By Nellie Day Today’s multifamily investment market can feel like a three-ring circus thanks to leveled-off rents, increased costs and more competition in many regions. Performers in this circus are often walking on a tightrope. On one side, there are repairs to be made and renovations that can lead to justified rent increases. On the other side, costs and reality must reign supreme. “Pre- and post-COVID markets have forced an evolution when it comes to investing in an asset,” says Sarah Connolly, vice president of operations at Capital Square Living in Glen Allen, Virginia. “Owners now have to ask themselves, ‘What is actually going to bring a return, and what should be incorporated into programming due to muted rent growth?’” It’s a challenging landscape, to be sure. National rent growth has slowed down significantly, with year-over-year increases hovering around 1 percent as of late 2024, according to the fourth-quarter multifamily report from Apartments.com. This is a stark contrast to the double-digit surges posted in 2021 and 2022. At the same time, construction costs have escalated, with Crescent Insurance Advisers noting that the average cost of building a multifamily property is about $398 per square foot. For context, the national average …

Features

Interview by John Nelson Commercial Property Assessed Clean Energy (C-PACE) financing is a lending option that is gaining traction in the commercial real estate lending world. This type of financing is beneficial for owners who are looking to finance their new construction or redevelopments with long-term debt. Rafi Golberstein, founder and CEO of PACE Loan Group (PLG), a C-PACE lender with offices in New York City, San Diego, Chicago and Minneapolis, says that what many borrowers are now finding out is how adaptable this loan structure is, especially when paired with traditional bank financing. “C-PACE as a product type is not just living and breathing — it’s expanding,” says Golberstein. Originated in Berkeley, Calif., in 2008, C-PACE financing is now available in 40 states and Washington, D.C. It serves as an alternative funding source for commercial projects that qualify on the basis that they will result in reduced energy and water usage and greater building efficiency. C-PACE is not a federal program as it is overseen at the state or local level, with some states allowing local governments to administer the program. “States are making their legislation more broad, which allows us to get more projects done and larger checks …

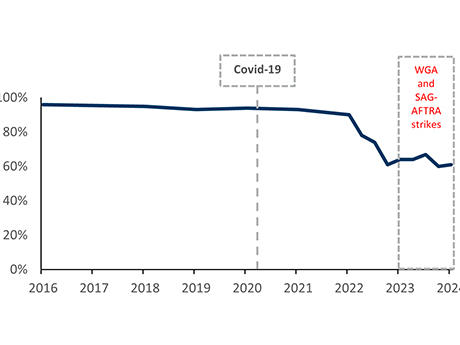

By Glenn Brill, Daniel Keller and Niculae Draghici of FTI Consulting Inc. Once viewed as a relatively stable niche for real estate investors, the film and TV production facilities (“studio”) market is entering a precarious future. According to a recent study by Ampere Analysis, global film and TV production spending is expected to grow just 0.4 percent in 2025 after the end of a pandemic-era spending surge, while the development of new, purpose-built studios has soared. Markets such as New York, Georgia and Toronto have more than doubled their stage capacity in the past five years, according to data from Film LA, reshaping the industry and its implications for investors in an uncertain market environment. Producers are following generous refundable tax credit programs and favorable foreign exchange rates around the world, prompting competition among regional production centers to offer more compelling incentives to lower the cost of production. New Supply, Tax Credits Lead The Way Los Angeles (LA) remains the home of legacy studios and the highest concentration of production facilities. Yet as Film LA notes, that market is struggling to lease space as major producers prioritize dedicated facilities for their own use in regions with attractive tax incentives and …

Affordable HousingDistrict of ColumbiaFeaturesHeartland Feature ArchiveMultifamilyMultifamily & Affordable Housing Feature ArchiveNortheast Feature ArchiveSoutheastSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

Why Fannie Mae, Freddie Mac Believe the Wind Is at Their Back

by John Nelson

Fannie Mae and Freddie Mac are adopting a more pro-business approach when it comes to closing multifamily loans in 2025 than in recent years, when sources say they were more selective. The two government-sponsored enterprises (GSEs) combined to produce 33 percent more multifamily loans in first-quarter 2025 compared with first-quarter 2024. “There is definitely a ‘volume on’ mindset at both shops,” says Landon Litty, director of agency sales at BWE. “This is a real positive for borrowers.” For Fannie Mae, the volume of multifamily loans totaled $11.8 billion in the first quarter of 2025, compared with $10.1 billion in the first quarter of 2024. Meanwhile, Freddie Mac produced approximately $15 billion in multifamily loans in the first quarter, financing around 144,000 rental units, well above the approximately $10 billion produced in first-quarter 2024. “The first quarter of 2025 has been dynamic, with real-time adjustments to meet market needs while maintaining a focus on soundness,” says a spokesperson at Freddie Mac Multifamily. Other sources attest that the GSEs are focusing on their sponsors more so than in previous years. T.J. Edwards, chief production officer for the multifamily finance division at Walker & Dunlop, says the agencies are proactively vetting first-time borrowers …

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastRegions Real Estate Capital MarketsSeniors HousingSoutheastTexasWestern

Multifamily, Seniors Housing Sectors Remain Positive Real Estate Performers

By Troy Marek, Regions Real Estate Capital Markets As we embark on the second half of 2025 amid some economic uncertainty, there are two bright spots within real estate. Both the multifamily and the seniors housing/healthcare sectors boast strong fundamentals and occupancies. RealPage data indicates 138,302 apartment units were absorbed in the first quarter, and NIC MAP data shows a seniors housing occupancy increase to 87.4 percent, or 621,000 occupied units over the same period. This suggests strong demand in both critical housing sectors, at the same time new supply is slowing. Interest Rates Drive Lending Activity Agencies Freddie Mac, Fannie Mae and HUD remain the primary loan providers supporting these two asset classes today. Unsurprisingly, interest rates heavily impact lending activity. Since the Federal Reserve decided to hold rates steady in May, sector experts have been closely watching employment and inflation data, as well as tariff impacts, as all three have the power to influence the Fed to lower rates later this year. With the Federal Reserve deciding to hold rates as-is in June, industry players will continue to keep an eye on the data. Once rates are brought down some, perhaps later this year, multifamily and seniors housing/healthcare …

CHICAGO — Philip Kroskin, head of real estate and senior vice president of investments with Sunrise Senior Living, has a message for those who are reluctant to invest in seniors housing development: “Why are you being so stupid?” Kroskin’s blunt question came during a recent two-day InterFace event at the Swissotel Chicago. Taking place June 24-25, the InterFace Seniors Housing Midwest conference drew 215 attendees and featured a number of panel sessions. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Joining Kroskin on stage for a panel titled “When Will Development Rebound?” during the first evening of the conference were Paul Branin, executive vice president of growth for Health Dimensions Group; Mike Mattingly, principal and co-founder of Avenue Development; Greg Markvluwer, vice president of real estate development at Erdman; and moderator Erin Berry, director of interior design Direct Supply Aptura. Development Deterrents Kroskin’s somewhat damning query was not to suggest that economic and logistical difficulties — such as heightened interest rates and labor costs — do not pose a valid deterrent. Panelists acknowledged these challenges throughout the course of session. …

Necessity has sparked innovation across the multifamily sector. Property managers are implementing new technology platforms to streamline leasing, maintenance and resident communications because of rising operating costs, says Jim Cunningham, president of Naperville, Illinois-based Marquette Management, which owns or manages nearly 16,000 units across eight states. Operating costs increased 7 percent last year, according to CBRE. Rising insurance costs are one of the primary drivers. Property managers are also embracing technology to enhance resident satisfaction. Wendy Deetjen, vice president of Habitat’s market-rate portfolio, says that today’s renters expect more convenience, personalization and instant communication than in the past. Chicago-based Habitat manages more than 13,000 units across Illinois, Michigan and Minnesota. “Reputation management and resident engagement remain critical, and while staffing challenges persist industrywide, automation helps our teams focus on what matters most — delivering excellent service and building stronger communities,” says Deetjen. The automation and problem-solving capabilities that come with artificial intelligence (AI) free up property managers to devote more time to other tasks. This advancement is especially beneficial at a time when the labor supply is low. Cunningham says that labor in multifamily management remains tight but is improving. The industry faced a 4.1 percent turnover rate in 2024, …

Affordable HousingConference CoverageFeaturesMultifamilyNorth CarolinaSoutheastSoutheast Feature Archive

Lenders Are Back in Action for Multifamily Development Deals, Says InterFace Panel

by John Nelson

CHARLOTTE, N.C. — In its first-quarter report, property management research firm RealPage stated that the “supply wave for multifamily was cresting” as the U.S. apartment sector set a record in terms of units absorbed (138,302), outpacing deliveries (116,092). A year prior, RealPage reported that deliveries (135,652) outstripped absorption (103,826) in first-quarter 2024. Will Block, partner and co-founder of Olympus Development Co., said that the flip in the U.S. apartment market’s supply-demand dynamic the past 12 months has made all the difference in terms of lenders’ perception. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “It couldn’t be more different what it looked like a year ago trying to capitalize deals in tertiary markets,” said Block. “Last year we would call 50 lenders with the hope of one to get to do it at terms that we didn’t like with ridiculous deposit requirements. I probably get four or five cold calls a week from bankers now.” Block’s comments came during the development panel at InterFace Carolinas Multifamily, an annual networking and information conference held on May 21 …

By Deb Smith, co-founder and CEO, The CenterCap Group What’s going on with infrastructure? It’s not just utility pipelines and toll roads anymore. Infrastructure is showing up in sectors that used to be the heart of commercial real estate — data centers, logistics parks, healthcare facilities, cold storage, even energy-embedded office campuses. Infrastructure capital is moving in, and it’s reshaping how we think about real estate. This isn’t a story about KKR merging its infrastructure and real estate divisions, or AustralianSuper and Aware Super being early movers in combining each of theirs. Those are consequences, not drivers. The blurring of asset classes is about capital. It’s about a masterful mix of silo-busting and cross-pollination. It’s about more products and more distribution — the two engines of growth. Labels aren’t the decision-makers anymore; property characteristics are. For example, long-term contracts can be viewed through an alternative lens: tenant “stickiness.” Essential, durable, cash-flowing and built to last — these qualities can be achieved in different ways, not just through public-private partnerships (PPPs) and government contracts. Take data centers. A few years ago, they were just real estate — leased space with strong tenants and cap rates. Now? They’re treated like digital utilities …

By Brett Reese of CP Group After several years of disruption, the office market is beginning to show meaningful signs of recovery. Market fundamentals are strengthening, sentiment is shifting and the data backs it up. Office sales totaled $64.3 billion last year, up nearly 21 percent from 2023, according to MSCI Real Assets. Net absorption also turned positive, with 6.5 million more square feet of U.S. office space leased than vacated, marking the most substantial annual gains since 2019. Rent growth has been substantial across key markets, lenders are re-engaging and marquee transactions are driving capital back to the sector. These are the first broad signs that the innovative strategies employed by experienced owners and operators over the past five years are beginning to pay off. Sun Belt momentum In Southeastern markets like South Florida and Atlanta, recovery outpaces national trends, driven by location, flexibility and amenitized space. Hard-learned lessons by tenants, lenders and landlords have reshaped the market. As the industry recalibrates, operators with conviction and capital can double down on what’s working. Debt is returning Perhaps the most significant harbinger of market recovery is the thawing of the debt markets. Just a year ago, lenders willing to underwrite …