By Taylor Williams As a subcategory of multifamily that is currently experiencing record rent growth, student housing is increasingly becoming a sought-after commodity in the world of institutional investment, according to a panel of industry experts. More institutional love for student housing is also arriving at a time in which concerns about COVID-19’s impact on enrollment and on-campus learning at the nation’s colleges and universities are largely being laid to rest. The verdict is in on whether students overwhelmingly prefer to live and learn on campus — they do. Capital sources are responding accordingly. At France Media’s 14th annual InterFace Student Housing conference, held May 3-4 at the J.W. Marriott Hotel Austin (Texas) Hotel, a group of industry veterans laid out the drivers behind the sector’s growth on institutional radars. As an affirmation of this trend, the “state of the industry” panel pointed to the $12.8 billion acquisition of Austin-based student housing developer and operator American Campus Communities (NYSE: ACC) by real estate giant Blackstone (NYSE: BX). Panelists implied that that deal, which was announced in April and will take ACC private, serves as a watershed moment for the asset class to institutional investors. As such, the transaction, which is …

Features

By Greg Lyon, Chairman and Principal, Nadel Architects The appearance of retail is always evolving in terms of space and function. Today, however, it is becoming increasingly important to ensure a shopping center is the “place to be” in a community to achieve long-term success. This strategy allows developers to consistently deliver retail projects that attract crowds, encourage increased length of stay and repeat visits, and set the bar for the next evolution of retail. But how can retail designers work with developers to create this go-to destination within a community? Use Demographics, Psychographics to Inform Design Plans When you’re creating authenticity, you want to analyze not just a region’s demographics, but its psychographics as well. Every, single community is different and there is no one-size-fits-all approach when it comes to creating a center that resonates. For example, Trails at Silverdale, a 35-acre shopping and dining destination in Silverdale, Wash., speaks to the very distinct lifestyle of the region. Pacific Northwest shoppers enjoy the outdoors, are dedicated to sustainable living, and are drawn to authentic architectural elements that are innovative and youthful, while still conveying an elevated and sophisticated experience. Having a diverse, complementary mix of tenants, programmed common areas, pop-up experiences, and experiential retail alongside traditional tenants are …

By Taylor Williams The combination of dwindling vacancies and skyrocketing construction costs is beginning to have a marginally negative impact on the confidence that industrial brokers across major U.S. markets have in their chosen property type, according to the latest sentiment report from the Society of Industrial & Office Realtors (SIOR). For the first time in the report’s history, the average sentiment of industrial brokers that carry the designation, while still very bullish overall, dropped below eight on a scale of one to 10. Specifically, overall sentiment fell from 8.2 in the fourth quarter of 2021 to 7.7 in the first quarter of 2022. The report also identified an environment of rising interest rates as an additional detractor on industry sentiment, though that factor is not unique to the industrial sector. With industrial users heavily investing in their supply chains amid the pandemic and e-commerce boom, there’s simply very little Class A space to be had, especially within infill locations in core markets. Disruptions within those same supply chains have helped drive costs of construction materials and timelines for projects to way-above-average levels, putting further downward pressure on supply growth. As a result, overall industrial leasing activity has slowed. According …

Investment in Student Housing Remains Robust Despite Volatility in Debt, Equity Markets, Says InterFace Panel

by Katie Sloan

AUSTIN, TEXAS — As we move toward the start of a new academic year, the outlook in the student housing industry keeps getting brighter, according to experts within the industry. All signs point to further movement out of the COVID-19 pandemic — a testament to which was seen at the 14th annual InterFace Student Housing conference in Austin, where over 1,300 attendees gathered last week at the JW Marriott downtown. The sector’s resilience during the pandemic was once again a major topic at this year’s conference, particularly during the ‘Power Panel,’ which brought together a consortium of high-level executives to discuss industry trends and the outlook for the upcoming academic year. “Evidenced once again by a packed house in this room, the sector is demonstrating continued strength, resilience and sustainability as a niche real estate asset class,” began moderator Peter Katz, executive director with Institutional Property Advisors (IPA), a division of Marcus & Millichap. “While 2021 was a record year for many asset classes, one constant that we can expect in life is change,” he continued. “Over the past 90 days, we’ve seen a huge turn of events in the global economic platform. The impact of the COVID-19 pandemic has …

Affordable HousingFeaturesMidwestMultifamilyNortheastSeniors HousingSoutheastStudent HousingTexasWestern

Four Ways Technology Can Keep Onsite Multifamily Staff Happier During the Great Resignation

by Jaime Lackey

The Great Resignation. The Big Quit. Call it what you will. The widespread trend of employees leaving their jobs in 2021 and 2022 has placed a burden on onsite property management staff at multifamily communities. Like other industries nationwide, the multifamily industry has been hit hard by this period where record numbers of employees are leaving their current positions. According to the National Apartment Association (NAA), rental owners and operators have reported up to 70 percent of their workforce resigning during this period. Historically, employee turnover ranges from 30 to 50 percent annually. In roles that often require wearing many hats to keep up with prospective renters and resident requests, leasing teams are feeling added pressure. With technology solutions that alleviate daunting tasks for onsite staff, you can save your staff valuable time and unnecessary manual effort. Your leasing team can simplify tour scheduling, automate routine communications, and set up seamless multifamily marketing campaigns that free up time for staff to better connect with renters. Here are four steps operators can take to maximize efficiencies and achieve better outcomes. 1. Automate Apartment Tour Scheduling The first step to helping your team thrive during a spike in renter demand is understanding …

Build-to-RentConference CoverageDevelopmentFeaturesMultifamilyNorth CarolinaSingle-Family RentalSouth CarolinaSoutheastSoutheast Feature Archive

Speed to Market is ‘Almost the Only Priority’ for Multifamily Developers Looking to Avoid Cost Risks, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Multifamily developers are pushing their chips in and aggressively looking for new development deals, especially for sites in and around high-growth markets in the Southeast. Michael Tubridy, senior managing director of Crescent Communities, said his firm isn’t leaving anything to chance and is looking to move quickly on development opportunities. “We’re trying to get as many units on the ground today as possible, because tomorrow will be more expensive,” said Tubridy. “I like the chances of today’s cost environment a lot better than I like the unknown of where we’ll be a year from now or two years from now. Putting a premium on speed to market is something that we are much more focused on; it’s almost the only priority right now.” Tubridy’s comments came during the development panel at InterFace Carolinas Multifamily 2022. The half-day event was held on April 14 at the Hilton Uptown Charlotte hotel and attracted more than 260 attendees from all facets of the multifamily industry in North Carolina and South Carolina. Michael Saclarides, director of Cushman & Wakefield’s Multifamily Advisory Group, moderated the discussion. Crescent Communities is far from the only multifamily developer pursuing ground-up construction opportunities in earnest. In …

SANTA BARBARA, CALIF. — The student housing industry continued to show strong fundamentals in the first quarter of this year, with preleasing levels off to a robust start and annual rent growth exceeding pre-pandemic levels, according to the latest installment of Yardi’s National Student Housing Report. As of March, preleasing for fall 2022 was reported at 63.8 percent — a number that is 13.5 percent higher than the same time last year and 9.9 percent higher than March 2019 — and the average rent per-bedroom for fall 2022 is $777. These figures are based on the company’s “Yardi 200” markets, which include the top 200 investment-grade universities across all major collegiate conferences, including the Power 5 conferences and Carnegie R1 and R2 universities (research universities in the Carnegie Classification of Institutions of Higher Education). A handful of university markets were almost fully preleased as of March, with Purdue University (99.9 percent preleased), the University of Pittsburgh (99.8 percent preleased) and the University of Wisconsin-Madison (98.3 percent preleased) topping the list. Few universities are struggling with fall 2022 preleasing so far, but those that are tend to have higher acceptance rates, according to the report. The University of Houston had the …

Affordable HousingArbor Realty TrustContent PartnerDevelopmentFeaturesMidwestMultifamilyNortheastSoutheastTexasWestern

As Affordability Crisis Deepens, Policies and Market Shift to Assist the Underserved

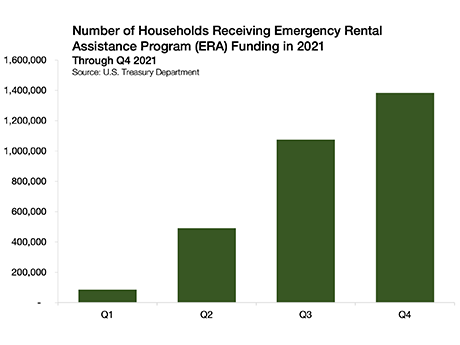

By Omar Eltorai, Arbor Realty Trust To understand the affordable housing market in spring 2022, one needs to first assess how this sector weathered the pandemic and then assess the current state of housing affordability across the country. In-depth findings on these trends are included in the Arbor Realty Trust-Chandan Economics Affordable Housing Trends Report, from which this article is excerpted. Weathering the Pandemic When it comes to the pandemic response, federal policymakers proved effective at defusing a large-scale increase in homelessness from financially insecure households. The Center for Disease Control and Prevention’s (CDC) eviction moratorium, while unpopular among industry advocates, prevented an estimated 1.6 million evictions, according to an analysis by Eviction Lab. After the Supreme Court struck down the federal moratorium in August 2021[1], the wave of evictions that many were forecasting did not immediately materialize. Nationally, tracked eviction filings ticked up but remained well below their pre-pandemic averages, according to Eviction Lab. A key reason why many at-risk renters have remained in their homes is the deployment of funds allocated in the Emergency Rental Assistance Program (ERA) — a funding pool designed to assist households that are unable to pay rent or utilities. The ERA Program was …

Conference CoverageFeaturesMultifamilyNorth CarolinaSouth CarolinaSoutheastSoutheast Feature Archive

Multifamily Operators Battle Fraud, Labor Shortages on the Front Lines, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — Property managers are navigating a minefield of issues in today’s apartment market. Analyzing renter applications for fraud, collecting overdue rent and turning over units from freeloading tenants are all in a day’s work for savvy apartment operators. Amanda Kitts, senior vice president of property management at Northwood Ravin, a multifamily owner and operator based in North Carolina, said that part of the role of an operations professional today entails poring over documents like check stubs, IDs and employment records to make sure the prospective resident is creditworthy. She said that fraud is more prevalent in some markets than others, so it’s imperative that property managers are adequately trained. “Charlotte still is a very big market for fraud, but Durham not so much. Chapel Hill is squeaky clean; nobody does anything wrong in Chapel Hill,” joked Kitts. “We have these applications and check stubs, and maybe one could be off, and you have to investigate and Google. We’re almost mini-FBI investigators.” Kitts’ comments came during the leasing and operations panel at France Media’s InterFace Carolinas Multifamily, which took place April 14 at the Hilton Uptown Charlotte. The networking and information conference drew more than 260 attendees from all facets …

In 2020, the multifamily marketplace took an unprecedented hit thanks to the global pandemic. Unemployment and layoffs were rife, rent moratoriums were put in place to safeguard against mass evictions, and multifamily investment and new builds took a nosedive. However, as the country has started to emerge from the throes of COVID-19, the marketplace has entered a banner period of growth with forecasts indicating that the number of apartments nationwide will grow by an additional 4.5 million by 2030. This period of unprecedented growth shows no signs of slowing, either. According to Richardson, Texas-based RealPage, a provider of data analytics and property management software, during the first quarter of 2022 there was a total of 18.59 million apartment units in the U.S., a nearly 75,000 unit increase from the fourth quarter of 2021. But that modest growth in supply is being greatly eclipsed by robust demand, says Carl Whitaker, director of research and analysis at RealPage. “In fact, the only thing holding absorption rates back is the fact that occupancy is approaching 98 percent, so there’s just not much available inventory to even be absorbed.” As the rental market continues to rapidly grow, developers and owners are faced with …