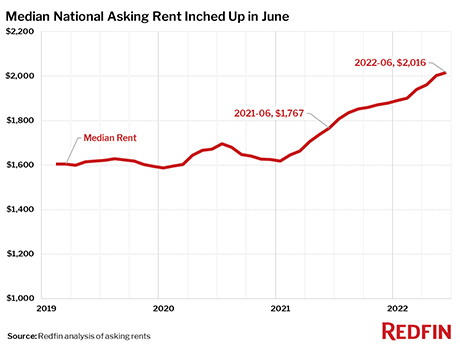

SEATTLE — Redfin, the residential real estate brokerage giant, has reported that the national median asking rent in June is $2,016 per month, a 14.1 percent increase year-over-year. The Seattle-based company analyzed data from 20,000 separate multifamily and single-family properties from its RentPath platform across the top 50 U.S. metro areas. The June figure is a slight increase from May at 0.7 percent, which represents the smallest month-over-month gain since the start of the year. The median asking rate is also the smallest annual increase since October 2021. Daryl Fairweather, Redfin’s chief economist, says while still elevated, the current slowdown in rent growth could be anticipatory on the part of landlords in reaction to overall inflation. (The Consumer Price Index saw its biggest annual gain since 1981 in May, according to the U.S. Bureau of Labor Statistics). “Rent growth is likely slowing because landlords are seeing demand start to ease as renters get pinched by inflation,” says Fairweather. “With the cost of gas, food and other products soaring, renters have less money to spend on housing.” “This slowdown in rent increases is likely to continue, however rents are still climbing at unprecedented rates in strong job markets like New York …

Features

By Brian Morrissey, Ragsdale Beals Seigler Patterson & Gray LLP How municipalities and counties tax medical real estate can vary by modes of ownership, location and how a property affects the local economy. Much, however, depends on each taxing entity’s goals and its degree of interest in attracting hospitals, creating medical hubs, enlarging commercial areas or encouraging excellent healthcare locally. A typical approach to achieving some or all of these goals is for local government to control the property. This can be through outright ownership, where the facilities are leased out. Governments can also create an economic zone and issue bonds to finance the area’s development. Each of these methods poses property tax issues. In a direct ownership scenario, the government owner is exempt from taxation. The operating and management company that leases the property has tax liability for its going concern, however. That going concern has untaxed intangible value, but also will have onsite assets such as medical equipment that can be taxed under standard code approaches at fair market value. They can also be taxed under a modified fair market value, which is a common incentive designed to entice investment by medical businesses. If the local government chooses …

By Kristin Hiller As the nation emerges on the other side of the pandemic, the retail and restaurant industries are tasked with adapting their store designs and business models to match consumer behavioral shifts. Shoppers and diners alike want to make purchases easily with multiple options for ordering and pickup. Border Foods, one of the largest privately held Taco Bell franchisees in America, enlisted the services of Minneapolis-based design consultancy Vertical Works Inc. in 2020 to create a new restaurant design. The result was Defy, a two-story concept with four drive-thru lanes situated below the restaurant kitchen. The 3,000-square-foot restaurant, which is located in the Minneapolis suburb of Brooklyn Park, recently opened. Josh Hanson, founder and CEO at Vertical Works and WORKSHOP, says his team set out to reimagine the drive-thru experience and create a concept that would solve many of the issues related to traditional drive-thrus. “By elevating kitchens and operations and adding multiple drive-thru lanes underneath, the Defy concept is able to increase efficiency and profitability within the same footprint and at the same cost as a traditional drive-thru,” he states. Defy customers will be able to place orders online via the Taco Bell app or traditionally …

By Bill Colgan, managing partner, CHA Partners Adaptive reuse projects have continued to garner the attention of the commercial real estate community, especially in light of the lasting impact of the COVID-19 pandemic. While office and retail conversion projects have remained popular in numerous markets over the last several years, in certain parts of the country, projects involving the adaptive reuse of hospitals and healthcare facilities have also played a major role in bringing new life back to communities. As seen throughout the country, the common pattern of large health systems consolidating acute care hospitals has challenged the survivability of standalone hospitals. When standalone facilities fail, it not only creates a healthcare void in the local community, but also results in the closure of large, outdated structures, many of which span several hundred thousand square feet. These structures often sit vacant for decades, become blights in the local area and fail to serve the needs of the communities in which they are situated. When compared with new ground-up projects, there are many benefits to adaptive reuse projects — including cost-effectiveness and shorter time frames — but there are also many challenges. Roadblocks to Adaptive Reuse Due to their very nature, …

Last year, a city known more for music than multifamily development led the nation in new construction growth rates, with luxury high rises popping up from downtown to the Gulch to along the Cumberland River. Nashville, attracting an abundance of debt and equity funding from sources old and new, is now considered an institutional-grade market. The driving force behind this growth: technology. Today, singers, songwriters and studio artists share the city with a growing number of software developers, systems architects and startup founders — and all of these innovators need a place to live, work, shop and play. Nashville’s tech evolution started from a solid foundation in healthcare, automotive and education, including HCA Healthcare and its associated startups, spinoffs and subsidiaries and an automotive hub that includes North American headquarters for Nissan and Korean tire manufacturer Hankook, as well as EV and battery cell manufacturing plants for GM. Twenty nine institutions of higher education, including Vanderbilt University, further helped develop a strong pipeline of tech talent. This ecosystem and a business-friendly climate have attracted some of the nation’s top tech employers: Amazon, who chose the metropolitan area for its much-coveted Center of Excellence; Oracle, relocating from Austin; and Capgemini, whose …

One Year Later: Surfside Collapse Inspires Newly Passed Florida Legislation Addressing Structural Integrity

by John Nelson

By Jim Prichard of Ball Janik LLP The 13-story, L-shaped Champlain Towers decorated the Surfside coastline. In the early morning of June 24, 2021, the pool deck suffered a partial collapse, triggering more destruction in the structure’s central section and eastern wing. In less than 30 seconds, approximately half of the 136 units in the building were destroyed, leaving 98 residents dead and establishing a horrific legacy as one of the deadliest structural engineering failures in U.S. history. In the wake of the tragedy, Miami-Dade County Mayor Daniella Levine Cava ordered an immediate audit of all high-rise buildings that were more than 40 years old and five stories tall constructed by the developer. The attention to South Florida development prompted a review of hundreds of older buildings. There was also an onslaught of editorial investigations, including features by The New York Times, The Wall Street Journal and the Miami Herald. Florida International University conducted its satellite analysis of the site as well. All investigations, first-hand experiences, and post-collapse engineering findings reported that there had been concerns about the structural integrity of the building and that the collapse was based on faulty construction and deterioration. As a law firm, our biggest …

Loan originations for Fannie Mae and Freddie Mac moderate while they navigate the rising interest rate environment. By John Nelson Multifamily mortgage loan originations rose 57 percent in the first quarter on a year-over-year basis, according to the Mortgage Bankers Association (MBA), but Fannie Mae and Freddie Mac’s combined multifamily origination volume dipped during the same period. Although Fannie Mae and Freddie Mac are still considered the premier capital sources for multifamily borrowers, sources say that the level of competition has increased as debt funds, banks, life insurance companies and lenders of commercial mortgage-backed securities (CMBS) are all active in the multifamily sector. What’s more, the sharp increase in inflation over the past year, the subsequent rise in interest rates and slowing economic growth have combined to make the near-term outlook for multifamily property valuations more challenging than at any other point in the past decade. Fannie Mae and Freddie Mac, commonly known as government-sponsored enterprises (GSEs), also tend to be risk-averse. “We’re in the middle of this capital markets-driven adjustment period that has impacted how everyone is looking at commercial real estate,” says Jeffrey Erxleben, president of Northmarq’s Dallas office. “Rising interest rates are adjusting values — by how …

What should potential landlords know about leasing space for cell towers or renegotiating their legacy leases? “Landlords need to understand what economic opportunity they have available to them,” says David Moore, CEO and principal at NAI Global Wireless. Involving cell tower lease consultants, especially for existing leases, and considering cell site buyouts are two powerful tools available to cell site landlords today. For decades, Moore explains, property owners have been willing to sign less-than-ideal agreements with carriers and tower companies. Over the years, landlords, thinking that just because these cell tower sites are small and out of the way or because they did not want to turn down “free money,” were willing to sign disadvantageous lease agreements. Landlords often do not understand the impact of signing a lease agreement with a potential term of 30 years (made up of five-year terms), especially when tenants might use leases to constrain certain real estate negotiations (including rights like tenant approval for buyers, rights of first refusal and noncompetition clauses). In many cases, tenants have the unilateral right to terminate their lease without notice, a right about which landlords frequently aren’t aware. Rent escalations, terms and conditions, inflation and more need to be …

Multifamily Industry Must Band Together to Navigate Challenges in Affordable Housing

by Jaime Lackey

In May, The White House announced its Housing Supply Action Plan to address rising housing costs by increasing the supply of housing in communities across the country over the next five years. The plan aims to create more housing of all asset types through new construction and preservation and singles out the importance of affordable housing, particularly in a time of high interest rates and inflation. The COVID-19 pandemic and the ensuing economic fallout have uniquely impacted renters unlike previous times of economic uncertainty. Renter demand and rental rates have increased at the fastest pace in decades, underscoring the importance and urgency of increasing the stock of affordable rental housing. The Housing Supply Action Plan does just that. Specifically, the plan seeks to finance more than 800,000 affordable rental units by expanding and strengthening the Low-Income Housing Tax Credit (LIHTC) program. Similar language was included in the Build Back Better Plan, which included a variety of actions aimed to bolster the lower and middle class with investments in housing, infrastructure and labor markets. This important piece of the proposed legislation would significantly increase resources that will ultimately expand the number of affordable units available. The Housing Supply Action Plan includes …

DALLAS — Completing the lease-up and stabilization of new communities in a timely and cost-efficient manner is the most difficult aspect of developing active adult properties in the current environment. Such is the assertion of developers that are immersing themselves more deeply in this fast-growing sector of commercial real estate, which lies somewhere in between traditional multifamily and independent living on the spectrum of residential uses and services provided. The challenges of fast and effective lease-up programs are attributable to several factors that are unique to the emerging asset class, which also tussles with obstacles like rising construction and operating costs that are impacting all product types in all major markets. A panel of industry professionals with experience in developing and operating both traditional multifamily and seniors housing properties spoke to these challenges during the second-annual InterFace Active Adult conference on June 2. Held at the Dallas Downtown Marriott Hotel, the event also featured insight and analysis from lenders, investors and architects that are active in the space, as well as active adult renters themselves. Ryan Maconachy, vice president at Newmark, moderated the development panel, which kicked off the main day of the conference with a discussion of what the …