The need for affordable housing has grown, but factors like municipal slowdowns and delays in financing have helped contribute to a lack of supply. Gregg Gerken, head of U.S. Commercial Real Estate with TD Bank, spoke to REBusiness about why the need for affordable housing is at a critical juncture and why this need is so difficult to fill. Finance Insight: What is the state of affordable housing right now? Gerken: There is a supply/demand imbalance. There continues to be a desperate need for more investment in affordable housing, not less. The arrival of COVID introduced more challenges for affordable housing, but the struggle to find high-quality affordable rental housing existed well before the pandemic. Rent prices affect millions of Americans, especially those with low incomes, and rents have only increased. Furthermore, the pandemic has caused an interruption of the supply chain and much-needed new projects have been delayed. Finance Insight: Can you outline a few big-picture national trends that are most impacting affordable housing right now? Gerken: As I mentioned, the imbalance of supply and demand is negatively affecting affordable housing. Rising rental rates mean fewer people will be able to qualify for affordable housing. Coming out of COVID …

Features

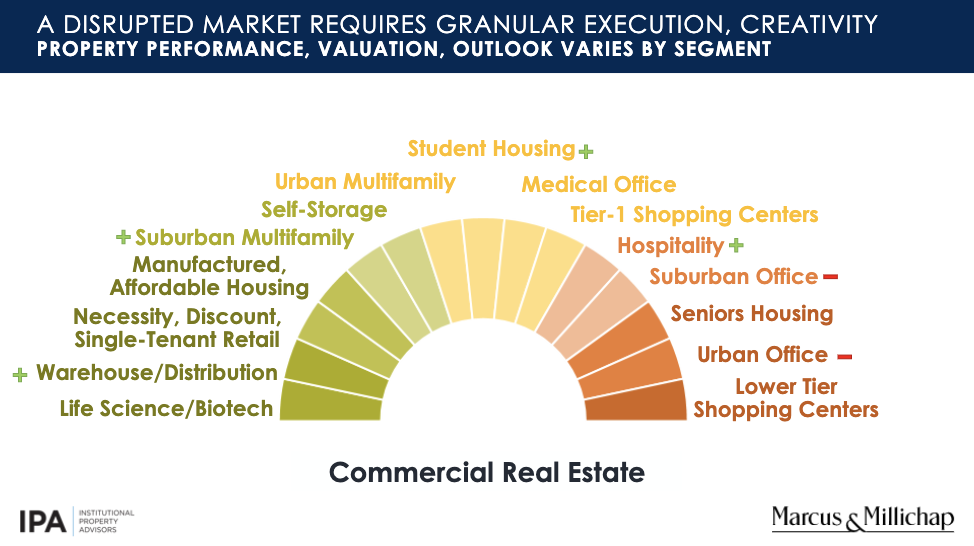

Job losses, shortages of qualified labor in the workforce and the imminent impact of rising interest rates are all real-time threats to the economy, with the first rate increase expected in March. Marcus & Millichap hosted a webcast on Jan. 27 titled “2022 Outlook: The Economy — Inflation — Fed Policy — Real Estate” to discuss how upcoming Fed action and inflation might affect the real estate market. The event’s speakers included Marcus & Millichap President and CEO Hessam Nadji; TruAmerica Multifamily President and CEO Robert Hart; ICSC President and CEO Tom McGee; and Henry Paulson, 74th Secretary of the United States Treasury and former chairman and CEO of Goldman Sachs. Without sugarcoating the challenges ahead, Paulson says if history is any predictor, the next year or so is not going to be easy. “I’m not really optimistic about the core economic recovery,” he said. “I’m pleased with how the business community has responded, but here’s where I’m going to get more somber: Inflation is really serious, and I don’t think any of us can find an example in recent economic history where the Fed has been able to contain inflation like this and have a soft landing.” On a …

Content PartnerFeaturesFinance InsightMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

Web-Based Multifamily Valuation Enhances Speed, Builds Better Predictions

The future of multifamily valuation requires flexibility and the use of technology to process data faster and more reliably. Meghan Czechowski, managing director and valuation lead for Apprise by Walker & Dunlop, spoke to Finance Insight about why multifamily valuations in particular are well suited to a web-based machine learning approach, resulting in faster appraisals with increased reliability. Finance Insight: How does the Walker & Dunlop Apprise program differ from traditional residential valuation programs? Czechowski: We’re focused on multifamily with our tech-enabled process. Most appraisal reports on the commercial side (multifamily included, that is, five units and up) are completed using a web-based database, and those databases are typically blank slates. When you’re entering sale comparables, rent comparables or other data, most people are starting from scratch and usually using an analyst to record that comparable information that then feeds into a database. The Apprise team of appraisal experts uses our Apprise application, which is a proprietary web-based system. It uses the property record database; therefore, it is not a blank slate. It has over 2.5 million multifamily records flowing into it from a public record aggregator and various industry resources like REIS, RCA and Yardi, using direct integration and …

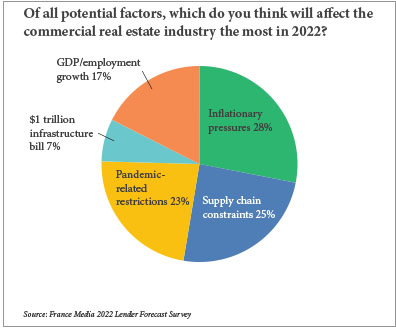

By Matt Valley An overwhelming percentage of direct lenders and financial intermediaries believe the multifamily and industrial sectors provide the most attractive financing opportunities for the lending community today, according to France Media’s 11th annual reader forecast survey. Conversely, the hotel and office sectors offer the least attractive financing opportunities, say survey participants. More specifically, 83 percent of participants in the email survey conducted between Nov. 19 and Dec. 13 indicate that the multifamily sector provides the most attractive financing opportunities, followed by industrial (75 percent), mixed-use (25 percent), retail (17 percent), hotel (14 percent) and office (7 percent). Multiple answers were permitted for this question. On the flip side, 62 percent of respondents believe that the hotel sector provides the least attractive financing opportunities, followed by office (58 percent), retail (27 percent), multifamily (7 percent), industrial (3 percent) and mixed-use (0 percent). Despite the persistence of the COVID-19 pandemic — which as of early January had claimed the lives of more than 830,000 Americans and has hobbled the hotel, office and retail sectors for nearly two years — the real estate fundamentals of the apartment and industrial sectors have remained rock solid. Fueled by strong tenant demand, the national …

Content PartnerFeaturesFinance InsightMidwestMultifamilyNortheastSeniors HousingSoutheastTexasWestern

Investment, Financing in Seniors Housing Driven by Property Performance

If there were one phrase to summarize the attitude of seniors housing investors and lenders in 2022, it would be “cautiously optimistic.” How quickly can the seniors housing industry hope to recover in the face of continued difficulties? What is likely to drive the financing and investment market? While difficulties due to COVID and labor shortages continue to create challenges in terms of immediate occupancy, strong demand fundamentals and a healthy appetite for seniors housing investments indicate a return to normality is possible in 2022, according to Brandon Taseff, senior vice president, and Lee Delaveris, vice president on KeyBank Real Estate Capital’s team. Headwinds, Tailwinds in Seniors Housing The headwinds for seniors housing investment and development should not be dismissed, Taseff indicates. Staffing issues, the Omicron variant, slow occupancy growth and sluggish absorption of senior living units have made for slow going in the market with acquisition, development and financing activity remaining below normal levels. 2021 saw many positive factors to counter these impediments: widespread vaccination, a rebound in occupancy and a strengthened capital market interest in seniors housing. 2022 may be able to continue this momentum, explains Delaveris. “There are a lot of good reasons to think the industry will …

The multifamily investment sales sector had well-documented success in 2021 with a record volume of over $220 billion in transaction activity. Factors driving competition for transactions within the sector included: increasing home prices, widespread interest in renting and the easing of COVID-19 restrictions bringing renters back into the nation’s cities, all of which drove the average, nationwide multifamily occupancy rate above 97 percent. With firmly rooted fundamentals, investor interest across the spectrum of multifamily has been intense. Traditionally popular core investment products (stabilized and value-add assets located in primary and secondary markets) were the clear winners with investors. Some multifamily REIT stocks increased by 75 to 100 percent in 2021, explains Arthur Milston, senior managing director with NAI Global and co-head of the company’s Capital Markets Group. Milston sat down with REBusinessOnline to explain where NAI Global sees growth and opportunities in 2022. REBusiness: Who are the primary investor groups acquiring multifamily? What types/locations are they attracted to? Milston: Historically, multifamily has always had very fragmented ownership compared to other asset classes. Currently, the dominant players are the large aggregators of product, whether it be REITs or institutional investors that are buying, typically in conjunction with an operating partner. Pension …

The small balance multifamily lending industry is antiquated, leaving thousands of prospective borrowers behind in a booming market. Multifamily property owners need access to fast, reliable quotes and a streamlined approach to financing. The current industry practice of quoting from rate sheets does not present a holistic or dynamic picture for borrowers or lenders. Walker & Dunlop is offering an alternative approach with a new digital lending platform that utilizes machine learning to quickly provide customized quotes for small balance multifamily acquisition and refinance loans. The rapid pace of lending means that borrowers need strategic partnerships with small balance loan experts that provide personalized customer experience backed by the data science capabilities to pull comparables, as well as online tools that can both streamline and inform processes. Sponsored: As the #1 multifamily lender in the U.S., Walker & Dunlop is launching a digital lending platform that will deliver tailored quotes in minutes for acquisitions and refinances. The platform uses machine learning powered by millions of data points from Walker & Dunlop’s proprietary property database to offer clients accuracy, transparency and confidence from kickoff to closing. The State of Small Balance Lending Small multifamily properties account for roughly 85 percent of …

By Katie Sloan The pandemic has brought many challenges to the student housing industry, particularly as it relates to the much anticipated — and often dreaded — summer turn season. In 2020, the biggest hurdle was keeping shared spaces sanitized while maintaining the safety of residents and onsite staff. Owners and operators had the added challenge of navigating labor shortages, which left many companies scrambling to find everything from cleaning crews to onsite staff, and supply chain issues that resulted in everything from paint to furniture and appliances being stuck offshore or in ports, with little predictability as to delivery. Student Housing Business polled a number of owners, operators and vendors on their thoughts and best practices for circumventing supply chain issues in the new year. Owners & Operators Plan Ahead Owners and operators are getting on the ball and starting to plan. “I’m no expert on the supply chain, but our experience this year really has focused on furniture delivery, whereas in the first year of COVID-19 it was supplies for cleaning and sanitizing,” says Christine Richards, president of management at Core Spaces. “Items that were supposed to be delivered in June were showing up in December, which created …

By James Yoakum, Associate, Real Estate & Finance Group, Kleinbard LLC Real estate, as an asset class, encompasses countless different niches and subsectors, each of which can appeal to a broad range of investors. From an investor’s point of view, the common denominator across the various real estate asset classes — from single-family homes to apartments to trophy office towers — is the ability to leverage investments in a way that simply isn’t available for most other investment options, not just with bank loans or other sources of debt capital, but also with equity from passive investors. In a nutshell, one reason for real estate’s broad appeal among investors is the ability to control a valuable asset using mostly (or sometimes entirely) other people’s money. When developers set out to raise funds from other people’s money for the first time, there are a few basic considerations to keep in mind. These five simple questions for first-time real estate fundraisers will make your efforts as effective as possible and provide for a successful ongoing relationship with the investors entrusting you with their money. What do I bring to the table? There are more ways than ever for people to invest their …

Yardi Matrix: Student Housing Leasing Surpasses Pre-Pandemic Levels, Outlook Bright for 2022

by Katie Sloan

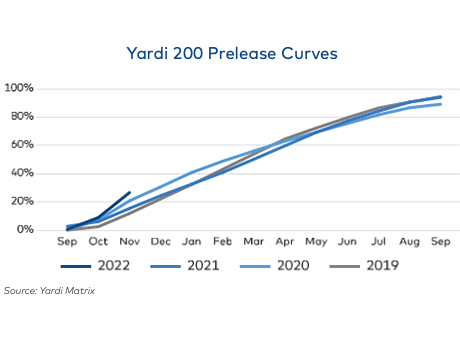

Often lauded as a recession-resistant asset class, the student housing sector was able to add another feather to its cap over the course of the past year, proving that it is also pandemic-resistant. The fall 2021 pre-leasing period ended in September at an occupancy rate of 94 percent, up from 89 percent in 2020 and 0.4 percent from levels seen prior to the start of the COVID-19 pandemic in fall 2019, according to the Yardi Matrix National Student Housing Report January 2022. These numbers were seen within the company’s ‘Yardi 200’ markets, which include the top 200 investment-grade universities across all major collegiate conferences. Pre-leasing for the fall 2022 term is already underway with levels at 27 percent as of November — an 11 percent increase over the same time in 2020, and a 6 percent increase over levels seen in 2019. Yardi reports that the top five universities with the greatest year-over-year growth in percentage of beds pre-leased are the University of Wisconsin-Madison with 66 percent growth; the University of Nevada-Las Vegas with 48 percent growth; Purdue University with 43 percent growth; the University of Pittsburgh with 31 percent growth; and the University of North Carolina at Chapel Hill …