LOS ANGELES — After a two-year slog through COVID-19, consumer demand for shopping, dining and entertainment experiences has become a cresting tidal wave ready to descend upon the shore. The term “pent-up” is frequently used to describe this mentality, but industry professionals know that cliché doesn’t really do justice to the degree of concentrated demand for just about any form of dining out, barhopping, gaming and fraternizing. To this end, the National Retail Federation (NRF) projects that total retail sales across both digital and brick-and-mortar forums will grow between 6 to 8 percent year over year in 2022. And yet, to invoke another nautical metaphor, this scenario is not necessarily a rising-tide-lifts-all-boats phenomenon — at least not in the long run. The reality for developers and operators of shopping, dining and entertainment properties is that in order to win customer loyalty in the long haul and infuse a center with true cross-shopping potential and destinational status, they have to create a legitimately unique draw. This notion, while not necessarily revelatory and Earth-shattering in the current brick-and-mortar retail market, has only been more deeply ingrained by the events of the last 24 months. At the seventh-annual Entertainment Experience Evolution conference that …

Features

Content PartnerFeaturesIndustrialLeasing ActivityLee & AssociatesMarket ReportsMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates’ First-Quarter 2022 Economic Rundown by Sector

Lee & Associates’ newly released Q1 2022 North America Market Report scrutinizes first-quarter 2022 industrial, office, retail and multifamily outlooks throughout the United States. This class-by-class review of commercial real estate trends for the first quarter of the year focuses on how real estate is adjusting to long-term post-COVID attitudes. Lee & Associates has made the full market report available here (with further breakdowns of factors like vacancy rates, market rents, inventory square footage and cap rates by city), but the overviews offered below provide sweeping looks at the overall health and obstacles for four major commercial real estate sectors. Industrial: Rents Pushed on Strong Demand Strong demand for industrial space throughout North America continued in the first quarter as vacancies fell to record lows and rent growth hit double digits. First quarter net absorption in the United States totaled 92.8 million square feet, which was up 25 percent year over year but down 35 percent from the 143-million-square feet average of the last three quarters of 2021. Annualized rents rose 10.1 percent in the U.S. and the average vacancy rate fell to 4.1 percent. Part of this trend was due to a pause in new construction starts early in the pandemic. However, …

Electric Vehicle Manufacturing Powers Real Estate Activity Along I-85 Industrial Corridor, Say InterFace Panelists

by John Nelson

CHARLOTTE, N.C. — The Southeast has long been home to automotive giants such as Honda, Hyundai, Toyota and Mercedes-Benz, as well as their large network of suppliers. In 2021, BMW led the nation in automotive exports by value, the eighth consecutive year the German automaker held that distinction. BMW produced and exported $10.1 billion worth of cars and SUVs from its mega campus in Spartanburg, S.C., last year, and the company recently announced two new facilities — one on its campus and the other across Interstate 85 — that will total $300 million in investment. Similarly, Hyundai Motor Manufacturing Alabama, the regional headquarters and only U.S. plant for the South Korean auto giant, announced last week that it planned to invest $300 million to expand and improve its Montgomery plant. The initiative will create 200 jobs and accommodate the manufacturing of the hybrid Santa Fe vehicle line and launch of the first Electrified Genesis GV70 SUV. Hyundai Motor Group said it aims to sell 1.87 million battery electric vehicles (BEVs) annually by 2030 in order to secure a 7 percent global market share of BEVs sold. The automaker announced on April 12 that it plans to invest $7.4 billion in …

Property tax systems vary from state to state across the country, with differing procedures in each assessor’s jurisdiction. Complicating things further, the personalities of assessors and their staff influence the way they interact with property owners or their agents. It is the responsibility of the property owner or their agent to learn and adapt to the procedures and behaviors at work in their assessor’s offices. However, there are universal pre-emptive steps that property owners in any jurisdiction can take to combat excessive valuations. These property-specific action items and best practices can significantly increase the chances of a successful valuation protest. 1. Document Property Financial Statements In most appraisal systems, income-producing apartment property will be valued using the income approach. Arguably the most important pieces of information the apartment owner can present in protesting assessed values are the property’s rent rolls and profit-and-loss statements. The timely preparation and completion of these documents prior to a protest is essential to any discussion of fair market value. Key line items such as potential gross income, vacancy and collection loss, and net operating income can assist in negotiating lower assessed values. Market rent, in-place rents and occupancy are key indicators on a rent roll …

Affordable HousingContent PartnerDevelopmentFeaturesGeorgiaLumentMidwestMultifamilyNortheastSoutheastTexasVideoWestern

Utilizing Tax Credits to Create Affordable Housing in High-Opportunity Communities

The Section 42 Low-Income Housing Credit program has been America’s primary tool in the effort to construct affordable homes for low- and moderate- income households and ease renter cost burdens since 1986. This public-private partnership has created or preserved more than 3.1 million rental units, accounting for over 30 percent of the nation’s affordable housing stock. Congress is considering legislation that would materially expand and strengthen the tax credit program. In addition to several technical changes to tax credit accounting and rules governing the use of private-activity bond financing, the legislation would authorize increases in credit allocation in 2021 and 2022. The impact of these changes would be substantial, catalyzing construction of more than 100,000 additional units per year over a 10-year period, perhaps trimming the number of rent burdened low-income households by half. Building more affordable housing will represent a significant step toward reducing housing instability and economic inequality in America. But are quantitative gains alone enough? Constructing affordable housing in low-poverty, high-opportunity census tracts is challenging. The following discussion explores some ways in which developers, lenders and credit allocating agencies can increase the level of affordable housing construction in low-poverty, high-opportunity areas (LPHOA) and optimize the …

AlabamaConference CoverageFeaturesGeorgiaIndustrialNorth CarolinaSouth CarolinaSoutheastSoutheast Feature ArchiveVirginia

I-85 Corridor Markets See Explosion of Industrial Development, But InterFace Panelists Wonder if Housing Will Follow

by John Nelson

CHARLOTTE, N.C. — During the closing panel at France Media’s InterFace I-85 Industrial Corridor conference, brokers from the major markets along the 666-mile interstate gave updates about developments and opportunities in their territories. Brockton Hall, vice president of Colliers’ Upstate South Carolina office, said that the Greenville-Spartanburg industrial market in South Carolina had 16 million square feet of industrial space under construction, which represents an inventory growth of approximately 7.4 percent. Graham Stoneburner, senior vice president of Cushman & Wakefield, said that the Richmond, Va., market currently had 11 million square feet underway, which represents an inventory growth of 11 percent. Similarly Robbie Perkins, shareholder and market president at NAI Piedmont Triad, said North Carolina’s Triad region had 8.7 million square feet in the development pipeline, a nearly 11 percent growth rate compared to the market’s 80 million-square-foot inventory. During nearly every panel throughout the conference, which was held on Wednesday, April 13 at the Hilton Uptown Charlotte, brokers, investors and developers described the industrial growth along the I-85 Industrial Corridor as “unprecedented.” “There’s a real lack of supply at the moment, but we have a lot coming,” said John Montgomery, managing director of Colliers’ Upstate South Carolina office, during …

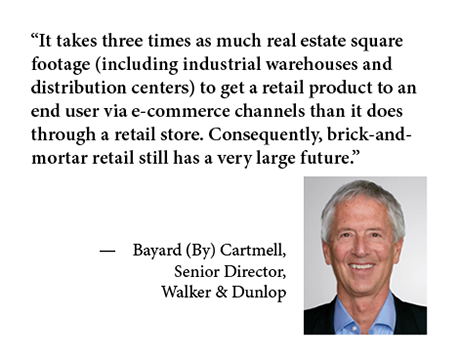

As the pandemic recedes, unusual supply and demand trends have taken root in retail and industrial markets throughout the nation. Factors that caused upheaval even before the arrival of COVID — the changing face of retail due to e-commerce and the growing demand for industrial real estate — continue unabated two years past the pandemic lockdowns. Los Angeles County may act as a bellwether for the rest of the country in retail and industrial trends, especially in high-cost, high-density areas, where these two real estate types often compete for space. Bayard (By) Cartmell, senior director at Walker & Dunlop, Los Angeles, has extensive experience with commercial real estate in the Los Angeles area. He has seen unprecedented demand for industrial space and growing investor interest in retail cap rates in the Los Angeles area. Cartmell sat down with REBusinessOnline to talk about the outlook for industrial and retail in Los Angeles, their intersections and the sector trends he expects to see in the coming year. Los Angeles Industrial — High Demand REBusiness: What are you seeing in terms of demand for industrial space — particularly in Los Angeles? Cartmell: There is currently almost unlimited demand for industrial space, of any size, …

By Kenneth Katz, co-founder and principal, Baker-Katz The COVID-19 pandemic has reshaped the commercial real estate landscape, and retail has been no exception. Over the past two years, Americans have flocked to rural and suburban communities on the outskirts of major cities, seeking lower living costs and a better quality of life. An uptick in demand for residential real estate followed, and hot on its heels came increased demand for new retail and restaurant spaces to serve growing populations. Done right, retail construction can meet the emerging needs that migration trends expose, bringing new life and vitality to communities. Intelligent, efficient development practices can bring major retailers to consumers who would have previously traveled further afield, costing the city revenue. However, not every site or project is workable. Developers need to identify the right location — and the right moment. In January 2021, Houston-based Baker Katz broke ground on Brenham Crossing, a 50-acre, 250,000-square-foot shopping center in Brenham, Texas. Nestled midway between Houston and Austin, with a population of close to 75,000, Brenham and the surrounding area quickly attracted new residents as more Americans sought temperate climates and a more accessible housing market. In 2021, Texas topped U-Haul’s growth index …

If there were any doubt that student housing stakeholders were quickly moving into the single-family build-to-rent market, the question was just settled for good. Chicago-based Harrison Street, one of the industry’s biggest players, recently announced a blockbuster deal to form a joint-venture with Core Spaces, one of student housing’s biggest developers. But this venture isn’t about student housing; it will invest up to $1.5 billion in subdivisions with hundreds of rental homes in markets such as Austin, Denver, Dallas, Orlando and Nashville. “We had an ah-ha moment,” says Justin Gronlie, managing director and Head of Education Real Estate at Harrison Street. He explains that Harrison Street was among the first firms to invest cottage-style student housing back in 2007, and since then, has developed and acquired more than 27 BTR-style student housing communities comprising 19,000 beds. The off-campus single-family style homes in highly amenitized developments are similar to the product in build-to-rent communities. “Due to our unique experience and track record in student housing, we recognized the patterns and magnitude of the BTR opportunity in front of us and pounced at it,” says Gronlie. Like student cottage projects, build-to-rent (BTR) or build-for-rent (BFR) developments offer detached units, townhomes or …

Three Keys for Shopping Center Owners to Remember When Protesting Property Tax Assessments

by John Nelson

Property owners should receive a Notice of Appraised Value from their appraisal district by mid-April. This year, it is imperative that retail property owners submit an assessment protest prior to the deadline and help to establish fair taxable valuations in the post-pandemic marketplace. Since March 2020, COVID-19 has brought uncertainty and ongoing challenges to real estate owners. People often discuss the commercial real estate “winners and losers” of COVID-19, and of the four commercial real estate food groups, retail certainly suffered one of the heaviest initial blows. But how has the property type recovered as the pandemic has evolved? This article explores where exactly retail falls, and then offers strategies to argue more effectively for reduced assessments. Evolving trends To develop a full picture of the current state of shopping centers, one must look back to 2019 and early 2020 before the pandemic. In 2018, approximately 5,800 retail stores closed nationwide and only 3,200 opened, for an overall deficit of 2,600 locations. In 2019, the size of the annual store deficit nearly doubled with 5,000 more closures than openings. E-commerce sales volume rose steadily from 2010 through 2019, which, coupled with accelerating physical store closures, clearly indicate a slowdown in …