmental issues and adapt sustainability practices for our multifamily properties throughout Arizona and New Mexico. Our goal is to have at least 75 percent of all MEB properties engaged in energy-saving initiatives. MEB is taking a two-pronged approach. We’re using ESG ratings to measure long-term environmental, social and governance risks while educating and sharing sustainable practices with our residents and management teams. Through a collaborative effort, we’re reducing emissions by making changes to both new and existing apartment buildings. Part of our strategy and collaboration involves partnering with one of the most sustainably conscious builders in Arizona …

Features

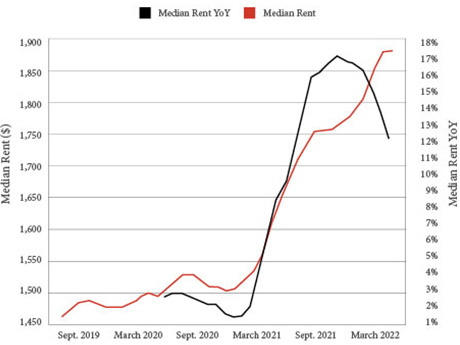

SANTA CLARA, CALIF. — During the pandemic, moving to the suburbs could save apartment renters more than $600 per month. Today, that difference is only $100. Regardless of location, rents everywhere reached an all-time high in July. Avail, a subsidiary of Realtor.com, recently released its Quarterly Landlord and Renter Survey, which collected and analyzed rental data from about 50 metros and suburbs. The study found that median asking rents in cities were $1,928 per month in July, while suburban rents averaged $1,821. That’s a stark difference from just a few years ago, when lower rents lured many remote workers to the suburbs to save money during the pandemic. A report published by Yield PRO in September 2020 estimated median urban asking rents to be $1,955 per month while suburban apartments were a much better bargain at an average of $1,349. Nationally, asking rents are about 23 percent higher today than they were in July 2020, according to Realtor.com, which also claims the latest across-the-board average of $1,879 is the highest rate in the past 17 months. Rent growth in the double digits is historically significant, but landlords are expected to lay off rent hikes in coming months while tenants grapple with inflation. …

The labor shortage that continues to plague the seniors housing industry is taking a toll on the capital markets side of the business as owner-operators find themselves underwriting sharper costs that are ultimately causing profit margins to shrink and spooking some potential investors. The origin of the dearth of qualified and committed staffers at all levels of seniors housing can largely be attributed to the pandemic. But other macro-level factors — low overall unemployment, stiff competition with hospitality and healthcare users, elevated demand for flexible work routines — are amplifying the problem, even as COVID retreats into the background of everyday life. According to data obtained by the St. Louis Federal Reserve, since January 2020, some 400,000 nursing home and assisted living employees have left the profession. In addition, a 2021 study by the American Healthcare Association and National Center for Assisted Living revealed that across approximately 14,000 surveyed properties, 99 percent of nursing homes and 96 percent of assisted living facilities reported staffing shortages of varying degrees. Higher labor costs put pressure on operating costs, which are further strained amid 40-year inflationary highs and the rising costs of capital that said inflation has subsequently prompted. For many owners and …

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

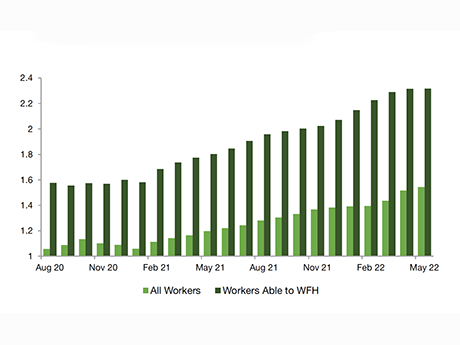

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

DALLAS — Rent growth and occupancy rates will likely not be as robust in 2022 compared with the prior year, but the U.S. apartment market remains quite healthy, according to a CBRE panel of experts who highlighted the strengths of the sector during an Aug. 8 webinar. Rent growth registered in the double digits in many active markets in 2021, but monthly rents are still affordable in relation to the average renter’s income, the panelists said. Additionally, developers are building apartment communities with the work-from-home tenant in mind. These two key trends will support a healthy market throughout the remainder of 2022, according to CBRE. The panel presenters included Julie Whelan, CBRE’s global head of occupier thought leadership; Jen Siebrits, head of U.K. research; and Matthew Vance, head of U.S. multifamily research. The panelists concurred that while consumer confidence is low, other trends, such as wage growth, indicate apartment demand will remain steady. This will especially be true if developers continue to meet demands to accommodate hybrid and remote workers by incorporating workspaces into units and common areas of the apartment communities they’re building. “Housing demand in the U.S. remains exceptionally high,” said Vance. “It has brought occupancy rates to historic levels. …

Amazon recently reconfigured and consolidated its network of warehouses, and many other retailers followed suit. The result? The outlook for industrial real estate, particularly retail warehouses, is now more difficult to interpret. Many retail clients are repositioning their supply chains to help avoid slowdowns and a potential International Warehouse Logistics Association (IWLA) union strike on the West Coast. This change has merged with a corporate need to find additional options for shipping and transport (especially as prices for transportation and industrial rents rise). The demand for industrial space has increased rapidly in less “congested” areas. As economic uncertainty continues, there is a shift towards tertiary markets for industrial real estate. This change provides significant opportunities for industrial investors, says Steve Pastor, VP of global supply chain, and ports/rail logistics/consultant at NAI James E. Hanson, who serves as NAI Global Industrial Council Chair. Investors and developers may be able to take advantage of a pause in a highly competitive field, in tertiary markets that have been traditionally less expensive than major and core markets. Amazon’s Impact News of Amazon’s plans to scale back its acquisition of industrial space (and to sublease its existing property to other retailers) has given some users opportunities …

Seniors Housing Operators See Rapid Rise in Online Leads and Universal Workers, Say InterFace Panelists

by John Nelson

By John Nelson ATLANTA — Property managers rely on various tools and methods to boost occupancy at their seniors housing facilities. One common avenue is for operators to have reliable online lead generators that connect their sales teams to potential residents and their families. Digital platforms in the seniors housing space like A Place for Mom and Grow Your Occupancy are churning out such leads for sales teams, and operators are saying that it’s a double-edged sword because they are coming in at a rapid clip. “We love the leads but we have one salesperson per community typically,” said Don Bishop, CEO of Tallahassee, Fla.-based SRI Management. “The response time is important. Some leads take a long time to prospect and work through the system. Having too many leads is a good challenge, but it is a challenge.” Bishop’s comments came during the operations panel at the ninth annual InterFace Seniors Housing Southeast, a networking and information conference hosted by France Media’s InterFace Conference Group and Seniors Housing Business. The event was held Wednesday, Aug. 17 at the Westin Buckhead hotel in Atlanta. Pilar Carvajal, founder and CEO of Innovation Senior Living, said that her firm has been discussing creative …

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

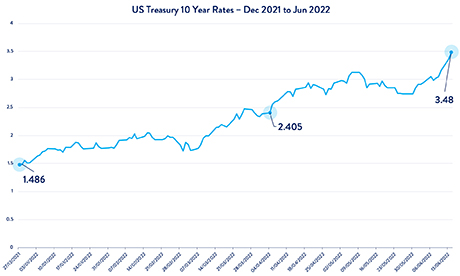

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

By Kristin Hiller The combination of a spike in material costs, disruptions in the supply chain and a lack of available workers has created a difficult building environment for general contractors. “It’s no secret that there are pressure points on our industry right now,” says Kinjal Patel, general manager and senior vice president for Lendlease Construction in Chicago. “The challenges we’ve faced the last couple years around supply chain disruption and rising materials and labor costs have only escalated, making planning and budgeting for projects incredibly unpredictable. In some cases, increases are as high as 10 percent in a span of just six months.” Despite these challenges, general contractors maintain robust pipelines and anticipate that this year’s revenues will exceed last year’s totals. “Last year, there was a lot of uncertainty as we were still in the process of rebounding from COVID, and construction deals were just finding their legs,” says Michael Meagher, president of Chicago-based McHugh Construction. “Our backlog today is better than the corresponding time a year ago as deals have continued to push forward. We forecast 2022 to be a better year for us than 2021.” Meagher anticipates that McHugh’s revenues will be more than 30 percent …

Content PartnerFeaturesIndustrialLeasing ActivityLee & AssociatesLife SciencesMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ Second-Quarter 2022 Economic Rundown by Sector

Rising interest rates, inflation and general economic uncertainty altered the patterns and outlooks for the industrial, office, retail and multifamily sectors across the United States. As Lee & Associates’ recent Q2 2022 North America Market Report reveals, certain sectors like industrial and multifamily, that were white hot last year, have begun to cool slightly. Meanwhile, retail is making historic gains in the face of decreasing interest in ecommerce. The full Lee & Associates report is available (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city) here. The analysis below provides an overview of four major commercial real estate sectors alongside economic factors impacting each. Industrial Overview: Record Low Supply, Rent Growth Demand for industrial space eased slightly from its record-setting growth of last year but remained strong through for the first half of 2022 as annualized rent growth moved into double digits and the overall vacancy rate fell to 3.9 percent, a record low. Net absorption through June totaled 192.2 million square feet. It was the second highest two-quarter total on record and more than the 170 million square feet of tenant growth for all of 2019. It was exceeded only by 297.8 …