ATLANTA — Multifamily borrowers have a plethora of financing options at their beck and call, both from traditional debt sources and alternative platforms. With the competition among capital sources on the rise, sponsors are in an advantageous position. “More lenders are chasing multifamily since they’ve taken three commercial real estate food groups off the table — office, retail and hospitality,” explains Shawn Townsend, president and chief investment officer at Ease Capital. However, financing challenges remain. “But by and large the cost of debt capital has not gone down,” Townsend adds. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Townsend’s comments came during the capital markets panel at InterFace Multifamily Southeast, a two-day event held Dec. 1-2 at the Intercontinental Buckhead hotel in Atlanta. InterFace Conference Group and sister publications Multifamily & Affordable Housing Business and Southeast Real Estate Business hosted the networking and information conference. Stephen Farnsworth, senior managing director of real estate finance at Walker & Dunlop, moderated the session, which featured five lenders and financial intermediaries. Farnsworth opened by touching on the ebbs and …

Southeast Feature Archive

Conference CoverageFeaturesGeorgiaLoansMultifamilyMultifamily & Affordable Housing Feature ArchiveSoutheastSoutheast Feature Archive

ATLANTA — In today’s multifamily development world, architects, designers and general contractors do everything in their power to avoid the one thing they dread most — going back to a developer mid-project to ask for more money. These “uncomfortable moments,” as Lori Ann Dinkins, president and CEO of Mood Interior Design, called them, happen more often these days thanks to rising costs, tariffs and collaboration snafus. Dinkins led a panel of architects, interior designers and general contractors through a bevy of topics — good, bad and ugly — that define the current state of building and designing apartments at InterFace Conference Group’s Multifamily Southeast event. The event took place over the course of two days at the InterContinental Buckhead in Atlanta. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Residents and developers alike are taking a more practical, less playful approach when it comes to stylizing apartments. Gone are the days of “those huge show-stopper, Instagram-moment amenity spaces,” said Ian Hunter, regional director at Atlanta-based Dwell Design Studio. “They’re out. And they’re out for a couple of reasons. Not …

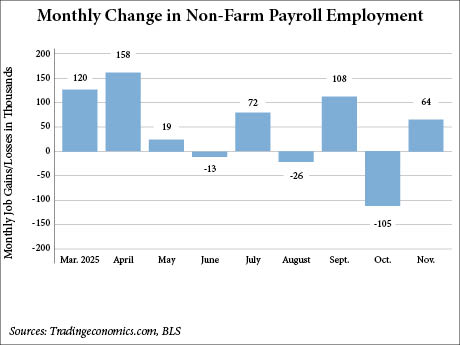

WASHINGTON, D.C. — The U.S. economy has added 64,000 non-farm payroll jobs in November and lost 105,000 jobs in October, according to the U.S. Bureau of Labor Statistics (BLS). The BLS included the October figures into the November report due to complications with the federal government shutdown, which lasted for 44 days in October and early November. The bureau, which also delayed the release of the consumer price index and producer price index in October, plans to release the December jobs report on Jan. 9, 2026. The November figure was higher than the 45,000 estimate from Dow Jones economists, according to CNBC. The news outlet also reported that the economists didn’t make an official estimate for the October report but were largely anticipating a drop in employment. In addition to the delayed report, the BLS also revised downward the employment figures for August, from a loss of 4,000 jobs to -26,000, and September, from 119,000 jobs to 108,000. The U.S. unemployment rate also ticked up 20 basis points from September to 4.6 percent in November, its highest level since September 2021. Federal government employment continued to decrease in November with a loss of 6,000 jobs. This follows a decline of …

InterFace Panel: Multifamily Operators Are Charting a Path from Oversupply to Opportunity in 2026

by Abby Cox

ATLANTA — The multifamily market in the Southeast still prevails as one of the nation’s most dynamic real estate ventures, but one aspect in particular is casting a dark shadow — the cultivation of oversupply in the region. When the demand for housing during and after the COVID pandemic increased, developers energetically responded with an aggressive building boom. However, when new supply began to outpace demand, vacancy crept up and concern for the market became more prominent. “We put shovels in the ground and started developing — and now we’re paying for that sin,” said Greg Mark, executive managing director at Cushman & Wakefield. “Across the board, we’re just not seeing the same kind of returns.” Mark’s comments came at the operations panel during the 2025 InterFace Multifamily Southeast conference, which was held at the InterContinental Buckhead in Atlanta. Co-hosted by France Media’s InterFace Conference Group and Multifamily & Affordable Housing Business magazine, the two-day event attracted a little more than 300 attendees. Ed Wolff, CEO of Dallas-based Aerwave, moderated the panel. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. Karen Key, Southeast …

ATLANTA — For many multifamily professionals, 2025 is a year to forget. Paul Berry, president and chief operating officer of Mesa Capital Partners, said that U.S. multifamily investment sales are on track to close out the year at $125 billion, which represents a 25 percent decline from an average pre-COVID year and a little more than a third of 2021’s total (a torrid $354 billion). Andrew Zelman, senior vice president of Southeast investments at Boston-based GID Multifamily, said that owners are doing “everything they can to hold out for a profit.” Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “As simplistic as this is, sellers will avoid transacting at less than peak values at any cost,” said Zelman, who added that owners are essentially kicking the can down the road by recapitalizing their assets or stopping and starting the marketing process if their pricing expectations aren’t being met. Zelman’s comments came during the opening panel on Tuesday, Dec. 2, at the 2025 InterFace Multifamily Southeast conference, which was held at the InterContinental Buckhead in Atlanta. Co-hosted …

FeaturesHeartland Feature ArchiveNortheast Feature ArchiveSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

Forecast Survey: What’s Your Take on Commercial Real Estate in 2026?

by John Nelson

The editors of REBusinessOnline.com are conducting a brief online survey to gauge market conditions in 2026, and we welcome your participation. The survey should only take a few minutes to complete. Questions range from property sectors that you are most bullish on heading into 2026 to trends in deal volume to your outlook for interest rates. The results of our 15th annual survey will be compiled and published in the January issues of our regional magazines. Conducting these surveys is part of our mission at France Media to provide readers with indispensable information, and we couldn’t do it without your help. To participate in our broker/agent survey, click here. To participate in our developer/owner/manager survey, click here. To participate in our lender/financial intermediary survey, click here. (Note: Please remember to click on “done” to properly submit the survey.)

Annual RevPAR for U.S. Hotel Sector Declines for First Time Since 2020, Says CoStar and Tourism Economics

by John Nelson

ARLINGTON, VA. — Revenue per available room (RevPAR) was revised downward in the final performance projections for the U.S. hospitality sector in 2025, according to the latest forecast from CoStar Group and Tourism Economics, an Oxford Economics company. RevPAR is projected to finish the year at a decline of 0.4 percent (or negative 40 basis points) compared to a year ago. This would result in the first total-year decline since 2020 and only the second since 2009, both of which were years with major macroeconomic disruptions with the COVID-19 pandemic and Great Financial Crisis, respectively. CoStar and Tourism Economics also lowered occupancy projections to end the year at 62.3 percent, a decline from 63.1 percent at year-end 2024, while average daily rate (ADR) was held steady at +0.8 percent for the year. For 2026, occupancy is projected to decline by another 30 basis points, while ADR and RevPAR are projected to trend positive by 90 and 50 basis points, respectively (see chart). “We expect little change in the macroeconomic environment as unemployment and prices continue to rise,” says Amanda Hite, president of STR, a hospitality research firm owned by CoStar. “As a result, our hotel performance outlook for the remainder of …

By Casey Smallwood of SRS Real Estate Partners The quick-service restaurant (QSR) industry is reshaping retail real estate by capitalizing on the “15-minute city” trend — a movement where people can access essentials within a short walk, bike ride or delivery window from home. This shift, fueled by evolving consumer behavior, urban densification and the rise of digital ordering, is pushing QSRs to prioritize hyper-local presence over traditional highway or regional ‘hubs. The result is a transformation in both real estate development and the metrics that define success in the foodservice sector. Embedding into daily life Hyper-localization is about placing restaurants within the flow of everyday life — close to where people live, work and socialize. Rather than clustering around big-box retail or commuter corridors, many brands now target neighborhood locations near apartment clusters, schools and small mixed-use developments. 7 Brew Coffee, a drive-thru-only brand, exemplifies this model. Its small footprint and fast service make it ideal for small lots and secondary intersection spots once overlooked by national tenants. These locations are now thriving due to residential growth and proximity to commuter paths. With minimal barriers to entry and an emphasis on quick-service, 7 Brew is establishing a strong local …

By Louis Rogers of Capital Square Navigating the complex tax rules of a Section 1031 exchange can be a complicated experience. For many, investing in a Delaware Statutory Trust, or DST replacement property, simplifies and streamlines the process so that more investors can enjoy the benefits of Section 1031. Introduction to Section 1031 Exchanges Section 1031 of the Internal Revenue Code, commonly referred to as a “tax-deferred exchange,” provides for the complete deferral of federal and state taxes on the sale of investment real estate. The seller must reinvest the net sale proceeds into a qualifying replacement property, which can be any type of real property. The gain that would have been recognized in a taxable sale is deferred until the replacement property is sold in a taxable transaction. Section 1031 has been in the tax code since 1921. Historically, most exchangers have acquired a “whole” property, meaning they acquired an entire replacement property. However, starting in 2002, many exchangers have acquired a fractionalized interest in their replacement property, first using the Tenant in Common (TIC) structure and, more recently, the DST structure. Instead of acquiring a whole property, they acquire a fractionalized interest or a percentage of a replacement …

By Gib Laite, Esq. of Williams Mullen North Carolina has little sympathy for taxpayers that miss filing deadlines, but a new law eases the potential repercussions for property owners otherwise qualifying for religion-based tax exemptions. Under the new measure, taxpayers can apply for the religious exemption from property taxes going back five years from the law’s adoption date earlier this year. It will be interesting to see whether the General Assembly extends a similar grace period to other exemptions over time. Regardless, the new measure provides welcome relief to a segment of taxpayers and offers a possible model for lawmakers to adjust the regulation of other exemptions down the road, if they choose to do so. And for all taxpayers, the recent change provides a good opportunity to review how North Carolina grants and regulates property tax exemptions. Machinery of Taxation As a rule, North Carolina subjects all real and personal property to property tax unless the General Assembly or the state constitution exempts the property, or it falls into a special class of exempted property. Most exemptions are set out in the Machinery Act, a framework of tax rules within the North Carolina General Statutes. The Machinery Act allows …

Newer Posts